Retail in the Red: BDO Bi-Annual Bankruptcy Update

Retail has had a tumultuous past few months. Despite briefly dipping in November and December, retail sales bounced back in January and February sales remained relatively strong. However, there is evidence that consumer spending may soon start to slow, as savings decline and debt rises. With respect to bankruptcies, the retail industry was healthy through the end of 2022, seeing minimal bankruptcies, but 2023 may paint a different picture.

Retail Bankruptcy and Store Openings and Closings Update

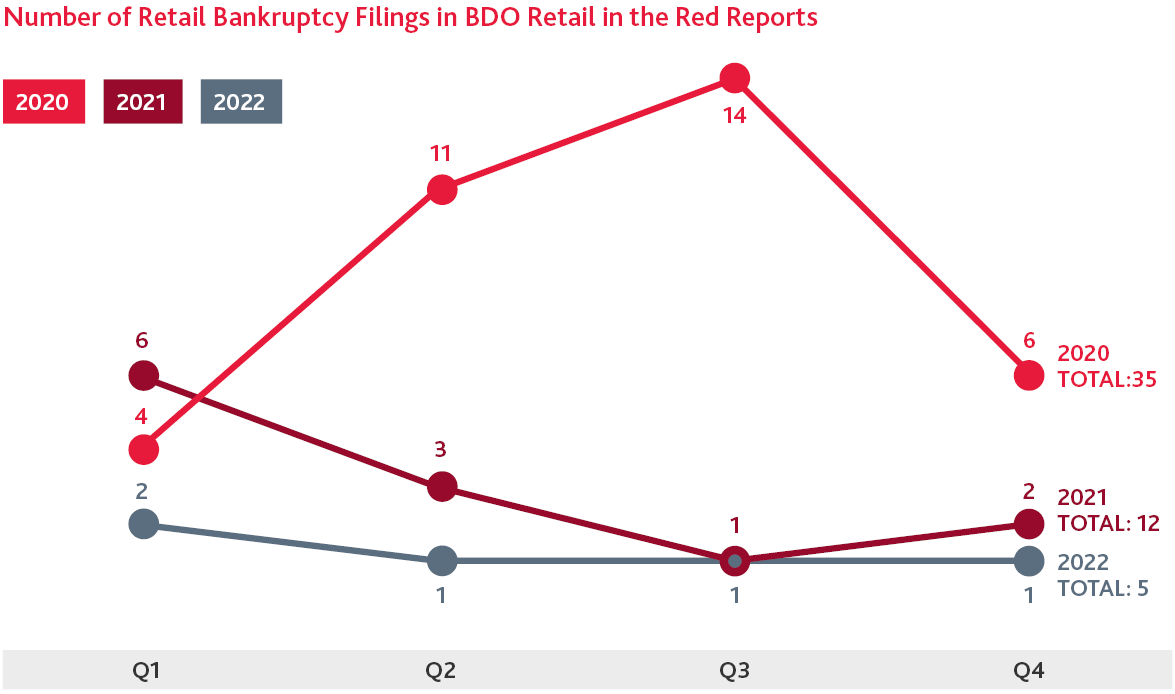

There were just two major retail bankruptcies in the second half of 2022 and only five major retail bankruptcies for the entire year, a 13-year low according to S&P Global market intelligence data. Both retailers who declared bankruptcy in the second half of 2022 are liquidating and closing all stores.

Despite low bankruptcies in 2022, 2023 is already looking grimmer. Through the end of February, there have been six retail bankruptcies, more than in the entirety of 2022.

It is notable that many of these stores sell primarily discretionary products. Consumers are likely pushing back big purchases of RVs and ATVs. Many may no longer have sufficient funds, don’t want to pay high interest on financing plans, or made these purchases at the start of the pandemic. Meanwhile, party supplies, for example, are seen as non-essential and can be one of the first places where consumers cut back on spending. It is likely that 2023 will continue to see additional retail bankruptcies, particularly among non-essential segments, but the pace observed at the beginning of the year will slow down. Distressed retailers who hung on through the holiday season now face a cooling of demand compared to the holiday period and will need to refresh and restock inventory for the spring and summer seasons amid mounting economic pressures.

While retail bankruptcies are starting to rise after a record-low year, store opening announcements continue to significantly exceed store closings. In total, U.S. retailers announced approximately 2,600 store closures and 5,100 store openings for the year, according to Coresight Research. The largest number of store opening announcements came from discount and dollar stores.

Planned Store Openings Announced in 2022

With high inflation, consumers are tightening their budgets and are turning to discount and dollar stores to get more for their money.

Macroeconomic Update: The Good and The Bad

The Good Indicators

The macroeconomic news at the beginning of March 2023 was largely positive. The U.S. economy grew at an annual rate of 2.7% in the fourth quarter of 2022, after growing 3.2% in the third quarter. The unemployment rate and the total job creation for 2022 even broke multi-decade records:

The Bureau of Labor Statistics reported:

- Unemployment fell to 3.4% in January 2023, the lowest level since 1969. It increased slightly in February to 3.6%, but this was due in part to an increase in the labor force participation rate.

- Wages and salaries were up by 5.1% for the 12-month period ending in December 2022. Wage growth also rose 1% in the fourth quarter.

- The job market remained very strong with 311,000 jobs added in February 2023 and 504,000 jobs added in January 2023.

- There were 4.5 million jobs added for all of 2022, the second-best year, after 2021, dating back to 1940.

- There are signs that inflation is cooling, as inflation eased in February for the eighth consecutive month. However, inflation remains stubborn and the CPI measured 6% for the year ending in February, down from January's 6.4% but still well above the Fed's target of 2-3%.

The Federal Reserve may decide to pause interest rate increases to fight inflation over the next several months, after raising interest rates from near zero to 4.75% in February 2023.

The Bad Indicators

However, there are also many market forces retailers are grappling with that are not positive:

- While retail sales rose by 3% in January, they declined in February by 0.4%. A sustained pull back in consumer spending could be a concern for retailers and the broader economy.

- Household budgets remain tight, as the high cost of essentials limits discretionary spending. According to a report by Pymnts and LendingClub, 64% of consumers said they were living paycheck to paycheck at the end of 2022, up from about 9.3 million people in 2021.

- Personal savings rates declined to 4.7% in January. This is above the 4.5% recorded in December, but still significantly lower than the 8.8% pre-pandemic average, according to the U.S. Bureau of Economic Analysis and S&P Global Market Intelligence.

- According to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit:

- Total US household debt hit a record $16.9 trillion during the fourth quarter of 2022. This was an increase of $394 billion, or 2.4% from the prior quarter.

- Credit card balances increased by $61 billion to reach $986 billion, surpassing the pre-pandemic high of $927 billion; mortgage balances rose to $11.92 trillion, auto loan balances to $1.55 trillion, and student loan balances to $1.60 trillion.

- The share of current debt transitioning into delinquency increased for nearly all debt types.

- The average credit card interest rate was 20.35%, according to CreditCards.com’s latest figures, forcing borrowers to shell out more to cover the interest burden.

- The U.S. stock market had its worst year since 2008 in 2022, according to Refinitiv.

- The U.S. Census Bureau reported that real estate activity has slowed: new home construction decreased 29.9% in 2022 versus 2021 and sales of existing homes in January 2023 were down 36.9% on an annual basis.

Excess Inventory and Impact to EBITDA

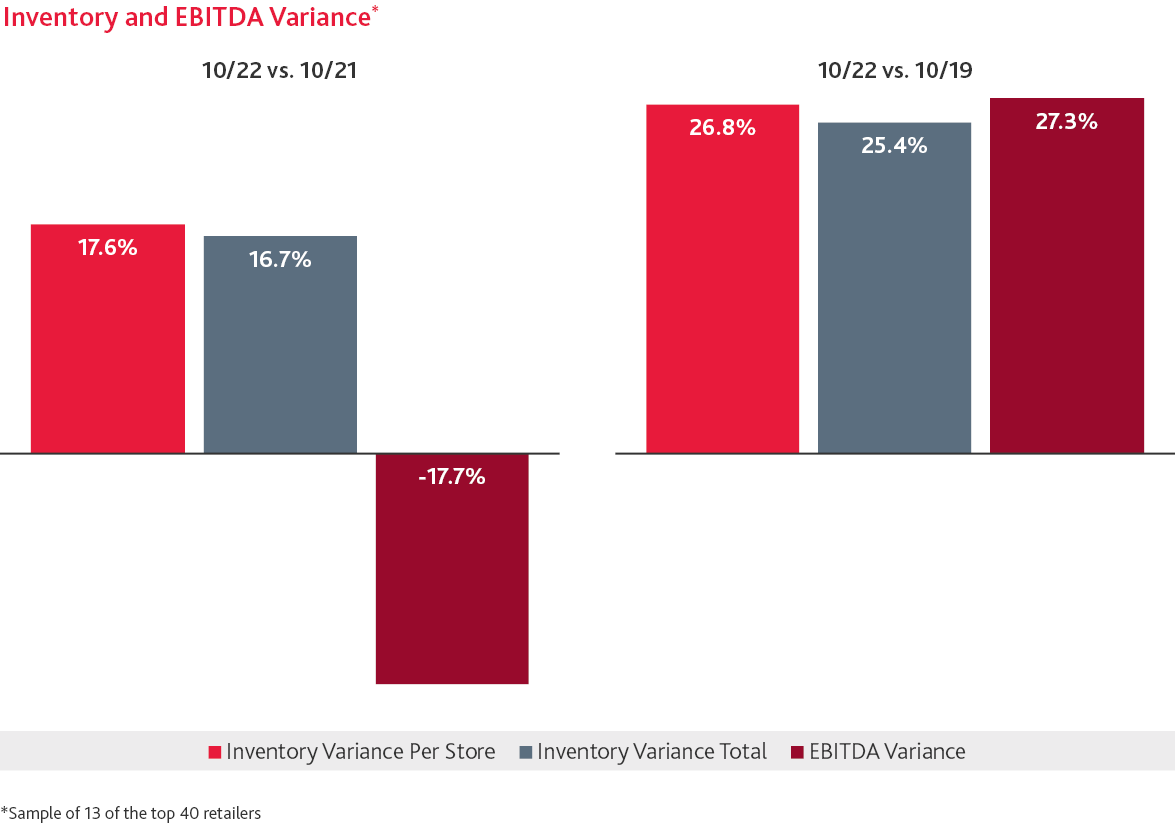

Many retailers struggled with excess inventory in 2022 due, in part, to over-ordering in response to supply chain slowdowns in 2021. However, high inflation, diminished savings and high personal debt caused consumers to slow their spending towards the end of 2022. This resulted in unhealthy levels of inventory for retailers. Retailers have been trying to remedy the situation with deep discounts, cutting purchase orders, and warehousing inventory to sell in the future, all of which negatively impact EBITDA and their bottom lines.

The above chart shows a sample of 13 of the top 40 U.S. retailers by sales and the changes in the dollar amount of their inventory between the third quarters of 2022, 2021, and 2019. The quantity of inventory increased in 2022 compared to both 2021 and 2019. EBITDA, however, decreased per store in 2022 compared to 2021, but increased in 2022 compared to 2019. Excess inventory is clearly putting pressure on EBITDA. Heading into 2023, retailers are looking for ways to improve profitability, and one such way is by eliminating excess inventory.

Returned items will represent $171 billion in lost 2022 holiday sales for retailers. This is 17.9% of the holiday purchases made.*

Returns and Recouping Losses

Another method for improving profitability is altering return policies. Returns cost retailers money and many retail executives have implemented strategies to reduce returns over the last several years. The data shows, however, that the issue isn’t going away any time soon.

Returned items during the holiday season are more than a full percentage point higher than the 16.5% average return rate throughout the year, and up significantly from 2021. Typically, returned goods must be heavily discounted to be resold.

Approximately 60% of retailers changed their return policies in 2022, according to goTRG. For example, some retailers have begun charging $4 to $7.50 to restock merchandise or to receive a return label, shortening the timeframe shoppers have to send an item back, or telling shoppers they will have to cover the shipping costs themselves.

Retailers need to be savvy about finding a balance between changing return policies and risking a loss of sales. Asking consumers to pay their own shipping costs or cover processing fees can discourage shoppers from making purchases entirely. Alternatively, it could encourage brick-and-mortar returns, increasing the likelihood that consumers will make an exchange or another purchase.

According to a recent report by PowerReviews, 98% of consumers said that free shipping was the most important consideration when shopping online and more than 75% said the same about free returns. In an environment where consumers have many options, retailers need to be careful before making changes to return policies to ensure they don’t inadvertently send customers to their competitors.

Retail Industry Outlook for 2023

Looking back at 2022, there were just two bankruptcies in the latter half of the year. Retailers were able to avoid bankruptcies during this time due to strong consumer spending in the summer and early fall, much of which was fueled by early holiday promotions that pulled holiday shopping up to earlier in the year. As a result, spending was somewhat suppressed in November and December. After the holiday season, consumer spending jumped by a seasonally adjusted 3% in January. While this was encouraging on the surface, it may have been too little too late for retailers who already faced a disappointing holiday season. Many sales in January were likely composed of discounted merchandise, generating little profitability. Purchases may have also been paid for using holiday gift cards, thereby not providing any boost in cash to the retailer. Additionally, as inflation on essential items, such as groceries, continues to eat away at consumer budgets, consumers have fewer available dollars to spend on discretionary items. All of these factors have led to additional strain on retailers’ bottom lines, which likely forced some distressed discretionary retailers to file for bankruptcy in 2023. The reduction in spending on discretionary goods was seen in the 0.4% reduction in sales in February.

Credit card purchases fueled some of the strong consumer spending in 2022. Looking forward, consumers are likely to realize that using credit cards to fund spending is unsustainable, as bills come due and any savings they do have are likely to be used to pay down debts. This may cause a further dip in spending in the coming months, reducing retail sales and disproportionally hurting retailers with weaker balance sheets. According to a Numerator survey, the top financial goals for consumers in 2023 include increasing savings and reducing spending, as shown below:

Overall, it seems that the early months of 2023 are where we’re going to see an uptick in bankruptcies. The post-holiday season is one of the most difficult times of the year for retailers. They face lower sales and need to buy new summer inventory at a time when they cannot pass increased costs on to consumers.

Additionally, the post-pandemic years may have caused an anomaly in store closings. The unique events of 2020 likely skewed bankruptcies downward in 2021 and 2022 because the shutdowns may have brought some retailers to bankruptcy faster. The pandemic also may have motivated companies to refinance earlier, extending the timeline for when they will face maturities. Now, high-interest rates make refinancing much more expensive. As the retail environment faces mounting challenges, lenders may tighten borrowing availability, leading to liquidity issues for distressed retailers. This will likely further contribute to an increase in loan defaults and, therefore, bankruptcies.

Our fall 2022 report correctly predicted that there would be more net store openings than closings. We expect this trend to continue into 2023. It is important to note that the store opening trend is largely driven by discount retailers – which is unsurprising as consumers look to save where they can. The discount format is also more suited to brick-and-mortar shopping, rather than e-commerce, due to the low-price, high-volume purchases that consumers tend to make. However, we expect certain retailers of discretionary goods, such as home goods, apparel, furniture and department stores to close some stores in 2023 in order to cut costs. Overall, while we expect store closings to increase in the first half of 2023, the number of openings will still likely exceed the number of closings.

To find success in 2023, retailers will need to:

- Prepare for continued economic uncertainty: Retailers should start by taking an honest assessment of their company’s performance. One way to assess this is by completing BDO’s free Retail Health Assessment. Beyond a general financial assessment, prepare cash flow forecasts to identify potential liquidity issues in advance and allow for time to address problems. A 13-week cash flow forecast summarizes key aspects of liquidity and includes the latest information available from all relevant departments and segments. Learn more in our guide to the 13‑Week Cash Flow Forecast.

- Address excess inventory issues: Many retailers are still struggling with excess inventory after the holiday season. While there is no magic wand to fix today’s inventory glut, retailers should continue to explore discounting, liquidating or storing inventory to sell in the future. The best solution to the excess inventory problem is to prevent it in the first place. Properly plan inventory needs by using supply chain technology to enhance visibility and better track where orders are in the supply chain. Additionally, demand forecasting technology can help retailers understand what they should order and when based, in part, on shifting consumer spending patterns or trends. This can help avoid extreme fluctuations in inventory in 2023. Learn more in our Ahead of Time Supply Chain Model eBook.

- Focus on cutting excess costs to enhance profitability: Identify where there are opportunities to cut costs, such as staff reductions, store closures, and reducing selling, general and administrative expenses. Additionally, adjusting return policies could reduce the number of items returned, saving retailers money.

Successful retailers will need to upgrade their forecasting capabilities to properly forecast both their liquidity, as well as demand. Avoiding swings between inventory scarcity and excess will be critical in this time of economic volatility.

We believe that retailers have reason to be cautiously optimistic for the year ahead, but certainly expect subsegments to perform differently as consumer spending patterns shift and macroeconomic factors strain retail’s bottom line.

*According to NRF data

SHARE