Technology Doesn’t Have to Be Taxing

The world is becoming increasingly automated, and the tax function is no exception. While automation can assist tax executives in creating efficiencies, transformation is never easy.

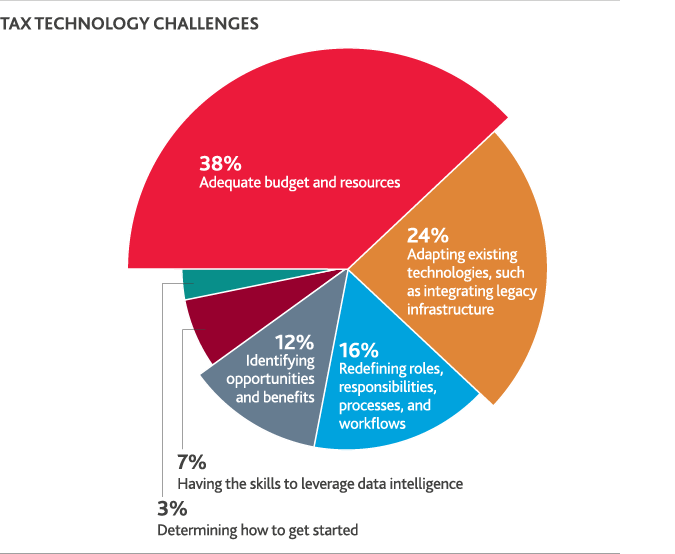

This year, 44% of executives indicate that resource issues like talent and infrastructure will pose the biggest challenge in tax-technology implementation.

Other tech-related obstacles include the automation of routine processes, a lack of transparency and collaboration with other business functions, and a lack of access to actionable data.

These tools aren’t being avoided by preference—many lack the budget and resources to implement tax technology like automation. However, as companies begin to see tax savings from reform, tax technology is an area where companies should consider reinvestment.

While many might think of tax executives as laggards when it comes to technology, those looking to advance should focus on incremental change. It’s important that companies walk before they run when implementing tax technology. Executives should identify where their business may see additional savings, as well as where tax-savings opportunities already lie. Incentives like research and development (R&D) tax credits are often a lucrative way to capitalize on innovation efforts businesses are already undertaking.

More than 81 percent of those surveyed are already claiming these credits in some capacity.

“Implementing tax technology is a key step in efficiently and accurately assessing a company’s total tax liability. However, technology is not the only answer. Thoughtful, tailored tax processes must be in place prior to implementing technology. To stay competitive, it’s imperative companies get up to speed here, investing time and resources wisely before it’s too late. And, as tax processes become automated, it’s important to seize the opportunity to measure the impact of tax strategies outside of the tax department to get a holistic view of tax liabilities across a business and to identify tax savings opportunities.”

BARBARA TORZEWSKI

BARBARA TORZEWSKI

Managing Director in BDO’s Tax Transformation Services practice

SHARE