Materiality Assessment: Identify the ESG Issues Most Critical to Your Company

While a variety of complex topics make up the ESG landscape, not every environmental, social and governance issue will be of equal importance to your organization.

An effective ESG strategy and program begins with understanding the highest priority topics for your business and stakeholders. To identify which issues are most relevant, we advise companies to conduct an ESG materiality assessment.

An ESG materiality assessment is a process that weighs the impacts of ESG issues and their importance to both a company and its key stakeholders. The assessment gathers and analyzes stakeholder feedback to provide insights into future trends, business risks and opportunities. These learnings help companies establish ESG strategic priorities, build a strong corporate value proposition, and set goals and targets.

Conducting an ESG materiality assessment is an important step in ESG strategy and program development. In this article, the second in BDO’s series on starting your ESG journey, we share insights to help you plan your ESG materiality assessment and effectively use the information it provides.

Materiality in ESG Reporting Is Unique

Materiality in the context of financial reporting focuses on the decision-making needs of an investor audience. Materiality in the context of ESG reporting often considers much broader stakeholder audiences and impacts.

In recent years, the “double materiality” perspective has become prominent in ESG reporting. Double materiality requires a company to report simultaneously on how ESG matters are financially material in influencing its business value as well as on how its own impacts are material to the market, the environment and people.

Double materiality calls on companies to report information that would be meaningful not only to investor decision-making but also to other stakeholders, such as local communities, non-governmental organizations (NGOs), environmental agencies, customers, consumers and employees.

The concept of double materiality is central to European Union sustainability legislation such as the Corporate Sustainability Reporting Directive (CSRD) and its associated European Sustainability Reporting Standards (ESRS). With the exception of the Global Reporting Initiative (GRI) Standards, which embrace this broader stakeholder and impact materiality approach, other ESG standards and frameworks focus primarily on reporting for investors.

We believe that considering broader stakeholders and corporate impact, in addition to investors and business value, can help your organization identify the full range of non-financial risks and opportunities. Referencing more than one standard or framework in your reporting — such as reporting against both the GRI Standards and the Sustainability Accounting Standards Board (SASB) Standards — may provide more balanced reporting for your stakeholders and better suit your reporting needs.

Benefits of ESG Materiality Assessment

Regardless of the materiality approach you choose, a materiality assessment can offer important benefits to your company’s ESG strategy and program. A materiality assessment can:

- Help Establish Priorities

Promote sustainability while focusing on issues with the most significant impact. - Assist With Setting Goals and Targets

Determine areas where setting goals and targets would be most beneficial. - Build a Stronger Corporate Value Proposition

Identify opportunities for sustainable value creation and mitigate risks to enhance business continuity. - Inform a More Dynamic Business Strategy

Evaluate risks and opportunities in the short, medium and long term, while considering the evolving nature of many ESG issues, such as climate, social equity or policy advocacy. - Enhance Stakeholder Engagement and Alignment

Bring different perspectives and viewpoints on issues that help shape your business strategy and illustrate long-term value. These stakeholders can include investors, customers, employees, NGOs and others active in your space. - Leverage Opportunity to Create New Revenue Streams

Stay ahead of industry trends, stakeholder expectations and regulatory developments.

Conduct Your ESG Materiality Assessment

An ESG materiality assessment and formal analysis of results can be completed in five key steps.

1. Assemble a Project Team

When assembling a project team to conduct your ESG materiality assessment, it is important to consider cross-functional collaboration across your organization. Doing so can help obtain initial buy-in and valuable expertise from key leaders across your company. A successful ESG materiality assessment will need support from the C-suite, the ESG Steering Committee and department leaders in Human Resources, Legal, Finance, Supply Chain and other areas.

2. Prepare a List of Stakeholders to Engage

The project team should prepare a list of the internal and external stakeholders they wish to engage. Many companies prioritize the interests of their institutional investors while dedicating fewer resources to identifying expectations from other groups such as community members, employees and consumers. To create a more complete picture of risks and opportunities, consider all relevant stakeholder groups. Once finalized, this stakeholder map will guide the rest of the analysis.

3. Develop an Initial Material Topics List

After identifying your stakeholder groups, develop an initial material topics list to help guide engagement. This list should reference your organization’s previous materiality work, ESG ratings and peer benchmarking. It should also consider ESG reporting standards, frameworks and initiatives — these could include GRI and SASB standards, Task Force on Climate-Related Financial Disclosures (TCFD) recommendations, proposed standards from the International Sustainability Standards Board (ISSB) and U.N. Global Compact guidance.

4. Conduct Stakeholder Engagement Initiatives

Next, select your methods for stakeholder engagement. Companies can tailor this activity to their needs and audiences. Determining what is right for your organization will depend on available resources, level of ESG program maturity, and existing engagement channels for each stakeholder group. For example, companies may opt to conduct a stakeholder survey only, rather than in-depth interviews. Companies may also opt to conduct more expansive stakeholder engagement initiatives such as roundtables or town halls.

5. Create a Formal Analysis of Results

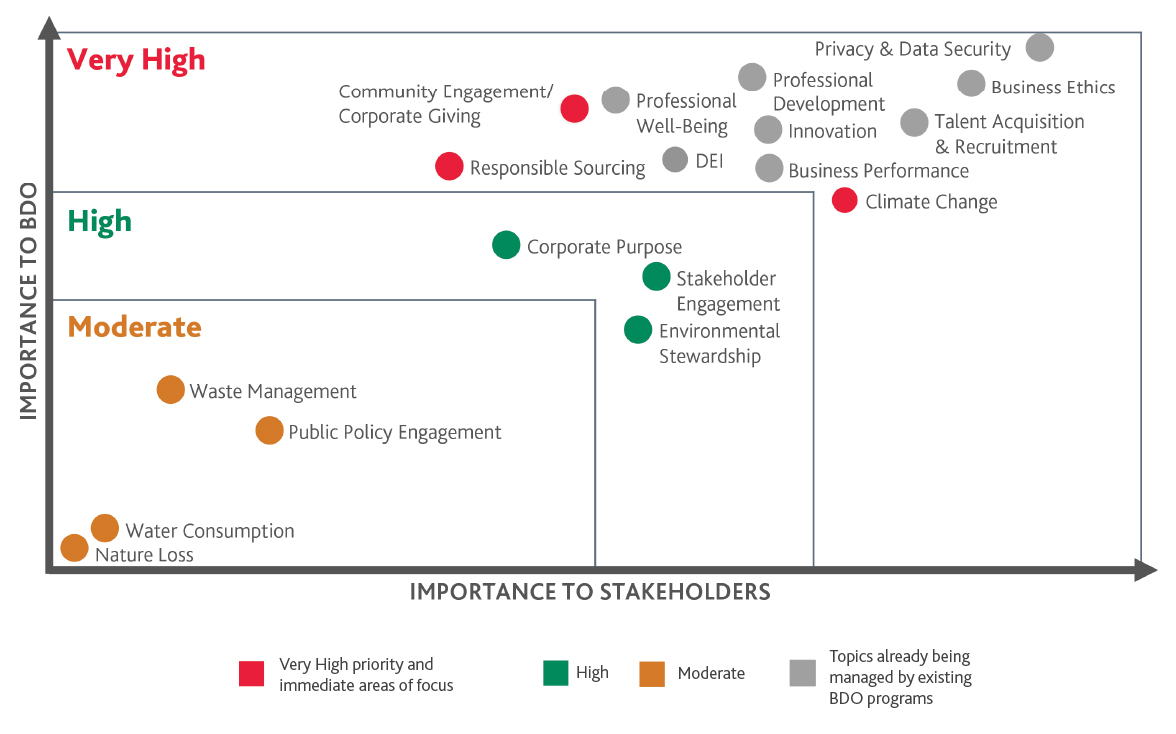

Following the engagement process, create a formal analysis of results. We recommend producing a final report that includes data, methodology and findings. The report should include a materiality matrix that visualizes the intersection of different topics by business impact and stakeholder importance.

Materiality Matrix

This matrix shows the results of the third-party-assisted materiality assessment that BDO conducted to better understand the issues most important to our stakeholders. It appears in BDO’s 2022 Sustainability Report.

Leverage Your Findings

The results of the ESG materiality assessment can help refine priorities for your ESG strategy and program and enhance alignment across your organization. Use the results of the ESG materiality assessment as guidance to determine and develop strategic ESG initiatives, assess ESG-related risk management and value creation opportunities, set goals and targets, and establish key performance indicators.

We also recommend publishing materiality assessment findings as part of your external ESG reporting to provide stakeholders with more complete, transparent information.

ESG Materiality Is Dynamic

Conducting an ESG materiality assessment should not be a one-time exercise. As risks change over time, it is critical to reassess materiality regularly. We recommend conducting an ESG materiality assessment every two to three years to help keep track of evolving ESG priorities and support program relevance and effectiveness.

SHARE