BDO Biotech Brief - Q1 2023

Table of Contents

- Introduction

- Stock Prices Declined in 2022, but Things May Be Looking Up

- Spotlight: Biotech IPO Success Stories

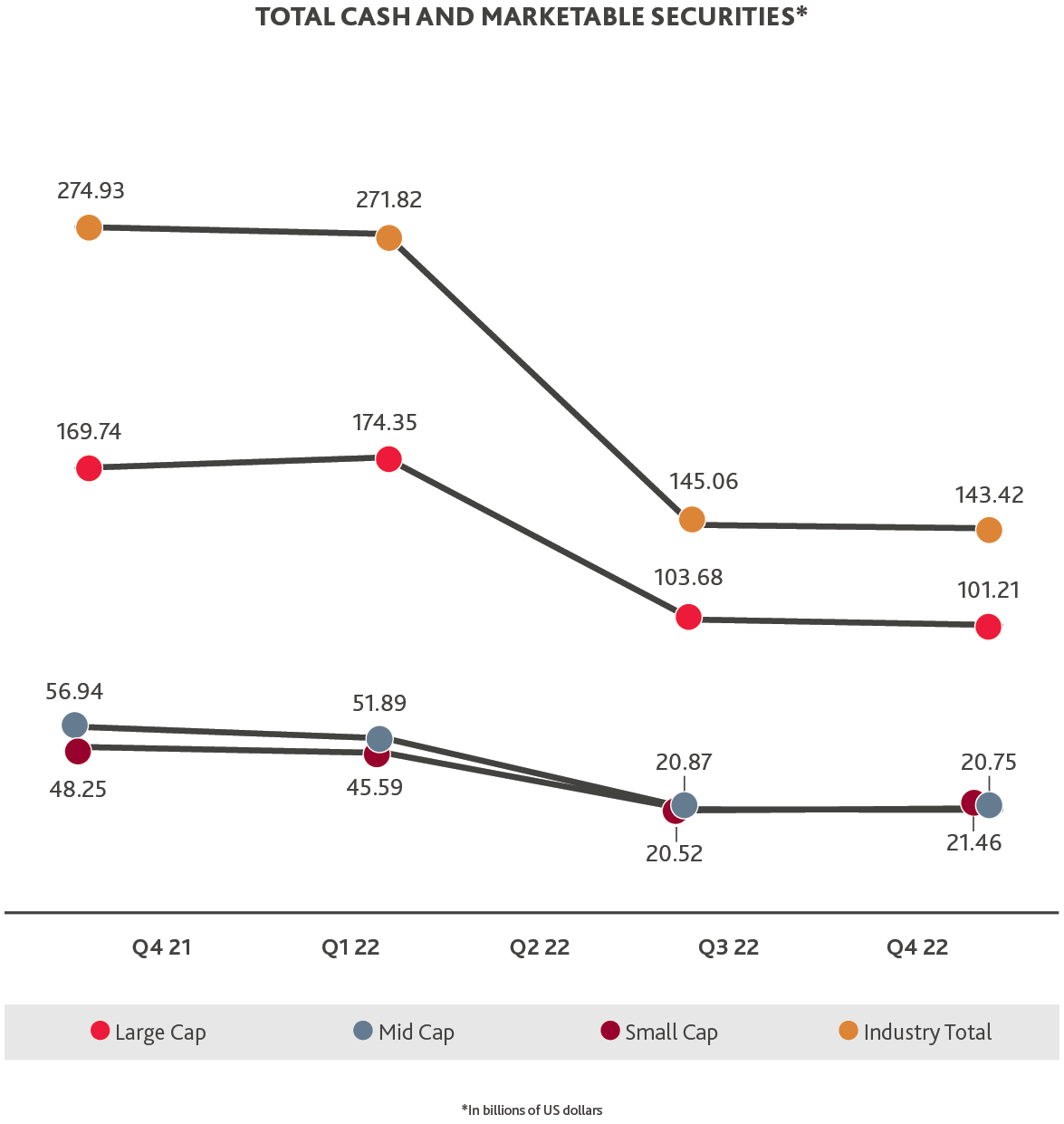

- Cash and Marketable Securities Decline as Companies Spend Their Savings

- What’s Next for Biotech

- Congratulations to the Companies Newly Added to the NBI in 2022

- Methodology

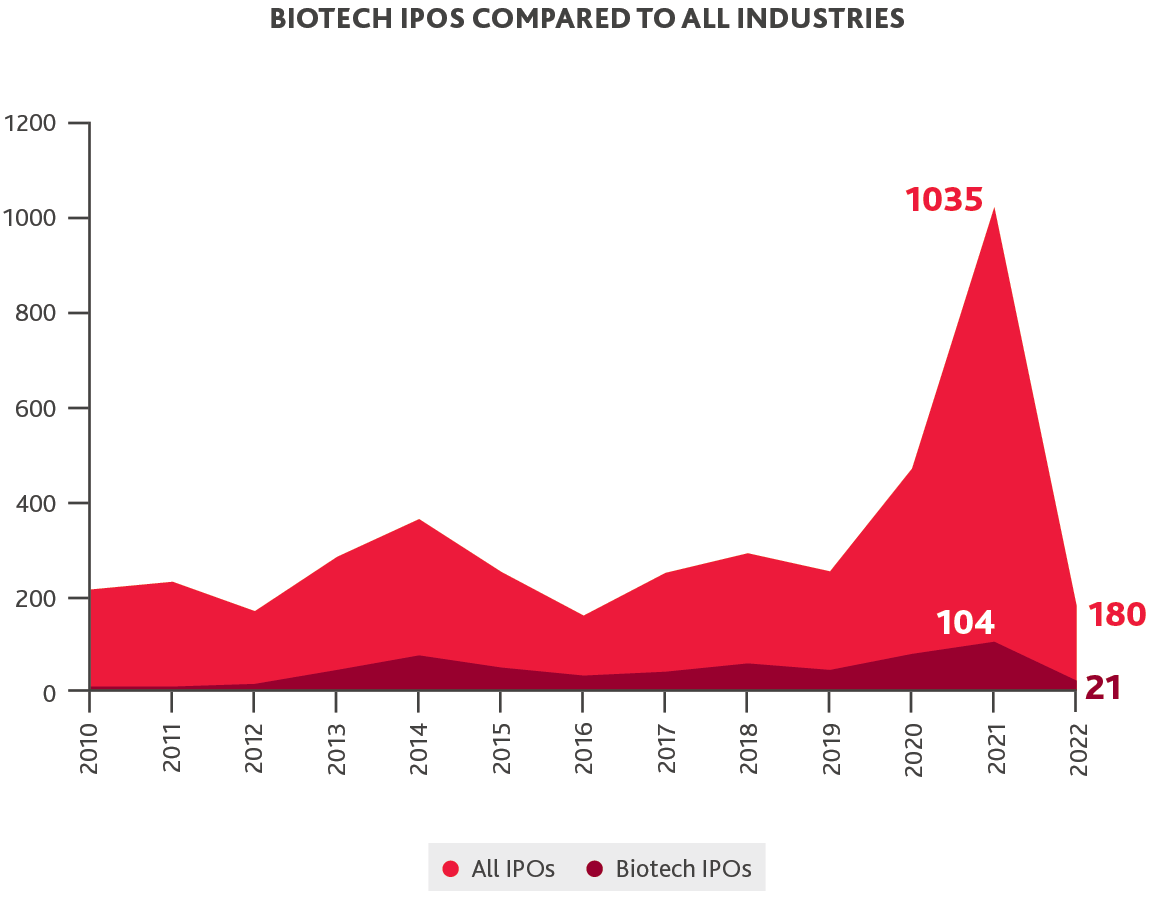

After years of plentiful cash inflows from eager investors, the biotech boom may have come to an end. COVID-19 multiplied investor interest in technology like mRNA, and areas like patient-specific therapeutic products benefited from some of that interest by proximity. The industry had a record-breaking 2021, with the Nasdaq Biotechnology Index (NBI) hitting a high of 5,476 points in August 2021 and 104 IPOs that same year. But by 2022 that came crashing down, with the NBI closing the year at 4,213 points and only 21 IPOs.

In 2022, the cost of borrowing rose, available cash dried up and the glimmer of mRNA and COVID-19 vaccines that attracted some casual investors to the industry began to wear off. This slower period could force investors and biotechs to focus all their efforts on late-stage products, as they have the greatest chance of receiving FDA approval. The biotechs that can generate strong clinical trial data will find the partnerships, buyers or investments to bring their technology to the next clinical phase. The ones that can’t produce the data will continue to struggle to raise capital. 2023 will likely reveal which biotechs have the groundbreaking research and technology to last the next 10 years and which will need to reevaluate their priorities.

2022 saw just 21 biotech IPOs, compared to a record-breaking 104 in 2021. There were almost as many biotech IPOs in 2021 (104) as there were for all industries in 2022 (180).

In addition to the IPO decline, the NBI declined by 10% by the end of 2022, compared to the start of the year. Market capitalization for companies on the NBI declined by an average of 15% between Q4 2021 and Q3 2022.

The economic uncertainty, inflation and rising interest rates that impacted every industry contributed to the steep dropoff of biotech IPOs and the decline in valuations. The Nasdaq Composite declined by 33% over the course of 2022, with the Nasdaq Biotechnology Index only decreasing by less than 10%. In addition, many casual investors who entered into the sector due to interest in COVID-19 vaccines and treatments began to sell off their investments when prices peaked and demand decreased due to market saturation in late 2021. Finally, some companies that went public in 2020 and 2021 were riding the coattails of the biotech boom. Without strong data and scientific fundamentals, some of these companies are now struggling to obtain financing on favorable terms.

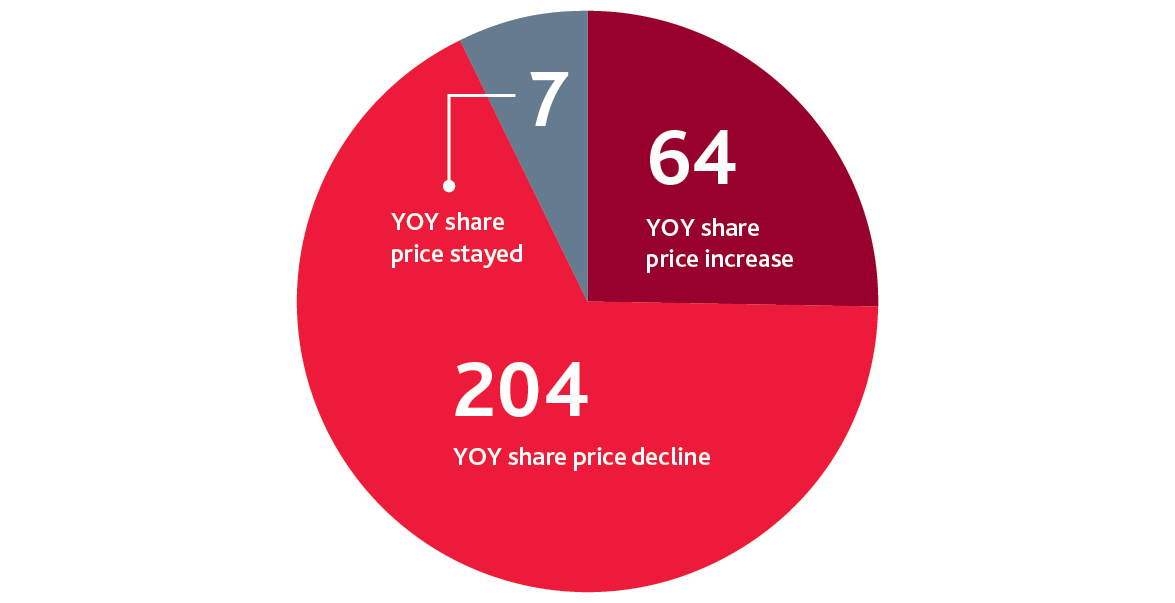

Over two-thirds of biotechs that went public in 2021 had drugs in either preclinical or Phase 1 clinical trials, according to a Nasdaq executive in an interview in Biopharma Dive. Going public before products were in clinical trials made it difficult for these companies to continue to demonstrate their value. For example, of the top 10 biotech IPOs of 2021, half are still in preclinical or Phase 1 clinical trials in early 2023. All 10 of these have seen a decline in share price since their 2021 IPOs.

More than three quarters of companies on the NBI saw their year-over-year share price decline or stay the same in Q4 2022.

Despite the tough year, some biotechs that went public in 2022 managed to end the year on a high note. These NBI companies all ended the year with a return of 30% or greater:

- CinCor Pharma went public in January 2022, while the company was in Phase 2 clinical trials. CinCor has developed the cardiorenal drug Baxdrostat for treatment-resistant hypertension. In March 2023, AstraZeneca completed its acquisition of CinCor and plans to bring Baxdrostat to Phase 3 clinical trials. Baxdrostat selectively targets aldosterone synthase. It has been studied for its use in treatment-resistant hypertension but could be used in a variety of diseases where aldosterone plays a significant role in disease pathophysiology, including primary aldosteronism. CinCor is exploring its utility in treating chronic kidney disease. Given its potential to treat multiple diseases, Baxdrostat and CinCor presented an attractive buy for AstraZeneca.

- Arcellx went public in February 2022, following a positive Phase 1 readout. The company develops cell therapies for cancer and autoimmune diseases. It recently announced a plan to co-develop and co-commercialize its CARTddBCMA product for multiple myeloma with Kite, a Gilead company. Arcellx is currently investigating CART-ddBCMA in a Phase 2 pivotal trial. Arcellx has also developed novel D-Domain technology, a small synthetic binding agent that can potentially enable higher transduction efficiency in CARs.

- PepGen went public in May 2022, when the company was conducting Phase 1 clinical trials. PepGen aims to develop the next generation of oligonucleotide therapeutics, with the goal of treating severe neuromuscular and neurological diseases such as Duchenne muscular dystrophy (DMD) and myotonic dystrophy type 1 (DM1). It produced positive clinical data from its Phase 1 trial of PGN-EDO51 for the treatment of Duchenne Muscular Dystrophy in the second half of 2022.

These companies only went public when they were in Phase 1 trials or later-stage trials.

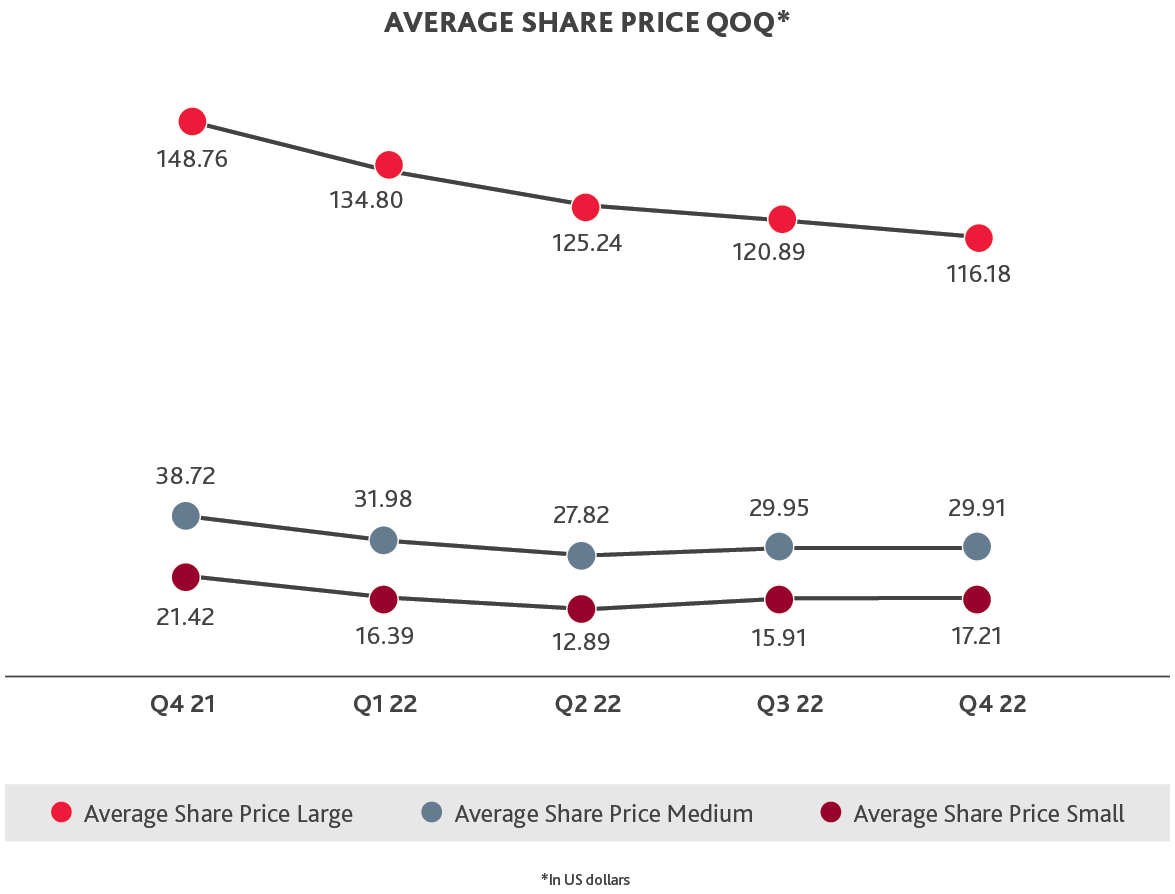

After a challenging year for the industry, signs indicate that the NBI and biotech IPOs are positioned to rebound as inflation levels out and a biotech bubble gives way to normalization. On average, small and medium biotechs saw their stock prices stabilize in Q4 2022 compared to the previous quarter.

While large cap biotechs saw their average share price continue to decline in Q4 2022, the rate of decline is slower, indicating large companies may soon see their average share price start to stabilize or increase. These share price trends are all indications that the biotech market could soon return to a healthier normal. We may see IPOs tick up once again by the end of the year, as stock prices reach a higher equilibrium and conditions become more favorable to biotech IPOs.

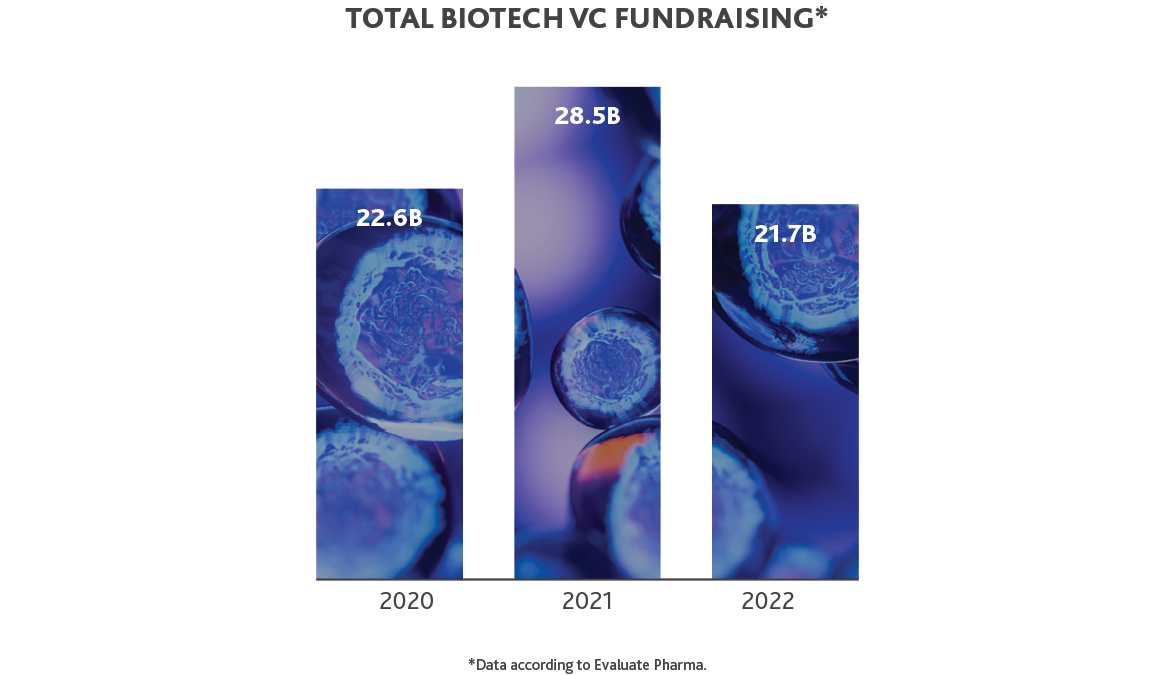

Venture funding slowed in 2022 compared to 2021 but was just slightly under funds raised in 2020.

Additionally, as interest rates increased, borrowing became more expensive and biotechnology companies began to spend down their cash. Cash and marketable securities declined by 53% on average from Q4 2021 to Q3 2022, for NBI companies.

As companies’ cash reserves have declined, biotechs have resorted to cash-saving measures. According to BDO’s 2023 Life Sciences CFO Outlook survey:

- 46% of life sciences companies surveyed were outsourcing their scientific/technical functions (such as process development, manufacturing, and/or clinical operations)

- 13% of life sciences companies are planning layoffs and/or furloughs

Outsourcing may be a particularly attractive strategy for small biotechs that don’t have the resources or experience to handle process development, manufacturing or clinical operations. And layoffs will likely hit smaller companies hardest, as they run out of cash first. However, due to the ongoing talent shortage across the industry, those who are laid off will likely soon find new jobs at larger organizations, or as contractors.

Despite the decline in cash, large-cap biotechs have maintained much greater reserves than their small and medium counterparts. Major pharmaceutical companies like Pfizer, Novartis and Merck have announced they are looking for acquisitions as they lose patent protections in the coming years and face reductions in COVID-19 revenue. If small and medium biotechs continue to run low on cash, and if borrowing remains expensive, we could see more partnerships and acquisitions.

2023 will be about finding balance as the biotech industry adjusts to its new financial reality. Here are three tips for companies navigating this cash-strapped environment:

- Don’t go public before you’re ready: The 2022 decline of both the Nasdaq Biotech Index and the number of biotech IPOs indicated that many biotechs went public before they were ready, likely in early-stage or even preclinical trials. Although the window for preclinical IPOs has closed, biotechs should take this lesson to heart: if you’re not ready for the demands of the public markets, going public too soon may not be worth the proceeds. BDO’s Biotech IPO Checklist can help you understand when is the right time to go public and how to prepare.

- Proactively manage cash in the early stages: As 2023 will be a time of cash scarcity, it’s important to manage cash effectively to reach the next stage of development. At early stages, aim to be as cash-efficient and focused as possible. The goal is to design a drug manufacturing process capable of supporting a regulatory filing and commercial launch, even if the process at this stage is not the most efficient. Learn more about managing cash throughout the drug development process in BDO’s Guide to Cash Conservation Across the Drug Development Cycle.

- Employ value creation strategies: Companies with strong asset pipelines will find investor interest and partnership opportunities, providing them with resources like cash, talent and manufacturing facilities. However, there are other ways to improve company value beyond scientific fundamentals. When preparing for a sale or partnership, focus on forecasting profitability, hiring the right team to manage a transaction and analyzing how supply chains will function under current and future production demands. Learn more strategies in BDO’s Guide to Selling Your Biotech Business.

2023 will not be a fundraising frenzy for biotech. The companies that can stay focused on the research for their high-priority, late-stage candidates, while managing their cash wisely, will be able to successfully bridge until the next cash influx or positive data readout.

This edition of BDO’s Biotech Brief examines the December reconstitution of companies listed on the Nasdaq Biotechnology Index, which includes organizations classified as biotechnology or pharmaceutical companies according to the Industry Classification Benchmark with a minimum market capitalization of at least $200 million and an average daily trading volume of at least 100,000 shares. BDO used CalcBench to conduct this data analysis and supplementary sources where noted.

SHARE