BDO & PitchBook: Shattering of Industry, Global Silos Drives Healthcare Deal Activity

Table of Contents

- Frothy Political Waters Could Dampen Cross-Border Opportunity with China

- China as the New Frontier

- U.S.-China Biotech Investment Trends

- What’s Next? Rocky Relations to Continue Undercutting Cross-Border Investment Potential

- Risk Management Checklist for U.S. Businesses in China

Frothy Political Waters Could Dampen Cross-Border Opportunity with China

Despite speculation of economic turbulence, the U.S. economy continued to grow in 2018, and the life sciences and health sectors saw high levels of deal making and investment.

Deal activity was catalyzed by the continued infiltration of technology as the health and life sciences ecosystem blurs and economies of care continue to change, centering more on value.

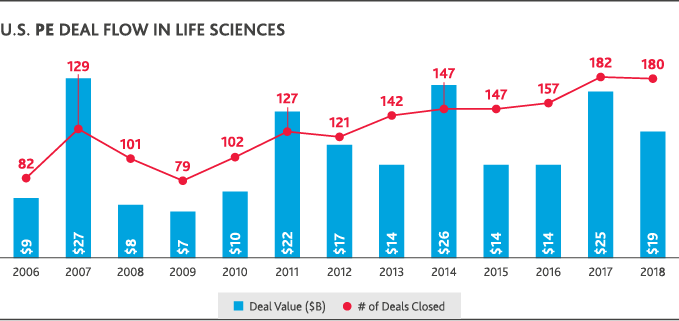

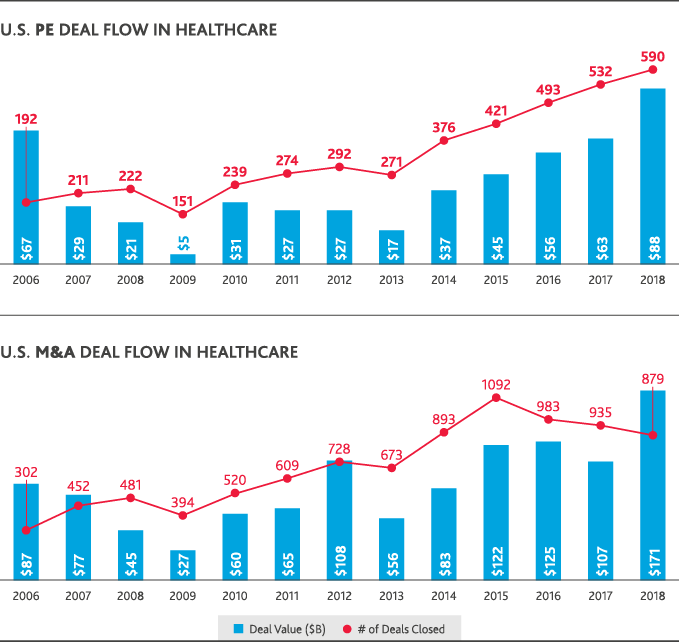

Most healthcare leaders (81 percent) expect innovative mergers—like Amazon’s acquisition of online pharmacy PillPack—to continue disrupting the industry in the next two years, according to BDO data. According to PitchBook data, those types of deals—and the push to share information across traditional boundaries to deliver greater value—are at the heart of U.S. health and life sciences activity. They’ve largely driven both increased deal volume and value over the last 10 years. U.S. private equity deal flow in life sciences has nearly doubled since 2008, though it began to plateau between 2017-2018. In healthcare, private equity deal flow increased since 2009 and reached a 10-year high in 2018 with 590 deals completed at a total value of $88 billion. U.S. healthcare M&A has also boomed, reaching a 10-year value peak of $171 billion in 2018—though the total number of deals fell compared to 2017.

To thrive in this environment of constant change, health and life sciences organizations will need to share information across traditional boundaries to deliver better patient outcomes, better treatments and better value for consumers—all while driving their own sustained growth and strong operational performance.

This move toward a strategy of Shared Care and Shared Value has been a driver of global deal flow throughout 2018 and will continue to drive opportunities.

Return to Table of Contents

China as the New Frontier

A few years ago, the Chinese government spelled it out: The country needs to develop a world-class healthcare sector to meet the changing needs of its population.

China’s five-year economic plan, approved in 2015 and adopted in 2016, designates a “Healthy China” as a priority, and encourages both inbound and outbound private investment in healthcare, with emphasis on the senior-care subsector.

Chinese investors are increasingly coming into the U.S. and European healthcare sectors seeking strategic alliances with companies that offer cutting-edge products, services, business models and distribution channels, with the goal of bringing them to China.

China is considered an El Dorado because it’s a 1.4 billion-person market—jampacked with the opportunity to bring about quality of life improvements to the larger Chinese population.

For example, China’s diabetes population—which is nearly one-third of the world’s diabetes sufferers—has undergone rapid growth that’s expected to continue. This represents a growing market for Western companies innovating around diabetes treatments to come in and provide important quality of life improvements.

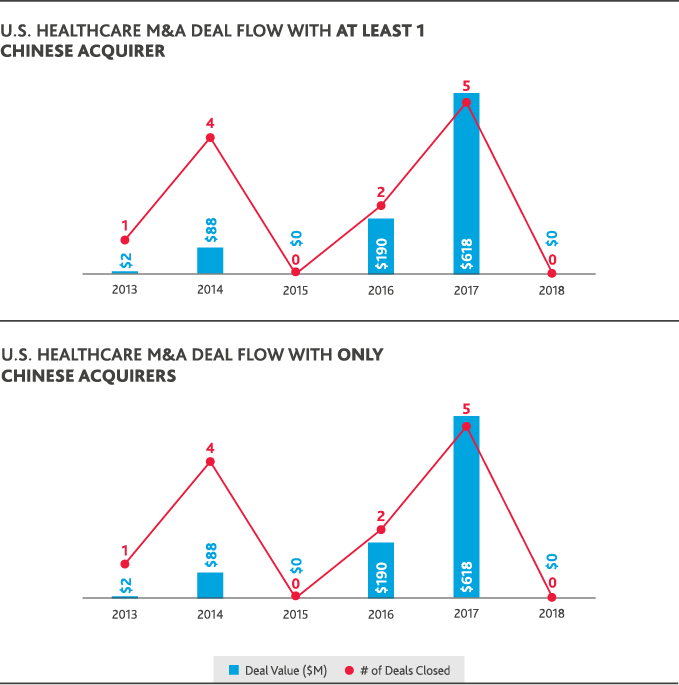

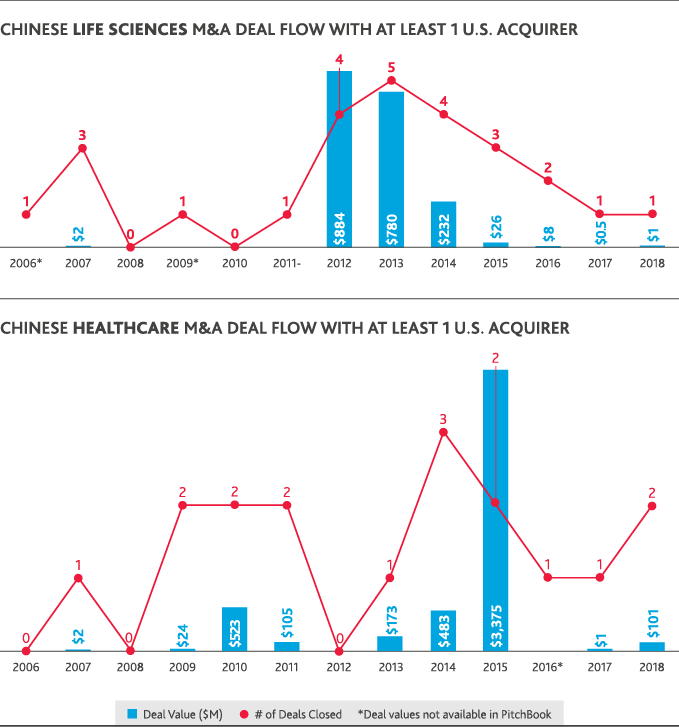

Despite ripe conditions in the healthcare and life sciences industries for cross-border investment between the U.S. and China, international dealmaking activity was hamstrung by political conditions. U.S. healthcare M&A involving a Chinese acquirer fell to zero in 2018, compared to five U.S. healthcare deals totaling $618 million in value that involved a Chinese acquirer in 2017. Chinese healthcare M&A deals involving a U.S. acquirer reached a 10-year peak of just over $3 billion in 2015 but fell to a total $101 million for 2018 involving the same total number of deals.

Rocky trade relations, a newly emboldened Committee on Foreign Investment in the United States (CFIUS) and shifting economic conditions in China have complicated what was expected to be a booming opportunity—particularly in the biotech space—just a few years ago.

Return to Table of Contents

U.S.-China Biotech Investment Trends

Last year was marked by a sharp increase in biotech deal activity as more than $100 billion poured into biotech and pharma M&A in the first 6 months.

The industry’s boom is even bringing demand for Wall Street analysts back to life.

Inbound and outbound private equity investment from China slowed, however, as the Chinese government restricted deal-making between foreign entities. Some would-be foreign buyers also reconsidered their transactions because of heightened government scrutiny.

The upward trend towards a higher volume of value-based pharmaceutical contracts in the U.S. continued, fostered by pressure to curb health costs and changes in the regulatory arena.

Ample opportunity for research investment to meet growing patient needs led to continued increased investor appetite that set the stage for a booming equity market in 2019.

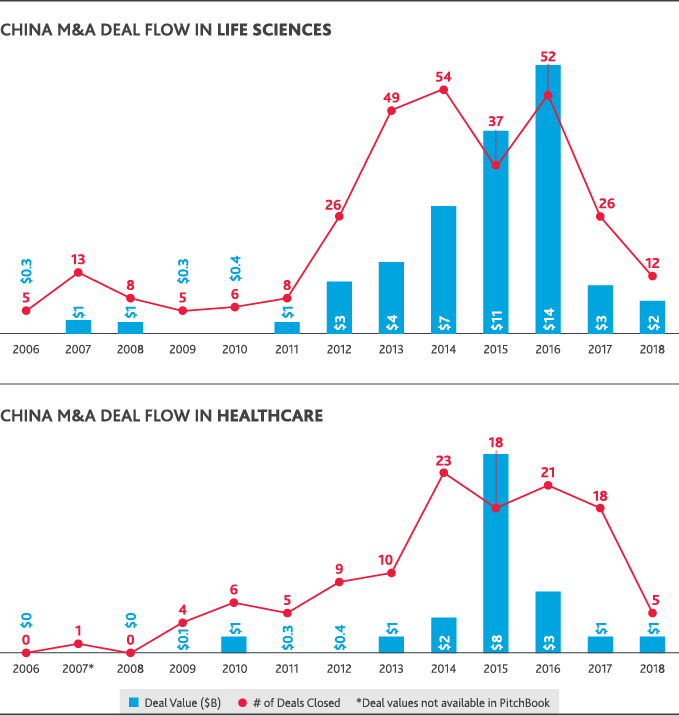

The only Chinese involvement in U.S. healthcare or life sciences M&A in 2018 was through Chinese-only acquisitions of U.S. life sciences companies—seven deals totaling just over $2 billion in value. China’s domestic healthcare M&A peaked in 2016 with 18 deals that totaled $8 billion in value and fell in 2018 to just five deals totaling $1 billion. Chinese life sciences M&A similarly fell from a peak of 52 deals totaling $14 billion in 2015 to 12 deals totaling $2 billion in 2018. U.S.-backed dealmaking in China has largely followed China’s domestic M&A trends. In 2018, just one Chinese life sciences deal involved a U.S. acquirer at a value of $1 million.

Return to Table of Contents

What’s Next? Rocky Relations to Continue Undercutting Cross-Border Investment Potential

In addition to the ongoing tariff saga between the U.S. and China, the U.S. has targeted Chinese technology companies it alleges are involved with industrial espionage or are violating global business practices.

In February, the U.S. officially levied charges against Chinese tech giant, Huawei, after years of scrutiny and more recently ramped up those investigations.

Under the Trump administration, CFIUS has been granted increased authority, including through a mandate to take a stricter stance against China specifically. Under new regulations implemented in October 2018, foreign investments that result in a non-controlling equity stake in U.S. biotechs will be subject to CFIUS review.

Since CFIUS’ expanded powers only took effect towards the end of 2018, we likely won’t see their impact until the end of 2019. We anticipate that unless relations and the Trump administration’s stance towards China shift, we’re likely to see a significant decrease in Chinese investment in U.S. life sciences. As long as relations remain chilly, tit-for-tat tariffs and regulation of foreign investment will continue, likely slowing cross-border dealmaking. Additionally, as stakeholders prepare for potential economic turbulence, there will be an increased focus over the next year on investments in sectors that fulfill constant, irreplaceable consumer needs. This may come at the expense of biotech, which may be perceived as riskier or less profitable in the short‑term.

Return to Table of Contents

Risk Management Checklist for U.S. Businesses in China

For U.S. healthcare and life sciences organizations that do operate in China, the compliance challenges and issues around quality control and fraud are real.

Foreign-owned organizations with China-based subsidiaries also face heightened risk under the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act. This is largely because operating through a third-party intermediary is common practice for many foreign companies in China and relying on third-party agents poses significant bribery risk.

Foreign entities operating in China can manage risk by keeping the following best practices in mind:

- Periodic, in-person site visits are key to early risk detection and mitigation. When it comes to identifying and staying ahead of potential risks, there’s often no substitute for in-person conversations and observation.

- Understanding local culture and business customs is key. Often, companies think of “business in Asia” as an umbrella term, but individual markets—countries and regional jurisdictions alike—are distinct.

- Incorporate U.S.-China relations into business planning. While companies might not be able to predict what will happen next, they should keep informed about the latest developments in trade or national security and factor them into long-term business planning. This could mean preparing for increased scrutiny by U.S. federal agencies or new requirements for cybersecurity infrastructure. In some cases, companies may find it necessary to rethink their entire involvement in China and shift focus to other countries with which the U.S. has friendlier relations.

Cultural change doesn’t happen overnight, but it does need to start from the top down. A fully aligned organizational culture change can take years to cement. If an organization is going to continue operations in China, where required, the sooner it begins revamping internal processes and procedures to account for the evolving risk environment, the better.

Return to Table of Contents

For more information, visit www.bdo.com/healthcare.

SHARE