Significant Changes to Fannie Mae and Freddie Mac Mortgage-Backed Securities – Accounting and Tax Considerations

The Single Security is a joint initiative between Fannie Mae and Freddie Mac (the Enterprises) to develop a Uniform Mortgage-Backed Security (UMBS). The goal of this initiative is to combine the separate To-Be-Announced (TBA) markets of the Enterprises (i.e., the TBA market for Fannie Mae Mortgage-Backed Securities, or MBS, and the TBA market for Freddie Mac Participation Certificates, or PCs) into a single, larger, more liquid TBA market, as well as to reduce or eliminate the trading disparities that exist today between the Enterprises’ TBA securities. This Single Security initiative launched in June 3, 2019.

The components of the Single Security initiative include:

-

Alignment of Security Structure

-

Payment delay remittance cycle - the UMBS will follow Fannie Mae’s MBS 55-day payment delay remittance cycle;

-

Security prefixes - the UMBS will follow Fannie Mae’s MBS prefixes; and

-

Security nomenclature - UMBS for first-level single-class mortgage-backed pass-thru securities, and Supers for second level resecuritizations of single-class mortgage-backed pass-thru securities, rather than Fannie Mae MBS and Megas, and Freddie Mac PCs and Giants.

-

-

Alignment of Investor Disclosures

-

The UMBS will follow Freddie Mac’s PCs; and

-

-

Alignment of Servicing Practices

-

Certain policies and practices related to the removal of loans from securities.

-

-

Commingling in resecuritization

-

Fannie Mae and Freddie Mac UMBS can be commingled and resecuritized into single-class passthrough mortgage-backed securities called “Supers”.

-

Supers are guaranteed by one of the Enterprises; however, the underlying collateral can include UMBS guaranteed by either Fannie Mae or Freddie Mac, or it can include a combination of UMBS guaranteed by both Enterprises.

-

Because the security structure of the UMBS is aligned with the features of Fannie Mae’s MBS, existing Fannie Mae MBS automatically become eligible for delivery into UMBS TBA contracts.

Freddie Mac PCs have a different security structure (namely a 45-day payment delay), so PCs must be exchanged for UMBS to deliver the securities into the UMBS TBA market. Freddie Mac will allow investors to exchange their existing 45-day PCs for new 55-day UMBS, along with compensation to investors for the loss of 10 days’ float. Investors can exchange their Freddie Mac PCs for UMBS through broker-dealer facilitated exchanges, or directly with Freddie Mac. There is currently no planned end date for the exchange of Freddie Mac PCs for UMBS.

Accounting Considerations

The Exchange of Freddie Mac PCs for UMBS

Investors should account for the exchange of Freddie Mac PCs for UMBS as a minor modification of the investment security (that is, the exchange does not result is a greater than 10 percent change to the cash flows that would trigger recognition of a gain or loss on sale of the 45-day PC and purchase accounting for the 55-day UMBS[1]).

The investor should carry-over the basis of its Freddie Mac PC to the UMBS. The cash payment paid by Freddie Mac as compensation for the 10-day change in the remittance cycle, as well as any incentive fees paid to encourage the exchange, should be recorded as an additional basis adjustment to the UMBS that will be amortized over the remaining life of the security. These accounting conclusions have been pre-cleared with the SEC.

Dollar Roll Transactions

In a dollar roll transaction, one entity sells an MBS in the current month and simultaneously enters into an agreement to purchase the same trade in a subsequent month. The appropriate accounting for dollar rolls depends on the terms of the arrangement and judgments about whether the MBS that will be repurchased are the same or substantially the same as the MBS that was initially transferred.

The terms and form of a dollar roll transaction can vary and include:

Dollar Roll Repurchase Agreements

This type of dollar roll transaction is the same as other repurchase agreements – an MBS is sold under an agreement to repurchase the same security at a later date. The initial transfer of the MBS will not qualify for sale accounting, as the transferor maintains effective control over the transferred MBS through the obligation to repurchase the same MBS at maturity of the arrangement. Accordingly, dollar roll repurchase agreements should be accounted for as secured borrowings.

Sales of an existing MBS and a forward purchase commitment for a similar MBS from the same counterparty that may either be physically settled or may be rolled to a later date

Like dollar roll repurchase agreements, the transferor must evaluate whether they have maintained effective control over the MBS initially transferred. Because the forward purchase commitment involves a similar security, judgement is required when evaluating the appropriate accounting treatment.

With this type of dollar roll, the forward purchase commitment is often for a TBA MBS. The MBS that will be used to fulfill the TBA trade is not designated at the time the trade is made. The securities are announced 48 hours prior to the trade settlement date. The buyers and sellers of TBA trades agree on these parameters for the MBS to be delivered: issuer, maturity date, coupon, price, par amount, and settlement date.

The accounting guidance for transfers of financial assets includes six criteria that must be met for a transferred asset to be considered the substantially the same (included in ASC 860-10-40-24). Judgment is required to determine whether these six criteria are met, in particular that the remaining weighted-average maturity be the same resulting in approximately the same market yield.

If the TBA MBS is not substantially the same as the MBS initially transferred, the dollar roll transactions should be accounted for as sales of the initial security, the forward purchase commitment should be accounted for as a derivative in accordance with ASC 815, Derivatives and Hedging, and when the dollar roll position is ultimately settled (i.e., the MBS is purchased) the MBS should be accounted for as the purchase of an investment security. If the TBA MBS is considered substantially the same as the MBS initially transferred, the transaction should be accounted for as a secured borrowing.

Sale of a TBA MBS and a forward purchase commitment for a similar TBA MBS from the same counterparty

With this type of dollar roll, the MBS may not yet exist or the parties to the dollar roll transaction may not own the MBS when they entered into the trade. Because these types of dollar rolls do not involve recognized financial assets on the transferor’s balance sheet, the accounting guidance for transferred of financial assets contained in ASC 860, Transfers and Servicing, does not apply. This type of dollar roll transaction, the accounting guidance for derivatives contained in ASC 815, Derivatives and Hedging, should be applied to both the initial transfer and the forward purchase commitment.

BDO Observation

Under the Single Security Initiative, the Fannie Mae and Freddie Mac TBA markets have been combined into a single TBA market where UMBS that meet the six generic parameters can be used to settle the trade. As a result, a dollar roll transaction could involve the sale of a Fannie Mae UMBS and the forward purchase commitment could be settled with a Freddie Mac UMBS (that meets the parameters for TBA delivery), or vice versa. In this example, the Freddie Mac UMBS would not be substantially the same as the Fannie Mae UMBS – the guarantor of the UMBS is different, and the same guarantor is one of the criteria that must be met for the UMBS to be considered substantially the same.[2]

[2]Because of the Single Security Initiative, dollar roll transactions that include TBA UMBS will be required to be accounted for as sales of the initially transferred UMBS, the forward purchase commitment should be accounted for as a derivative, and when the dollar roll position is ultimately settled (i.e., the UMBS is purchased) the UMBS should be accounted for as the purchase of an investment security.

Resecuritizations

The Enterprises offer single-class pass-through resecuritizations where the underlying collateral consists of groups of existing single-class MBS or other single-class resecuritizations. The single-class pass-through securities issued by the resecuritizations are guaranteed by the issuing Enterprise. These transactions enable investors to manage their portfolios more efficiently by consolidating smaller MBS into larger MBS.

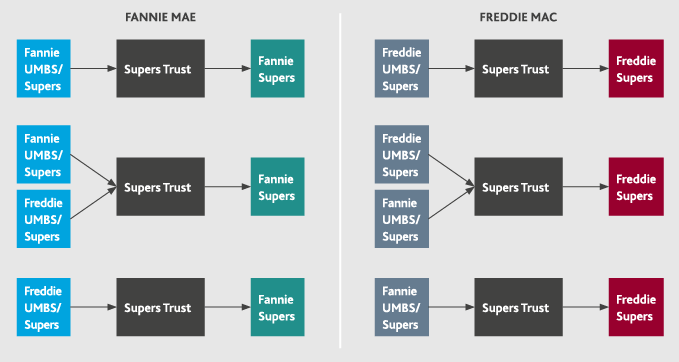

Under the Single Security Initiative, a new and unique feature includes the ability to commingle collateral guaranteed by both Enterprises, and the ability to resecuritize collateral guaranteed by one Enterprise with the other Enterprise. The following diagrams illustrate the types of securities that can be used to form single-class resecuritizations.

.png)

There is diversity in practice with how companies analyze the accounting for resecuritization transactions. Some companies evaluate the transfer of the collateral to the resecuritization trust with the guidance for transfers and servicing in ASC 860 and conclude that the transfer of the collateral is a sale with a retained interest in the single-class pass-through security issued by the resecuritization trust. Other companies have historically concluded that these resecuritizations should not receive any accounting recognition, because the single-class pass-through security received from the resecuritization is backed by the single-class pass-through collateral, and both the security received and the collateral were guaranteed by the same Enterprise.

As noted earlier, and as illustrated in the diagrams above, under the Single Security Initiative collateral from both Enterprises can be commingled in resecuritizations, or collateral guaranteed by one Enterprise can be resecuritized, and thus guaranteed, by the other Enterprise. As a result, the accounting analysis for resecuritizations will need to consider these new factors.

Tax Considerations

The Exchange of Freddie Mac PCs for UMBS

In August 2018, the Treasury Department published guidance[2] on the exchange of Freddie Mac PCs for UMBS, which indicated that the exchange will not constitute a taxable exchange of property for the purposes of Section 1001, if the total of compensation for the 10 days’ float does not exceed 25 basis points. The float compensation may be considered income, and the tax consequences of that should be considered by holders. For its part, Freddie Mac has indicated that it will treat the float compensation payment as a tax-free adjustment to the security basis, and for investors that exchange their Freddie Mac PCs for UMBS directly with Freddie Mac, they will not report the Payment as taxable income to the investor.

Diversification Requirements under Section Rule 817(h) of the Internal Revenue Code (the “Code”)

Section 817(h) of the Code required that the investments in a segregated asset account supporting a variable contract must be adequately diversified, meaning that assets may not be concentrated in the securities of one or more issuers. For example, no more than 55% of the assets may be from a single issuer, and no more than 70% of the assets may be from two issuers. The Enterprises are considered separate issuers for purposes of this rule.

In October 2018, the IRS issued Revenue Procedure 2018-54 (RP).[3] The RP applies to TBA-eligible GSE securities that an investor acquires by taking delivery pursuant to a TBA trade where, at the time that the investor entered into the TBA contract, the investor had no way of knowing the actual issuer of the securities that will be delivered under the contract – referred to as Generic GSE Securities. The RP allows for a taxpayer to elect a deemed issuance approach to these Generic GSE Securities, where a taxpayer could elect to treat their issuers, for the purposes of 817(h) compliance tests, according to a ratio that will be set forth by the Federal Housing Finance Agency (FHFA) for each year (i.e., a UMBS could be treated as 60% Fannie Mae and 40% Freddie Mac). A deemed-issuance-ratio election is applicable to all of the generic GSE securities acquired under TBA contracts that were entered into for quarters ending in the year specified in the election and for quarters ending in all subsequent taxable years where the election is effective. FHFA announced the deemed issuance ratio for 2019 to be 60% Fannie Mae / 40% Freddie Mac.[4]

BDO Observation

With the Single Security Initiative, it may be more difficult to conclude that the collateral transferred and the security received in a resecuritization are essentially the same, as there may be different guarantors. This is particularly true with commingled collateral or resecuritizations involving collateral guaranteed by on Enterprise that is resecuritizated, and thus guaranteed, by the other Enterprise.

Valuation Considerations for the Enterprises’ Securities

Because Fannie Mae’s existing MBS automatically become eligible for delivery into the UMBS TBA market, there should not be an effect on the valuation of these securities – the size of the UMBS TBA market is at least as large as the legacy Fannie Mae TBA market.

Because Freddie Mac’s existing PCs must be exchanged for 55-day UMBS, it is uncertain what, if any, impact there will be on the valuations of these securities. By design, the barriers to exchange Freddie Mac 45-day PCs for 55-day UMBS are low, so we would expect there to be little if any effect on the valuation of these securities; however, it is uncertain how market participants will react to the declining liquidity of the Freddie Mac TBA market, and thus the legacy 45-day PCs. If declining liquidity in the Freddie Mac TBA market results in unusual valuation implications, that could be an incentive for holder to exchange their Freddie Mac 45-day PCs for 55-day UMBS.

[1] ASC 470-50-40-10

[2] Rev. Rul. 2018-24: Conversion involving mortgage-backed securities not taxable exchange of property

[3] https://www.irs.gov/pub/irs-drop/rp-18-54.pdf

[4] https://www.fhfa.gov/PolicyProgramsResearch/Policy/Pages/Deemed-Issuance-Ratio.aspx

SHARE