PCAOB Guidance Outlook for 2021 Inspections

The PCAOB has issued guidance on what audit committees and auditors can expect with regard to their upcoming 2021 audit inspection cycle and the principal changes responsive to reporting and risk posed by the continuing COVID-19 pandemic and means to reduce predictability of inspections. Two publications—a Spotlight and an Audit Committee Resource—on the PCAOB staff’s outlook for 2021 inspections were issued in early April that provide a wealth of information for audit committees, management and auditors to consider both relative to the 2021 inspections of 2020 executed audits as well as audits and interim reviews being conducted in 2021.

PCAOB Spotlight: Staff Outlook for 2021 Inspections

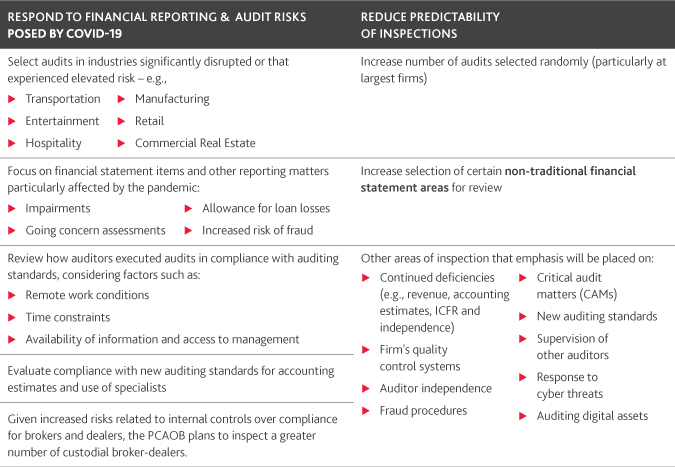

In early April, the PCAOB issued a Spotlight: Staff Outlook for 2021 Inspections highlighting objectives and planned changes to increase audit quality and promote compliance with auditing standards. Objectives include being responsive to financial reporting and audit risks posed by the continuing COVID-19 pandemic along with a desire to reduce the predictability within the inspection process.

The PCAOB includes several key reminders for auditors within its publication and indicates further plans to place emphasis on certain other areas of the audit.

The PCAOB doesn’t anticipate changing the volume of audits they select for inspection. Refer to summary of changes below followed by BDO’s insights.

To summarize the PCAOB planned changes to its 2021 inspections:

BDO Insight: PCAOB Reminders to Auditors

With respect to the PCAOB’s response to increased financial reporting and audit risk posed by COVID-19, BDO notes the following reminders from the PCAOB and action items to be deploying during the audit process:

-

Exercise due professional care and professional skepticism: We remind both audit teams as well as audit committees the importance of exercising due professional care as well as professional skepticism. We courage the embracing of a framework, such as BDO’s Professional Judgment Framework, as you define the matter, specify your objectives, identify possibilities, gather and analyze information, reach conclusions and reflect upon your judgment process. This further assumes the individual responsibility to perform the iterative actions of coaching, consulting, avoid traps and biases, documenting and communicating.

-

This process combined with demonstration of technical knowledge, adopting the appropriate mindset and continuing to enhance business acumen shall serve as a safeguard against the evolving risks and better help inform high- quality judgments used to address them.

-

-

Identify and assess the risks of material misstatement due to error or fraud: New or evolving risks that arise given uncertainties related to COVID-19 that may result in human errors or create incentives, pressures, opportunities and rationalizations for individuals to commit fraud need to be top of mind during the audit. Areas where this may be particularly prevalent may include:

-

Revenue recognition – existence/timing

-

Management estimates, including valuations

-

Propriety of usage and reporting of federal relief program funds

-

Misappropriation of assets

-

-

We remind audit committees of the engagement team’s responsibilities to:

-

(1) obtain sufficient appropriate audit evidence regarding the risk of material misstatement (RMM) due to fraud through designing and implementing appropriate responses; and (2) respond appropriately to fraud or suspected fraud identified during the audit. The responsibility of the audit committee is to understand fraud risk factors specific to the organization that may result in financial statement fraud, asset misappropriation and corruption. Best practices for audit committee consideration include, but are not limited to:

-

Understanding significant fraud risks that the organization’s business is facing via fraud risk assessment and education

-

Understanding the programs and controls that management has developed for managing fraud risks, including relevant policies and procedures

-

Developing alternative sources of information about what is happening in the organization with respect to fraud risks

-

Seeking supporting documentation and be willing to ask difficult questions

-

Having mechanisms in place for both reporting (e.g., “whistle-blower hotlines”) and conducting independent investigations of fraud

-

Independently assessing and monitoring the effectiveness of those mechanisms

-

-

-

We refer you to a variety of timely resources in this area issued by the Anti-Fraud Collaboration.

-

Establish a materiality level for the financial statements as a whole: When considering materiality for a particular client engagement, the PCAOB reminds audit engagement teams to consider what may be most appropriate, considering all of the particular circumstances. The audit committee needs to understand how both the auditors and management leverage materiality in making determinations about proposed financial statement adjustments, identified deficiencies and disclosures to incorporate into the financial statements. Additionally, the audit committee should understand when materiality is re-evaluated throughout the course of audit, particularly as circumstances continue to evolve, and what the impact that may have on the financial statements.

-

Understand the company’s process to develop its accounting estimates: This includes consideration of the methods, data and assumptions used by management and the extent to which the processes involve the use of third parties. Uncertainty, remote work, changes in procedures, data integrity and changes to assumptions to reflect unknowns are all areas that engagement teams need to continue to be mindful of when planning audit procedures. Use of third parties, from the client’s standpoint, can heighten risks related to data protection, questionable qualifications of those performing the work, indicate a need for additional audit procedures to satisfy ourselves of the use of third parties, etc. Additionally, the challenge to the audit team in understanding evolving estimates being made by management or other complexities within the audit may identify the need for the audit team to bring in its own subject matter specialists to assist the team in its audit work. Teams are reminded of their responsibility to determine whether the work of the auditor-engaged specialist is suitable for the auditor’s purposes and supports the auditor’s conclusion regarding the relevant assertion. This includes assessing the knowledge, skill, ability and objectivity of the specialist. Audit committees should expect the auditor to communicate such information to them.

-

Assigning work to engagement team members and determining necessary supervision: Engagement teams take into account the:

-

Nature of the entity – ability of the management teams, complexity of the accounting and reporting, financial position, whether there are significant or unusual transactions, etc.

-

The audit staff and the nature of the work being assigned to each member – their individual knowledge, capabilities, workload and specific considerations for oversight and supervision

-

Risk of material misstatement - that could impact the “normal” team assignments in terms of resources and timing allotment for conducting audit work in those areas where RMMs have been identified

-

Consideration of remote work environments and any additional challenges that may pose to the timing, execution, supervision and review of the audit work being performed

-

-

Audit committees should have a good overall understanding of the above by having robust dialogue with the engagement team in order to evaluate the quality of the audit work being conducted and the process for both supervision and review by qualified professionals. Challenges to this should be communicated timely to the audit committee by the auditor.

-

Compliance with the PCAOB and SEC auditor independence rules: Engagement teams are reminded to be vigilant in areas where the nature of auditor relationships and those of affiliates with clients along with the specific audit and non-audit services provided to the client could present independence violations and impair the auditors’ objectivity. The PCAOB has issued specific guidance and the audit firms have additional formal consultation guidance with respect to the following:

-

PCAOB Rule 3524 regarding auditor requirements when seeking audit committee pre-approval of tax services to:

-

Describe, in writing, to the audit committee:

-

The scope of the service, the fee structure for the engagement, and any side letter or other amendment to the engagement letter, or any other agreement (whether oral, written, or otherwise) between the firm and the audit client, relating to the service; and

-

Any compensation arrangement or other agreement, such as a referral agreement, a referral fee or fee-sharing arrangement, between the registered public accounting firm (or an affiliate of the firm) and any person (other than the audit client) with respect to the promoting, marketing, or recommending of a transaction covered by the service;

-

-

Discuss with the audit committee the potential effects of the service on the independence of the firm, and

-

Document the substance of its discussion with the audit committee.

-

-

PCAOB Rule 3526(b) regarding auditor obligations to communicate with the audit committee when violations of independence are identified and the auditor concludes such would not impair the auditor’s objectivity. The audit committee is expected to provide their written confirmation that they are in agreement with the auditor’s conclusion.

-

BDO Insight: PCAOB Selection of More Non-Traditional Focus Areas

The PCAOB has indicated that they will continue to target areas that they believe pose higher risk of material misstatement in particular audits or those that are the subject of recurring audit deficiencies. However, they intend to additionally select more “non-traditional” focus areas for inspection but did not provide specific details within the publication.

Traditional areas of PCAOB focus have pertained to revenue recognition, accounts receivable, inventory valuation, financial instruments, business combinations, goodwill and intangibles, share-based compensation, income taxes and the internal control environment, among others. Other “core” financial statement areas that the PCAOB may be considering include: operating expenditures, payroll expenses, accrued expenses, etc. Essentially, engagement teams need to operate under the assumption that any element of the audit that carries a risk of material misstatement is fair game.

BDO Insight: PCAOB's Emphasis on Other Areas of Inspection

The PCAOB further outlines the following other areas of inspection that they intend to place emphasis on:

-

Addressing of continued deficiencies (e.g., revenue, accounting estimates, ICFR and independence): Reviews of how firms are identifying underlying causes of and remediating deficiencies and preventing reoccurrence.

-

Firm’s quality control systems: Continued gathering of information to aid in the development of auditing standards to enhance quality controls. This includes continuing to monitor a firm’s responses to pandemic- related risks that impact leadership communications, consultation requirements, client acceptance and continuance procedures, real-time monitoring and pre- issuance reviews.

-

Auditor independence: This covers four focal points: (1) identified independence violations related to quality control issues, (2) pre-approvals of non-audit services provided to audit clients, (3) audit committee communications regarding independence matters, and (4) firm responses to past quality control criticisms.

-

Fraud procedures: This will expand to how auditors incorporate elements of unpredictability in their audit procedures year over year.

-

CAMs: Continued understanding of how auditors adjust their methods, tools, and level of assistance of engagement teams in compliance with AS 3101. This will likely further include evolving areas of reporting related to judgments being made about CAMs and considering matters that were deemed CAM “close calls.” See further discussion below.

-

Implementation of new auditing standards: 2021 inspections will focus on how audit firms are monitoring their own compliance with auditing of accounting estimates and use of the work of specialists and any challenges that were encountered in applying the requirements of the new standards.

-

Supervision of other auditors: The remote environment in which we find ourselves may place additional restrictions and challenges for the supervision and review of work being performed by other auditors, both domestically and globally. Teams should be able to demonstrate adjustments made to procedures and protocols for incorporating the work of others and ensuring the quality of communications and oversight in response to changing circumstances impacting the audit.

-

Response to cyber threats: As cyber risk continues to evolve and broaden in scale and complexity, how auditors assess the financial statement impact of cyber-attacks and incidents experienced by audit clients and the guidance the firms provide to engagement teams to inform continual risk assessment needs to keep pace with the changing threat environment.

-

Auditing digital assets: Auditors need to be mindful of emerging material risks associated with evolving industries, including those involving emerging technologies and the valuation of digital assets (e.g., cryptocurrencies). Additionally, audit teams should be anticipating increasing interest by the PCAOB and the SEC in changes made to firm audit methodologies and the incorporation of additional technology and automation and the impact on traditional auditing and risk assessment procedures.

-

Engagement of audit committees: Audit committees are an important facet in enhancing audit quality. They are in the unique position to share insight on matters happening within the company and the management teams as well as provide feedback directly on the audit process both to the auditors and to regulators. Ongoing dialogue and knowledge-sharing among these members of the board and the audit engagement team helps provide a communication channel for timely insight that can facilitate early identification and addressing of audit risk and allow for greater transparency, efficiency and effectiveness of the audit process to enhance the quality of a company’s financial reporting to the investor community.

For more on the role of the audit committee in consideration of these other areas of focus, refer to the next section.

PCAOB Audit Committee Resource: 2021 Inspections Outlook

As a companion to the Spotlight outlined above, the PCAOB issued Audit Committee Resource: 2021 Inspections Outlook that contains certain questions for the audit committee to consider when engaging with auditors during the current year’s audit cycle regarding understanding of the:

-

Auditor’s risk assessments amid COVID-19 and the related economic and cyber risk factors

-

Changes to the firm’s system of quality control and queries about the audit firm’s cultural emphasis on and promotion of audit quality

-

Monitoring of auditor independence compliance and the role the client management and audit committee may play in helping the auditor satisfy audit requirements

-

Auditor’s formulated response to RMMs due to fraud and how COVID-19 may have impacted or may impact the nature, timing and/or extent of audit procedures performed

-

Nature of CAMs that were “close calls” and how and why the auditor concluded ultimately such matters did not rise to the level of being a CAM. Additionally, understanding how COVID-19 may have contributed to an auditor having to exercise especially challenging, subjective or complex judgment. Examples may include areas subject to impairment considerations where significant uncertainty over management’s assumptions may have been present.

-

New auditing requirements pertaining to estimates as well as the extent of engagement of specialists by the auditor and any challenges in applying these requirements.

-

As mentioned above, whether restrictions on travel or in-person interactions created issues with respect to adequate supervision and review of other auditors and how this may have been addressed.

Within both publications referenced above, the PCAOB highlights a variety of other publications and guidance that it has issued to better inform stakeholders as well as provided a link to a brief survey as a means to engage not only audit committees but others including auditors, investors, media, and preparers who may also have utilized the PCAOB guidance and assess its usefulness and whether there are other topics for which the PCAOB could provide additional resources to stakeholders.

Next Steps for All

We encourage audit committees, other board of directors, management and our engagement team professionals to review the PCAOB’s guidance and engage one another in dialogue about the specific facts and circumstances relevant to the client’s business, additional impacts experienced by both the client and the auditor as a result of COVID-19 that may impact the execution of the audit and overall audit quality.

We invite you to explore additional resources of interest and educational programming via BDO’s Center for Corporate Governance and Financial Reporting.

SHARE