Goodwill and Impairment

Overview

Recent Events

In early 2020, the coronavirus pandemic spread globally, resulting in vast economic impacts, including supply chain disruptions, changes to working environments, increased market volatility and changing consumer spending habits. As a result of these challenges, companies may be facing a negative impact on their financial condition and results. Even with restrictions beginning to lift in 2021, some companies may continue to face these disruptions throughout the next few years. As such, companies should consider the ongoing impacts of the pandemic when assessing asset impairments.

In this newsletter, we focus on the application of the impairment guidance for goodwill, with a focus on private companies.

Application Order – where do I begin?

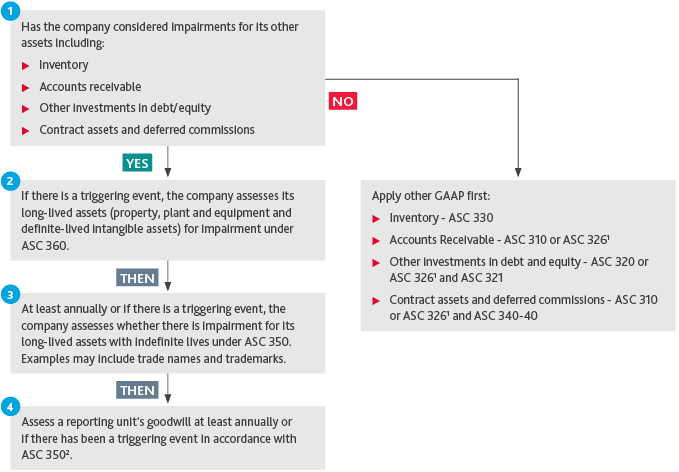

The accounting literature provides for a specific order in which assets which are held for use are assessed for impairment, as illustrated in the following flowchart:

Goodwill

The goodwill impairment assessment is always the last impairment assessment performed after considering impairment of all other assets. This is especially important if there are asset groups that include goodwill (for example, the asset group for a corporate headquarters building will often include all of the assets and liabilities of the company, as there is no lower level at which standalone cash flows exist).

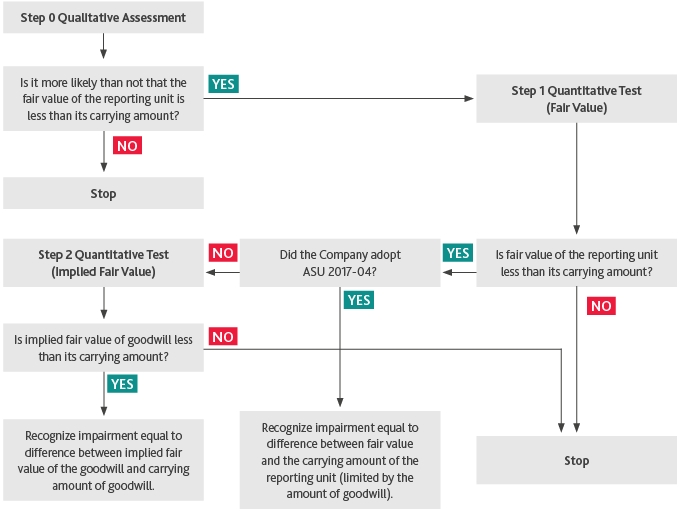

Unless a company has elected to amortize its goodwill under the private company alternative, goodwill must be assessed for impairment at least annually and more frequently if there are triggering events that create a situation where goodwill is more likely than not impaired[1]. A company has an option to perform the same qualitative assessment as that for intangible assets with indefinite lives. If the company elects to bypass the qualitative assessment or if the results of the qualitative assessment indicate that it is more likely than not that the reporting unit is impaired, the company compares the carrying value of the reporting unit inclusive of goodwill to its fair value. This assessment is typically referred to as the “step 1 test”. If the carrying value exceeds the fair value, then the entity must perform the second step, which is to compare the implied fair value of goodwill to its carrying value and record an impairment charge for any excess of carrying value over implied fair value.

In 2017, the FASB simplified the goodwill impairment assessment[2]. Under this revised guidance, instead of performing the second step, a company will recognize a goodwill impairment charge for the amount by which the reporting unit’s carrying amount exceeds its fair value. However, any loss recognized is limited to the total amount of goodwill allocated to that reporting unit. This update to the goodwill impairment assessment is applicable in 2022 for all private companies when performing an impairment assessment. This guidance may also be early adopted.

Recently, stakeholders raised concerns with the Financial Accounting Standards Board (“FASB”) about the cost and complexity associated with evaluating triggering events and potentially measuring a goodwill impairment during the reporting period, rather than aligning the evaluation date with the end of the reporting period. In particular, the issue had become exacerbated during the COVID-19 pandemic, which resulted in economic uncertainty and significant changes in facts and circumstances throughout 2020 and 2021. As such, the FASB provided an accounting alternative for private companies to evaluate triggering events for goodwill impairment only as of the end of each reporting period[3].

In this newsletter, we focus on the testing for impairment of goodwill by private companies.

Accounting for Goodwill

-

What is Goodwill?

-

Unit of Account

-

Private Company Accounting Electives – Subsequent Measurement of Goodwill

-

Evaluating Triggering Events – Private Company Alternative

-

Goodwill Impairment Assessment

-

Step 1 Quantitative Test (Fair Value)

-

Determination of Fair Value of the Reporting unit

-

Determination of Potential Impairment

-

-

Step 2 Quantitative Test (Implied Fair Value)

-

Before adoption of ASU 2017-04

-

After adoption of ASU 2017-04

-

[1] Private companies have the option to amortize goodwill. If a company elects to amortize goodwill, then the annual impairment assessment is not required, and goodwill is only assessed for impairment if a triggering event occurs.

[2] ASU 2017-04 Intangibles—Goodwill and Other (Topic 350) No. 2017-04: Simplifying the Test for Goodwill Impairment

[3] ASU 2021-03, Intangibles – Goodwill and Other (Topic 350): Accounting Alternative for Evaluating Triggering Events, provides a practical expedient for private companies. Under that option, private companies can elect to only assess whether a triggering event has occurred as of the end of the reporting period.

SHARE