4 Trends Shaping Industry 4.0 in 2019

Stormy trade conditions, continued fallout over tax reform and sustained economic growth made 2018 an eventful year for the manufacturing industry.

As we kick off 2019, uncertainty is the name of the game: The U.S.-China trade war does not seem likely to fully abate; analysts speculate that the U.S. economy is due for a downturn; and the IRS will continue to release new guidance on provisions introduced via tax reform in 2017.

While on the surface, the forces shaping 2019 present a mixed bag for manufacturers eager to start or ramp up their Industry 4.0 plans. The reality is that the reduced corporate tax rate, strong economic fundamentals and high demand for their products means that manufacturers are well positioned to make long term investments in Industry 4.0 strategies and technologies.

Here are the top trends we predict will shape Industry 4.0 in the year ahead:

#1 The U.S.-China trade relationship will remain on rocky ground, increasing the importance of Industry 4.0 security

U.S. manufacturers have long relied on China for affordable manufactured materials and haven’t needed to source alternatives for decades. Under the Trump administration, however, U.S. manufacturing’s long honeymoon with China may be coming to an end. Beginning in early 2018, concerns over technological espionage and trade imbalances led to increased legal and political scrutiny, tariffs and outright bans on certain hardware and manufactured technologies from China.

President Trump’s announcement to implement tariffs on imports of steel and aluminum dominated global trade news headlines for most of 2018. Since the initial announcement, the U.S. and its major trading partners, including the EU, South Korea and China, have traded a series of exemptions, extensions and retaliatory tariffs.

Talks to de-escalate trade tensions have had varying degrees of success. After imposing retaliatory duties on American-made goods, the European Union and the U.S. entered into talks to draw down to zero-tariff levels, but haven’t yet reached a permanent agreement. Other countries, like South Korea, immediately sought and secured permanent exemptions from the U.S. tariffs.

In 2019, as a March 2nd deadline looms to increase China tariffs from 10% to 25% on many products, the Trump administration’s concerns over Chinese business practices are expected to continue. Even if tariffs are reduced and removed, we’re likely to see ongoing regulatory and legal scrutiny of China, which has potential to disrupt manufacturing supply chains. Meanwhile, the threat of corporate espionage from China has not abated, jeopardizing U.S. manufacturers’ intellectual property at the same time unprecedented connectivity is introducing new vulnerabilities.

Manufacturers not only need to assess the impact on their global supply chains, they may also need to reassess their industrial systems’ security controls and more closely scrutinize imports for potential exploits, unintentional or otherwise—though it should be noted the blockbuster report in October 2018 of “spy chips” ultimately proved false.

#2 The U.S. will fall further behind China and Europe in Industry 4.0 readiness…if U.S. manufacturers don’t take action

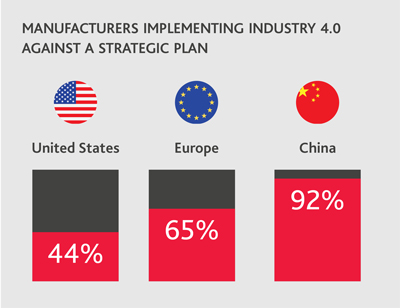

The U.S. lags significantly behind Europe and China in Industry 4.0 strategic readiness and implementing Industry 4.0-enabling technologies, according to data from the 2019 MPI Internet of Things Study.

Despite windfalls of cash from tax reform and strong consumer demand for their products, U.S. manufacturers aren’t likely to close the gap of Industry 4.0 investment in 2019. Uncertainty around trade policy and general fear of a market correction will likely cause delays.

Putting off investment today, however, decreases competitiveness tomorrow. While there may be more immediate concerns dominating conversations at board meetings—such as supply chain disruptions or cybersecurity—manufacturers can’t afford to forget Industry 4.0. Forgoing or pausing Industry 4.0 investment and implementation plans could prevent manufacturers from keeping up with—or leapfrogging—global competitors.

#3 Manufacturers will add jobs—but will hire a different kind of worker

Despite turbulent trade conditions and disruptions to supply chains, U.S. manufacturing continued to expand in 2018—correlating with the U.S. economy as a whole.

Future manufacturing growth and implementation of Industry 4.0, however, will be hamstrung by workforce-related issues. The U.S. manufacturing workforce skews older and an increasing number of workers are entering retirement each year. Even worse, there are not enough new, upskilled workers entering the sector to replace them. New technology doesn’t act in a vacuum and Industry 4.0 is all about man and machine working together. In addition, workers will require new sets of skills to wield the latest Industry 4.0 technologies that manufacturers integrate into their operations. This means that manufacturers need to both retrain their existing workers, as well as recruit a new generation of tech-savvy workers to ensure long-term success.

To successfully navigate this crisis and bridge the impending skills gap, manufacturers will need to take proactive steps to bolster their recruitment pipelines.

Manufacturing is no longer a dark and dirty profession—but many eligible young professionals believe the sector is stuck in the Stone Age. Manufacturers need to participate in recruitment initiatives, like Manufacturing Day, and launch programs to educate the next generation about the opportunities a career in manufacturing presents. They need to show how they’re incorporating technology into their operations and that their business encourages creative and innovative thinking. Unfortunately, if manufacturers don’t have technology to showcase, that’s a problem in itself.

#4 Blockchain will integrate with global supply chains

Blockchain has generated significant buzz the past few years, attracting a flood of entrepreneurial interest and venture capital. While limitations related to scalability and speed have prevented widespread adoption so far, blockchain does have potential to revolutionize processes across several industries. In 2019, we expect that at least one global manufacturing company will announce adoption of an enterprise-level supply chain management blockchain solution.

More than just a shiny toy, blockchain can provide real value to manufacturers with operations anywhere in the world. At its most basic level, blockchain is a transparent and secure conveyance method. By integrating their supply chains with blockchain, manufacturers can track goods from the factory floor to cargo ships, secondary production facilities and beyond. Manufacturers can also integrate their data-capturing systems with blockchain and input data collected from machinery anywhere in the world. By incorporating predictive analytics, manufacturers can use the data collected from machinery to create a global view of their operational performance, proactively identify repairs or upgrades and discover which of their methods are most efficient and should be replicated.

There’s no telling exactly how 2019 will shake out, but manufacturers shouldn’t let uncertainty cause inaction. While manufacturers may need to prioritize operational adjustments amid tariff disruptions and bearish market conditions in the short-term, they can’t afford to ignore long-term planning for their businesses. Hesitating or pausing on Industry 4.0 investment plans could prevent manufacturers from keeping up with—or leapfrogging—their global competitors.

SHARE