2018 BDO Biotech Briefing

Race Against Patent Expirations Fuels Biotech R&D

For biotech, the time for innovation has never been better. With more than 25 patent expirations on the horizon from 2018-19, an FDA focused on encouraging competition, and a charge to break down silos across counterparts in healthcare to drive more precise, improved outcomes and shared value, research and development (R&D) in the industry is booming.

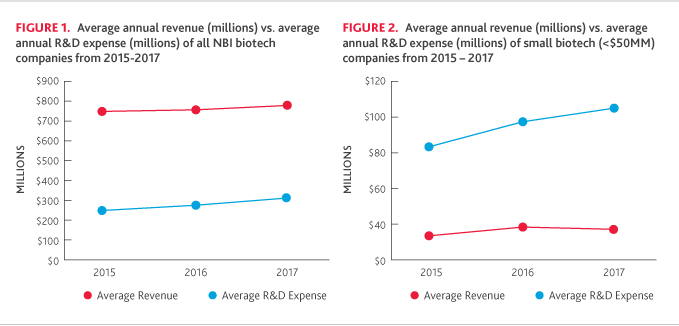

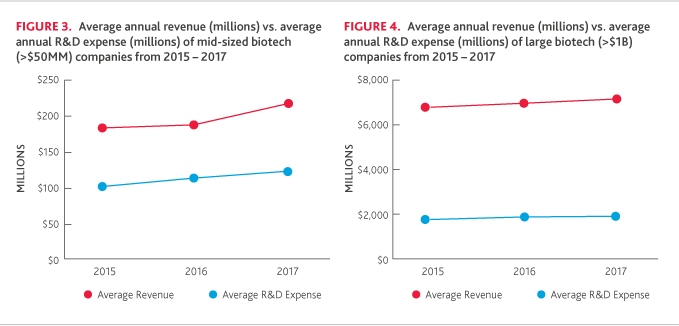

Specifically, in 2017, for companies listed on the NASDAQ Biotechnology Index (NBI), R&D increased 12 percent, while average revenues increased 7 percent and average liquid investments increased 15 percent, BDO’s 2018 Biotech Briefing revealed. The analysis underscores the importance of innovation, optimization and transformation in today’s landscape.

Companies of all sizes and subsectors—notably, those in oncology and rare diseases—are playing their part to develop more precise therapies to address the medical needs of the global public, inching ever closer to finding revolutionary treatments and cures.

Still, biotechs face numerous external pressures. Uncertainties in the capital markets, political environment, drug pricing, regulation, the shift to value-based contracting and the threat of new entrants have created obstacles in financing R&D investments. The bright side: New technologies, ongoing pipeline needs at large pharma companies and upcoming patent expirations, spurred a sharp increase in 2017 deal activity relative to the previous year. The vertical integration trend is continuing into 2018: More than $100 billion poured into biotech and pharma M&A in the first six months, according to Bio Space, and the industry’s boom is even bringing demand for Wall Street analysts back to life, according to WSJ.

To thrive in this consumer-centric, value-driven market, biotech companies must innovate patient care, maximize profitability, and transform and compete to find their place in the future healthcare ecosystem.

“Every life sciences company has unique needs and opportunities based on where they are in their lifecycle. All companies, though, are battling the pressures of pricing, the threats of disruptors and the intensified consumer-driven demand to break down silos between their healthcare counterparts to drive more precise, improved outcomes. Investors and patients alike are ready for the fruits of unprecedented R&D efforts, but the path to sustainable growth is rocky, and the stakes have never been higher.”

Eric Jia-Sobota

Partner and national leader of BDO’s Life Sciences practice

Innovate Patient Care and Maximize Profitability

Across all biotechs listed on the NBI, R&D increased alongside revenues, but trends varied among small, mid‑size, and large companies who have unique challenges when it comes to their respective pipelines.

Due in part to fluctuation in the small and mid-size categories*, small companies showed a decline in revenue (-27 percent) after last year’s modest increase (+4 percent), but the average R&D expense continued to increase (+19 percent) in 2017 (Figure 2 below). R&D spending as a percentage of revenue continued to soar in 2017 (526 percent), compared to 2016 (321 percent).

*The average revenue among smaller companies fluctuated materially over the period due to dynamic movement of companies between the small and mid-size categories in the study. In 2016, there were larger collaboration deals that drove up revenue and moved some companies into the next tier. Looking ahead, we expect deals will continue to impact revenue trends and the categorization of companies on the index.

*The average revenue among smaller companies fluctuated materially over the period due to dynamic movement of companies between the small and mid-size categories in the study. In 2016, there were larger collaboration deals that drove up revenue and moved some companies into the next tier. Looking ahead, we expect deals will continue to impact revenue trends and the categorization of companies on the index.

Alternatively, mid-sized companies posted a 27 percent increase in average revenue since 2016, along with a 14 percent increase in average R&D expense (Figure 3). Average R&D spending for mid-sized companies as a percent of average revenue remained nearly steady at 48 percent, compared to 53 percent in 2016.

Large companies reported similar trends in average revenue and average R&D expense, up 6 percent and 9 percent, respectively, in 2017 (Figure 4). Average R&D spending as a percent of average revenue stayed constant for the second consecutive year, remaining at approximately 19 percent.

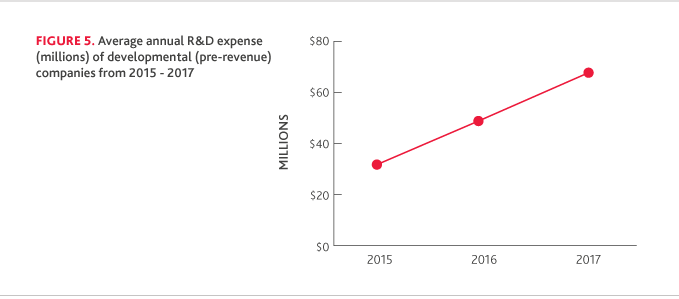

R&D is the sole goal of pre-revenue developmental companies. Among these companies, average R&D expense increased a notable 43 percent. Developmental companies’ investment in R&D could be due in part to preparation for major patent expirations and the abundant availability of capital, which will lower barriers for smaller companies to enter the industry and create opportunities for new entrants.

R&D SPENDING IN LIQUID ASSETS

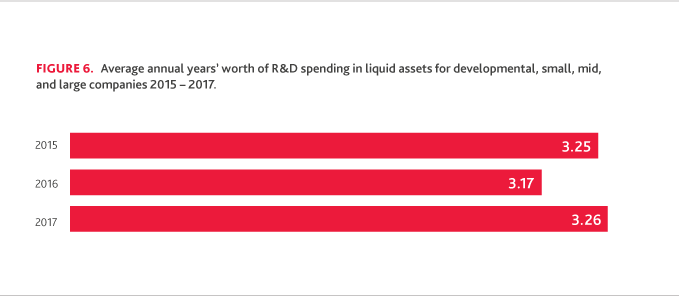

Biotech companies continue to prioritize cash reserves. The total average years’ worth of R&D spending in liquid assets was 3.25 in 2017, up from 3.17 in 2016.

Looking Ahead: Tax Reform Impact on R&D

R&D is likely to be a continued priority, as biotechs work to address the emerging needs of the aging population, respond to trends in value-based care and work to fend off competition from new entrants, like Amazon, which has signaled that healthcare and pharma are a key priority for growth.

Biotechs should also carefully consider R&D plans in the context of the Tax Cuts and Jobs Act. The R&D tax credit has long been a valuable way for companies to offset the cost of innovation, especially since smaller taxpayers have been able to use it to offset up to $250,000 of their payroll taxes.

Under tax reform, the R&D credit wasn’t directly impacted, but indirectly its value was increased for tax years beginning after 12/31/2017 thanks to three changes:

-

First, the reduction in the maximum corporate rate from 35 percent to 21 percent effectively increased the R&D credit’s net benefit by more than 21 percent, from 65 percent to 79 percent.

-

Second, tax reform’s repeal of AMT means that taxpayers who would have been subject to AMT and who therefore generally would not have been able to use R&D credits to offset their federal income tax liability will be able to do so under tax reform.

-

And third, because taxpayers are now able to offset only 80 percent of their taxable income using NOLs generated in tax years beginning after 12/31/2017—instead of 100 percent—NOL taxpayers may be able to use R&D credits against taxes they’ll now have to pay because they can’t offset them with NOLs.

Against these increased benefits, the downside of tax reform is that research expenditures must now be capitalized and amortized between five and 15 years, instead of being eligible for current expensing. This change will have a big impact on some life sciences companies.

In addition, the new rules limit the orphan drug credit to 25 percent of qualified, clinical testing expenses for the tax year, a reduction from 50 percent. The reduction in this credit might change an organization’s focus

on developing orphan drugs and hamstring long-term development of treatments for rare diseases and conditions.

Given the pace of research, life sciences companies seeking to maximize the benefit of immediately deducting R&D expenditures should consider the effective date of the required amortization rule (i.e., Dec. 31, 2021) and, if possible, accelerate their R&D activities prior to this date. For more on how tax reform impacted the industry, see our FAQs.

“The long-term implications for biotechs in the wake of tax reform are a mixed bag. No current expensing of R&D expenditures, half the orphan drug credit, but a much more beneficial R&D credit. Given these broad sweeping changes, it’s an ideal time for life sciences companies to look at their tax strategy holistically and understand their total tax liability across their entire enterprise. Any business change—whether it’s a new law, revenue stream or an acquisition— creates a butterfly effect of tax implications throughout the organization.”

Chris Bard

National leader, BDO Tax R&D, and chairman, BDO Global R&D Center of Excellence

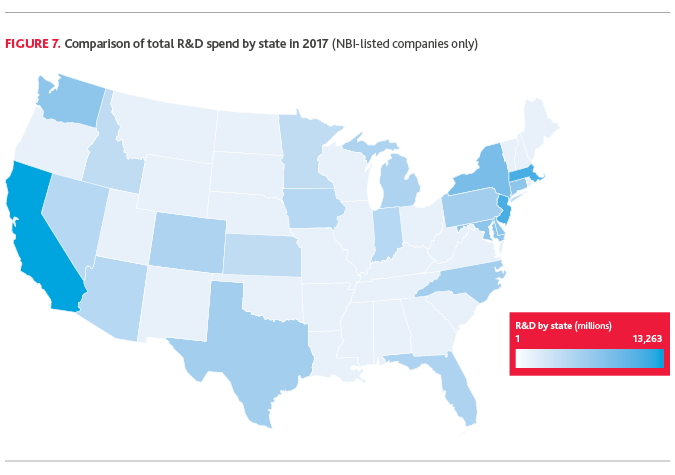

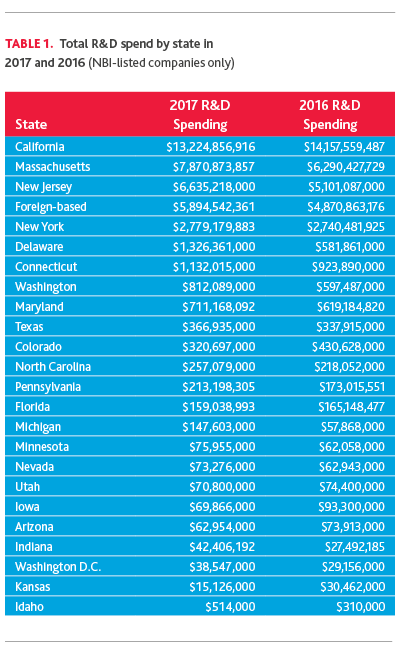

Reviewing total R&D spend by state (based on company headquarter location) over 2017, California, Massachusetts, New Jersey and New York are the top markets for R&D investment. Delaware and Connecticut also spent more than $1 billion on R&D in 2017.

“Why is R&D so concentrated in the Northeast and California? A triple threat of R&D boosting benefits: access to state incentives for job creation and investment, access to VC and NIH funding, and perhaps most critically – access to premier talent from leading university systems and big pharma headquarters. When you put those three factors together, you build a corridor of innovation and spur economic growth.”

Tim Schram

Managing director and national leader of BDO’s Credits & Incentives practice

Industry Breakdown

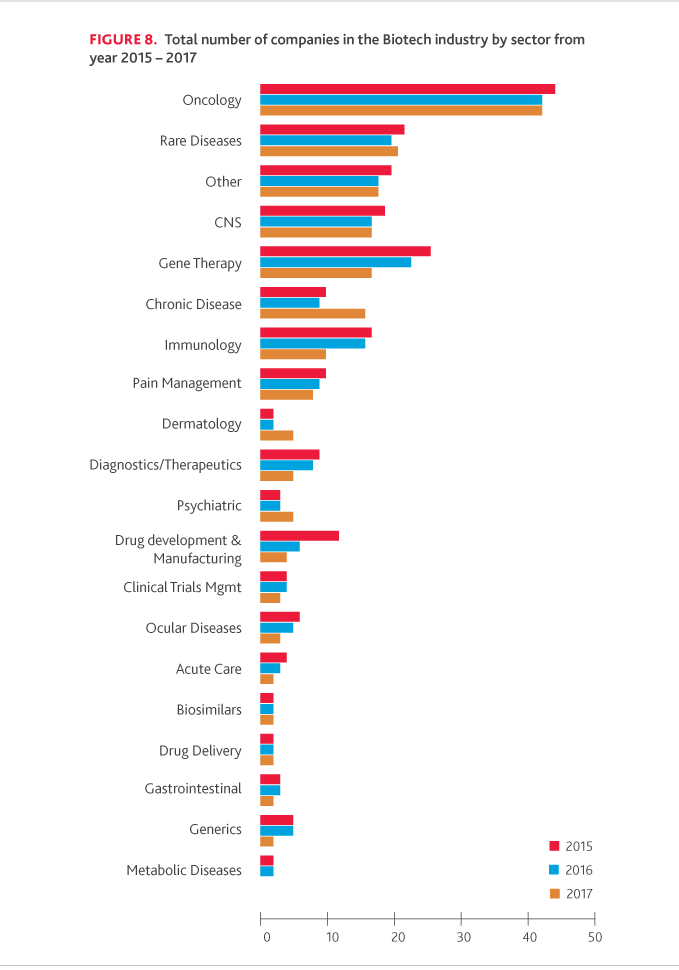

Upcoming patent expiration, market volatility and tax reform led to significant movement in the composition of the biotech industry.

While the total number of companies included in the NASDAQ Biotech Index has increased from 164 in 2016 to 198 in 2017, oncology represented 22 percent of the total industry, and rare disease companies represented 10 percent of the total industry. Moreover, global spending on cancer therapies and supportive care drugs is currently greater than $133 billion and is expected to grow over the next five years to nearly $180-200 billion, according to IQVIA Institute.

.png)

Looking Ahead: Generic Competition and Deregulation Pressure Drug Prices

Large pharmaceutical companies continue to confront the “patent cliff,” as upcoming patent expirations of branded drugs will create new opportunities for generic competition.

Evaluate Pharma reports that an annual average of $35.3 billion in prescription drug revenue is at risk as brand name drugs go off-patent in the years leading up to 2024. In addition to increasing generic competition, regulators continue to promote changes in pharmaceutical pricing through a variety of levers.

First, government regulators aim to speed up the pace of drug approvals while reducing pharmaceutical prices through an accelerated approval process for generics and biosimilars, alongside the implementation of the 21st Century Cures Act’s focus on “breakthrough treatments”. FDA Commissioner Scott Gottlieb outlined a plan to encourage the development and approval of biosimilars by standardizing review processes, streamlining biosimilar labeling and partnering with international regulatory agencies through data sharing agreements. Additionally, Health and Human Services (HHS) Secretary Alex Azar has suggested importing generic drugs when the sole provider of a generic raises its price above a set ceiling.

Second, and more radically, HHS is in the process of reviewing a proposal that would remove federal safe-harbor protections to anti-kickback statutes that allow manufacturers to offer discounts to Pharmacy Benefit Managers (PBMs) and insurers. A move towards fixed-price discounts would upend the familiar interplay between pharmaceutical companies and PBMs, with no clear picture of what new pharmaceutical

pricing model would emerge. Regardless of the specific lever employed, the goal of HHS is clearly to remove much of the revenue from discounts that goes to PBMs and redirect it towards consumers, likely decreasing the importance of PBMs within the pharmaceutical value chain.

“Revenues from existing brand name portfolios are at risk due to increased generic and biosimilar approvals coupled with regulatory changes. We expect this will lead to two trends: stimulating the transition towards value-based pricing and accelerating the pace of biotech M&A to drive and increase the value of the research pipeline for acquirers.”

Todd Berry

Partner and national leader of BDO’s Life Sciences practice

Considerations for Value-Based Contracting

The trend towards a higher volume of value-based pharmaceutical contracts tracked in previous issues of the BDO Biotech Briefing has continued apace in 2017 and 2018, fostered by competitive pressure and changes in the regulatory arena.

On the regulatory front, Oklahoma received approval from HHS for the nation’s first value-based purchasing agreement for Medicaid, effective as of January 1, 2018. This program provides the state authority to provide supplemental prescription drug rebates based on treatment outcomes.

Beyond simply approving the plan, HHS has also touted it as a model for other states.

High-priced specialty drugs (including biologics), which represent a growing share of total drug spending and may reach 50 percent of drug sales by 2020 (according to Segal Group), will be a particular target for payers and providers attempting to reduce their pharmaceutical spending. Payers are likely to focus on these drugs when partnering with pharmaceutical companies and deploy real world-evidence, population health studies, and other analytic capabilities to develop outcomes-based pricing models. To successfully implement value-based reimbursement contracts, pharmaceutical companies must continue to invest in solutions that allow them to track drug efficacy throughout patients’ medical journeys and help align pricing with patient outcomes.

Transform to Compete

DEBT AND EQUITY FINANCING

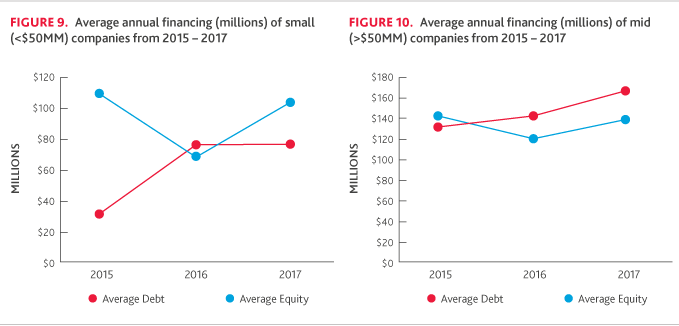

Ample opportunity for research investment to meet growing patient needs led to increased investor appetite in 2017, with strong equity raises setting the stage for a booming equity market in 2018.

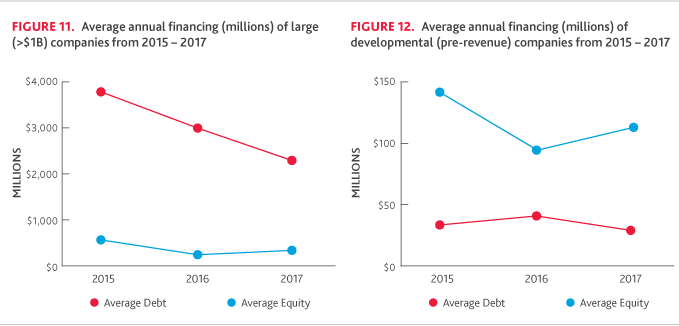

In capital markets, debt financing generally declined in 2017. The average debt raise for large companies decreased to approximately $2.26 billion, down from $3.06 billion in 2016, when major players Amgen and Mylan took large raises. However, mid-sized companies raised $165.87 million on average through debt financing in 2017, up from $138.82 million the previous year, as several companies issued significant convertible notes as transitional financing.

The decreasing rate of debt financing throughout the pharmaceutical sector will likely continue as U.S. interest rates continue to climb.

Across small companies, average debt and equity financing changed course in 2017 (Figure 9). While debt financing was relatively flat, equity financing was strong: 77 percent of small companies raised equity in 2017, up from 53 percent in 2016.

Mid-sized companies were the only category to see a notable increase in debt financing, with 43 percent raising debt, compared to 30 percent in 2016. The average amount of equity raised also increased with 51 percent of companies securing financing, compared to 37 percent in 2016.

For the large company cohort, there was a significant decrease in average debt financing for 2017, but the percentage of companies raising debt financing increased slightly, from 50 percent in 2016 to 60 percent in 2017. On the other hand, the amount of equity raised increased despite the number of companies raising equity declining from five to four.

Among developmental companies, equity financing increased, while debt financing declined. Only 14 percent of developmental companies raised debt financing in 2017, relative to 27 percent of companies in 2016. Alternatively, nearly all (95 percent) of these companies raised equity financing in 2017, significantly higher than 2016 (45 percent).

In August, the NASDAQ Biotechnology Index returned 4.8 percent, compared to the S&P 500 which returned 3 percent. Upcoming patent expirations, new drug approvals, increased competition and technology innovation will all serve as likely boons to investor and VC interest in 2018 while the industry continues to grow.

OPTIMISM AND TAX REFORM FUEL M&A AND IPO ACTIVITY

Expiration of existing patents and federally-encouraged generic/biosimilar competition have driven pharmaceutical companies to turn to acquisition for a competitive edge. In both 2017 and 2018, pharmaceutical companies faced drug pricing pressure from patent expiry and the continuing consolidation of the payer, provider, and PBM space in the U.S.

However, in 2017, uncertainty about the passage of tax reform through Congress likely delayed potential deals as buyers did not want to miss out on opportunities to repatriate cash or conduct transactions at a lower corporate tax rate. That changed with the passage of the Tax Cuts and Jobs Act at the end of 2017.

In Q1 2018, $47 billion in deals announced, compared to $40 billion in Q1 2017, according to Pharmaceutical Technology. With a lower corporate tax rate and incentives to repatriate foreign cash reserves, deal-making has increased in 2018 as a tool for acquirers to improve pharmaceutical R&D pipelines and competitive position. VC interest is also high. Global VC investment in biotech reached $11.47 billion by August of 2018, already surpassing 2017’s record breaking levels, according to Pitchbook. Bloomberg projects that 2018 global biotech M&A will be at the highest level in 12 years.

The M&A activity has correlated with an increased rate of US biotech IPO deals from 2017’s base of 37 IPOs that raised about $3.8 billion. The Wall Street Journal reports that as of July 2018, the number of completed IPOs has come close to matching 2017’s entire IPO output, with 32 biotech IPOs raising $3.4 billion.

WHAT’S NEXT?

With continued focus on innovation and R&D, the outlook for the biotech industry is promising. The entrance of pioneering biotechnologies, such as cell therapy, gene therapy and microbiomes, as well as the potential impact of biosimilars, should drive growth and further motivate deal-making.

A continued rise in M&A activity should boost investors’ outlook on the industry and support a willingness to finance new product developments and future growth.

While many biotech companies may turn to acquisition for a competitive edge, it’s critical to remember you have to make the deal work. A sound strategy and business case for acquisition, combined with a thorough integration plan will be essential to making the deal—whether with a traditional player or a new entrant—a long-term success.

In addition, faced with pressure to both improve care and drive down costs, companies should continue to invest and capitalize on consumer-driven data to support valuebased pricing.

As the focus on fee-for-value permeates throughout the entire healthcare landscape, biotechs should embrace digital disruption and consider partnerships with technology firms and other non-traditional organizations that have a wealth of patient and consumer data.

The end game? By better incorporating data analytics, security and collaboration into R&D and target drug selection, biotech firms can create a more efficient product development process which has potential to simultaneously increase revenue and value, while at the same time improving the affordability of new drugs. This is especially important in a climate where current policy efforts support deregulation and increased competition, possibly limiting the financial impact of a new product patent.

If any industry is up to the challenge of innovating to drive growth, it’s biotech.

“Traditional silos in the life sciences and healthcare industry are coming down as new models and new entrants emerge. Collaboration has long been in vogue, but it’s time for foes to become friends. Executives must be open to learnings from other industries. The truth is, we may need new names for these emerging health systems, but these players share a singular goal: improving patient care.”

Dr. David Friend

Managing director and chief transformation officer, The BDO Center for Healthcare Excellence & Innovation

ABOUT THIS RESEARCH

BDO’s Biotech Briefing examines the most recent 10-K SEC filings of companies listed on the NASDAQ Biotechnology Index (“NBI”), which includes companies classified according to the Industry Classification Benchmark (ICB) as Biotechnology or Pharmaceutical companies. The companies have been separated into four categories for analysis: “large” companies with revenue greater than $1 billion, “mid-sized” companies with

revenue greater than $50 million (but less than $1 billion), “small” companies with revenue less than $50 million, and “developmental” pre-revenue companies.

In our debt and equity analysis, debt and equity raises have been adjusted to reflect the issuance of debt and

equity for financing operations, asset purchase, or merger/acquisition activity. Equity raised does not include, for instance, issuances for common stock options exercised.

SHARE