Retail in the Red: BDO Bi-Annual Bankruptcy Update

An Overview of U.S. Retail Bankruptcies and Store Closures in the first half of 2019

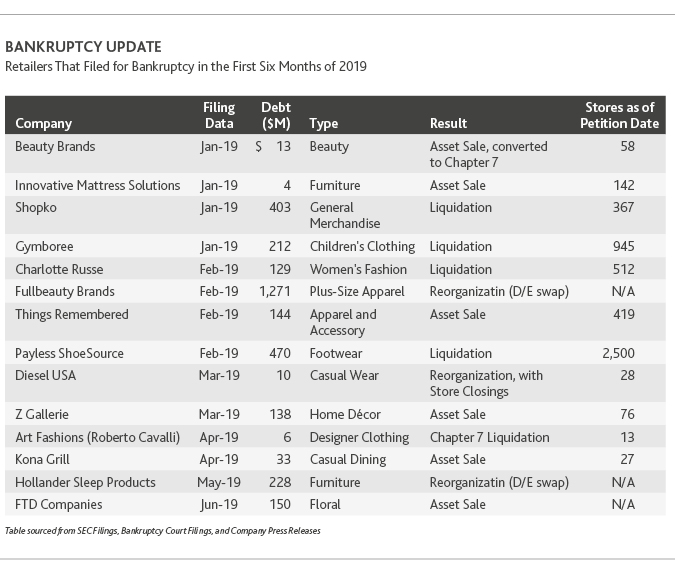

The pace of retail bankruptcies in 2019 to date is accelerated compared to what we observed in late 2018. The 2018 holiday season failed to meet expectations, with December retail sales dropping 1.6% from the month prior—the weakest sales performance since December 2009. Last year’s lackluster holiday season contributed to 10 retailers filing for bankruptcy in 2019’s first quarter alone, including Payless, Gymboree and Charlotte Russe. The bankruptcies of just these three retailers led to the closure of roughly 3,700 stores. Several retailers also filed in July and August, including Charming Charlie, Barney’s, A’gaci and Avenue Stores.

Beyond the 2018 holiday season, other factors including tax reform’s after-effects, trade tariffs, January’s historic government shutdown and inclement weather challenged some brick-and-mortar retailers in the first half of 2019.

Specifically, the average taxpayer saw a 2.7% decrease in their tax refund in 2019. With smaller tax refund checks, many consumers did not have as much money available to spend during the spring, leading some retailers to offer deep discounts to move merchandise.

At the same time, the U.S. tariffs on goods from China have forced some retailers to hike prices to maintain profit margins, which had an impact on retail sales. The National Bureau of Economic Research estimates that higher tariffs will impose an annual cost of $831 a year on the typical U.S. household. Reduced household income will likely lead to lower retail spending.

One notable trend that signals the strain on retailers in the first half of the year is that U.S. companies have announced over 42,000 job cuts, with most of these job losses in the retail sector. The 2019 job cuts are already 20% higher than all bankruptcy-related job losses in 2018 and larger than the annual totals in any year since 2009, according to a report by outplacement firm Challenger, Gray & Christmas.

In the first half of the year, most retail bankruptcy filings resulted in an asset sale and/or liquidation. For example, Shopko filed contemplating either a reorganization supported by a plan sponsor or the sale of its assets to a third party. The company ended up winding down since it was unable to find either a plan sponsor or a going concern buyer. Gymboree sold its Gymboree and Crazy 8 assets to The Children Place’s, and Gap acquired its Janie and Jack brand. Payless shuttered its North America brick-and-mortar operations to reorganize around its Latin America and franchise businesses.

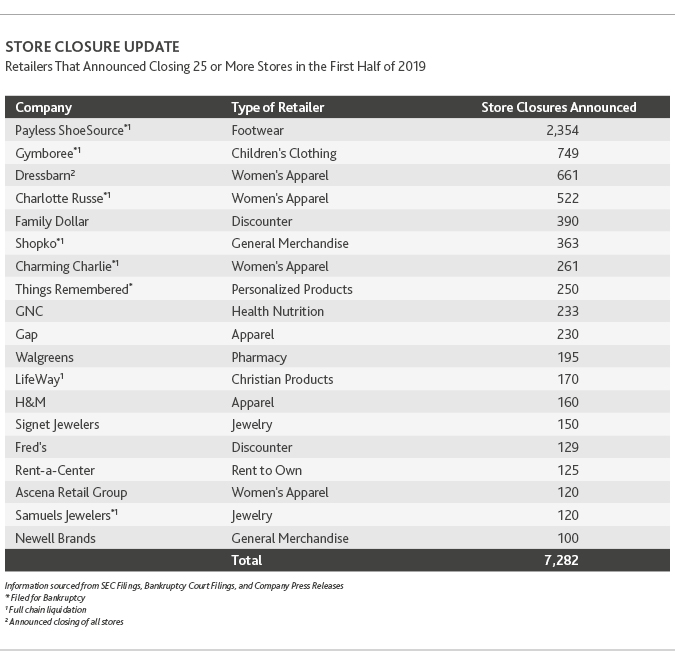

Retailers of all scale and size have closed a combined 7,000 stores so far this year, already exceeding all prior full years. For 2018 overall, total store closures were just under 6,000, while Coresight Research predicts over 12,000 stores will be closed this year. These closures result from a combination of retailers going out of business and others reducing their physical footprint.

The retailers with the most store closings were apparel specialty stores, which accounted for about 36% of total store closures in the first half of 2019, up from 14% in 2018 overall, according to Coresight Research. Footwear retailers accounted for about 28% of closures, compared to 8% last year, and general merchandise stores comprised approximately 14% of closures, an increase from 2% in all of 2018.

Most of the store closure announcements were a result of bankruptcy filings, including Payless, Gymboree, Charlotte Russe, Shopko, Charming Charlie, Things Remembered and Samuels Jewelers. These retailers and others continue to grapple with excessive debt, over-expansion, private equity pressures and the fast clip of industry innovation.

In response to these pressures, many retailers are dropping the traditional flagship store and instead opting for smaller size store models situated in prime urban areas. Flagship stores no longer generate the volume of sales needed to justify the cost. Through their closures, retailers hope to offer an omnichannel brand experience while reducing the effect of onerous leases. Spearheading this trend are Lord & Taylor, Abercrombie, GAP, Diesel, Calvin Klein, and Ralph Lauren.

BDO’s Take: Outlook for the Second Half of 2019 and Beyond

Despite the large number of bankruptcy filings and store closures, overall retail sales remained solid through the first half of 2019 and continue to show positive signs, thanks to a strong economy, record low unemployment (currently 3.7%), and rising wages. While positive economic factors lead us to believe that the risk of a significant downturn in the retail sector is slim for the remainder of 2019, retailers should remain cautious heading into 2020.

Ongoing trade disputes with China may continue to bear down the U.S. economy, especially if tariffs are placed on consumer goods such as electronics and apparel. As it stands, the U.S. has chosen to delay tariffs on a substantial portion of consumer goods until December, providing retailers ample time to stockpile products for the holiday shopping seasons. However, all additional trade tariffs are likely to have an adverse impact on the U.S. economy and retail sales.

Separately, consumer debt is now at record levels, recently exceeding $4 trillion for the first time, according to the Federal Reserve. Mortgages, specifically, are the largest component of household debt. Since hitting a peak in the 3rd quarter of 2008, U.S. mortgage debt dropped about 15% through the middle of 2013 and has been climbing ever since. In the 2nd quarter of 2019, mortgage debt reached a record of $9.406 trillion, exceeding the $9.294 trillion peak in 2008. Consumers are now spending about 10% of their disposable income on nonmortgage debts, including credit cards, automobile, personal and student loans. For example, outstanding student loan debt—totaling approximately $1.5 trillion—has tripled over the past 10 years. Meanwhile, credit card debt is also at its highest point ever, exceeding $1 trillion, and credit card interest rates are at a record high, with the average interest rate about 17.4%.

The rising debt burden could start to put pressure on consumers and lead to reduced spending, which would weigh heavily on distressed retailers in the 2nd half of the year or into 2020.

Looking ahead through the end of 2019, we expect to see additional bankruptcy filings—but at a slower pace than the first half of the year—and for the heightened rate of store closures to continue.

SHARE