CARES Act Update: FDS Reporting, Waivers and Period of Performance

PIH Notice 2020-24 was issued by HUD on September 14, 2020. This Notice provides information on the following topics related to:

-

Implementation of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

-

Supplemental Public Housing Operating Funds, Housing Choice Voucher (HCV) and Mainstream Administrative Fees

-

Housing Assistance Payment (HAP) funding

-

Moderate Rehabilitation Program HAP funding

Specifically, the Notice extends the deadlines of the period of performance, extends certain waivers, extends the submission of the unaudited FDS for June 30, 2020 year ends, provides guidance for reporting CARES Act funds on the Financial Data Schedule (FDS) and provides a brief overview of the upcoming reporting requirements.

The United States is continuing to experience the impacts of the COVID-19 pandemic. More recently, several states and localities have experienced increased rates and/or number of infections. This has resulted in extensions or renewals of stay-at-home orders, extensions of school and business closings, and the need for protective actions to limit the spread of COVID-19. As such, the Secretary finds that the period of impact on the public housing and HCV programs of COVID-19 will extend past December 31, 2020 and that families assisted by the program will continue to require expanded services due to COVID-19. To that end, HUD is exercising its authority under the CARES Act to extend the time-period for which the programs are impacted by COVID-19. The extended period of performance [period of availability] for the Operating Fund, HCV HAP & Admin., Mainstream HAP & Admin., and Moderate Rehabilitation has been extended to December 31, 2021. HUD will continue to monitor the impact of COVID-19 and consider future extensions.

Since the period of performance has been extended to December 31, 2021, HUD has also extending all guidance in PIH Notices 2020-07, 2020-17, 2020-18. PIH Notice 2020-18 supersedes PIH Notice 2020-8. In addition, the following waivers that were originally in PIH Notice 2020-07 have been extended as well;

-

PHAs can transfer the entire amount of the CARES Act Supplemental Funds between projects without having excess cash.

-

LIPH and HCV fees paid to the COCC in excess of the safe harbors (the additional 50%).

-

The Capital Management fee increase to 15%.

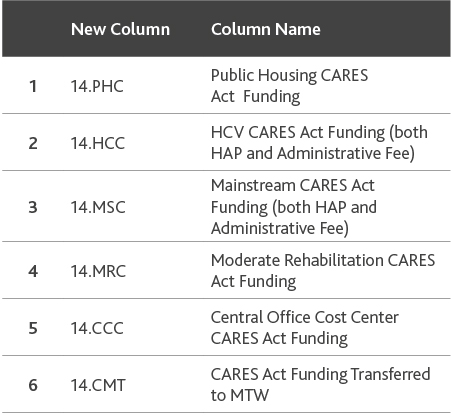

Due to the likely one-time appropriation of the supplemental funds provided under the CARES Act, CFDA numbers for these funds will not be issued. For example, the HCV HAP and Admin. funding that was received under the CARES Act supplemental funding will be reported under the HCV CFDA number. Instead, HUD will be adding columns to the FDS to report the CARES Act funding.

.jpg)

If a PHA has received CARES Act funding from any one of the following four sources noted below, the PHA is required to add the respective reporting column(s) in its FASS-PH submission.

-

Public Housing Operating Fund

-

Housing Choice Voucher

-

Mainstream Voucher and/or

-

Moderate Rehabilitation programs

If a PHA is operating a COCC and the PHA transferred fees above the safe-harbor rates from the CFP or the other programs, then the PHA must crate a COCC CARES Act column on the FDS and record the activity. If the PHA is an MTW PHA and the PHA transferred CARES Act funds to its MTW program, the PHA is also instructed to add 14.CMT, CARES Act Funding Transferred to MTW column to its FDS. Once all reporting columns have been added, the PHA will be able to enter balance sheet and income statement data to the FDS and submit to HUD.

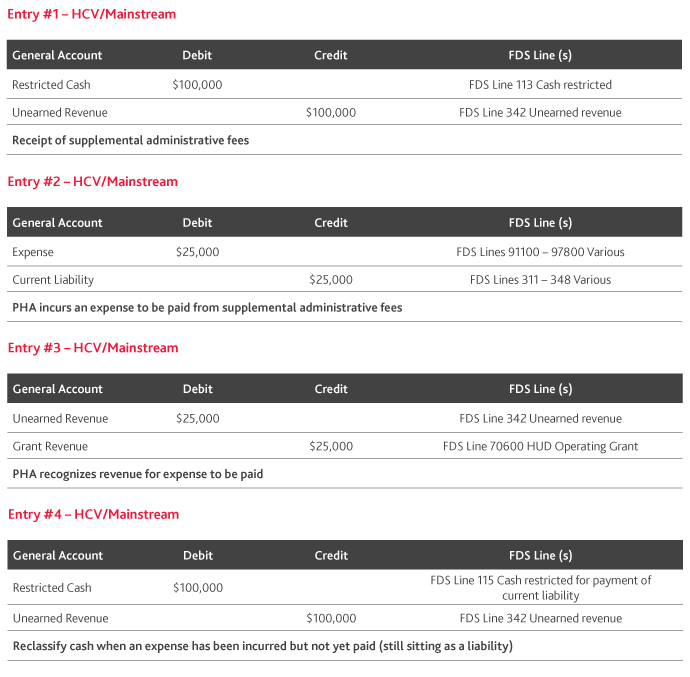

Based on the above, supplemental HCV and Mainstream Voucher funding will be reported in column 14.HCC and 14.MSC. Due to the restrictions placed on the supplemental administrative fees for HCV and Mainstream, the revenue can’t be recognized until an expense has been incurred. Even though HUD provided the entire supplemental administrative fee funds to the PHA, the PHA will report as deferred revenue until an expense has been incurred. See the entries below.

.jpg)

Typically, the PHA will report entries two and four at year-end when there is a timing issue.

Normal administrative expenses and enhanced/increased administrative expenses (i.e., non-COVID-19 eligible activity whose costs are higher than normal due to the pandemic, e.g., higher payroll costs because the PHA is providing hazard pay) will be reported in the proper FDS expense line item based on the type of expense, with no distinction between the two categories (e.g., both normal salary and hazard pay would be reported under FDS line 91100 Administrative Salaries). For FDS reporting, enhanced/increased administrative expenses should not be comingled and reported in one account such as FDS line 96200 Other General Expense or FDS line 10080 Special Items.

All COVID-19 related costs should be reflected in the 92xxx FDS line item series. The 92xxx series of accounts are associated with tenant services (i.e., 92100 Tenant Services – Salaries, 92200 Relocation Costs, 92300 Employee Benefit Contribution – Tenant Services, 92400 Tenant Services – Other and 92500 Total Tenant Services).

No “unit months leased” or “unit months available” data should be reported in 14.HCC or 14.MSC. PHAs should continue to report leasing information under the respective HCV (CFDA #14.871) or Mainstream (CFDA #14.879) program.

Supplemental administrative fees used for capital activity will be reported as an equity transfer out of 14.HCC or 14.MSC to the respective HCV (CFDA #14.871) or Mainstream (CFDA #14.879) program. The HCV and Mainstream Voucher program will show the receipt of the capital assets as an equity transfer in (FDS line items 11040- 070 through 11040-110). Once the asset is placed into service, the PHA should transfer the asset to the program and report any associated depreciation expense in the program and not in 14.HCC and/or 14.MSC.

Normal administrative expenses and enhanced/increased administrative expenses funded by non-supplemental administrative fees (just regular administrative fees) should be reported in the HCV or Mainstream Voucher program and not in 14.HCC or 14.MSC. Enhanced/increased administrative expenses should be reported in the proper FDS line and not comingled/reported in one FDS line.

All HCV and Mainstream Voucher program COVID-19-related costs should be reported in 14.HCC and/or 14.MSC, regardless of the funding source. All HCV or Mainstream Voucher COVID-19 costs should be reflected in the 92xxx series of FDS line item of 14.HCC and/or14.MSC. This reporting will allow HUD to specifically determine all expenses used for preparing for, preventing and responding to COVID-19. So if the PHA used regular Administrative Fees for COVID-19 costs, the PHA has to transfer these revenues and expenses to 14.HCC or 14.MSC.The transfer in will match the expense incurred, meaning there should be no increase in equity in 14.HCC or 14.MSC due to these transactions. The PHA will use FDS Lines 10010 Operating Transfer In and 10020 Operating Transfer out.

Any supplemental HAP funding received by a PHA will be accounted for and reported like supplemental administrative fees. That is, the HAP funding is not earned until the PHA has incurred an eligible HAP expense, which will then be funded by the supplemental HAP. Supplemental HAP funds received will be reported in the 14.HCC and/or 14.MSC column. HAP expenses associated with supplemental funds will be reported in FDS line 97300 (HAP expense).

Supplemental Operating Funds (Public Housing) are to be reported in 14.PHC (Public Housing CARES Act Funding) at the overall program level and not at the individual project level. While the supplemental Operating Funds were calculated, obligated, and disbursed by HUD at the project level, these funds should be reported as revenue directly in 14.PHC and in FDS line 70600 HUD PHA Operating Grants, even if the supplemental funds were used for capital activity. PHAs should not report these funds as revenue of the project and then transfer the supplemental Operating Funds into 14.PHC. For example, if a PHA has three projects (AMPs) the PHA had three supplemental funds for additional operating subsidy. Typically, the PHA would report subsidy only in the AMP that it benefits. But, all supplemental funds will be reported in the CARES Act column 14.PHC.

The supplemental operating funds accounting should be treated similar to accounting for capital funds. Think of the supplemental operating funds as a grant and follows grant accounting rules. The PHA will be able to draw subsidy once the PHA incurs a costs.

The PHA is required to track and account for these additional COCC funds separately. This means that a PHA’s COCC records must show the amount, when these additional funds were transferred to the COCC, the actual expenses that the additional COCC funds were used to cover, and the date paid. In addition, PHAs will need to document the fee type, the amount the fee was increased, and how the total fee amount for that month was calculated. For example, a PHA normally charges a $12.00 per unit month (PUM) for an HCV management fee and the PHA determines that a $4.00 PUM increase was a reasonable increase. The PHA would need a separate record showing the additional $4.00 fee charged.

For the fees earned above the safe harbor fees, the COCC must report that activity in the 14.CCC column of the FDS. The fee revenue in the 14.CCC column will be reported on the typical FDS line for fee revenues (70710 - Management Fee Revenue, 70720 - Asset Management Fee Revenue, 70730 – Bookkeeping Fee Revenue) and will follow the guidance above for operating and COVID related expenses. The corresponding fee expense will be paid out of COVID 19 new columns on the FDS along with the related FDS Fee Expense line (91300 – Management Fee, 91310 – Bookkeeping Fee, 92000 – Asset Management Fee).

Capital Fund Program (CFP) management fees in excess of the safe harbor fees transferred to the COCC should be reported as a capital fund management fee in the Capital Fund column of the “Other Project”.

Additional information pertaining to MTW agencies and FDS reporting can be found in section 10 of the Notice.

A few other points to highlight from the notice include:

-

The CARES Act supplemental funding will be reported with each current CFDA number. For example, Public Housing CARES Act supplemental funding will be reported with CFDA # 14.850, Low Rent Public Housing.

-

When preparing the data collection form for the FDS, the CARES Act supplemental funding will be reported in the CARES Act column.

-

When PHAS scoring resumes for PHAs with Fiscal year’s ending on 3/31/21, the CARES Act related activity will not be included.

-

For PHAs with a June 30, 2020 year-end, the FDS is now due 10/30/2020.

-

HUD is estimating quarterly reporting of CARES Act funds beginning in October 2020. HUD is going to want to reconcile the quarterly reporting to the PHA’s FDS.

As more information develops regarding CARES Act funds, BDO will be publishing this information to keep our readers updated.

SHARE