Alaska Native Settlement Trusts: The Future for Alaska Native Corporations

Alaska Native Settlement Trusts (ANSTs) promote the health, education, and welfare of its beneficiaries, and preserve the heritage and culture of Alaska Native Corporation (ANC) shareholders. The Alaska Native Claims Settlement Act (ANCSA) grants the authority allowing ANCs to establish ANSTs.

Though ANSTs have long been a valuable mechanism for ANCs due to the favorable tax treatment received from the Internal Revenue Service on trust income and beneficiary distributions, they became much more lucrative after the tax reform known as the Tax Cuts and Jobs Act of 2017. The value they bring to ANC shareholders is no longer only a current benefit, but now a benefit for future generations as well. By strategically taking advantage of the favorable tax treatment of ANSTs and maximizing tax benefits to the ANC and its shareholders, a permanent fund can be built that will last for generations.

One of the most well-known benefits of the new changes is that ANC cash contributions to ANSTs result in a deduction equal to the amount of cash contributed to the ANC. However, there are many more options aside from cash contributions. ANSTs may choose to defer recognizing non-cash contributions as income until the trust sells or disposes of the property. Non-cash items include:

- Buildings/commercial property

- Investment portfolio

- ANCSA land (surface estate – the tax basis is established with a retrospective appraisal)

- Passive interests in partnerships

- Non-controlling interest in a corporate subsidiary

- Other passive investments

Note: This list is not all-inclusive, and each contribution must be evaluated to ensure it meets contribution requirements and provides the desired tax benefits you are seeking.

Corporate assets can be conveyed that will provide value to the ANC and the ANST. Consider the following:

- ANC non-cash property contributions result in a deduction equal to the lesser of its adjusted basis in the property or its fair market value.

- The ANC will not recognize gain or loss on such contributions.

- Deductions are limited to taxable income, and any excess may be carried forward for 15 years.

- The ANC’s earnings and profits for the taxable year are reduced by the amount of any deduction.

- Contributions to an ANST will provide a permanent tax benefit to the ANC. There is no corporate-level tax for contributions to ANSTs.

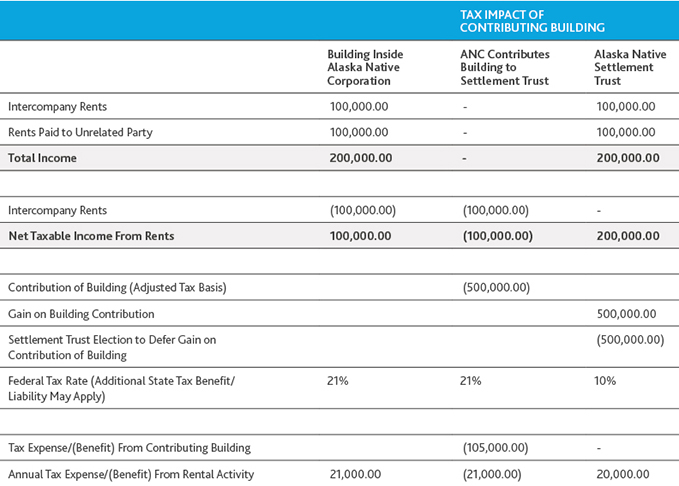

Non-cash property contributions can create long-term benefits past the year of contribution. For example, consider the tax impact of contributing a building to an ANST:

Current year ANC tax benefit from contribution of building to ANST $105,000

Additional annual tax benefit for rents paid:

Tax saved at ANC level on 3rd party rents by contributing rental property to ANST $21,000

Tax benefit for ANC deduction on rents paid to ANST $21,000

Tax for total rental income received by ANST from contributed property ($20,000)

Net annual tax benefit for rents $22,000

BDO Insight

- An ANST can receive appreciated property and defer tax to future years. This will help get income-generating assets into the ANST to benefit the shareholder beneficiaries.

- If the ANC anticipates disposing of a capital asset with an unrealized built-in gain, a contribution of the asset to the trust may be beneficial as the long-term capital gain would be taxed at zero percent.

- Complexities with non-cash property contributed to the trusts exist as they relate to ASC 740. These properties must be evaluated and properly recorded as deferred tax items.

ANCs can benefit greatly from taking advantage of ANSTs, if done the right way. Contact BDO for assistance with tax compliance, financial statement audits, board and shareholder education and workshops, and asset contribution and beneficiary benefit modeling.

SHARE