2016 BDO Retail Compass Survey of CMOs

Retailers Set Sights High for the Holidays

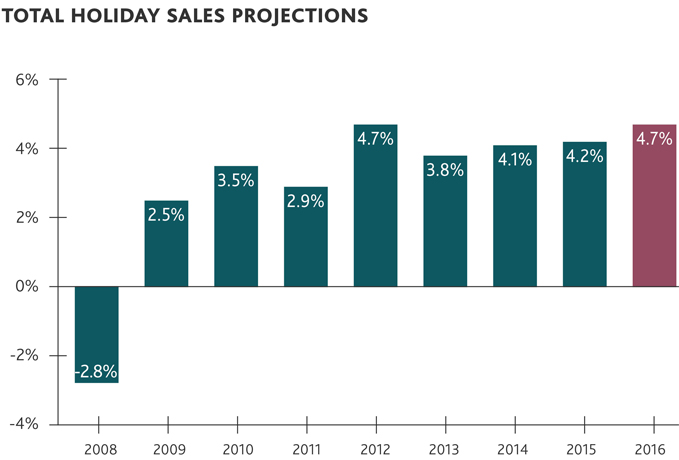

Consumers may loosen their grips on their wallets heading into the holiday season…if the price is right. Steadily climbing consumer confidence and growth in sales in certain categories suggest consumers are dedicated to finding the best deals, but also that they may have greater flexibility when it comes to their overall budgets. With that in mind, retail chief marketing officers (CMOs) project a bullish 4.7 percent increase in total holiday sales this year, tied with the highest projection in the 11-year history of our annual Retail Compass Survey of CMOs.

But even with more chips on the table, retailers are aware that the right pricing and timing—complemented by creative promotional strategies at every consumer touchpoint—will be key to winning the season.

Economic Issue Influence Evolves

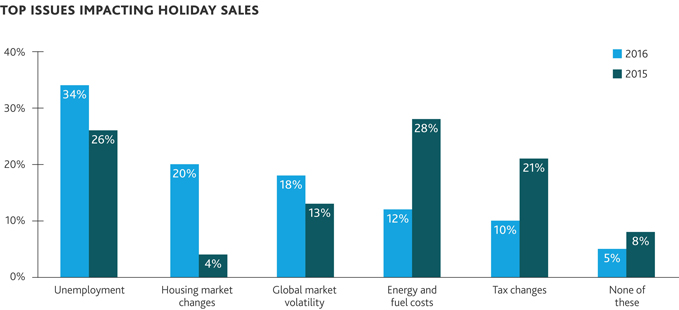

Despite low jobless claims in recent months, unemployment remains chief among the economic factors retailers worry will stymie holiday sales. At the same time, low energy and fuel costs in 2016 led fewer retailers to cite it as a top concern this year (12 percent, compared to 28 percent in 2015).

On the flip side, overall economic growth and low interest rates have driven U.S. home prices up, fostering hesitation among first-time buyers. Meanwhile, interest rate hikes have been on the Federal Reserve’s near-term radar for some time. As a result, there was a significant jump in retailers concerned about the impact of housing market changes this year (20 percent, compared to 4 percent in 2015).

In addition, global market volatility is cited as a concern by more retailers this year than any other in the survey’s history. With Brexit in the backdrop, 18 percent believe global market volatility will have the biggest impact on their holiday sales, up from 13 percent last year and 7 percent in 2014.

“Competing on deep discounts and pricing alone is not a sustainable strategy and, for some retailers, it isn’t a viable option. To stay in the game during the holiday season, it’s important that players of all sizes spread their focus to other offerings, like customer service, loyalty programs, flexible fulfillment options and exclusive products.” - Jennifer Di Giovanni, Partner in BDO’s Consumer Business practice

Price Competition Fuels Widespread Deals and Discounts

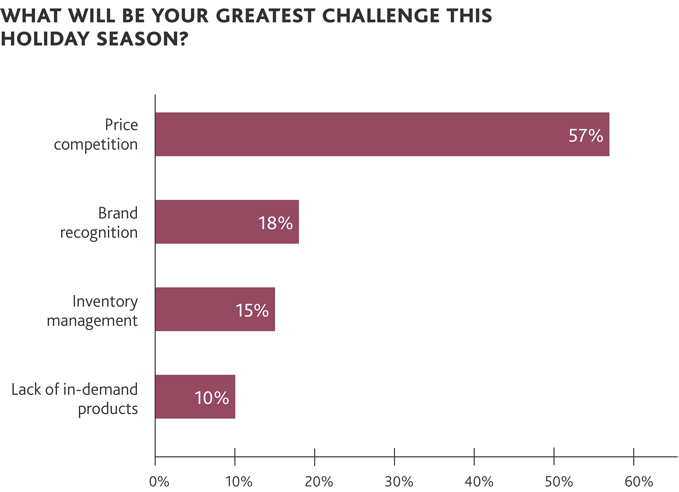

The right pricing strategy is paramount to holiday success. Consumers have grown accustomed to deep discounting and are conditioned to research, price-compare and dig for coupons before making a purchase. This pressure to offer the best price without sacrificing margins or neglecting other crucial business drivers poses retailers’ greatest challenge this season, according to respondents.

Behind Wal-Mart’s recent acquisition of Jet.com is a powerhouse pricing play. By leveraging Jet.com’s pricing algorithm that offers reduced prices to customers who buy in bulk, pay with debit rather than credit and opt out of free returns, Wal-Mart is strategically positioned to deliver on its lowest price brand promise.

Competition broadly remains a top risk throughout the industry, and was cited as such by 98 percent of the largest U.S. retailers in the 2016 BDO Retail RiskFactor Report. As retailers compete to attract customer dollars, discounting continues to be a widespread tactic. In fact, the number of retailers anticipating more discounts over the prior year has steadily increased since 2013, reaching 72 percent this year. One quarter of survey respondents say they plan to offer more discounts and promotions during the 2016 holiday season than in 2015.

“Conditions seem favorable heading into the holiday season this year. But the pressure is on for retailers to identify the optimal mix of promotions and pricing across channels. It’s arguably the toughest decision retailers will make—and the most critical factor in their holiday season success.” - Natalie Kotlyar, National Leader of BDO’s Consumer Business practice

.jpg)

Retailers Keep their Eyes on the Omnichannel Scoreboard

Among survey respondents familiar with the concept of omnichannel (64 percent), one-third plan to adjust their marketing strategies this holiday season in response to customer demands for cohesive shopping experiences across channels. Those adapting their omnichannel approaches to meet evolving demand are focusing on using consistent pricing (91 percent) and promotional strategies (86 percent) across channels.

However, the latest innovative omnichannel technologies—like digital in-store technologies—that are helping some retailers stand out from the competition may be overlooked by the majority of the industry. In fact, none of the survey respondents say they are leveraging digital in-store technology. Retailers who are revamping their physical locations are winning over consumers by appealing to their thirst for authentic, engaging and interconnected shopping experiences. Saks Fifth Avenue, for example, recently unveiled a promotion allowing shoppers to take a 360-degree look in smart mirrors that send a short video of the shopper to an on-site iPad, which customers can share to garner real-time feedback. This strategy demonstrates the retailer’s deep understanding of their consumer base and the importance of convenience, as well as peer review and approval, among today’s shoppers.

Mobile Use Reaches Maturity

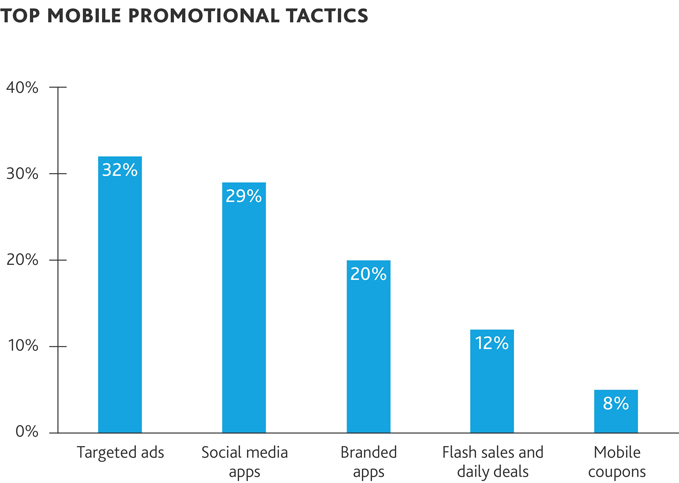

The majority (58 percent) of retail CMOs surveyed report that they are leveraging mobile in their holiday marketing plans. Of those tapping into mobile, 32 percent will focus most heavily on delivering targeted ads. As retailers look to connect with consumers who are increasingly tethered to their smartphones, 29 percent plan to focus on social media apps while 20 percent will be prioritizing their branded apps.

Retail Still Rooted on Solid Ground

Despite recent headlines questioning the relevance of brick-and-mortar, most transactions still take place in-store. According to a recent survey by the International Council of Shopping Centers, 91 percent of shoppers plan to spend at brick-and-mortar stores this holiday season. Many retailers are using stores as a foundation for their omnichannel experience, such as offering in-store pickup for purchases made online, while online behemoths like Amazon and Google are establishing physical footprints. In fact, 93 percent of retailers in this year’s survey have not decreased their square footage in the past year, and those who have do not anticipate it will have an impact on their marketing strategies.

Further emphasizing the value of brick-and-mortar in retailers’ marketing strategies, 39 percent are focusing the majority of their discounting and promotions for the holiday season in stores, just slightly less than those equally focused in-store and online (42 percent).

When asked about their top tactics for compelling customers to venture indoors, 44 percent of CMOs pointed to in-store events, up from 27 percent in 2015. Thirty-two percent will focus on exclusive in-store deals and discounts this holiday season, down from 45 percent last year.

Last year, for example, Macy’s hosted an early morning substance-free holiday rave party in a handful of its stores, leading to a near clean-out of its “ugly” Christmas sweater inventory. Young shoppers increasingly see shopping as a form of entertainment, and retailers that offer a unique and community-oriented experience in-store are more likely to capture their dollars.

Retailers Use Social to Influence the Influencers

Social media use is no longer a question of “if,” but “how,” for the vast majority of retailers in this year’s survey: 87 percent of retailers say they will be using social networking sites as part of their holiday marketing strategies, up from 78 percent last year.

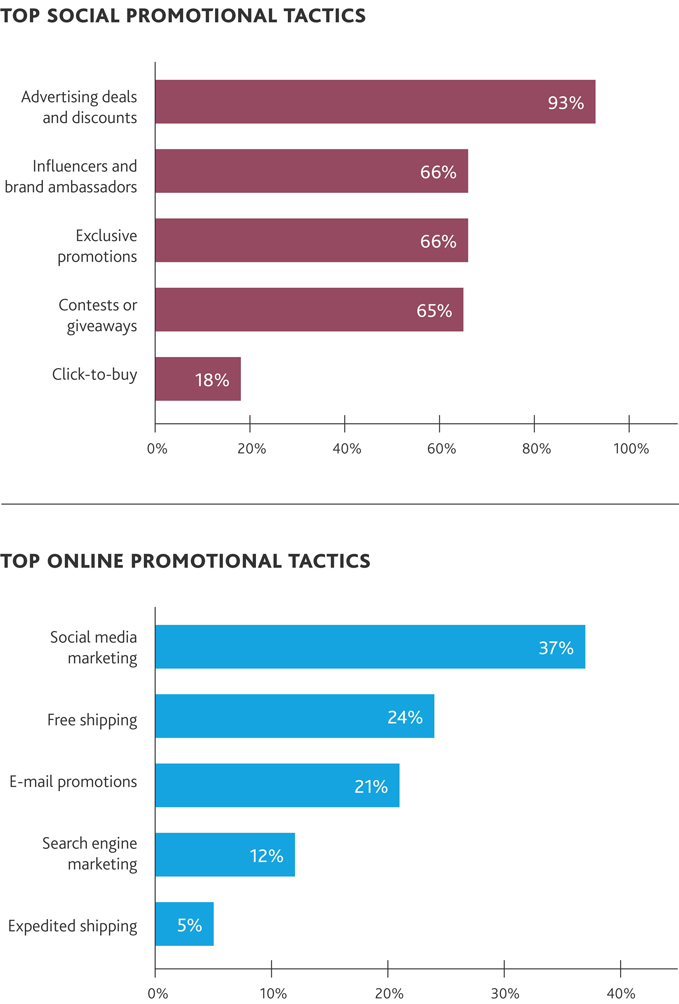

Most retailers are using social platforms to advertise deals and discounts (93 percent). Two-thirds will also be using social media marketing this holiday season to leverage influencers and brand ambassadors. While the use of influencer marketing in retail is a tale as old as time, a new breed of brand ambassador has emerged with the rise of social media: the customer. Consumers rely heavily on peer-to-peer recommendations, and influencer marketing is essentially a digitally driven version of traditional word-of-mouth marketing. Strategic players—from e-tailers and big box to mid-market and specialty retailers—are partnering with influencers, including “YouTube Stars” and “Instafamous” fashion bloggers to reach coveted consumers via their most trusted sources.

The uptick in using paid brand ambassadors as a marketing strategy has also led to tighter regulation. The Federal Trade Commission recently announced it’s planning to crack down on brands and social media influencers to boost transparency about sponsored content. It’s important that retailers revisit their influencer marketing strategies to ensure they are in compliance.

Click-to-buy, on the other hand, is still an experimental tactic, with just 18 percent of retailers using it on social. According to Digiday, the online subscription service Birchbox, which has a shoppable Instagram store, admitted that it is not yet a big sales driver for the brand.

Social media marketing rules when it comes to online promotional tactics generally this holiday season. Though search engine and email marketing are seen as top online promotional tactics among some retailers (12 and 21 percent, respectively), 37 percent cited social media marketing, compared to 24 percent last year.

“Social commerce is the apparent evolution of shopping, but neither retailers nor social networks have figured out a winning strategy. However, strategic partnerships among tech, media and retail companies are driving innovation. I wouldn’t write off the ‘buy’ button just yet.” - Ted Vaughan, Partner in BDO’s Consumer Business practice

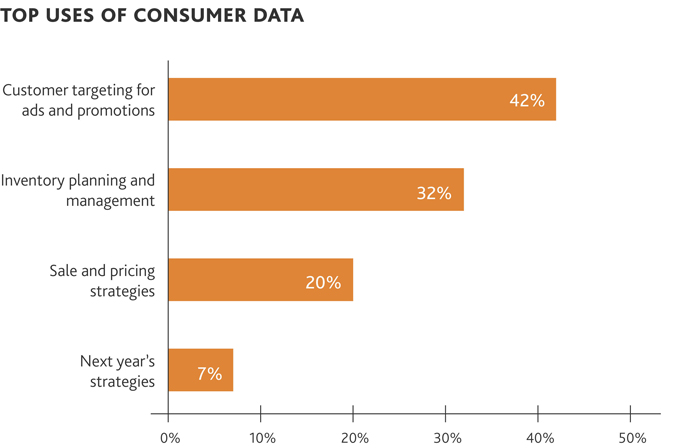

Omnichannel Requires Omnisecurity

The troves of data retailers collect across platforms can be both a blessing and a curse, and challenges persist when it comes to data management and security issues. When asked about the most important use of consumer data during the holiday season, 42 percent of retail CMOs point to customer targeting for ads and promotions while 32 percent cite inventory and management. Retailers will also use data to adjust sales and pricing strategies in real time and apply lessons learned to next year’s holiday marketing strategies.

But using data in any of these capacities requires diligence and, often, a dedicated team to keep it organized and appropriately protected. In this year’s survey, 91 percent of retail CMOs say they see managing and integrating customer data as challenging.

Keeping sensitive consumer information secure remains top of mind for retailers. In fact, 100 percent of retailers in our 2016 Retail RiskFactor Report cited cybersecurity as a top risk to their business. As retailers face the reality of their heightened cyber risk during the holiday season, they are moving from reactive to proactive approaches to cybersecurity, and feeling more confident in their efforts to secure and protect their systems. Twenty-three percent of retail CMOs believe that risks related to potential data breaches during the 2016 holiday season are lower than last year.

.jpg)

Forecasts Signal Cooling of Staple Shopping Days

Retailers’ expectations suggest that the “Christmas creep” will remain a defining factor of this year’s holiday season. With consumers spreading their shopping across months instead of weeks, retailers are shifting away from relying on what used to be major shopping days. A majority of retail CMOs (55 percent) say they plan to spread their promotions throughout the holiday shopping season and 22 percent intend to deploy their promotions before Black Friday. Just 14 percent of retailers are planning most of their promotions during Black Friday and Thanksgiving weekend.

CMOs forecast a modest 2.6 percent increase in Black Friday sales and a 0.7 percent increase in Cyber Monday sales. Overall, just 28 percent of retailers expect Black Friday sales to increase this year, down from the 41 percent who felt the same level of optimism in 2015. Meanwhile, 70 percent of retailers anticipate Cyber Monday sales will remain flat this year despite record results last holiday season.

With the shopping season lasting longer, retailers will need to invest the time and resources to plan and execute effective inventory, pricing and promotional strategies to maintain steady momentum throughout the season.

When it comes to resources, nearly a quarter (23 percent) of retailers say their holiday marketing and advertising budgets will be higher this year while 59 percent say their budget is the same as in 2015. This year, retailers expect overall inventory to grow 0.9 percent, a drop from 3.4 percent in 2015, but a level consistent with historical trends. A quarter of retailers have increased their inventory purchases for the holiday season.

Technophiles Continue to Take Over

For the sixth consecutive year, retail CMOs place their bets on consumer electronics when it comes to both performance and discounting. Seventy-two percent of retailers anticipate consumer electronics will be the top performing product category this holiday season, and 60 percent say it will be the most heavily discounted.

The 2016 holiday season is slated to break records this year as consumers add wearable tech, virtual reality headsets, drones and digital assistant devices to their wish lists, according to the Consumer Technology Association. They say approximately 170 million people in the U.S.—or 68 percent of the U.S. consumer base—intend to purchase technology gifts this season, a 6 percent increase from last year’s figures.

High demand for big-ticket, researched purchases will require retailers to implement a dynamic pricing strategy to compete. Identifying the optimal mix of promotions and pricing across channels is arguably the toughest decision retailers will make in the run up to the holiday season—and the greatest contributor to their success.

The BDO Retail Compass Survey of CMOs is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with chief marketing officers. The survey was conducted within a scientifically developed, pure random sample of the nation’s leading retailers. The retailers in the study were among the largest in the country. The eleventh annual survey was conducted in September and October of 2016.

For more information on BDO USA’s service offerings to this industry, please contact us.

SHARE