Retail in the Red: BDO Bi-Annual Bankruptcy Update

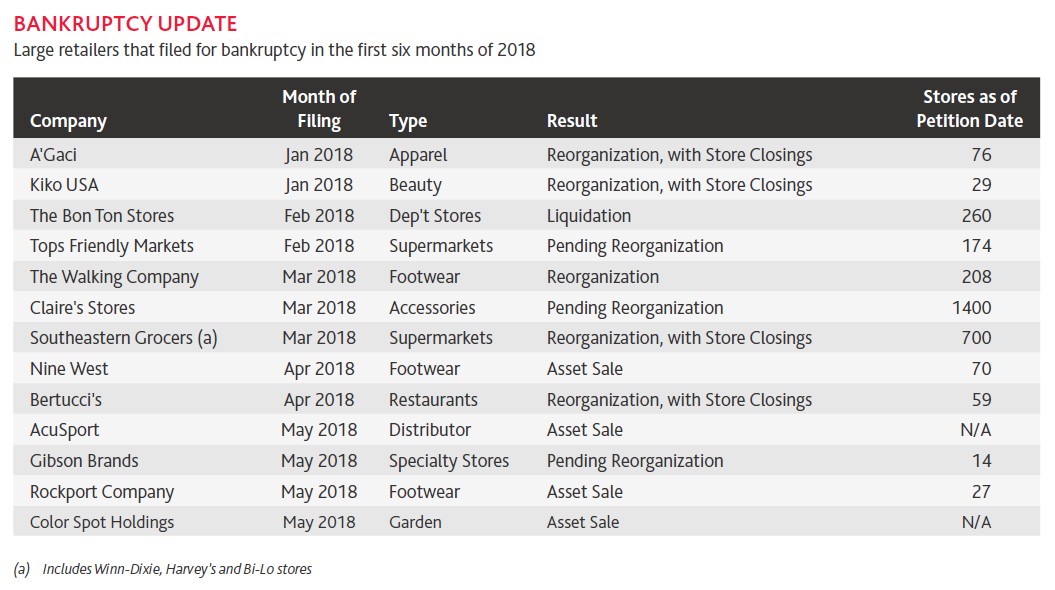

For the first six months of 2018, more than a dozen retailers with 20 or more stores filed for bankruptcy–a figure which aligns closely with the pace of retail bankruptcy filings during the second half of 2017. In July and August 2018, at least six other retailers filed for bankruptcy, including Brookstone, National Stores, Heritage Home, Real Mex Restaurants, Gumps and Samuel Jewelers.

What does this trend signal for the balance of 2018?

Several of the consumer businesses that filed for bankruptcy in the past 18 months had burdensome levels of debt, resulting in part from their private equity owners’ use of financing in acquiring the retailers. The fixed interest and lease payments proved too onerous for these leveraged retailers, as sales and margins deteriorated. A majority of these retail bankruptcies resulted in major asset sales and several liquidations. However, in the first half of 2018, more of the retailers filed seeking a reorganization with store closings than those that did so in 2017. These trends point to some private equity owners potentially placing too much debt on their retail companies. It also highlights the importance of partnering with the right bank, investment or PE firm that understands the cyclical nature of business and will not overreact when there’s a dip in business.

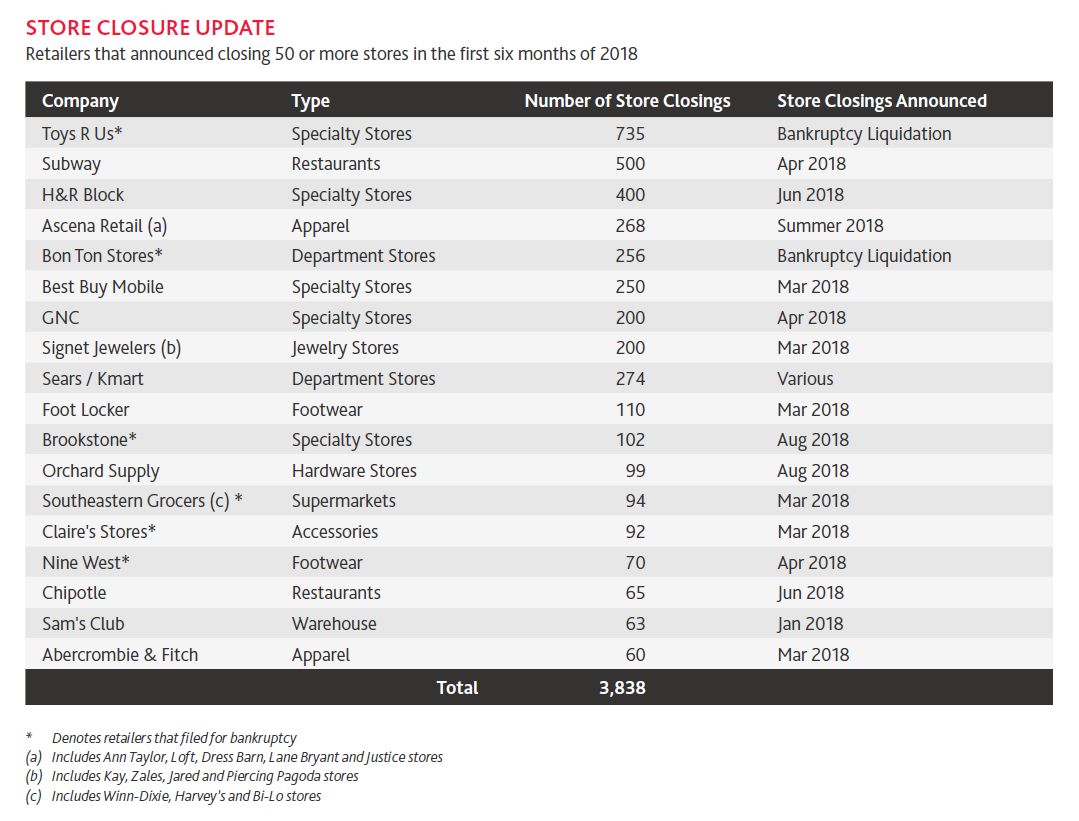

In 2017, the retail industry saw a record number of brick-and-mortar store closures. Although the pace of store closure announcements is down somewhat in 2018 thus far, we are still seeing a heavy dose of store closings. As anticipated, retailers are consolidating underperforming stores and wrestling with declining foot traffic.

While the economy has been expanding in 2018, the sizable number of brick-and-mortar store closings and retail bankruptcy filings reflect shifting consumer preferences, the continued growth of e-commerce and the United States’ over-built retail footprint. Consumers are spending a smaller share of their budgets on clothing and accessories than in the past, and younger generations continue to spend more on experiences than goods. These shifts in spending patterns continue to drive sales away from mall-based retailers that primarily sell clothing and accessories.

Still, there are too many brick-and-mortar stores selling apparel in malls. In response, certain legacy brands are re-evaluating their market strategy and several newer brands are focusing on direct-to-consumer marketing as opposed to selling their products through retail stores. Additionally, some retailers are selling via pop-up shops to facilitate authentic connections with consumers through novel experiences. Pop-ups allow consumers to connect with the brand off-line, and don’t require the commitment of a lease agreement that traditional brick-and-mortar retailers are bound to.

The overall retail sector has performed well in the first half of 2018 and the results have trended toward the higher range of the National Retail Federation’s growth forecast of 3.8 percent to 4.4 percent. In particular, the second quarter showed strong results with most retailers reporting increases in comp store sales. Meanwhile, consumer confidence remains high, jobs are being created, wages have been rising and unemployment is very low.

However, U.S. retail sales posted their weakest gain in six months in August. Retail sales were up only 0.1 percent in August, the Commerce Department reported—a large decrease from the upwardly revised gain of 0.7 percent in July. Retail sales were constrained by weakness in clothing and department store sales, which saw sales drop 1.7 percent and 1.0 percent, respectively, from July.

On the other hand, consumer confidence in the U.S. economy is nearing a 14-year high. The University of Michigan’s consumer sentiment index rose to 100.8 in September, marking the second highest point since 2004.

BDO’S TAKE:

WHAT TO EXPECT IN 2018

Overall, the positive economic signs bode well for retailers for the remainder of 2018. The increase in retail sales will likely continue into the second half of the year. Nevertheless, there is the ongoing threat of possible additional tariffs, which would likely drive up the prices of retail goods and also create some short-term supply chain disruptions. In addition, gas prices have been increasing and the Federal Reserve continues to gradually raise interest rates.

As such, we expect to see some more store closings announced, as well as some larger retailers file for bankruptcy, especially those that are too highly leveraged to fund a transformation to a new omnichannel strategy, or those that assume simply shutting doors will keep them afloat. That said, a retailer that is not Amazon must be realistic about its status quo before beginning any sort of transformation, taking steps to evaluate its financial strengths and weaknesses, and considering issues such as internal digital capabilities, supplier and distributor liabilities and core differentiators. Only at that stage can a retail business be optimized to prepare for calculated change and refining its business strategy to better align with customer needs. Then, retailers can initiate next steps on a better foundation without losing sight of the full picture.

For more information, contact:

| David Berliner New York |

Natalie Kotlyar New York |

|

|

|

|

|

| Jennifer Valdivia Los Angeles |

Ted Vaughan Dallas |

|

|

|

|

|

| Scott Ziemer Phoenix |

SHARE