Industry 4.0: Redefining How Mid‑Market Manufacturers Derive and Deliver Value

Table of Contents

- Industry 4.0: The Lay of the Land

- Section 1: Industry 4.0 Opportunities

- Section 2: The Six Dimensions Of Industry 4.0 Maturity

- Section 3: Technology: The First Dimension

- Section 4: Data: The Second Dimension

- Section 5: Process: The Third Dimension

- Section 6: Organization: The Fourth Dimension

- Section 7: Governance: The Fifth Dimension

- Section 8: Security: The Sixth Dimension

- Conclusion

Industry 4.0:

The Lay of the Land

The Fourth Industrial Revolution—Industry 4.0—calls into question the very definition of manufacturing, blurring the lines between tangible and intangible, digital and physical, product and service. At its core, Industry 4.0 redefines how manufacturers derive and deliver value.

Industrial innovations today are less about products, materials and equipment, and increasingly about the integration of human, machine and data. Enabled by data analytics, unlimited storage, decentralized computing power and Internet connectivity, manufacturers have the potential to transform into connected, customer-centric organizations capable of developing highly customizable products safer and more efficiently, and delivering them faster and at lower cost. And as manufacturing is digitized, a whole new universe of production data opens up endless possibilities for monetization—new services, platforms and payment models.

According to BDO’s 2019 Middle Market Industry 4.0 Benchmarking Survey, 99 percent of middle market manufacturing executives today are at least moderately familiar with Industry 4.0. Yet, despite all its potential to create value, only 5 percent are currently implementing—or have implemented—an Industry 4.0 strategy.

Industry 4.0 comes with a jumbled mix of lofty concepts and flashy technologies that confuse rather than illuminate the opportunity. But underlying the buzzwords are real-world applications offering significant ROI.

Because their resources are finite, middle market manufacturers have to be prudent in their Industry 4.0 investments. The possibilities of tomorrow must be tethered to concrete goals and a clear sense of purpose. And the middle market has a limited window of time before the technology enablers underpinning Industry 4.0 become essential to competing in an ever-advancing digital world. They must master the art of balancing quick wins with longer-term, strategic investments.

We hope this benchmarking survey can help inform conversations among decision-makers when it comes to planning and focusing in specific areas along your Industry 4.0 journey. It’s intended to give middle market manufacturers a useful barometer to measure Industry 4.0 maturity, including strategic planning, technology integration, organizational readiness and key challenges.

About the 2019 BDO Middle Market Industry 4.0 Benchmarking Survey

The 2019 BDO Middle Market Industry 4.0 Benchmarking Survey was conducted by Market Measurement, Inc., an independent market research consulting firm. The survey included 230 executives at U.S. manufacturing companies with annual revenues between $200 million and $3 billion, and was conducted in November and December of 2018.

JOB TITLES

JOB FUNCTION AMONG OTHER SENIOR EXECUTIVES

For the purposes of this survey, organizations are categorized into three groups based on their annual revenues:

-

“Lower” Middle Market: $200M-$500M

-

“Mid” Middle Market: $500M-$1B

-

“Upper” Middle Market: $1B-$3B

Top Five Survey Findings

1) BUSINESS MODEL DIVERSIFICATION TOP INDUSTRY 4.0 GOALS

Middle market manufacturers recognize that Industry 4.0 offers the opportunity to both improve the bottom line and spur top-line growth. They see it as “lean 2.0” and more—not just unlocking new operational efficiencies and reducing risk, but as potentially transformational to their business itself. As they look beyond their immediate needs and toward tomorrow’s digital future, they are prioritizing business model diversification above all else as a means of competitive separation or disintermediation. That doesn’t mean they’re ignoring opportunities to drive greater efficiency and profitability; it suggests a fundamental shift in customer demand that can’t be met by traditional manufacturing.

TOP INDUSTRY 4.0 BUSINESS GOALS

2) SOME STRATEGY, LITTLE ACTION

While 26 percent of all middle market manufacturers have developed an Industry 4.0 strategy, with another 28 percent in the process of developing one, only 5 percent have reached the implementation stage—a figure indicating they are behind other industries’ implementation readiness for their digital transformation strategies, according to the 2019 BDO Middle Market Digital Transformation Survey.

An organization doesn’t need to exhibit poor performance to be at risk of falling behind. In the words of Thomas Edison, “strategy without execution is just hallucination.”

INDUSTRY 4.0 STRATEGIC PLANNING & IMPLEMENTATION

CURRENT DIGITAL TRANSFORMATION STATUS

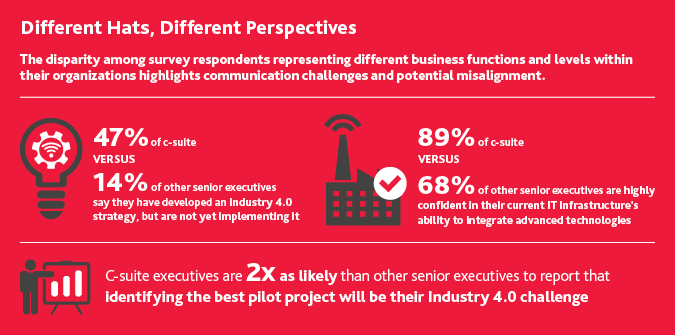

3) THE BIGGEST BARRIER TO IMPLEMENTATION IS POOR COMMUNICATION

Successful Industry 4.0 adoption requires collaboration between functional areas of the business that have historically operated in silos. Building cyber-physical systems that integrate software and information with physical processes requires the alignment of information technology with operations technology. If the IT and OT departments aren’t in constant communication and committed to learning together, either can become a bottleneck in the roll-out of new capabilities. It therefore comes as no surprise that poor communication is the biggest barrier to successful Industry 4.0 implementation. Poor communication may also stem from the traditional view of IT as a necessary evil or hindrance rather than as a strategic partner to improving business performance.

TOP BARRIERS TO INDUSTRY 4.0 IMPLEMENTATION

4) INDUSTRY OUTSIDERS POSE THE GREATEST THREAT

Middle market manufacturers are most concerned that failure to adequately invest in Industry 4.0 will lead to encroachment from non-traditional competitors. Even without manufacturing roots, a technology upstart has the potential to disrupt manufacturing, whether through hyper-customization or transforming the economics of production. Anyone can be a manufacturer in a world where 3D printing is fast and affordable. Costly barriers to entry no longer exist, opening the floodgates to new and unlikely entrants to manufacturing. Meanwhile, the rise of the sharing economy—collaborative consumption in which customers pay for access to a shared asset—has called into question the very definition—and appeal—of “owning” property. Ride-sharing services, for example, are already impacting consumer interest in purchasing personal vehicles.

GREATEST THREAT OF INADEQUATE INDUSTRY 4.0 INVESTMENT

5) THE DIGITAL THREAD IS MORE THEORY THAN REALITY

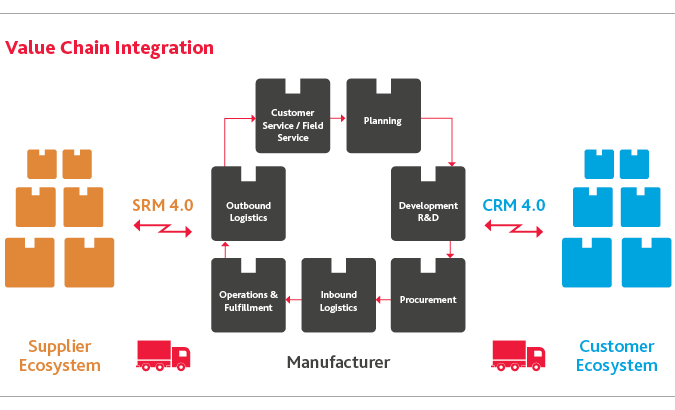

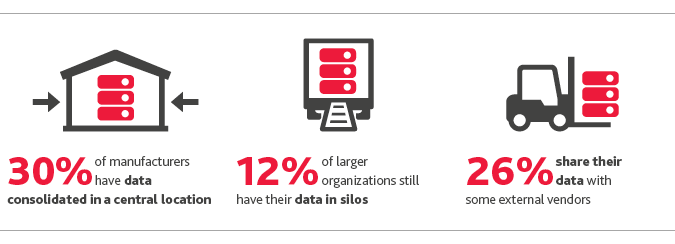

In an idealized Industry 4.0 world, supply chains become integrated value chains with end-to-end traceability and transparency, enabled by the constant, bi-directional flow of information. This flow of information and aggregated business intelligence across the supply network is often referred to as the digital thread, the lifeblood of Industry 4.0. These mutually beneficial supplier relationships—or SRM 4.0—and customer relationships—or CRM 4.0—enable collaboration to achieve efficiencies and lower costs by exchanging information and securely integrating systems and processes.

Most middle market manufacturers aren’t there yet; they’re still focused on breaking down internal silo walls.

SECTION 1:

Industry 4.0 Opportunities

Creating Value

Traditionally, manufacturers have been exclusively in the product business, focused on growing their customer base and customer fulfilment while keeping production costs low.

But as manufacturers look to the digital economy of the future—one dominated by services and ideas rather than goods—they see the greatest opportunity for value creation in true business transformation. Though lean manufacturing remains as important as ever, executives see more value creation potential in service innovation and new payment models than in improving their products and customer service—mirroring the threats posed by new industry entrants.

GREATEST OPPORTUNITY FOR VALUE CREATION

Improving Connectivity

Industry 4.0 can be conceptualized by the smart factory, which makes use of technologies like embedded sensors and wireless connectivity in factory machinery and equipment.

Similarly, smart logistics—including automated warehousing, cargo and remote fleet management—transform operations outside of production.

Some uses of connectivity have already crossed into the mainstream, from predictive facilities maintenance and automated quality control, to inventory tracking and forecasting consumer demand using real-time data. The term “smart factory” is misleading, though: for connectivity to transform the business, it needs to engage the broader ecosystem, beyond just the shop floor.

GREATEST OPPORTUNITY FOR IMPROVED CONNECTIVITY

The highest percentage of overall manufacturing executives surveyed (28 percent) think their inbound or outbound logistics offers the most opportunity to improve connectivity. Larger organizations, however, see far greater promise than their smaller peers when it comes to connectivity in customer service support.

Priority Supply Chain Improvements

To accurately capture progress in Industry 4.0 maturity, and to ensure KPIs remain in alignment with new or shifting business goals, it’s critical for manufacturers to consistently reevaluate their supply chain metrics—and identify areas for improvement.

When considering their supply chains, manufacturers are divided in the metrics identified for improvement. Upper middle market organizations are aiming to speed up customer order cycle times and are less focused on getting their total delivered costs down. On the other hand, lower mid-market manufacturers say reducing inventory turnover is their biggest priority. Overall, strengthening customer service increases in importance with size of the organization.

TOP TARGET FOR SUPPLY CHAIN IMPROVEMENT

SECTION 2:

The Six Dimensions Of Industry 4.0 Maturity

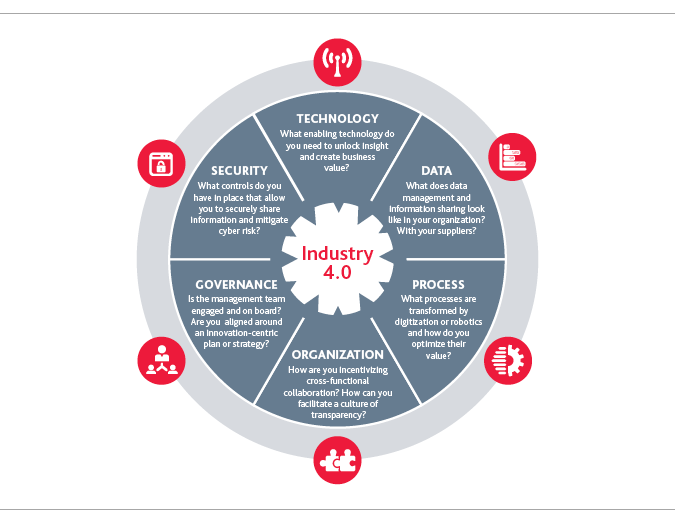

When dealing with complex, multi-stakeholder systems, change doesn’t occur in isolation.

Any change in technology, will have corresponding implications for required data inputs, connected processes and security protocols—and therefore will potentially introduce new vulnerabilities or interoperability issues.

To get the full picture of how Industry 4.0 implementation impacts the overall organization, we developed an Industry 4.0 Maturity Model across six dimensions: security, technology, data, process, organization, and governance.

As you benchmark yourself against peers throughout this report, think about all six dimensions as interrelated, interdependent components of the planning process.

SECTION 3:

Technology: The First Dimension

Technology Adoption Plans

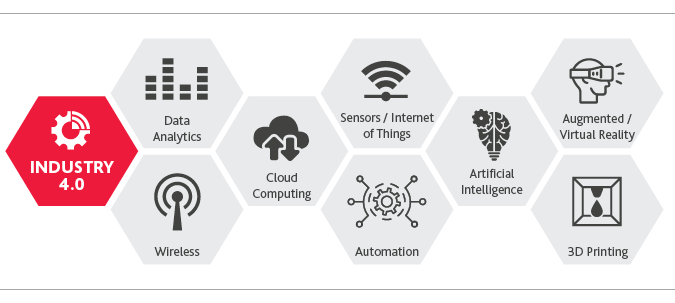

Industry 4.0 is driven by the confluence of many different technology disruptions.

Some manufacturers today, for example, are using real-time tracking to gauge transportation performance and delivery route inefficiencies while others have embedded sensors into their infrastructures to communicate disruptions. However, the level of advanced technology adoption varies by organization size.

WHAT ADVANCED TECHNOLOGIES ARE MANUFACTURERS USING NOW?

WHAT ADVANCED TECHNOLOGIES ARE MANUFACTURERS PLANNING TO USE?

76% are highly confident in their IT infrastructure’s ability to integrate advanced technologies.

64% say interoperability with legacy technologies and processes is their biggest barrier to Industry 4.0 implementation.

Technology Takeaways:

-

Focus on functionality instead of flash—but don’t be afraid to be bold. Small experimental pilots can uncover significant opportunity.

-

Cloud computing and advanced analytics are necessary precursors to adopting more sophisticated technologies. Building a cloud-based data collection hub is an important first step for Industry 4.0 enablement.

-

Your current technology investments should factor in future business needs—and the underlying digital capabilities to support them.

-

Modernizing legacy technology doesn’t necessarily require a total overhaul—to the extent it doesn’t impose any limitations and can easily be integrated with other processes and third‑party Application Programming Interfaces (APIs).

-

IT systems must be scalable to accommodate Big Data growth and higher computing power needs. Start upgrading systems now to avoid systems overload down the line.

Choosing the right technology

You can’t implement advanced technologies without laying the necessary infrastructure foundation.

7 QUESTIONS TO ASK YOURSELF BEFORE INVESTING IN ADVANCED TECHNOLOGY

-

What advantages do you need to stay competitive?

-

Does the technology address a specific pain point related to these advantages?

-

What is the potential return on investment in this specific use case?

-

What is the compatibility with legacy IT and OT systems?

-

Does your current IT infrastructure have the capacity to handle the volume of data input required?

-

Do you have controls in place to ensure the quality of data inputs?

-

Do you have the skillsets you need to deploy and maintain new technology, or do you need to hire and/or invest in training?

SECTION 4:

Data: The Second Dimension

More data equals more value—but only if that data is clean, accurate and accessible as part of an overall information governance strategy.

If underlying data or data analysis has errors, the decision-making based on that data will be riddled with errors too. For starters, manufacturers should consider investing in an Enterprise Resource Planning System, which can integrate data from all core business components into a single place to automate decisions and streamline operations.

CURRENT LEVEL OF TRACEABILITY

Data Monetization Strategies

Smarter use of data is the crux of Industry 4.0.

The ability to collect, process, store and share data in structured and unstructured forms enables advanced technologies and applications. But to realize the full potential of Industry 4.0, manufacturers need to think critically about monetizing their data, thereby using these assets to unlock and deliver value. This could come in the form of new business models, selling data as products or layering new services onto existing offerings. For instance, manufacturers could offer a custom service or product that benchmarks a customer’s performance against its peers using analytics already being collected across their digital thread.

DATA MONETIZATION STRATEGIES

Overall, middle market manufacturers have room for improvement when it comes to their data monetization strategies, with the highest percentage (71 percent) deriving value from their data through risk mitigation and fraud detection. Slightly more than half are leveraging data to offer customized products or free value-add services, or syndicating data to customers.

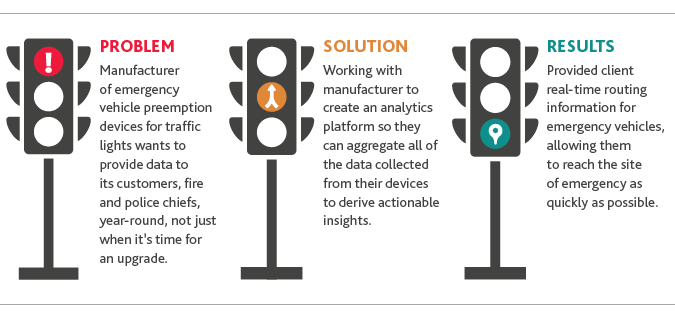

Case Study:

Business Model Transformation

BDO works with the leading manufacturer of emergency vehicle preemption devices for traffic lights. Essentially, an ambulance can turn the lights green with this device when there’s a direct line of sight.

The company owns about 80% of the market share, primarily selling to fire and police chiefs. But their only opportunity to resell to existing customers was when it’s time for an upgrade.

They decided they wanted to evolve to being both a traditional manufacturer and a business intelligence platform.

BDO is now working with them to create an analytics platform, so they can aggregate all the data collected from their devices and derive actionable insights.

The goal is to provide real-time routing information for emergency vehicles to help them reach the site of the emergency as fast as possible.

Data Takeaways

-

The use of data—at the heart of Industry 4.0—is driving an evolution in manufacturers’ business models as they increasingly deliver value through services rather than just goods.

-

A comprehensive information governance strategy is necessary to maximize the value of data outputs and minimize the risk of errors that have the potential to spoil data quality.

-

Between the complexity of emerging data types and the sheer volume, manual methods of data management and analysis simply can’t keep up.

-

In an era of cloud networks and the Internet of Things, data can be spread across an expansive network of partners and vendors. Industry 4.0 maturity is only possible if manufacturers know where and how their data flows internally and externally.

-

Any digital initiative must not only take into consideration the way you use information now, but the way you want to use information in the future.

Data Readiness Checklist

7 QUESTIONS TO ASK YOURSELF BEFORE INVESTING IN DATA GOVERNANCE

-

Does your company have a documented information or data governance program that is used across the enterprise?

-

Is data maintained, stored and/or preserved to meet the organization’s legal, regulatory and business needs?

-

Has an assessment been performed to identify the current state of the information management program, and to identify future state requirements?

-

Can your information management systems reconcile data from disparate sources and in variable formats?

-

Does your organization have an up-to-date data inventory and/or data map?

-

Does your organization currently use an ERP or MRP system?

-

Does your organization use a Mobile Device Management system?

SECTION 5:

Process: The Third Dimension

Process Integration

Process improvement isn’t just about operational excellence; it’s the engine of customer experience excellence—what enables manufacturers to provide a consistent, efficient and personalized customer journey across all channels and touchpoints.

Any change in systems and technologies has an impact on both back-end and front-end processes. Consider how customer behaviors tie into existing processes and what alternative process flows might be needed to account for diverse customer preferences throughout the customer journey. Overly rigid processes—while easier to manage—don’t account for variations in customer behaviors and process exceptions.

Implementing new capabilities requires revamped processes and competencies, which naturally takes a system-wide perspective and helps facilitate transformation. And in an Industry 4.0 world, an end-to-end view of processes doesn’t just look at enterprise-wide processes, but intra-organizational processes in the context of an integrated supply chain. However, while most manufacturers today have moved beyond having siloed processes, end-to-end process integration is only a reality for about half of manufacturers, a substantial proportion of which are upper mid-market. Few manufacturers overall have any level of process integration with outside suppliers.

CURRENT LEVEL OF PROCESS INTEGRATION

Horizontal vs. Vertical Supply Chain Automation

When it comes to digitization of processes across supply chains, middle market manufacturers overall have higher levels of automation in their horizontal supply chain processes—in which similar functional areas are integrated—compared to vertical supply chain processes, involving integration with links that are either closer or further from the customer.

Automation level indicates the extent to which processes are reliant on human input. A “high” level of automation indicates primarily machine-driven processes requiring minimal human intervention. A “low” level of automation indicates processes require significant manual intervention.

LEVEL OF VERTICAL SUPPLY CHAIN PROCESS AUTOMATION

LEVEL OF HORIZONTAL SUPPLY CHAIN PROCESS AUTOMATION

Process Takeaways

-

Process improvement is central to creating a consistent and efficient customer experience across all channels and customer touchpoints.

-

Process integration is vital to facilitating traceability and communication across the supply chain.

-

Manufacturers need an end-to-end view of process flows to understand how systems information, processes and external entities interact and interface, where there are interdependencies, and how these elements cross borders and organizational boundaries.

-

Every Industry 4.0 project should seek to continuously improve business processes, reduce complexity and increase flexibility.

Process Management Checklist

7 QUESTIONS TO ASK YOURSELF BEFORE INVESTING IN UPDATING YOUR ORGANIZATION’S PROCESSES

-

Does your organization have an up-to-date representative model of processes across the enterprise?

-

Does your organization have established KPIs and dashboards to measure process efficiency?

-

Has an assessment been performed to identify process deficiencies and improvement opportunities?

-

Has your organization identified the associated business requirements of new functionalities or capabilities?

-

Have you diagrammed your desired future state process design?

-

Does your organization currently use BPM or workflow management software?

-

Do you have change management activities in place to prepare and train employees?

SECTION 6:

Organization: The Fourth Dimension

The integration of processes and information flow in a connected Industry 4.0 environment requires a more collaborative way of working, with the goal of generating collective intelligence and solutions that extend beyond the limited view of a single person, function or entity.

It isn’t enough to use collaborative tools or IT processes; it requires building a culture of collaboration and improving transparency and communication. At its core, organizational maturity is about philosophy and mindset.

At the baseline level, balancing individual contribution and collective intelligence means erasing the artificial barriers between departments, moving away from extremely rigid organizational structures and laying the groundwork for cross-functional teams.

Empowerment and accountability are key, as are alignment on the vision and purpose.

Employee Adoption & Business Enablement

Organizational change needs to start with people.

Technology for the sake of technology is a wasted investment. Employees need to understand why they need to leave the status quo behind and feel engaged in the process. Beyond that, they need to be clear on what’s expected of them and adapt to evolving processes and technologies.

How are manufacturers ensuring their employees adopt technology advances?

STRATEGIES FOR EMPLOYEE ADOPTION OF ADVANCED TECHNOLOGIES

Fulfillment Models

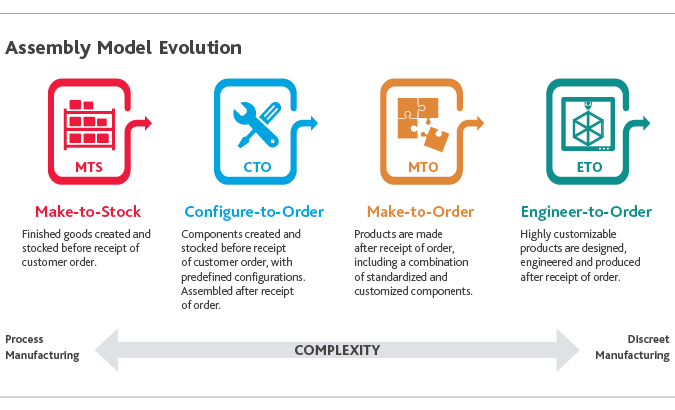

As organizational maturity increases, manufacturers can explore new assembly design models that better account for shifts in supply and demand and enable more customization by the customer.

Historically, the “make-to-order” inventory model has been the domain of higher-end products, like vehicles and technological products, like laptops. However, as sales and production become more closely integrated and processes are automated, accelerated lead times allow even mass manufacturers to offer more product customization.

Some of the most innovative in the industry are shifting from mass customization to personalized production, where customers are involved from the product design phase. This requires complete product and process traceability and real-time collaboration with external partners. Middle-market manufacturers are not quite there yet.

CURRENT FULFILLMENT MODEL

Organization Takeaways

-

Organizational change needs to start with people. The shift to Industry 4.0 hinges on the adoption of new digital capabilities by the end users—both employees and customers.

-

The connected Industry 4.0 environment requires a more collaborative way of working, with the goal of generating collective intelligence and solutions that extend beyond the limited view of a single person, function or entity.

-

Consider establishing a formal Industry 4.0 Office (DTO) to bring together cross-functional teams who have historically worked in silos to align strategy and purpose with execution, as well as to drive momentum and instill accountability.

-

As organizational maturity increases, manufacturers can explore new fulfilment models that enable more customer order customization and personalization throughout the customer lifecycle.

Organizational Checklist

6 QUESTIONS TO ASK YOURSELF AS YOU REDEFINE YOUR ORGANIZATION IN AN INDUSTRY 4.0 WORLD

-

What new capabilities and roles will the organization need to unlock the value promise of our Industry 4.0 investments?

-

Are there material organizational changes required to de-silo and support the seamless flow of information and accountability for end-to-end process outcomes?

-

Are there decisions to be made about data/ information ownership that better align with a fully integrated operating model?

-

Have we taken into account the cultural implications of the changes required to operate in a fully integrated and collaborative environment—both internally and with our customers and suppliers?

-

Are our people appropriately prepared/trained professionally and technically to operate and deliver results in an Industry 4.0 world and at an Industry 4.0 pace?

-

What continuous improvement and growth-oriented mindset and acumen need to be established to continue our journey?

SECTION 7

Governance: The Fifth Dimension

Governance in Industry 4.0 maturity encompasses the decision-making processes and strategic vision that govern the business.

At the enterprise level, governance must be viewed from the business model perspective, including all the business activities, relationships, processes and resources that create value. In the traditional, linear manufacturing model, governance is maintained through structure, processes, policies, products and services and supply chains. However, the traditional command-and-control management structure may not align with the dynamics of new business models created by Industry 4.0.

Industry 4.0 creates opportunities for organizations to evolve their core business model in a way that fundamentally changes outputs, outcomes and stakeholder relationships.

Revenue Generation Strategies

Manufacturers are increasingly evolving their focus from standalone product to a product-as-a-service model in which the manufacturer delivers a service while the product is in use.

Typically, the next customer touchpoint is when a part needs to be replaced or requires an upgrade. Manufacturers can deepen that customer relationship by offering preventative or predictive maintenance services.

Following the product-as-a-service stage in Industry 4.0 maturity is exploring new payment models, including pay-per-use, taking a lesson from the sharing economy. For example, products like industrial equipment can be offered on a pay-per-use basis similar to the software-as-a-service model in IT, which helps customers reduce upfront capital expenditures while affording the manufacturer a continuous service revenue stream.

Information-as-a-service is the most advanced level of business model maturity today, and 84 percent of upper mid-market manufacturers are generating revenue this way, compared to 67 percent of middle market manufacturers overall.

REVENUE GENERATION STRATEGIES

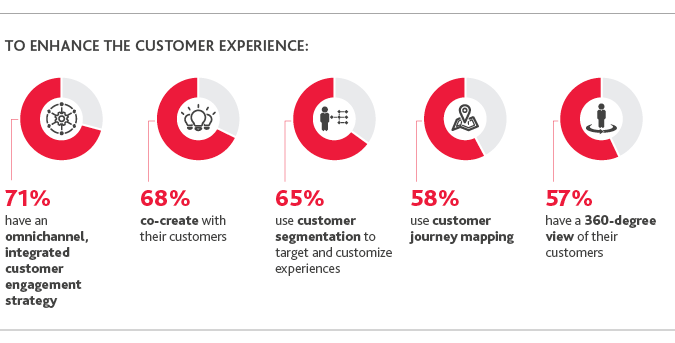

Customer Experience

Governance Takeaways

-

Business model innovation is a top Industry 4.0 goal for most manufacturers—requiring a more flexible approach to governance mechanisms and processes that includes suppliers and customers.

-

Corporate governance should be viewed as management of both conformance and performance activities, including strategy formulation and vision.

-

Blueprinting your future-state business model is critical to understanding all the levers that impact performance. Start by setting your highlevel business performance outcomes and then cascading down through each successive layer of decision-making.

-

Customer-centricity is key to business model reinvention. Prioritize revenue-generating initiatives that address unmet customer needs, embracing design thinking principles to reframe the problem in a human-centric way.

Governance Checklist

6 STEPS TO TAKE AS YOU IMPROVE YOUR ORGANIZATION’S GOVERNANCE

-

Appoint an Industry 4.0 steering committee

-

Define and evangelize integrated, firm‑wide Industry 4.0 vision

-

Define KPIs and establish review mechanisms

-

Determine budget and prioritize investments

-

Set uniform standards and policies to ensure regulatory compliance and alignment with the broader business

-

Build Industry 4.0 skills across the enterprise

SECTION 8:

Security: The Sixth Dimension

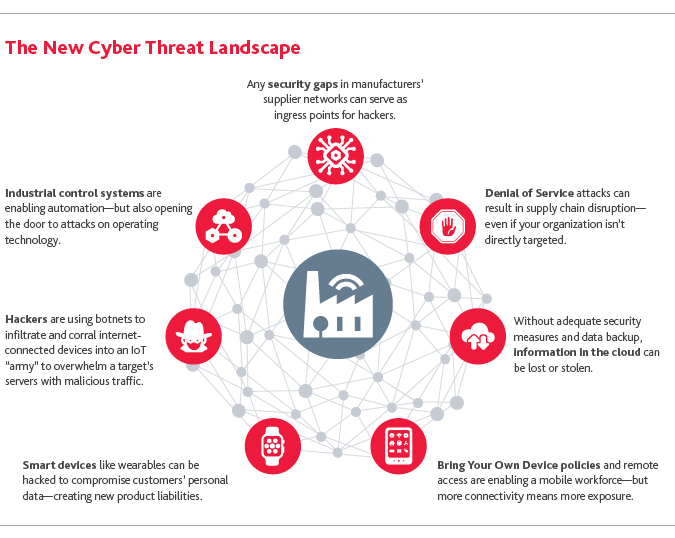

The integration of new cyber-physical systems and networked systems between partners, suppliers and customers creates more potential access points for bad actors, leading to an entirely new set of security risks on factory floors and in products themselves.

28% of manufacturers have experienced a data breach in the past 12 months.

More than 2x the number of upper mid-market manufacturers have been breached than lower mid‑market peers.

Only 15% are very confident in their organization’s ability to detect a data breach.

GREATEST SECURITY THREAT

HOW ARE MANUFACTURERS MITIGATING THEIR SECURITY RISKS?

Protecting personal data isn’t just about reputation—it’s now law. The General Data Protection Regulation (GDPR) is the most comprehensive data privacy law that U.S. manufacturers have ever faced.

Manufacturers who wish to avoid the hefty penalties of noncompliance—which could be four percent of annual revenue or €20 million (about $23M as of March 2019), whichever is greater—will go beyond checking the box by making an overall commitment to responsible information governance and data privacy.

23% of manufacturers have not taken any steps to comply with the GDPR.

Security Takeaways

-

More connectivity means more ingress points for bad actors. The way your suppliers handle your data matters as much as the way you handle it. Organizations will need to identify all existing and future third-party vendor relationships and map those relationships against data flows.

-

The integration of IT and OT systems means hackers are now launching attacks specifically designed to penetrate industrial control systems.

-

Reassess security and privacy risk at the onset of any new process or development of technology to ensure stronger controls are embedded in a system’s core functionality from the very beginning.

-

Cyber investments need to focus on proactive threat intelligence, detection and rapid response in order to build a forward-looking cybersecurity framework that considers the evolving threat environment.

-

A more mature security function will continuously monitor external threats and automate threat detection and response accordingly.

Security Checklist

7 QUESTIONS TO ASK YOURSELF BEFORE INVESTING IN A PRIVACY AND SECURTY UPGRADE

-

Do you have an up-to-date inventory of your most critical information, where it is stored and who has access to it?

-

Have you assessed the security and privacy impact of integrating new capabilities or processes?

-

Are data privacy and security concerns currently considered at the onset of product development?

-

Do you have an incident response plan in place—and has it been tested?

-

Do you have sufficient minimum cyber requirements for all third parties?

-

Have you employed a layered defense approach to secure your Industrial Control Systems?

-

Have you identified remedial measures to shore up any security and privacy gaps introduced by change?

Conclusion

To see tomorrow, middle market manufacturers must start their Industry 4.0 journey today.

For the middle market, that means establishing an Industry 4.0 strategy that balances the long-term vision with realistic short-term goals and committing to continuous progress toward a more digital future.

This begins with a simple (and yet, not so simple) step: understanding where they are currently and where they want to go. The middle market includes both process and discrete manufacturers in multiple sectors, from fabricated metals to transportation equipment to food products, each in varying states of disruption and stages of Industry 4.0 maturity. What may work for one middle market manufacturer may not necessarily work for another.

If there is any certainty amid uncertainty, it is this: Industry 4.0 is real, and it isn’t going anywhere. To compete in an Industry 4.0 world, manufacturers need to embrace digitization, with the evolving needs of the customer at the center of everything they do. Those that embrace the fourth industrial revolution will reap the rewards, while those that don’t will quickly fall behind.

How BDO Can Help

BDO’s integrated team of professionals from multiple disciplines work with middle market manufacturers to assess Industry 4.0 adoption readiness, identify opportunities for value creation, develop a strategy and facilitate end-to-end project implementation.

For more information on our Industry 4.0 services, visit our Industry 4.0 practice page, and read our Middle Market Manufacturer’s Roadmap to Industry 4.0.

Return to table of contents

SHARE