International M&A Deals: Financial Due Diligence Considerations for U.S. Acquirers When Assessing Targets Outside the U.S.

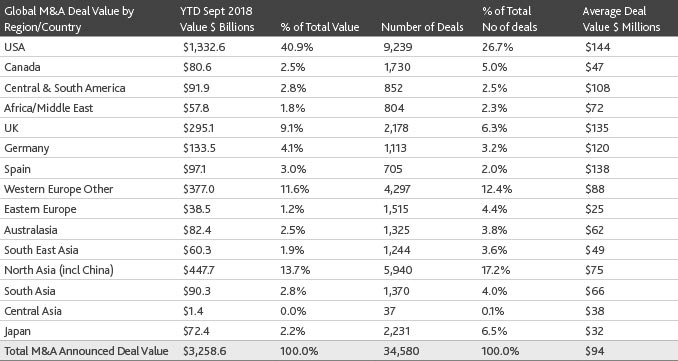

Global M&A value reached $3.3 trillion for the first nine months of 2018. The following highlights the value, volume and average size of deals, listed by location of the target.

Who’s Doing International Deals?

M&A transactions in the U.S. accounted for approximately $1.3 trillion or 40.9% of all M&A transactions worldwide (based on value) in the first nine months of 2018. Of these transactions in the USA, approximately 8.6%[1] were by non-American acquirers.

M&A transactions in Europe (per table above, UK, Germany, Spain, Western Europe Other, and Eastern Europe) accounted for approximately $941.2 billion or 28.9% of all M&A transactions worldwide (based on value) in the same time frame. Of these transactions in Europe, approximately 16.6%[2] were by non-European acquirers.

This provides a general perspective on the extent of cross border transactions in the U.S. and Europe during the first three quarters of 2018.

Historically, international and cross border M&A transactions have been dominated by large, multinational corporate acquirers. During 2017, more than 38,000 companies were bought and sold globally, with private equity firms accounting for less than 10% of those deals.

Private equity firms have increased the amount of capital raised in recent years. Total dry powder on hand in September 2018 was estimated at $1.8 trillion[3]. In an effort to deploy that large pool of capital, many private equity funds have focused on winning more large-scale deals and becoming more like a corporate investor “…albeit one that is more efficient and aggressive in all respects. That means using scope and scale deals to add large assets to equally large platforms, capturing synergies and playing the same game as many corporations, only with a higher bar.”[4] Increasingly, that also means pursuing targets located (in whole or in part) outside the United States.

Considerations When Conducting Financial Due Diligence Outside the U.S.

International M&A deals give rise to unique due diligence challenges depending on the country where the target is located. The following are some, but not necessarily all the key considerations:

Cultural Issues:

-

Language differences where the target’s management team and staff do not speak English and financial records are not maintained in English. Consider engaging bilingual advisors if adequate language resources are not available in-house on the investor’s team.

-

Communication style differences where the target’s management team may not provide accurate, direct responses to questions due to cultural norms requiring that ‘guests’ be told what they’d like to hear and ‘hosts’ not disappoint their guests.

-

Cultural differences in relation to organizational hierarchy and formality of interaction between investor and seller – this is especially the case in relation to China. It’s important that a trusting relationship (“Guanxi”) be established between the senior U.S. decision maker and the principal at the seller at the start of exploratory talks and not delayed until the process is further advanced. Substantive progress with the seller’s team is unlikely until a trusting relationship (“Guanxi”) is established between the principals.

-

M&A transactions not common in the target’s country. In many countries outside the U.S., middle market family businesses are passed from one generation to the next rather than being sold to a private equity investor or corporate acquirer. This can be seen in Germany (re. the Mittelstand firms) and in Central and South America. Investors should note the risk that employees may retain multi-generational loyalty to the former principal of the target even after the business has been acquired by a private equity investor or corporate acquirer.

Compliance Issues:

-

Inconsistent levels of tax compliance by targets based on local country norms (significant non-compliance and tax avoidance have been reported in many transactions in China and Mexico for example). Local country tax and legal due diligence is recommended to assess the risk in this area and advise in relation to resolution and treatment in the purchase and sale agreement.

-

FCPA Matters – varying attitudes towards making payments to government officials that may not be consistent with the U.S. Foreign Corrupt Practices Act ‘(FCPA’). In many cases, the payments are accounted for on the target’s books but incorrectly described. Local country and U.S. legal due diligence is recommended to assess the risk in this area.

Employee Rights:

-

Employees in many countries outside the U.S. have significant rights and protection under employment law. This is especially true in the European Union. In France and Germany it’s nearly impossible to lay off long-time employees. In many such countries, employees have rights to statutory redundancy payments (calculated based on years of service) payable upon voluntary or involuntary termination. In countries such as Germany, some employees have power at the board of director’s level with up to 50% of a company's supervisory board consisting of employee representatives. Local country human capital and legal due diligence is recommended to assess the risk in this area and advise in relation to resolution and treatment in the purchase and sale agreement.

Commercial Matters

-

Permits and Licenses – investors should note that the volume, complexity, and importance of government permits and licenses required to operate a business varies significantly from country to country. The consequences of non-compliance can be minor in one jurisdiction and extremely serious in another. For instance, when China joined the World Trade Organization in December 2001, the country regulated foreign investment and cataloged all industries in the economy into one of four categories of eligibility in relation to foreign investment: (a) foreign investment permitted; (b) foreign investment encouraged; (c) foreign investment restricted; and (d) foreign investment prohibited. While these categories have been modified and relaxed over the years, significant restrictions on operating a business in China remain by way of permits and approvals required from agencies at multiple levels of government. The most important of such permits is issued by the Administration for Industry and Commerce (‘AIC’). Local country legal due diligence is recommended to assess the risk in this area and advise in relation to resolution and treatment in the purchase and sale agreement.

-

Grants and Clawbacks – in many countries outside the U.S., government agencies provide grants to businesses to incentivize employment in particular regions. A clawback liability can arise in relation to the grant in the event of reducing the employee head count below the number specified in the grant agreement. Investors should consider this in the context of any planned reduction in force post transaction. Local country legal due diligence is recommended to assess the risk in this area and advise in relation to resolution and treatment in the purchase and sale agreement.

Data and Logistics

-

Audit Data – private companies in the European Union are required to prepare and submit audited financial statements to the Companies Registration office (or comparable bureau) each year. The extent of information provided in the financial statements is dependent on assets and revenue of the subject company (as specified in the legislation). These statutory audited financial statements are available to the public and should be obtained as part of the initial data gathering for targets in Europe. Investors should also note that: (a) the extent of procedures and testing performed in relation to statutory audits is significantly less than a full scope audit under U.S. Generally Accepted Accounting Principles (‘GAAP’); and (b) the ability for investors and their advisors to review audit workpapers supporting statutory and GAAP audits of Targets overseas varies by country and is restricted in many jurisdictions outside the U.S.

-

GAAP – financial statements of targets based outside the U.S are likely prepared in accordance with International Financial Reporting Standards (‘IFRS’) and or local country GAAP. Investors should consider performing a reconciliation from IFRS/local country GAAP to U.S. GAAP early in the due diligence process to confirm operating results of the Target business, as reported under IFRS/local country GAAP do not differ significantly when recast in accordance with U.S. GAAP.

-

Internal financial and commercial data – in many countries outside the U.S., private companies maintain books and records primarily for tax purposes. Investors should not be surprised to learn that monthly management accounts are not prepared by the target. Commercial practices, marketing, and lead generation varies significantly by country. For example, many middle-market businesses in China don’t have their own website and generate the majority of their leads from platforms such as Alibaba.

-

Timeline and Costs – based on the factors outlined above, Investors should anticipate that financial due diligence of a target based outside the U.S. may take longer and as a result cost more than diligence on a comparable domestic U.S. target. Day-to-day coordination of overseas due diligence with multiple teams, crossing multiple time zones adds to the complexity of the process.

In summary, the core aspects of financial due diligence in relation to domestic and international transactions are similar. The key focus is on understanding the investment thesis, commercial risks inherent in the business and the transaction, understanding the quality of earnings, free cash flow, working capital, and debt and debt like items of the business. The jurisdiction where the target operates creates additional challenges as outlined above in relation to culture, compliance, employee rights, commercial matters, availability of data, and logistics.

U.S. investors planning a cross border deal should consider designating a U.S.-based team to lead the financial due diligence process and manage against required timelines. Key roles to include: (a) scoping the diligence, managing and supervising the work of the local country financial due diligence team; (b) serving as a bridge between the U.S. investor deal team and the local country diligence team; and (c) reviewing and issuing a U.S. format financial due diligence reports to the investor.

BDO's Transaction Advisory Services practice is well placed to assist U.S. investors completing financial due diligence on cross border transactions with over 1,500 offices in 162 countries around the world. This article is focused primarily on financial due diligence considerations. Investors should also consider the need to perform international and local tax due diligence, tax structuring analysis, legal due diligence, information technology due diligence, human capital and benefits due diligence, and commercial due diligence.

SHARE