BDO Private Capital Pulse Survey - Fall 2020

Private Capital through Crisis: Calculating Risks

In the winter of 2019, the private equity and venture capital industries were certain a recession was imminent. The bull market run would have to end at some point, global GDP was slowing, and trade tensions had skyrocketed, inverting the yield curve and sounding economists’ alarms.

These were matters of course.

Fast forward to the fall of 2020 to a world transformed by a pandemic that in a handful of months brought a once-in-a-generation health crisis, transformed entire industries, and sent unemployment to levels not seen since the Great Depression, all of which wreaked havoc on a global economy that is just now beginning to see signs of recovery.

And while it would be difficult to find a business that was not challenged by the impacts of COVID-19, for most private equity and venture capital firms, those challenges brought with them plenty of opportunities.

At the end of 2019, dry powder globally stood at $2.5 trillion across all fund types, in part due to aggressive fundraising because of recession fears. Fundraising, it turned out, wasn’t particularly challenging. Deploying it, however, was: Deal pace slowed as competition for quality deals intensified.

The pandemic has magnified this challenge. Funds have been in triage mode as they moved to shield their portfolio companies from the escalating financial fallout. Deals that closed during 1H 2020 and were not already in process before the pandemic reflect opportunism or strategic alignment efforts.

But private capital is resourceful. Investment vehicles not widely used since the Great Recession, such as private investment in public equity (PIPE) deals, have reemerged, and co-investments and joint ventures are on the rise, as are the secondaries market and special purpose acquisition companies (SPACs).

As the global economy recovers, private capital will be well positioned to deploy the dry powder it has stored to buy quality assets at a discount and align those acquisitions for above-average returns.

"With the road to recovery shrouded in uncertainty, deal makers are grappling with an unfamiliar landscape. Deal flow will remain comparatively muted for the balance of 2020, but, in line with industry expectations, we believe M&A will pick up as the economy turns around in 2021."

|

SCOTT HENDON |

Price Dislocation Signals Upside for The Opportunistic

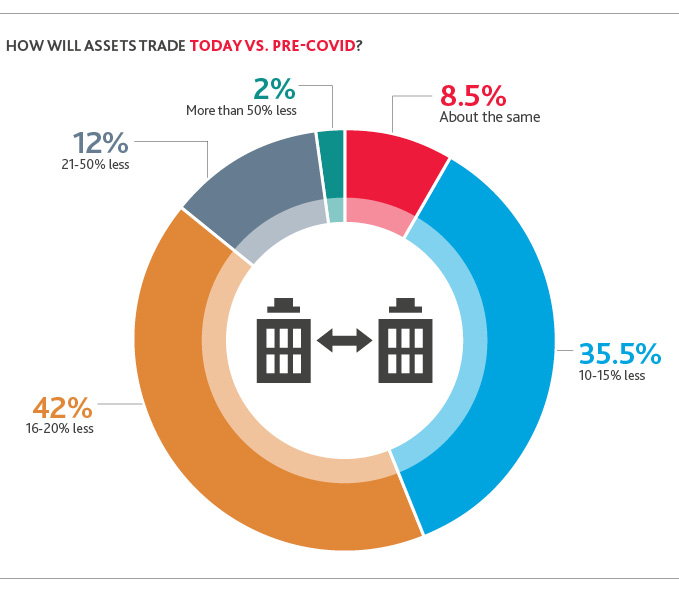

With no historical analogue to show what an economic recovery from a pandemic might look like or when it might take place, modeling a business’ future cash flow and revenue stream is an uncertain process. More than three-quarters (77.5%) of PE and VC respondents say assets today will trade 10% to 20% lower than they would have pre-COVID, reflecting an institutional perspective that the public market remains overvalued.

For PE and VC funds transacting during this time, price dislocation will translate into higher returns. On the flip side, of course, it means portfolios are generally down, which will fan the secular trend toward longer holding periods as fund managers wait for more favorable exit timing.

"The impact of the COVID-19 pandemic has changed the landscape of exit activity. Rather than private to private trades between fund sponsors, we are seeing more exits from companies accessing the public markets—that includes private equity shops that before the pandemic may not have considered IPOs as viable exit strategies. The IPO pipeline is building, which is perhaps an unexpected outcome of the crisis, and may offset other investment and financing strategies."

|

KEVIN BIANCHI |

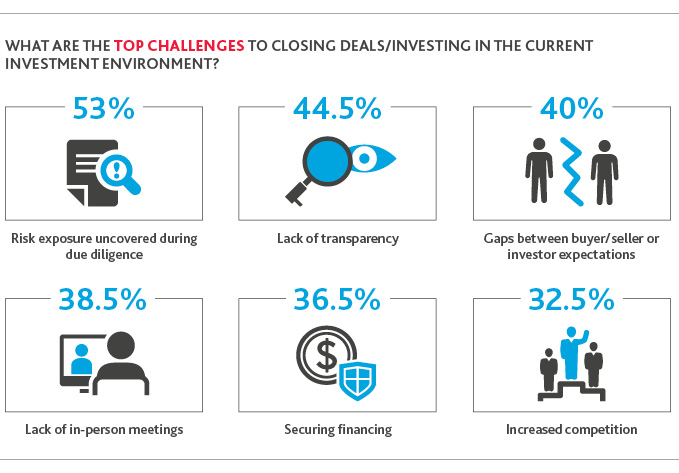

The challenges to deal close, however, are many, and despite the headlines, gaps between buyer and seller expectations are not the top. Funds have been confronted with conducting due diligence entirely virtually—a pivot few, if any, were prepared to make as in-person travel has been traditionally fundamental for deal making. While PE and VC by and large have adapted to conducting business remotely, the inability to have boots on the ground to inspect facilities or assets leaves buyers worried about the diligence they are unable to realize in person.

Private Capital Preparing for M&A amid Optimism about Economic Recovery

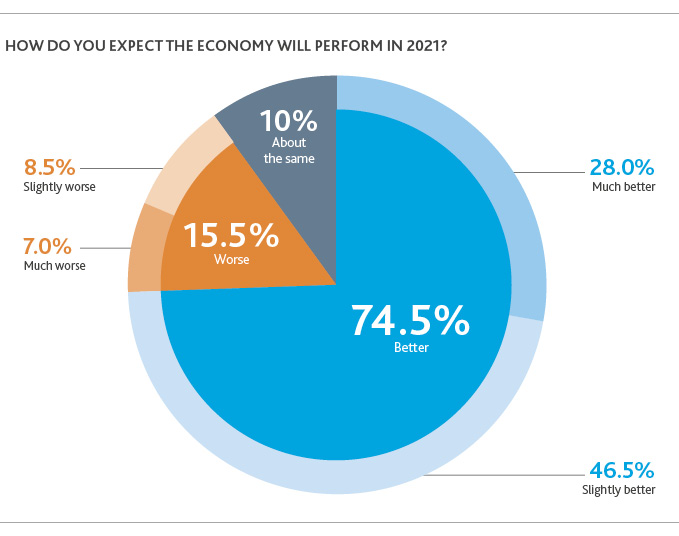

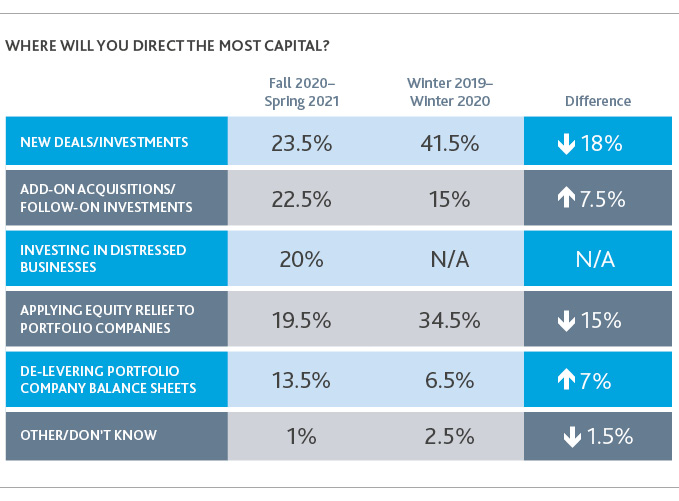

Though funds today are decidedly more bearish on pursuing new deals than they were last winter, and survey responses support the thesis of a shift in strategy to add-on acquisitions as a vehicle for growth, 74.5% of fund managers believe the economy will perform better in 2021—and are eager to put their capital to work.

Among those who indicated they will direct the most capital toward new deals and investments, nearly 50% believe the economy will be only “slightly better” and almost 30% believe the economy will be “much better,” indicating many fund managers are willing to transact with only a slight improvement in economic conditions.

23.5% of fund managers say they will direct the most capital toward new deals or investments in the next six months, down from 41.5% in December.

While it may not be surprising to think next year will be better than a year in which a pandemic took a sledgehammer to the global economy, private capital is positioning its investment strategies for what they expect will be a turn for the positive.

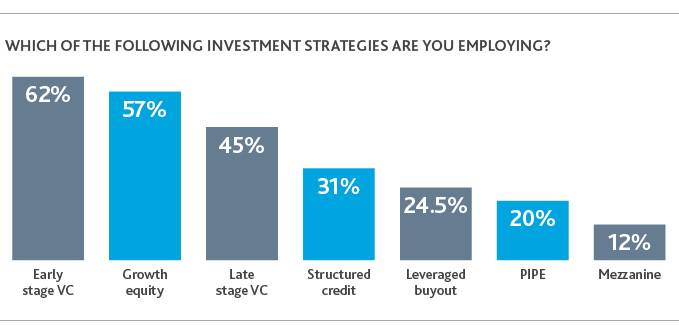

Leveraged buyouts are not the strategy of choice now. With debt financing more constrained, private capital is looking to other strategies, and general partners (GPs) are leaning into more venture-focused strategies. Meanwhile, supporting the add-on and value creation approaches that private capital is taking, growth equity continues to attract limited partner (LP) interest.

M&A in Distress

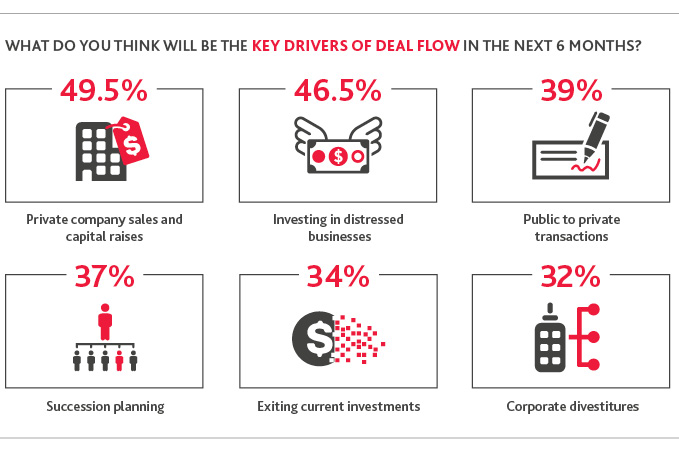

Last winter, 40% of fund managers indicated distressed business deals would be a key driver of deal flow, up from 4% the previous year, and many believed the pandemic would magnify this trend. Reluctance to trade at dislocated prices as well as government aid in the form of the CARES Act’s Paycheck Protection Program, which helped keep businesses afloat, delayed a spate of distressed sales. However, we expect to see distressed deal activity pick up in 2H 2020 and into 2021 as businesses that are still experiencing disruption deplete their government loans. Also, deal activity may potentially be affected by the impact of the end of stimulus checks on consumer spending, another ripple effect private equity fund managers are monitoring as it pertains to certain segments of their portfolios.

"Private capital outperformed the public markets during the recovery from the Great Recession, but the asset class was slow to make new acquisitions and missed on the returns that would have come from buying quality assets at a steep discount. If they are looking for an opportunity to correct the so-called sins of the past, now is the time."

|

JIM LOUGHLIN |

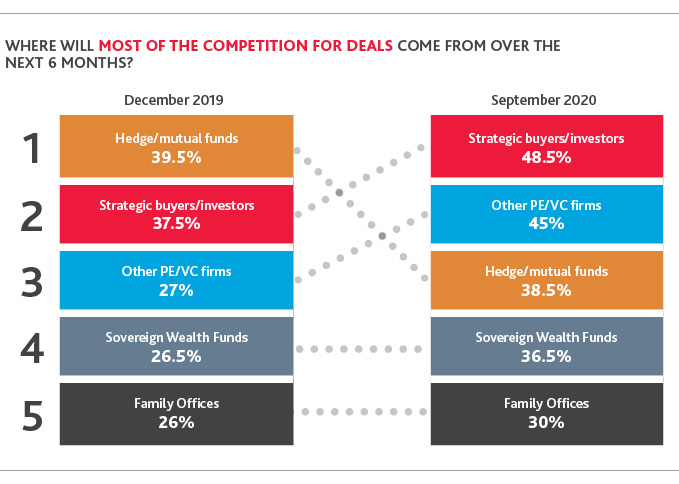

In a departure from December’s poll when hedge funds and mutual funds were identified as the greatest competitors, private capital now believes most competition will come from strategic buyers and other private equity and venture capital firms—with increases of 11 percentage points and 18 percentage points year over year, respectively. This may be due to the uneven nature of the winners and losers during COVID—the winners taking the opportunity to gain market share by swallowing up competitors and adjacent companies. On the private equity side, the rise of tech-focused mega funds looking to capitalize on opportunities and the industry-wide digitalization accelerated by the pandemic have also created more competitors within the industry.

The Road Ahead: “Cautious Optimism” Lives Again

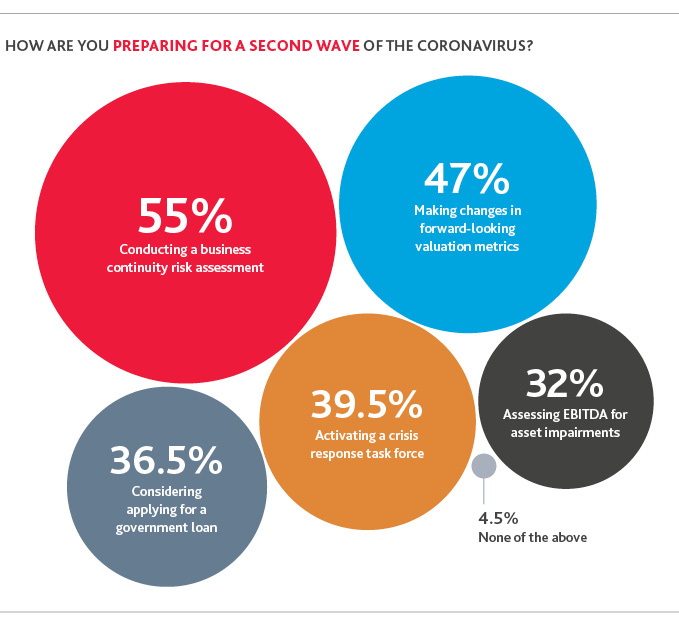

During the Great Recession, the phrase “cautious optimism” peppered executives’ statements on the anticipated course of their business’ performance. Similarly, today, while optimistic for an economic recovery, fund managers have one eye trained on the course of the health crisis and its fallout. Notably, more than one-third (36.5%) would consider applying for a government loan in the event a second wave occurs, but existential threats to business top fund managers’ concerns.

Conducting risk assessments is a strategic measure to undertake in the context of a global economic crisis, but it also gives funds a competitive advantage by allowing them to identify fund- or portfolio company-level vulnerabilities. Having this knowledge can translate into divestitures or informed efforts to remediate and strengthen portfolios.

SHARE