The BDO 600 2020 CEO and CFO Compensation Practices Trends in the Healthcare Industry

The Industry in the Time of COVID-19

“Uncertainty” is the prognosis for the healthcare industry both during the remainder of 2020 and beyond. The coronavirus pandemic has generated upheaval and acute instability in a once stable industry, changing the landscape for both providers and payors.

The pandemic came at a difficult time for healthcare providers. Hospital revenue declined at an annualized rate of 1.5% in the five years leading up to 2020.[1] Looking forward, providers will find profits scarce, at least until the pandemic turns a corner. COVID-19 has resulted in shifting volumes in patient care: over-capacity for COVID-19-related illnesses but under-capacity for revenue-generating elective surgery and nonessential and nonemergency care. The consequences of this imbalance include escalating expenses—particularly for the costly purchase of personal protective equipment, respirators and ventilators—while reimbursements deteriorate. Couple this with retiring clinicians and clinician burnout, and many hospitals and other healthcare providers are struggling.

In contrast to hospitals, the health and medical insurance segment of the healthcare industry saw a 2.9% growth in revenue over the last five years[2] driven by increased healthcare expenditures. Due to the pandemic, however, payors are now under pressure to lower premiums, give rebates and increase provider reimbursements. The overall decline in healthcare profits in 2020 will hit insurers as they take on expenses related to paying for coronavirus treatments.

Trends that have emerged in 2020 as a result of COVID-19 have the potential to reshape the healthcare business for providers and payors. The site of service will shift progressively from hospitals to outpatient clinics and doctor offices. Telemedicine will continue to expand as consumers gravitate toward low-cost telehealth visits.

Going forward, both payors and providers will need to evaluate and redefine their relationships and contracts. For many, it may require a significant change in how they approach and navigate their markets to find success in the post-pandemic world.

Impact on Executive Compensation

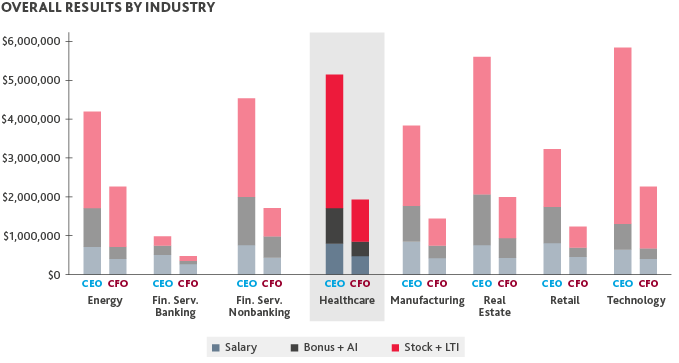

While the healthcare industry is one of the highest paying industries in the 2020 BDO 600 Study, this industry is on the frontline of the pandemic and we anticipate that compensation for many businesses will decline, although some businesses will flourish as they provide needed services and products.

As part of the initial response to the pandemic, many organizations made cuts to executive and board compensation, most of which came in the form of temporary salary reductions. For example, about 20% of the healthcare organizations in the BDO 600 reduced CEO salaries by an average of 46% for an average of five and a half months.

While salary cuts are effective in the short term and demonstrate executive commitment to the viability of the organization, longer-term strategies are more complicated and the "right" approach is hard to achieve. There are several factors impacting the approach to managing executive compensation for 2020 and 2021:

- Solidarity with Stakeholders: It is critical for leadership to clearly show solidarity with their stakeholders who have suffered. These stakeholders include patients, medical and non-medical staff, policy holders and, in the case of publicly traded companies, shareholders. Compensation is visible and very personal—executive pay must reflect the reality of these stakeholders.

- Talent Management: Organizations need talented and forward-thinking leadership to navigate a way forward in a time of unprecedented uncertainty. The challenge is how to design financial incentives that will attract, motivate and retain leadership while not undermining the number one objective as described above.

- Impact of Uncertainty on Goal Setting: The ongoing health and economic uncertainty makes the challenging process of selecting performance measures and setting goals even more difficult.

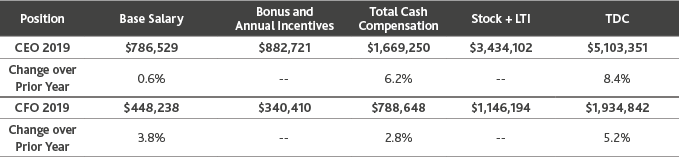

On average, industry-wide compensation levels increased from 2019 to 2020 (as shown in the table below). The increases are among the highest of the BDO 600 industry groups, although in the future, changes in pay are likely to be more nuanced. The financial impact of the pandemic is very uneven, with some organizations benefiting and some being deeply destabilized.

While there is no silver bullet for ensuring the perfect compensation arrangements in 2021, there are some key concepts that management and boards should consider:

- Selecting Metrics: Selecting and weighting metrics needs additional consideration. The two most common metric categories within the BDO 600 healthcare industry group are revenues (95% of organizations) and profits (75% of organizations). About a third of organizations also used a combination of the following: a measure linked to their strategy, an individual measure and board discretion. The development of metrics has always been challenging. To help our clients understand and visualize incentive plans, BDO has categorized performance metrics into five potential dimensions. Read more about the Dimensionality of Incentive Metrics.

- Setting Goals: Goal setting is challenging even without a pandemic; goals are heavily scrutinized by stakeholders yet minimal guidance is available:

- Regulatory Guidance: under the prior rules of Internal Revenue Code (IRC) Section 162(m), compensation will be considered “performance-based” only if it is substantially uncertain[3] on the date of grant.

- Investor Guidelines: ISS and Glass Lewis – Must establish the “rigor” of performance goals, but there is scant guidance on the definition of rigor; other than it must be higher than the prior year, which may be an unreasonable expectation given the current economic environment.

- Other Considerations: These should include current goals, future strategic goals, investor/marketplace expectations, risk assessment and industry comparisons.

- Ongoing Monitoring: More than ever it is imperative to track performance against goals at least quarterly and as often as monthly. Assess performance by comparing to external economic indicators and peers.

- Communicating with the compensation committee of the board: Regularly update the compensation committee regarding the performance against goals for both the annual and long-term plans. Assess whether goals are realistic and whether adjustments are needed. In this environment, large payouts are potentially as problematic (or more so) as very low or no payouts.

Now is a good time to assess the metrics being used in the annual and long-term incentive plans. Ensure that the goals are realistic and consider:

- Utilizing goals that measure performance relative to an industry or a peer group standard. This helps ensure that performance is calibrated relative to external market forces.

- Broadening the upper and lower performance ranges. In times of uncertainty this effectively allows at least a small payout if an acceptable minimal level of performance is achieved and requires a high level of performance to payout above target incentives, reducing the chance of paying out an incentive for high performance based on external factors.

As we look to 2021, healthcare organizations should monitor actual performance and payouts relative to plan and discuss these findings with their board's compensation committee. It is important to develop a partnership with the board as companies move through these challenging times. This will help minimize the chance of surprises and increase the chance of plan payouts successfully reflecting actual performance.

[1] Curran, Jack, “Hospitals in the US, Apple a Day: More Patients Will Likely Undergo Elective Procedures, Supporting Revenue,” US Industry (NAICS) Report 62211, 10, July 2020, IBISWorld.

[2] Curran, Jack, “Health & Medical Insurance in the US, Self-care: As Demand From the Aging US Population Increases, Industry Revenue Is Expected To Rise,” US Industry (NAICS) Report 52411b, 9, March 2020, IBISWorld.

[3] The IRS has provided limited guidance on the meaning of "substantially uncertain."

SHARE