Coronavirus Aid, Relief, and Economic Security Act: Retail & Consumer Products Impact

On Friday, March 27, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (also known as the CARES Act), a $2 trillion stimulus package intended to help mitigate the economic devastation caused by the novel coronavirus (COVID-19).

The stimulus is good news for retailers and consumer product companies, many of whom are struggling given the current economic circumstances and stand to benefit financially from the package. However, the CARES Act also includes restrictions and responsibilities that companies need to be aware of.

We’ve summarized some of the key portions of the CARES Act for retailers and consumer products companies.

Lending Programs

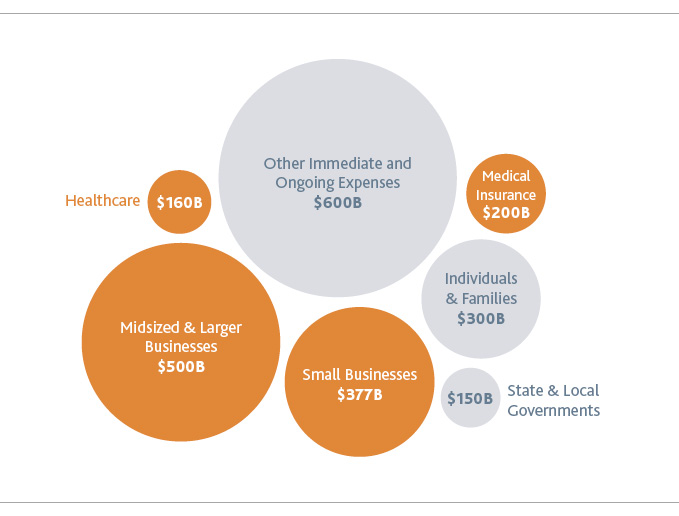

The CARES Act is comprised of multiple loan programs targeted at different groups impacted by COVID-19. The programs retailers and consumer product companies may be eligible for, both past and present, are highlighted in the figure below.

SBA Paycheck Protection Program – $350B

Under the Small Business Administration (SBA) Paycheck Protection Program, specific funds totaling $350 billion have been set aside for small businesses, to be administered by SBA-approved lenders. Loan amounts for this provision may only be used for rent, insurance premiums, utility payments, mortgages, and payroll.

In order to qualify for a loan under this program, your company must employ 500 workers or fewer (both full-time and part-time), or meet the industry size standard set forth by the SBA.

The maximum amount for these loans is 2.5 times the average total monthly payroll costs for the prior 12 months, or up to $10 million. The interest rate may not exceed 4%. Businesses can also defer payment of the principal, interest and fees for six months to one year.

One of the biggest appeals of the SBA Paycheck Protection Program is that the loans are forgivable, assuming certain conditions are met. The SBA can grant forgiveness up to the total amount borrowers spend of up to eight weeks of payroll costs and mortgage interest, rent, and utility payments between February 15 and June 30, 2020, if the borrower retains its employees and does not reduce salary levels more than 25%. Loan forgiveness is prorated for organizations that do not maintain payroll. The CARES Act provides an exception to the reduction if the eligible entity re-hires employees and/or eliminates the reduction in salaries by June 30, 2020. Forgiven amounts do not need to be reported as taxable income. The Treasury Department is anticipating that not more than 25% of the forgiven amount may be for non-payroll costs. On April 16, the SBA announced that the PPP ran out of the initial $349 billion allocated for small business loans and the website is no longer accepting new applications. Retailers will have to standby as Congress negotiates the possible release of additional rescue funds.

SBA Economic Injury Disaster Loans

The SBA’s Economic Injury Disaster Loan (EIDL) program gets an honorable mention here since the CARES Act temporarily expands eligibility to all businesses with 500 employees or fewer. The program offers up to $2 million in economic aid to small businesses, at an interest rate of 4% or less. Loans smaller than $200,000 can now be approved without a personal guarantee. In addition, the CARES Act removes the requirement that borrowers must demonstrate they have not been able to secure credit elsewhere.

Companies can also request an emergency grant cash advance of up to $10,000, to be funded within three days of the SBA’s receipt of the loan application. This $10,000 grant does not need to be repaid, even if the candidate isn’t ultimately approved for a loan.

Companies can apply for loans under both SBA programs as long as they don’t cover the same expenses.

You can apply directly for an EIDL loan via the SBA’s online portal.

Mid-sized & Larger Businesses – $500B

The Treasury will have $500 billion at its disposal to give loans to eligible businesses as part of the economic stabilization plan included in the CARES Act. The $500 billion will be allocated as follows:

The terms and conditions of these loans are delineated between the $46 billion for air carriers and businesses deemed critical to national security, and the $454 billion allocated for other businesses, states and municipalities. The former will be provided directly via the Secretary of the Treasury, while the latter will be allocated via programs and facilities established by the Board of Governors of the Federal Reserve program—which means requirements relating to loan collateralization, taxpayer protection and borrower solvency under the Federal Reserve Act also apply. The process to get a loan will also likely be lengthier, as these programs and facilities have not yet been established.

The $454 billion does explicitly include a loan program for midsized businesses—defined as organizations with between 500 and 10,000 employees, for which annualized interest rates cannot exceed 2%. No interest payments are due within the first 6 months of the loan.

Unlike the SBA Payment Protection Program, these loans are not forgivable. The loans also come with public disclosure requirements, which will be overseen by a Special Inspector General for Pandemic Recovery appointed by the President.

Read our in-depth overview of the CARES Act’s economic stabilization plan for more information on eligibility requirements and qualifications.

Mainstreet Lending Program

The Mainstreet Lending Program is the latest action taken to offer companies liquidity. Using appropriated funds from the CARES Act, the Treasury will make a $75 billion equity investment in a special purpose vehicle to implement the Mainstreet Lending Program. This program aims to increase the flow of credit to small and medium-sized businesses that were in good financial standing prior to the COVID-19 crisis, including those who employ up to 10,000 employees and/or had 2019 annual revenues of $2.5 billion or less. This option is specifically aimed at those who own the 40,000 medium-sized businesses which employ 35 million Americans.

Importantly, eligible borrowers cannot use the loan proceeds to repay other loan balances or other debt of equal or lower priority unless the eligible borrower has repaid the eligible loan in full. Additionally, the borrower cannot cancel or reduce any existing lines of credit.

Tax Provisions

The CARES Act also introduces several tax changes, including credits, payment delays and increases to interest deductions that have immediate implications for retailers’ total tax liability:

-

Employee Retention Credit for Employers Subject to Closure due to COVID-19 – This tax credit against applicable employment taxes amounts to 50% of “qualified wages with respect to each employee.”

-

Delay of Payment of Employer Payroll Taxes – Employers may delay their 2020 payroll taxes, to be paid in full within two years.

-

Modification for Net Operating Losses – Tax losses from 2018-2020 can be applied retroactively five years to offset income.

-

Modifications of Limitation on Business Interest – Businesses may increase their interest deductions for 2019 and 2020. Previously, the maximum interest deduction was 30% EBITDA. It has been raised to 50% EBITDA.

Labor Provisions

The most important labor provisions for retailers and consumer product companies are those regarding paid leave and unemployment insurance. Under the CARES Act, there is a cap on the payments an employer must pay for emergency paid leave. Employers can also elect to receive an advance tax credit on paid leave. If they do not elect to receive the tax credit, they will be reimbursed on the back end.

Unemployment insurance is available to both the unemployed and the underemployed. State short-term compensation programs will make it possible for employers to preserve pro-rated unemployment benefits for employees when reducing their hours.

Note: This piece was last updated on April 20, 2020.

SHARE