Planning Perspectives

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law in late March of 2020 to mitigate the damage caused to the U.S. economy by the Coronavirus pandemic. The $2 trillion stimulus bill provides for much needed aid to the country in a period of duress. The CARES Act is a robust bill that includes direct payments from the government to citizens to help navigate a difficult financial period, enhances unemployment insurance, provides aid to state governments, and injects needed relief to both the smallest local businesses and global corporations.

The CARES Act has created valuable opportunities which should be carefully reviewed as potential catalysts to the long-term benefit of financial and tax plans, investment portfolios, and wealth transfer to the next generation.

Required Minimum Distributions for 2020 are Waived

- The CARES Act provides a waiver for required minimum distributions (RMDs) for Tax Year 2020.

- If an IRA owner turned 70.5 after 7/1/19 and was able to delay their first RMD to 2020, the 2019 RMD is also waived (procrastination pays in this case, and 2 RMDS are waived).

- The RMD for 2020 is also waived for owners of an Inherited IRA.

- Planning Opportunity: If the 2020 RMD was taken in the last 60 days, it may be possible to roll the distribution back into the IRA via an Indirect Rollover (consult with a tax professional, certain restrictions apply, and not applicable to Inherited IRA owners).

IRA Early Distribution Exemptions (up to $100k)

- The CARES Act allows for a distribution of up to $100,000 from retirement accounts (401k, IRA, 403b, etc.) if the owner of the account faces a Coronavirus disruption event.

- The distribution is not subject to the 10% early withdrawal penalty if the owner is below 59.5 years old.

- A Coronavirus disruption event includes:

- Owner, spouse, or child is infected by the virus

- Loss of income caused by the quarantine including reduction of business owner’s profits, loss of employment, furlough, reduced work hours, or inability to work in order to care for a child

- Three-year loan: Amount withdrawn can be paid back to the qualified account over a three-year period and would not be subject to tax (consult with a tax professional).

- Spread out the tax: Alternatively, the amount withdrawn does not have to be paid back and the income tax due from the distribution can be spread out over the next three tax years (consult with a tax professional).

Opportune time to consider a partial or full conversion of IRA assets to a Roth IRA

- Roth Conversions are most effective when the assets converted from a Traditional IRA to a Roth IRA increase in value over time and future personal income tax rates are higher vs. today’s personal income tax rates.

- Asset Prices: The equity markets have experienced a substantial sell-off with asset prices currently reflecting a much lower price point today than two months ago.

- Tax Rates: Various programs like the CARES Act eventually need to be paid for and could lead to higher tax rates in the future (tax rates currently are low on a historical basis due to the Trump tax cuts).

Direct Payment to Eligible Tax Filers to Mitigate Damage Caused by the Pandemic

- The CARES Act is providing a direct payment to eligible taxpayers to ease the economic impact of the coronavirus pandemic and potentially stimulate the economy.

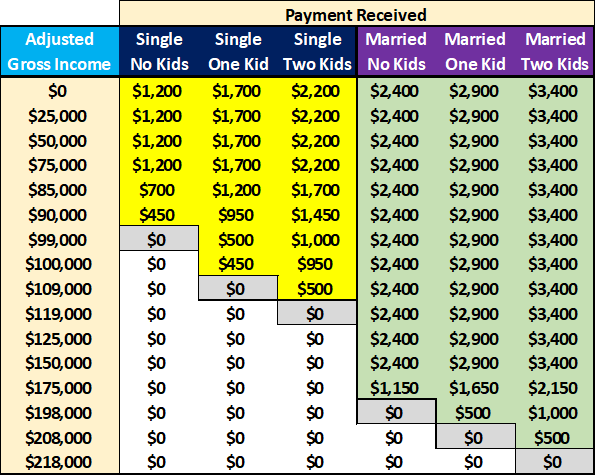

- Eligibility is based on the tax filer’s Adjusted Gross Income (“AGI”) from their most recent tax return filed with the IRS (AGI can be found on the first page of Form 1040, line 7 on 2018 return and line 8b on the 2019 return). The matrix below helps to determine the potential payment based on AGI.

- If 2018 AGI would allow for eligibility for the direct payment, and 2019 AGI would make the tax filer ineligible, then consider holding off on filing a 2019 tax return. There is no claw back provision in the law, so once you receive the payment, it is kept even if 2019 AGI would make the filer ineligible for the payment.

- Treasury Secretary Mnuchin announced that those collecting Social Security who have not filed a tax return for 2018 or 2019 and meet the AGI eligibility requirements will not have to submit a separate tax return to receive a rebate. The payment will be sent directly to their bank account associated with those benefits.

Summary

The Coronavirus has impacted and changed almost every aspect of life, not only in the United States, but around the globe. Our government has provided substantial fiscal and monetary stimulus to jump-start the economy and provide aid to people in need. In difficult times, it is important to keep a focus on your long- term financial goals and to potentially modify existing plans based on the new opportunities provided by changes in market environments and legislation.

When you next meet virtually or in-person with your BDO Wealth Advisor, make sure to dedicate time to both your financial planning strategies and portfolio management. We want to evaluate how to take full advantage of the unique opportunities available at this time which could lead you down a more successful financial path.

Other Opportunities from CARES Act

- The Federal Tax deadline date for filing 2019 taxes has been extended from April 15, 2020 to July 15, 2020 (~ most states have followed suit).

- Increased Tax Benefit for Charitable Contributions

- Qualified Charitable Contribution: For tax filers that claim the Standard Deduction (and do not file an itemized tax return) who normally would not receive a tax benefit from a Charitable Contribution, the CARES Act allow for an “Above the Line” deduction for a $300 cash donation made direct to a 501(c)3 charity.

- For tax filers who file an itemized return, the normal maximum deduction for a cash charitable donation is limited to 60% of AGI, yet the CARES Act allows for a deduction up to 100% of AGI (consult with your tax advisor for details). Combining the change to AGI limitation in the same tax year as a Roth Conversion can be a potentially powerful planning strategy.

- Student Loan Relief

- Student Loan payments have been deferred until September of 2020 and interest will not accrue during the period.

- For students who may be eligible for certain Student Loan Forgiveness (example PSFL program), the 6-month period should count towards the 120 Month Accumulation Period even though no payments are required to be made.

- Unemployment Insurance:

- State unemployment checks, for certain eligible filers, will be increased by an additional $600 per week paid for by the Federal Government.

- The CARES Act established a new Pandemic Unemployment Insurance Program available to self-employed individuals and others that may not have been previously provided coverage by the various Unemployment Insurance programs.

SHARE