BDO & Pitchbook: Healthcare's Consolidation Funnel, Told Through Private Equity

This analysis was conducted prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Healthcare organizations and private equity are aligned on one thing: Success in a reimbursement world is key

New technologies and entrants, the shift from hospital-focused care to more outpatient and home-based services, and the move towards value-based care continue to create new financial pressures for healthcare organizations. In response, healthcare leaders must reimagine their services and transform their operations. Finding sources of capital to do that is imperative. Though other forms of capital infusion like specialty financing are on the rise, for many organizations, PE financing has become an attractive option.

As PE interest in healthcare continues its upwards trajectory, the changing reimbursement environment in healthcare—and the winners and losers created—will point the way toward future consolidation, our latest healthcare report with PitchBook shows.

The Race for Stable Reimbursement Settings

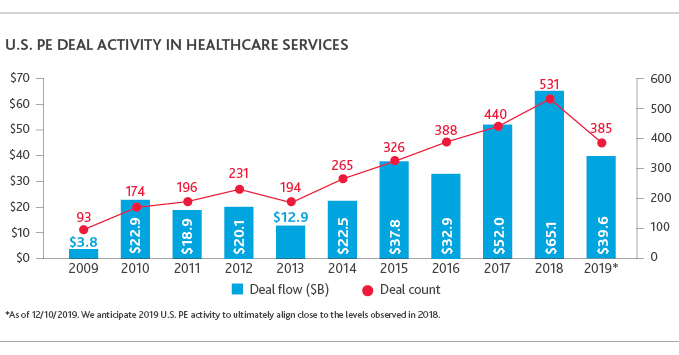

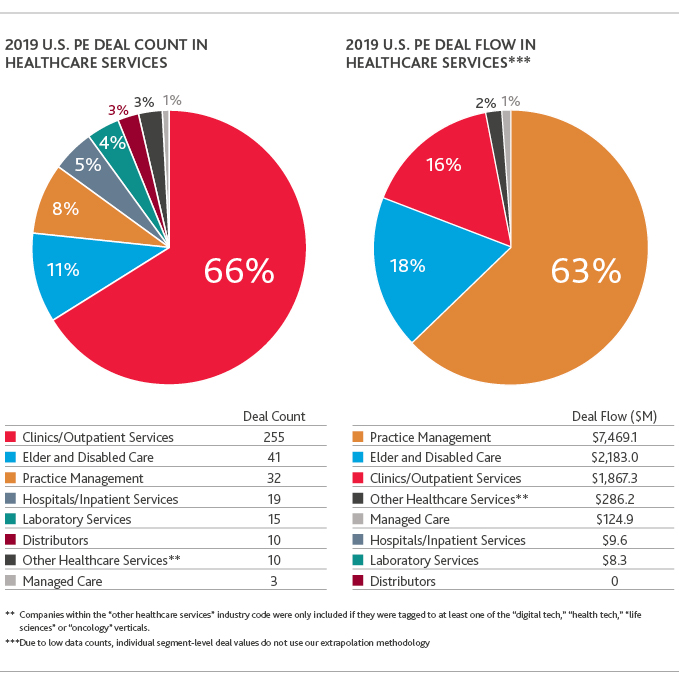

From 2009-2019, U.S. PE deal activity in healthcare has continued to trend upwards in both deal count and deal flow. In fact, 2018 was a record year with 531 deals completed and $65.1 billion invested. As 2019 wraps, here’s a closer look at this year’s winners in PE: practice management, clinics/outpatient services, and elder and disabled care:

Practice Management: We’ve seen an uptick of interest in acquiring physician practices—and while projected reimbursement in 2020 is lower than in other services, the rise in activity is no accident. To capitalize on the highly fragmented market, PE firms are looking to acquire larger physician practices with scale, and orthopedists and other specialty practices have become attractive targets. This is especially true in light of the recently finalized Centers for Medicare & Medicaid (CMS) 2020 Medicare payment rule, which represents a focused shift towards ambulatory surgery centers among lucrative joint replacement patients—presenting investors with a growing opportunity for profitability, as orthopedic services provided in the outpatient setting have shown lower readmission rates and fewer complications. As the industry’s move from inpatient to outpatient threatens highly lucrative revenue streams for hospitals, we expect PE activity in practice management to continue to swell and pressures on providers to expand ancillary services both horizontally and vertically to grow.

Clinics/Outpatient Services: Amid the healthcare landscape’s transition from fee-for-service arrangements to value-based contracts, a rise in clinics and outpatient centers has caught the attention of many PE investors. As these facilities can offer patients more cost-effective, convenient care, PE is capitalizing on opportunities to invest and explore roll-up strategies. With money to buy and build, PE firms are aiding healthcare organizations in combining to compete with larger players and providing better bargaining power against payers.

Elder and Disabled Care: Seniors are the fastest-growing age demographic in the nation and are poised to make up more than 20% of the U.S. population by 2029, according to CMS and Census Bureau estimates. As seniors have more choice in their care and move into the driver’s seat, they’re demanding care that focuses on improving their quality of life in their preferred environment. With the demand for elder care services increasing, healthcare organizations are planning to invest in home health, palliative care and geriatric caretakers, according to BDO’s Candid Conversations on Elder Care. It’s clear that PE firms are following suit.

As clinics and outpatient services lead the pack in terms of deals completed in 2019, and practice management outpaces other healthcare services in terms of total dollars invested, one question arises: Why have these three areas been especially attractive for PE in 2019?

It all comes down to reimbursement. Practice management, clinics and outpatient services, and elder and disabled care have the most stable outlook in today’s reimbursement and demographic environment—making the prospective for positive return on investment stronger for investors.

And as PE investors look for opportunities to enter healthcare, they are also looking for clear exit strategies. They’re likely to shy away from healthcare companies where reimbursement is questionable, or where business models may be outdated or collapsing.

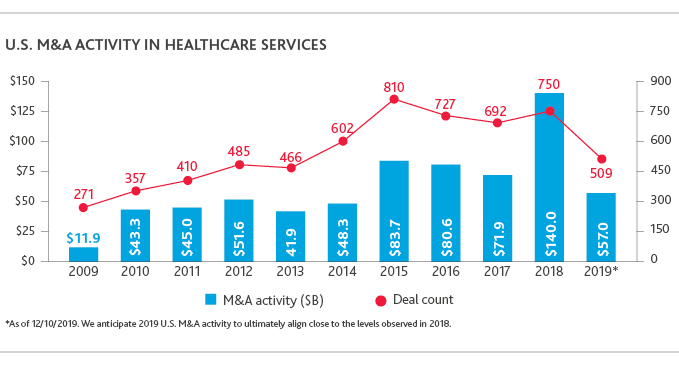

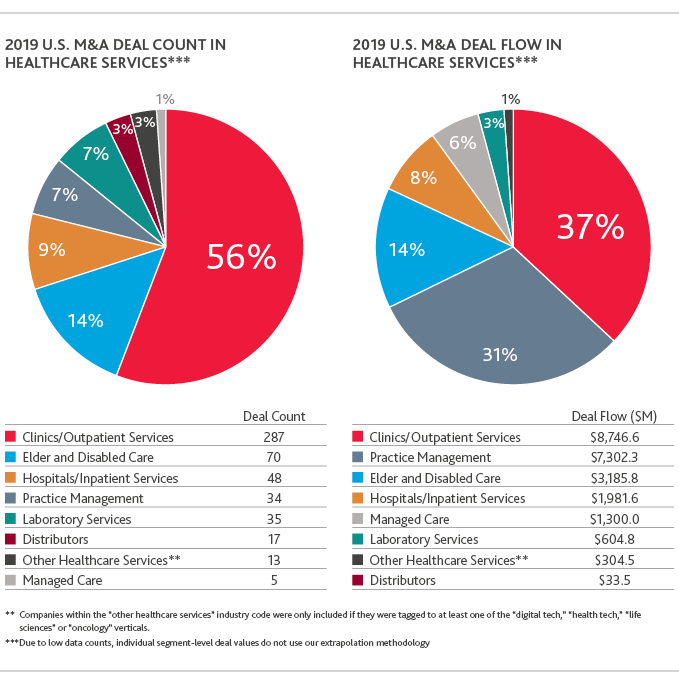

The Consolidation Funnel: An Outlook for 2020

Amid the move towards value-based care, traditional healthcare organizations are being pressured to adapt to ever-shifting consumer and competitive landscapes. With PE investments on the rise and more sources of capital to play with, many healthcare companies are looking to use this influx of cash to transform operations, grow offerings and increase market share. As M&A can lead to success in all three, a consolidation funnel has formed. And while this year’s M&A winners are reflective of the PE winners stated above, it’s important to note that hospitals and inpatient services have also had a strong showing in 2019.

How will this consolidation funnel impact the future of care?

As consolidation persists, we expect competition and innovation in the healthcare space to ramp up—putting greater pressure on healthcare entities to focus more on value versus volume, and to look for innovative ways of boosting revenue and profitability. For some, that may mean developing a new product or service offering, and for others, investing in a new research initiative.

PE firms are interested in playing in the value-based care arena and are looking for opportunities within healthcare spaces that traditionally have lower costs than hospitals. The two areas we’ve identified as top targets for PE in 2020 are hospice and health tech.

Hospice

Proposed CMS Innovation updates could create new investment opportunities in the industry. The updates, which would allow hospice to be covered as a benefit through Medicare Advantage under the agency’s MA Value-Based Insurance Design model, aim to give patients better access to more coordinated, lower cost end-of-life care. Set to be piloted in 2021, the hospice carve-in could present PE with a unique opportunity to invest in and position hospices for sale. While stable hospice reimbursement has been a main driver of PE interest in the market, we expect the carve-in to create a frenzy of activity as PE firms look to capitalize on increased reimbursement for such services.

Health Tech

An election year is on the horizon, and uncertainty remains around healthcare reform. Regardless, though, historical reimbursement models are likely to continue changing—requiring investors to look for other ways to diversify their traditional healthcare portfolios. Health tech organizations could provide a stable bet—especially if further changes to the Affordable Care Act take shape. As Big Tech players like Google, Apple and Amazon continue to extend their reach into healthcare, it’s become evident that regulation has yet to catch up. With wiggle room outside of today’s regulatory and reimbursement system—and greater immunity to potential reimbursement changes coming down the pike—we expect health tech to continue to boom and PE interest to follow.

While PE activity in healthcare is forecast to accelerate, it’s worth noting that caution around political winds may impact the ways in which PE attempts to take on, buy up or partner with healthcare organizations in 2020.

Healthcare’s rapidly evolving landscape will challenge both PE and healthcare leaders to reimagine how they provide better value to patients. As PE interest and consolidation continue, the resulting consolidation funnel will require healthcare organizations to better coordinate care across the continuum, which could provide patients with better quality care and improved outcomes. However, to deliver successful outcomes, healthcare organizations and private equity firms must keep investments grounded upon a mutual understanding of organizational values and priorities for future care delivery.

SHARE