It’s Time for a Candid Conversation on Elder Care

Investing in Home Health, Palliative Care and Tech to Meet New Senior Care Demands

Executive Summary

Seniors and their families are getting more comfortable with having productively uncomfortable conversations about their care options.

Historically, healthcare providers have fallen into a trap of medicalizing old age so much that they recommend continued treatments even if the ultimate outcome remains the same. Physicians have been hesitant to have difficult conversations with their patients about realistic end-of-life care options. Important questions—like what metrics the patient uses to measure quality of life—have gone unasked.

The tide is changing slowly, helped in part by Medicare’s recent move to reimburse providers for having these conversations.

A bigger driver is seniors themselves. Their expectations are different. They’re tired of receiving care that focuses just on increasing the number of days left without maximizing the quality of that time. And their advocates have more information and access.

If their near-term investment plans are any indication, healthcare organizations are listening. Their future, and our seniors, depend on it.

We worked with NEJM Catalyst to survey healthcare executives, clinical leaders and clinicians about the outlook for elder care investment and innovation as providers work to meet the changing needs of the fastest-growing U.S. age demographic.

We found that the future of elder care is one rooted in empathy and focused on improving quality of life. We’ll see greater investment in home health, palliative care and geriatrics and a move away from facility-focused models. Part of that includes improved training for physicians to have those important conversations about end-of life care. Another piece of that means hiring or training more on-staff geriatric caretakers to identify health risk factors for seniors before they evolve into greater health problems.

Changes in health models have a ripple effect. Implications abound for investors and the real estate industry. Read on for Candid Conversations on Elder Care.

Elder care is in a race against time.

To win, providers are placing their bets on home health and palliative care—and technologies that will improve both.

In 2010, seniors made up 13 percent of the U.S. population but accounted for 34 percent of healthcare spending through Medicare and Medicaid. By 2029, as the fastest-growing age demographic in the U.S., they’re projected to make up more than 20 percent of the total population, according to CMS and Census Bureau estimates. By 2050, those aged 85 and above are predicted to start growing at a faster rate than the entire working age population.

In turn, providers are facing new pressure from the government to curb overall healthcare costs, but especially in senior care—with cuts to Medicare and Medicaid and greater pushes toward Medicare Advantage plans taking shape. They’re also being incentivized to leverage new tools to do so, including electronic or telemedicine capabilities, mobile devices, artificial intelligence and even virtual reality.

At the same time, ideas about what senior care should look and feel like are changing, with consumers in the driver’s seat. Mirroring healthcare’s broader push towards value-based care over traditional fee-for-service models, seniors are demanding that their last years be measured by quality of life and autonomy rather than number of days. They want to spend their last days outside of the hospital and in the comfort of their own homes.

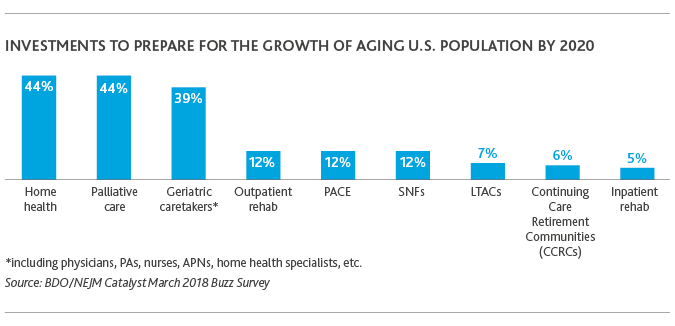

In response, healthcare organizations say that by 2020, they’ll invest most in home health (44 percent), palliative care (44 percent) and geriatric caretakers (39 percent), Candid Conversations on Elder Care reveals. And they see the greatest opportunities for tech disruptors to improve elder care centered around those areas, too. Healthcare executives also remain focused on more traditional elder care models like Skilled Nursing Facilities (SNFs) and Long-Term Acute Care Facilities (LTACs)—as well as more innovative yet lesser-known models like Programs of AllInclusive Care for the Elderly (PACE).

The ‘traditional’ nursing home is undergoing rapid change while the overall healthcare industry consolidates at a record pace. Under consumer-centric value-based care, elder care providers that evolve business models to improve care quality and satisfaction, boost population health and reduce healthcare costs—whether inside bricksand-mortar facilities or not—will thrive. As reimbursement expands for home health and telehealth services, those who don’t evolve will be replaced.

As demand for elder care services increases in line with population growth, the biggest investments needed—particularly within home health—center around people. Healthcare is projected to be the largest U.S. employer by 2024, according to Bureau of Labor Statistics projections, with home health leading the charge. From 2014-24, the compound annual growth rate for home health services is forecast to be about 5 percent—or more than 760,000 new jobs.

But elder care, which is less attractive to medical students both because of the negative connotations associated with aging and often lower-paying specialties, faces stiff competition in an industry already struggling with a mass talent shortage. To build and maintain elder care services that produce better outcomes, healthcare entities will need to invest in new ways of staffing. These include advanced and technology-enabled processes to forecast patient levels, and to recruit, manage and train clinical staff, according to Modern Healthcare.

Another way healthcare organizations can invest more in specific service offerings is through the acquisition of a smaller organization already successfully providing them.

MACRA, and programs like it, intensify pressure on acute-care providers by encouraging even less use of acute-care facilities. Providers who depend on those services to stay afloat will need to diversify their offerings to incorporate care models outside the hospital walls.

Can Big Tech Solve Some of Elder Care’s Biggest Challenges?

Healthcare organizations are looking to technology disruptors to help them thrive in a consumer-driven era of elder care.

.png)

Healthcare has been slow to adopt technology relative to other industries, and challenges around the acceptance of digital health initiatives by seniors remain. But as of 2016, more than three-fourths (76 percent) of seniors were using mobile phones and 64 percent computers, according to a study in the Journal of the American Medical Association. Over time, with the increased integration of technology into everyday life, seniors wanting to stay out of the hospital may be more open to digital health initiatives.

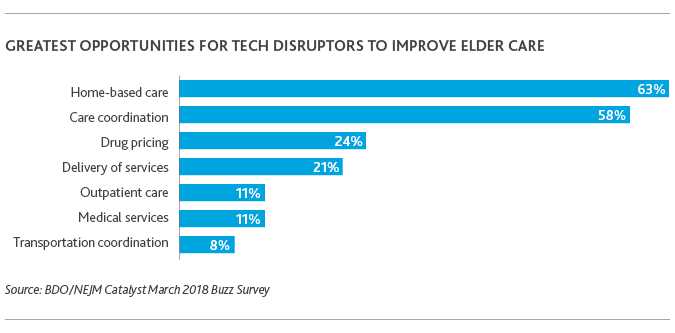

Sixty-three percent of healthcare organizations said home-based care was most ripe for tech disruption by 2020, followed by care coordination (58 percent), drug pricing (24 percent) and delivery of services (24 percent). Ride-sharing apps like Lyft and Uber have already moved to make healthcare transportation more convenient.

Technologies like internet-connected door locks, smoke alarms, thermostats and even at-home cameras enable family members of seniors to remotely monitor and care for their loved ones while empowering elders to remain in their homes for longer. Telemedicine and remote patient monitoring allow hospitals to provide follow-up care to seniors at more regular intervals without them having to worry about getting to an appointment. In fact, wearable monitoring devices that alert nurses to a fall allowed a non-profit running senior living communities in Pennsylvania to reduce the percentage of patients moving to nursing homes from 20 to 12 percent, according to AgingCare.com.

Virtual assistants like Amazon’s Alexa make it possible for seniors to order groceries, home products and over-the-counter medications without leaving their living room. And soon, self-driving cars and the impending entrance of Amazon and other tech giants into the pharmaceutical industry, will revolutionize senior living.

Technology—and its consumer data stockpiles—could also solve one of the biggest obstacles to bringing down elder care costs: rising drug prices.

Prescription drugs account for $1 out of every $6 in Medicare spending, Kaiser Family Foundation estimates, making any price increases to drugs used to treat seniors have a significant impact on overall healthcare spending.

The way the pharmaceutical industry has been historically structured makes it difficult for new entrants to pharmaceuticals to compete. But the tide looks to be changing under an administration focused on moving a healthcare marketplace characterized by regulation to one more guided in competition.

More importantly, FDA Commissioner Scott Gottlieb (a former BDO senior fellow) and HHS Secretary Alex Azar have labeled combating rising drug prices a priority. And Gottlieb has signaled that the current model by which hospitals purchase drugs in bulk through group purchasing organizations—oftentimes being rewarded with rebates—could be re-evaluated to increase competition.

It’s only a matter of time before Amazon and other tech giants overpower the outdated institutional pharmaceutical model.

When used effectively and in coordination with physicians, technology could be the key to executing effective population health management—especially for the elderly. Telehealth aligned with data analytics and IT infrastructure will be critical to chronic disease management, including care coordination, home monitoring and the integration of patient-centered health data into comprehensive electronic health records.

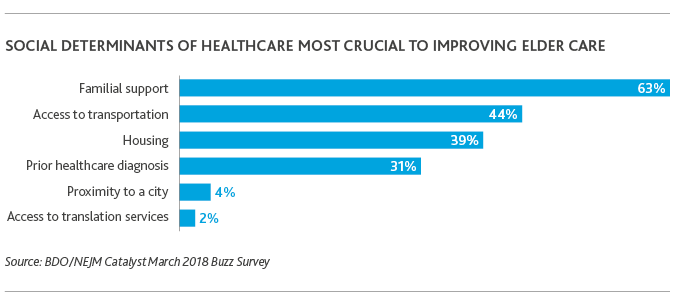

Tech could also mitigate the social determinants of health providers say are most crucial to improving elder care: familial support (63 percent) and access to transportation (44 percent).

Through digital health tools like e-visits or e-consults, mobile applications, wearables and sensors, and virtual reality, seniors can better manage chronic care conditions, gain access to transportation needed to attend appointments or pick up medications, and virtually visit with family members living across the country. They can even gain access to free translation services needed to best understand the care they need.

These tools become even more crucial to community hospitals serving rural populations.

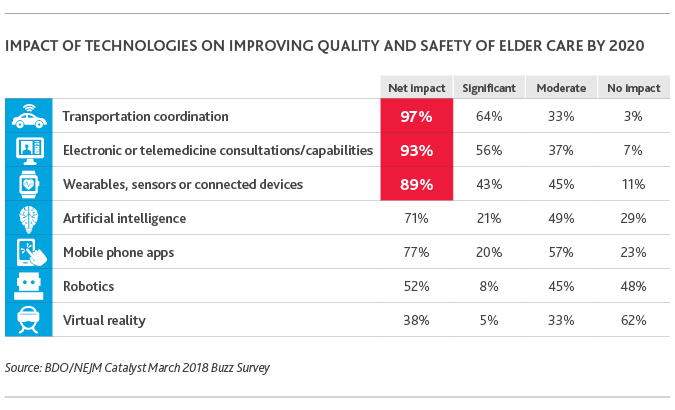

When it comes to using technologies to improve care quality and safety, healthcare organizations place transportation coordination (97 percent), electronic or telemedicine capabilities (93 percent), and wearables or connected devices (89 percent) at the top of their list.

Medicare reimbursement of telemedicine initiatives—which has already expanded under the most recent federal budget—will only grow as the FDA continues to deregulate certain medical devices that help consumers better manage their health.

Clinician shortages and budget woes continue to plague rural communities forcing community hospitals to close their doors at faster rates than ever before. Improved access to patients through electronic telemedicine capabilities is one innovative way community providers can focus their services, reduce their financial burden and continue to provide crucial care to difficult-to-reach patients.

.png)

Traditionally, quality of life and independence start to go downhill when seniors lose their driver’s license. They become confined to their homes and isolated from social circles. Running errands for vital goods like groceries and medications—or making it to doctors’ appointments—becomes difficult, and health deteriorates. Innovations like mobile and connected devices, transportation coordination apps, virtual reality and soon, self-driving cars, will fundamentally change that pattern. The tech entity that provides the first full-circle health product for the independent senior will lead elder care.

What Lies Ahead?

Healthcare as a whole is moving from a system of mandates to choice, regulation to competition and subsidies to actuarial soundness. At the same time, revolutionary forces that have taken the industry by storm—including the growth of mobile technologies and the convergence of the supply chain—are picking up speed.

Elder care is at the eye of the storm.

It’s the most important piece of the larger U.S. healthcare puzzle. Five percent of Americans are responsible for almost 50 percent of the country’s healthcare costs—many of them chronically ill seniors.

By focusing more on at-home care, palliative care and geriatrics, and using technology to do it, healthcare organizations can identify health risk factors before they get to the point of chronic illness. Or, when patients are already facing chronic illness, they can use at-home and palliative care, and more geriatric resources, to provide seniors a better quality of life—measured on their terms.

But innovative, outcomes-based elder care models are only as good as the quality of the patient insight that goes into them.

Gaining that insight requires a thoughtful dialogue between provider and patient upfront.

Are you ready to start the conversation?

SHARE