CARES Act Employee Retention Credits for Retail Employers

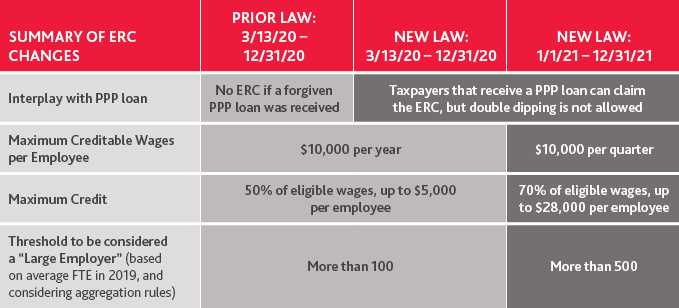

Many companies in the retail industry were forced to close their operations as a result of the coronavirus pandemic while others were forced to severely limit their offerings. One way to continue to pursue your organization’s objectives is to ensure that you are still able to function, even if only in a limited capacity. The government has supported retail and the continuation of their services with the passage of the CARES Act in March 2020, which includes the Paycheck Protection Program (PPP) and the Employee Retention Credit (ERC). Under the CARES Act, companies could take advantage of either the PPP or the ERC, but not both. In welcome news for retail companies, the Consolidated Appropriations Act of December 2020 (Relief Act) and American Rescue Plan Act, H.R. 1319 retroactively eliminates this limitation and extends and enhances the ERC through the end of 2021.

The ERC is one of the most beneficial provisions of the Relief Act relevant to retail companies. If you did not consider the ERC in 2020, or were not eligible to consider the ERC because you took a PPP loan, the retroactive ability to benefit from both PPP loans and the ERC is a powerful reason to consider the ERC for 2020. Looking ahead to 2021, the enhanced amount of the credit for wages paid during all four quarters of 2021 provides yet another strong reason to consider the ERC.

What is the ERC?

The ERC is a refundable payroll tax credit for wages paid and health coverage provided by an employer whose operations were either fully or partially suspended due to a COVID-19-related governmental order or that experienced a significant reduction in gross receipts. The ERC can be claimed quarterly to help offset the cost of retaining employees. Employers may use ERCs to offset federal payroll tax deposits, including the employee FICA and income tax withholding components of the employer’s federal payroll tax deposits. Unlike the PPP, which was on a first come first serve basis, the ERC can be claimed up to three years from the date in which your quarterly payroll return was filed.

Who is eligible for the ERC?

To claim the ERC in any given calendar quarter, retail companies must meet one of the following criteria during that quarter:

-

Operations were fully or partially suspended as a result of orders from a governmental authority limiting commerce, travel or group meetings due to COVID-19; or

-

The organization experienced a significant decline in gross receipts during the calendar quarter compared to 2019. Specifically, for 2020, gross receipts for the 2020 quarter decline more than 50% when compared to the same 2019 quarter. Eligibility for the credit continues through the 2020 quarter in which gross receipts are greater than 80% of gross receipts in the same 2019 quarter.

-

For 2021 the gross receipts eligibility threshold for employers is reduced from a 50% decline to a 20% decline in gross receipts for the same calendar quarter in 2019 and a safe harbor is provided allowing employers to use prior quarter gross receipts compared to the same quarter in 2019 to determine eligibility.

-

Employers not in existence in 2019 may compare 2021 quarterly gross receipts to 2020 quarters to determine eligibility.

Can you claim the ERC if you receive a PPP loan?

Yes! As described above, one of the most favorable provisions in the new law allows taxpayers to both receive PPP loans and claim the ERC. This overlap was not permitted when the CARES Act was originally enacted, and companies in need of cash infusions during 2020 more frequently turned to PPP loans as a source of funds rather than the ERC. Importantly, the new law makes the ability to claim the ERC and receive PPP loans retroactive to March 12, 2020. As a result, companies that received PPP loans in 2020 (and/or will receive new loans in 2021) can now explore potential ERC credits for 2020 and 2021.

What wages qualify for the ERC?

The answer depends on an organization employee count. Eligible companies that are considered large employers can only claim the ERC for wages paid to employees for the time they are not providing services. This aligns with the purpose of the ERC, which is to encourage employers to retain and compensate employees during periods in which businesses are not fully operational.

Smaller eligible companies may claim a credit for all wages paid to employees. The Relief Act increases the threshold used to determine large employer status for 2021 claims to an employee count of more than 500 (for 2020 it is more than 100). This favorable change broadens the number of eligible retail companies that can claim the ERC for all wages paid to employees, including wages paid to employees who are providing services. Importantly, qualified healthcare expenses count as wages.

BDO Insight: If you furloughed your employees but continue to pay their health insurance, you can claim the ERC. Furloughed employees do not have to receive wages—health care expenses alone qualify as wages for purposes of the ERC.

How is the determination of Large Employer status made?

Large Employer status is determined by counting the average number of full-time employees employed during 2019.

For this purpose, “full-time employee” means an employee who, with respect to any calendar month in 2019, worked an average of at least 30 hours per week or 130 hours in the month. This is the same definition used for purposes of the Affordable Care Act. Importantly, aggregation rules apply when determining the number of full-time employees. In general, all entities are considered a single employer if they are a controlled group of corporations, are under common control, or are aggregated for benefit plan purposes.

Companies that operated for the entire 2019 year compute the average number of full-time employees employed during 2019 through the following steps:

Step 1: Count the number of full-time employees in each calendar month in 2019. Include only those employees that worked an average of at least 30 hours per week or 130 hours in the month.

Step 2: Add up each month’s employee count from Step 1 and divide by 12.

BDO Insight: Part-time employees that work, on average, less than 30 hours per week are not counted in the determination of large employer status. Omitting part-time employees from the computation should result in more retail companies having 500 or less full-time employees and therefore being able to claim the ERC for all wages paid to employees in the four quarters of 2021 (assuming eligibility criteria are met).

Can the same wages be used for the computation of both the ERC and the amount of PPP loan forgiveness?

No. Simply put, there is no double dipping. Wages used to claim the ERC cannot also be counted as “payroll costs” for purposes of determining the amount of PPP loan forgiveness, and companies that want to benefit from the ERC and have their PPP loans fully forgiven will need to have sufficient wages to cover both. To the extent an organization does not have sufficient wages, strategic planning will be needed in order to generate maximum benefits.

BDO Insights

|

Employers that previously reached the credit limit on some of their employees in 2020 can continue to claim the ERC for those employees in 2021 to the extent the employer remains eligible for the ERC. |

|

|

Qualification for employers in 2021 based on the reduction in gross receipts test may provide new opportunities for businesses in impacted industries. |

|

|

Retail companies typically have lower participation in health insurance programs by their employees but the increase in the threshold for qualification as a “large employer” to 500 for 2021 may provide substantial benefits for those below the threshold. |

|

|

Eligible employers with 500 or fewer employees may now claim up to $7,000 in credits per quarter, paid to all employees, regardless of the extent of services performed. Previously this rule was applicable to employers with 100 or fewer employees and a maximum of $5,000 in credit per employee per year. Aggregation rules apply to determine whether entities under common control are treated as a single employer. |

SHARE