Real Estate & Construction Monitor Newsletter - Winter 2018

Table of Contents

- What WeWork's Jump into Retail Means for REITs

- The Tax Incentives Keeping the LED Lights On: Q&A with: David Diaz, Managing Partner at Walker Reid Strategies

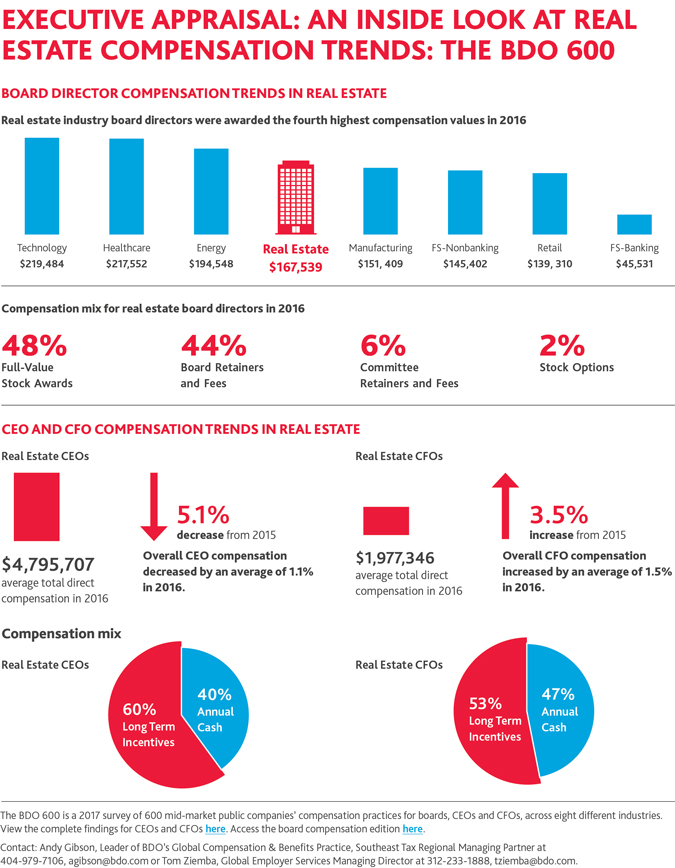

- [Infographic] Executive Appraisal: An Inside Look at Real Estate Compensation Trends: The BDO 600

- Contractors, Don't Wait to Act on Revenue Recognition

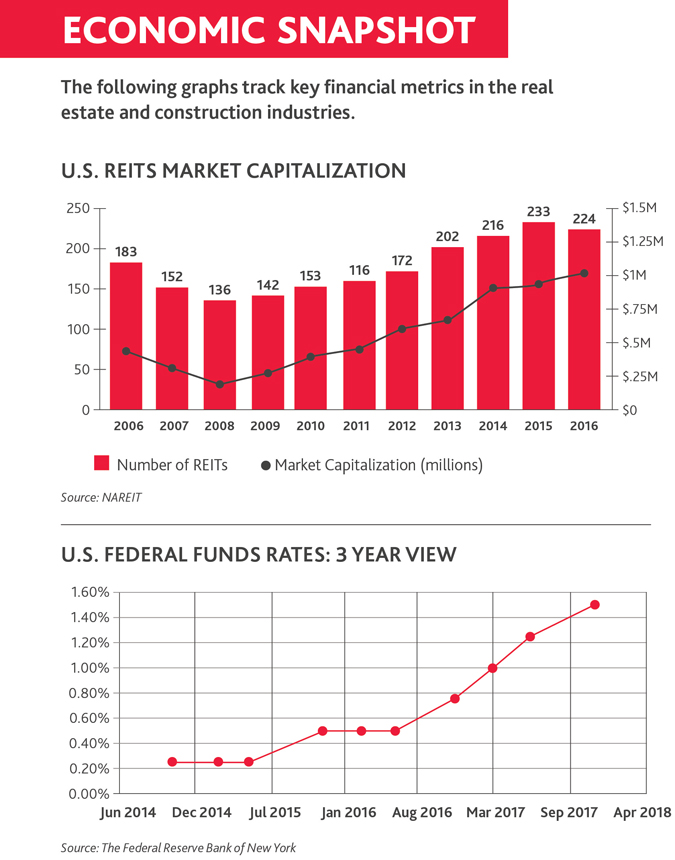

- Economic Snapshot

What WeWork’s Jump into Retail Means for REITs

By Stuart Eisenberg

While lots of eyes and attention remain fixed on 2017’s string of retail bankruptcies and the growth of “clicks-to-bricks” retailers, WeWork may be quietly laying the foundation for a broader move into retail real estate.

There certainly appears to be no shortage of funding momentum for the $26 billion startup, following a $4.4 billion commitment from the SoftBank Vision Fund in August that is expected to fuel global expansion.

And REITs should be watching—WeWork’s model for expansion could disrupt not only office REITs, but REITs across some unexpected sectors.

Underscoring the company’s interest in potentially extending its business model into the retail space, The Wall Street Journal reported that WeWork Property Advisors would get a seat on the Hudson’s Bay Co.’s (HBC) board after WeWork and its private equity partner Rhone Group acquired the Lord & Taylor building in midtown Manhattan from HBC in October. It has also been reported that WeWork principals have invested in a retail technology startup and that several of the real estate company’s recent hires hail from an online electronics retailer.

Behind the Lord & Taylor Buy

One factor that makes the Lord & Taylor deal notable is the $850 million price tag. The property sold for 30 percent more than its appraised value last year. While the property’s location likely partially contributed to the deal value, it’s no secret that there’s a greater demand for spaces that can be converted to alternative uses, and the building’s flexibility might have also driven up the price. This suggests REITs that own buildings that can be readily converted to alternative use could see a bump in valuation based on an assumption that the highest and best use value exceeds the value based on the existing use. Retailers with flexible space in prime markets, where demand remains high, are likely to see the greatest benefit.

This trend isn’t limited to retail, though. On the hospitality front, WeWork has experimented with nightly rentals in its co-living space in lower Manhattan. During a recent panel at the Urban Land Institute fall meeting moderated by WeWork’s Liz Burow, several industry leaders pointed to the growing emphasis on short-term lease arrangements across industries. Panelists noted that space flexibility is now playing a key role in growth trajectory for many types of companies, with flexible lease terms allowing for the development of new groups within a company and greater experimentation with short-term projects.

Adaptability is the name of the game for a huge variety of tenants—think retailers, food pop-ups and boutique hotels, but also health care providers, as the care continuum expands far outside the walls of traditional hospitals. For REITs, this means potentially baking in greater flexibility to lease-term length in sectors beyond offices, and further blurring the lines in large mixed-use spaces. These changes could have significant implications for REITs’ maintenance and property management needs, as well.

When it comes to the co-everything movement, We(will be) Watching.

This article originally appeared in Commercial Property Executive.

Stuart Eisenberg is a partner and the national leader of BDO’s Real Estate & Construction practice. He may be reached at [email protected].

The Tax Incentives Keeping the LED Lights On

Q&A with: David Diaz, Managing Partner at Walker Reid Strategies

As energy efficiency initiatives become common procedure for new construction, many in the real estate and construction industries could be eligible for tax incentives but not taking advantage of them. For a closer look at the cost saving opportunities for real estate operators and contractors, we spoke with David Diaz, Managing Partner with Walker Reid Strategies, a BDO Alliance firm specializing in energy efficiency and specialty tax services.

What are the energy incentives available to the real estate and construction industry?

There are two tax incentives that intersect with the real estate and construction industries: section 179D tax deductions for commercial buildings and section 45L tax credits for residential properties. The latter is most commonly leveraged by developers of large multi-family buildings or complexes. The commercial deduction—179D—is also available for contractors, architects and engineers on eligible government projects.

What are examples of common energy improvements that qualify?

For energy savings, changing lighting is the low-hanging fruit. This can be as simple as updating fluorescent lights to LED. One common misconception with 179D is that if you make those improvements, you can only claim the lighting portion of the credit, but if your lighting is efficient enough, you can claim the whole thing.

How has market pressure for corporations to be more environmentally conscious impacted the energy-efficient building sector?

External factors have had a tremendous influence on energy efficiency initiatives. We’ve seen a substantial increase in the number of qualifying projects since around 2011. I see two factors at play in that growth. First, and most importantly, a lot of new construction automatically meets the energy tax incentive targets that have been set by the IRS and the Department of Energy. Second, the public’s expectations to increase environmentally friendly building practices, building standards and technological advancements have all progressed faster than the tax code.

On the commercial real estate side, who are the best candidates for taking advantage of tax incentives?

Developers, landlords or contractors that have an appetite to reduce their tax liabilities—perhaps they just built a new building or received a major influx of capital—are at the perfect juncture to consider their energy incentive options and leverage accelerated depreciation. We have a lot of clients that are great candidates from an energy perspective, but they are highly liquid and not actively investing, so they have less need.

Once savings are realized from energy tax incentives, the value really comes from putting that money to work. The smartest use of energy tax credits is to directly reinvest it into the business. Among those strategies is funding other energy improvements.

What is the biggest reason builders or landlords aren’t taking advantage of the credit?

Both tax credits available for the real estate and construction industries are extremely underused. Savvy real estate professionals and investors are usually aware of cost segregations and local rebates to drive tax savings, but they often overlook the energy angle. Many in the industry also wrongly assume that their buildings aren’t “green enough” to qualify for the deduction and don’t pursue the credits. In reality, most building codes align with and meet IRS requirements for energy efficiency, so the majority of new construction projects at least partially meet 179D requirements.

The deduction is particularly underused in the fixed asset space. Only 10 to 20 percent of eligible building owners making improvements to their fixed assets are taking advantage of the available credits. Lack of awareness is really the primary driver for underuse, but there are other considerations as well. Developers and property owners have a lot of tax saving options available to them that they may prioritize before energy tax credits. Cost segregation, for instance, is an option that yields a better return on investment than the 179D certification. Taxpayers that have already performed cost segregation and still have the appetite to reduce their tax liability are good candidates to explore tax savings in energy.

How do the requirements compare between the residential and commercial credits?

While most new commercial construction will fulfill the 179D requirements, qualifying for the residential credit (45L) is a bit more difficult. To meet the standards, homebuilders need to consider energy efficiency before breaking ground. It needs to be a more intentional process. Common green building strategies for single and multi-family homes include building envelopes for windows and doors and integrating efficient heating, ventilation and air conditioning (HVAC) technology.

Despite the stricter requirements on the residential side, most projects we review do qualify for the credit. Before 2013, only about 20 percent of projects Walker Reid reviewed qualified for 45L. Today, that number has climbed to around 60 to 70 percent of projects. Over the course of our collaboration with BDO, we’ve certified over 3,000 residential units with 45L.

Are there any frequent audit issues related to the tax incentives?

The most common audit risk occurs with government-owned buildings. Since governments and municipalities are non-taxable entities, those organizations can’t qualify for the credit themselves. For qualifying projects, however, governments can allocate the tax savings to individuals and companies that design the energy efficient aspects of the building. This clause extends the credit to contractors, architects and engineers contracted by governments for energy efficiency projects.

The audit risk comes into play because there is some gray language in the tax code about the definition of “designer,” and what kind of professionals and work are eligible for the credit. As a result, a lot of contractors and subcontractors are taking this incentive even though they didn’t complete design work. In these cases, the designers that created the specifications and deserve the credits aren’t claiming them because they are going to other firms.

In audits, individuals that claim this credit are being asked to prove they completed design work for the energy efficient building. Designers should document their role in the design process, including design meetings, design specifications and energy-specific equipment to prepare for this audit risk.

What is the outlook for these tax incentives?

The 179D tax credit expired for projects in 2017, so the industry is waiting on a legislative extension and there is a very real possibility the credit will change. While there is one piece of legislation on the table that proposes making the credit permanent—HR 3507—the outcome of that bill and the credit overall remains uncertain.

The policy details are still being ironed out, but it’s likely that the bar for qualifying energy efficient projects will be raised in the future. As the tax code catches up to the public’s expectations for energy efficiency and technology continues to advance, I expect more green building projects will start to shift beyond lighting retrofits to a more holistic efficiency plan.

Contractors, Don’t Wait to Act on Revenue Recognition

By Jody Hillenbrand and Luis Torres

Jan. 1, 2019, is quickly approaching. For most privately held construction companies, this is the implementation deadline for the new revenue recognition standard, Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers. The time to act is now, especially for contractors with projects lasting over 12 months. A contract that starts now, but extends into 2019, will be subject to the new standard.

In discussing the implementation with many people in the industry, the responses range from “Can’t you just tell me what to do?” to “I just need to write a memo; we’re not changing anything.” Why is there such disparity in responses regarding the implementation of an accounting standard? In the U.S., there’s an expectation of specific, rules-based authoritative guidance from the Financial Accounting Standards Board (FASB). As we move toward convergence with international standards, the change from rules-based to principals-based guidance means there won’t always be black-and-white answers. Under ASC 606, there’s the potential that two companies could account for similar contracts differently—but both appropriately. This could cause significant issues with sureties and bankers, who have grown accustomed to percentage-of-completion accounting under the previous guidance, which has been consistent for 35 years.

What do contractors need to do NOW to make sure they are ready to implement the standard?

1. Assemble your team. While revenue recognition is inherently an accounting topic, this evaluation will need to involve owners, accounting personnel, project managers and anyone else familiar with the company’s contracts.

2. Identify whether a contract exists. Under ASC 606, a key step in the evaluation process is to identify the contract. Fortunately, the construction environment tends to make the identification of when a contract exists fairly clear.

3. Take an inventory of contracts. Once the team has been identified, one of its first tasks is taking an inventory of contracts and segregating them by type. There are several issues that impact a contractor’s determination of when it has a contract. For master service agreements, job order contracts and other similar contracts, careful evaluation will need to be made to ensure all five criteria to account for a contract under ASC 606 are met. This is why the inventory of contracts is such an important process. It is the foundation of the evaluation for accounting under ASC 606.

4. Evaluate contracts. Once the inventory is complete, a representative sample of contracts by type should be evaluated regarding implementation issues. Consideration should be made for multiple performance obligations (especially for master service agreements), uninstalled materials, termination clauses, warranties, liens, change orders and any other nuances that impact costs, collection and delivery of service.

5. Evaluate impact on internal controls. In addition to accounting implementation issues, the impact on systems, internal controls over financial reporting and operations should also be evaluated.

6. Engage software providers in the conversation. Software that was sufficient under the previous standard may not provide adequate information under the new standard. Contact with software providers early in the planning process is important to clarify system controls versus manual controls.

7. Consider the potential tax implications now. In addition to the impact on book reporting and internal controls, there are many potentially significant tax implications that companies should consider up front. Because the new standard not only impacts how revenue is recognized, but also potentially when it is recognized, there are significant changes to book rules that may require your organization to put in place new data collection and retention policies to substantiate tax changes.

Possible tax implications could include:

-

Tax accounting method changes

-

Book-tax differences

-

Cash taxes

-

Accounting for income taxes (ASC 740): Deferred taxes, current/non-current taxes payable—at adoption/prospective

-

Federal, state, indirect and foreign taxes

-

Transfer pricing

What are the core differences between the new revenue recognition standard and the old?

Revenue will be recognized based on transfer of control:

Under ASC 606, we move from a model where revenue was recognized based on transfer of risks and rewards to a model where revenue will be recognized based on transfer of control. While this may result in many construction contracts being recognized in a pattern similar to percentage-of-completion, there are certain differentiating factors to consider. Revenue may now be recognized either over time or at a point in time. First, a contractor must determine if revenue for a contract must be recognized over time. To qualify, one of the following criteria must be met:

-

The customer simultaneously receives and consumes all of the benefits,

-

The entity’s work creates or enhances an asset controlled by the customer, or

-

The entity’s performance does not create an asset with alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date.

If none of these criteria are met, revenue will be recognized at a point in time. In some cases where the first two criteria are not met and it was believed that the third criteria would be met, upon further review of the contract terms it is not clear that the contractor has an enforceable right to payment. This has been the case with certain government contracts. If the contractor and legal counsel can’t support that there is an enforceable right, revenue for these contracts will have to be recognized at a point in time, which will be a significant change. Careful review of contracts and their terms is necessary and it’s best to do this well in advance of date of adoption.

Changes related to measuring performance:

Once a contractor concludes that recognition over time is appropriate, the method of measuring performance should be determined. Both output methods (surveys, appraisals of results, milestones, etc.) and input methods (labor hours, costs incurred, time, etc.) can be used to measure performance. Currently, under percentage-of-completion, the “cost-to-cost” method of measuring completion on a project is the most commonly used, which is similar to one of the input methods permitted under ASC 606. However, costs such as pre-contract costs, uninstalled materials and cost overruns from inefficiencies or re-work may be treated differently. These changes can shift when revenue is recognized during the project.

New guidance on the treatment of precontract costs:

Under current GAAP, contractors can capitalize precontract costs as long as recovery is probable. Once the contract is awarded, the costs are allocated to the project and are included in costs in evaluating percentage-of-completion. Under ASC 606, these same costs, along with mobilization costs, may be required to be capitalized and then amortized over the life of the contract as the performance obligation is satisfied. This will create another level of monthly adjustment to contract costs and a deferral of the incremental profit recognition.

Changes to accounting for uninstalled materials:

Currently, there is diversity in practice for how to account for uninstalled materials, which for many contracts can be significant and can greatly affect when revenue is recognized when a cost-to-cost method is applied. The new standard asserts that there may not be a direct relationship between these costs and the satisfaction of the contractor’s performance obligation. As a result, revenue may be recognized only up to the cost on uninstalled materials, but the incremental profit related to those costs will be deferred until the equipment is installed and the applicable costs will be excluded from the cost-to-cost calculation. This will result in timing differences in profit recognition.

In addition, for contractors recording percentage-of-completion adjustments monthly under cost-to-cost, there will need to be a two-part evaluation on revenue recognition for installed and uninstalled costs. Judgment will be required to determine how to treat the related costs in the cost-to-cost model after installation (e.g., should the costs be added back or excluded for the full length of the contract?) For many contractors, tracking this data will be a big change and conversations with software providers should be happening soon.

Increased disclosure requirements:

The new standard will require the gathering of information in new and different ways, which could be time-intensive to implement initially. Remember that even if the timing of revenue recognition is not materially changed from current reporting, the new standard requires much more robust disclosures, even for private companies. Many contractors will have to change their processes and controls over contracts and job costs. Accounting departments will need greater understanding of the underlying contracts, including when the sales teams make modifications to the standard contract clauses.

With these complex considerations in mind, there is no time to waste. Contractors that haven’t started the process of implementing revenue recognition yet are already behind.

For more information on how to prepare for the new revenue recognition, access the complete collection of BDO’s Revenue Recognition resources.

Jody Hillenbrand is an assurance director in BDO USA’s San Antonio office. She can be reached at [email protected] or 210-424-7524.

Luis Torres is an assurance partner in BDO USA’s New York office. He can be reached at [email protected] or 212-885-7388.

Return to Table of Contents

SHARE