The CFO’s Role in ESG

The business case for ESG continues to gain traction with the C-suite: 64% of CFOs believe ESG adoption will improve their long-term financial performance, BDO’s annual survey found. Now, their focus should turn to execution. How does ESG fit into business strategy? Who should lead the charge?

For sustainability initiatives to succeed, ESG needs to be a cross-functional partnership. Finance leaders — with access to large amounts of organizational data and influence over budget and business strategy — must play a leading role in advancing their organization’s ESG strategy. Without the leadership and support of the CFO’s office, meaningful operational change cannot take root.

The CFO’s ESG Mandate

Finance leaders’ remits have expanded in recent years to include everything from digital transformation to workforce management. The CFO’s purview and influence cut across all functions of the organization, positioning them to drive lasting change.

Sustainable transformation is no exception. The successful integration of ESG into an organization’s core business operations and long-term business strategy will require the CFO’s sponsorship and active involvement to make the data-driven decisions and allocate the resources necessary to transform.

CFOs must also lead efforts to identify, measure and report ESG factors. CFOs know well that “what gets measured gets managed.” ESG impact and program outcomes should both be measured, not only to benchmark progress against ESG objectives but also to provide transparency through external reporting. As financial reporting expands to include non-financial ESG metrics, CFOs must help shape ESG disclosures and define how the underlying data is captured and tracked. Finance leaders are best equipped to integrate these non-financial metrics into existing financial reporting processes.

Managing ESG Risk and Reporting

ESG strategies not only advance corporate social responsibility and address the environmental and social impacts of the organization but also mitigate potentially damaging ESG-related risks. As organizations evaluate their operations through an ESG lens, they must integrate these risks into overall enterprise risk management. CFOs should collaborate with risk leaders to address both strategy and oversight around issues like climate, workplace matters and reputation. On financial and reporting-related risks, CFOs will take the lead.

Navigating New Metrics

For many, ESG reporting will soon escalate from best practice to mandate. Organizations with international operations may already face sustainability reporting requirements. Once the SEC finalizes its proposed climate change disclosures, publicly traded U.S. companies will be required to disclose the impact of material climate risks on their business, operations, value chain and strategy, and greenhouse gas emissions data. Key stakeholders, including investors and customers, are beginning to hold private companies to similar levels of transparency.

Transparency is a core tenet of sustainable business. Stakeholders now demand that organizations disclose data that tracks their ESG programs and progress toward targets. Even absent regulation, ESG reporting is critical to achieving the level of confidence that the market desires. And beyond stakeholders, ESG ratings agencies are not waiting on regulators: Organizations that do not disclose ESG information receive low ESG scores, which can impact everything from customer loyalty to capital access.

Assessing the materiality of ESG risks is one of reporting’s biggest challenges — one best tackled by a collaboration between the CFO and the organization’s sustainability leader, with board oversight. The CFO brings insight into the risks and reporting metrics that matter to the business and its stakeholders and aligns them to business strategy. The sustainability leader then determines stakeholder materiality, nonfinancial ESG priorities, industry-specific standards and disclosure best practices.

Gatekeepers on Greenwashing

In the absence of mandatory standards, organizations have significant flexibility in ESG reporting practices. Without sufficient oversight, internal excitement about ESG and pressure to report can result in overstatement and overpromises. Inconsistent data collection methods can also lead to inaccurate reporting. Establishing internal controls to ensure that ESG reporting is both accurate and reliable is critical to mitigating greenwashing risk.

CFOs have expertise facilitating assurance over financial reporting, working with internal audit teams and external auditors to ensure systems and processes are in place to collect non-financial information and then strengthening and testing the controls environment. Finance leaders can impose the rigor of financial reporting on ESG, aligning policy and practice to preempt stakeholder skepticism and regulatory scrutiny. Many organizations also obtain third-party attestation — already a requirement in some jurisdictions — to independently validate the integrity of ESG-related claims and reporting processes.

Capital Access

According to Sustainalytics, most major banks now screen their loan portfolios against ESG risks, following guidance from the Organisation for Economic Co-operation and Development on due diligence for responsible corporate lending. Failure to meet lenders’ ESG criteria may disqualify businesses from financing or spoil borrowing terms.

The investment community has also embedded ESG into their evaluation criteria. BDO’s recent survey of the private equity industry found that 95% of PE firms conduct ESG assessments as part of due diligence.

What does this mean for the CFO? CFOs should incorporate ESG materiality assessments as a pre-requisite to their capital-raising strategies, as a failure to adequately address those risks could severely constrain capital access, increase the cost of capital or decrease valuation. CFOs — who bear primary responsibility for managing investor and lender relationships — need to help their organizations integrate these stakeholders’ ESG expectations and criteria into the broader strategy.

Insurance Costs

Infusing ESG Into Value Creation

Most ESG programs start with data collection, reporting and risk mitigation, while more mature ESG strategies drive both top-line and bottom-line benefits. Realizing these benefits requires upfront investment and time to pay off. Though it can get lost in the shuffle of burgeoning reporting and regulatory requirements, the ultimate objective of ESG is shared and sustainable growth: creating long-term value for all stakeholders.

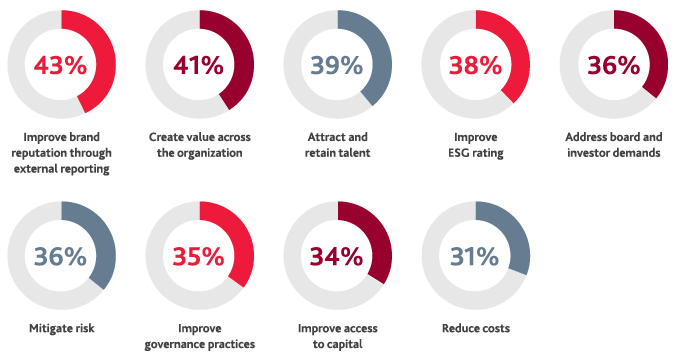

CFOs’ Top ESG Objectives

Solving the ESG-Cost Conundrum

According to research from NYU Stern School of Business, ESG and sustainability initiatives like carbon emissions reduction strategies can uncover hundreds of millions and even billions of dollars in savings. Organizations exploring ways to reduce their environmental impact may downsize their real estate footprint, seek buildings with environmental certifications or migrate data from onsite storage to the cloud — initiatives that decrease energy consumption and operating costs. PepsiCo famously saved $80 million in five years by recycling water used in its Arizona Frito-Lay snacks facility. Additional energy, packaging and waste reduction initiatives saved the company more than $600 million over that same period.

For finance leaders, half of the battle is ensuring that ESG initiatives are implemented with an eye on the bottom line. Integrating ESG into cost management means striking a balance between targeted, socially responsible cost-reduction initiatives and smart spending to fuel growth. Instead of slashing costs at the first sign of a slowdown, CFOs with a sustainability mindset focus on eliminating areas of waste and operational inefficiency. They reprioritize and reallocate costs toward initiatives that support long-term value creation objectives. By applying an ESG lens to cost management, finance leaders are more likely to expand profit margins.

The bottom line? ESG and cost optimization can and should go hand in hand.

ESG Integration Boosts Long-term Revenues

Organizations with sustainable business models grow faster than those without them. Tesla, in creating the first luxury electric vehicle, saw the fastest revenue growth over the last decade of the 10 largest public companies.

Sustainable business model innovation is quickly becoming necessary to attract and retain ESG-conscious customers. In the U.S., 61% of consumers rate sustainability as an important purchase criterion. 42% are willing to pay a premium for sustainable products or services. The purchasing data backs this sentiment: Between 2013 and 2018, sustainably-marketed products grew faster than alternatives in 90% of consumer packaged goods categories, NYU Stern research found.

Tesla represents a breakthrough technology that effectively created a new market, but that is not the only path to sustainability. Redesigning products to use recycled materials, last longer, or be recyclable at end-of-life can be a competitive differentiator that increases market share. Adopting ethical sourcing practices may also provide revenue uplift. CFOs can support revenue-generating ESG strategies by budgeting for sustainable innovation initiatives and partnering with the sustainability team to quantify and track the potential financial value created.

While ESG can open new markets and drive new innovations and sources of revenue, neglecting ESG can also put revenue at risk. From increased insurance premiums to lower credit ratings and customer attrition, failure to adequately address ESG factors can result in a significant hit to the bottom line. Visibility into ESG risk exposure is essential to understanding how financial performance may be affected. CFOs need to assess the potential impact and likelihood of ESG risk events on financial performance, as well as consider material ESG priorities when making decisions on where to fund growth and innovation.

The CFO as ESG Champion

Few roles are better positioned than the CFO to motivate and mobilize an organization to adopt new behaviors and embrace change. Leading by example is key: CFOs need to embed ESG into their own decision-making processes. Business investments and performance goals should align with the established ESG vision. Finance leaders must also drive accountability, not only through external reporting efforts, but also by setting internal targets and incentivizing progress toward them. For ESG strategy to transform from vague values to tangible action, CFOs need to take the lead.

SHARE