2017 BDO Retail Compass Survey of CFOs

“The 2016 holiday season was a moment of reckoning for many in the retail industry. Some are fired up following record-breaking results, and others are catching their last sparks. 2017 holds promise, but there’s no room for coasting in a marketplace so saturated with new and legacy concepts.”

- Natalie Kotlyar, national leader of BDO’s Consumer Business practice

Retail CFOs Bet on a Strong 2017…With Caveats

Better-than-expected holiday results and healthy economic indicators are driving optimism in the retail industry. But, retailers’ bullish sales projections and capital investment plans come with caveats, chiefly uncertainty around the impact of potential tax and regulation changes and intense competition to capture dollars and market share.

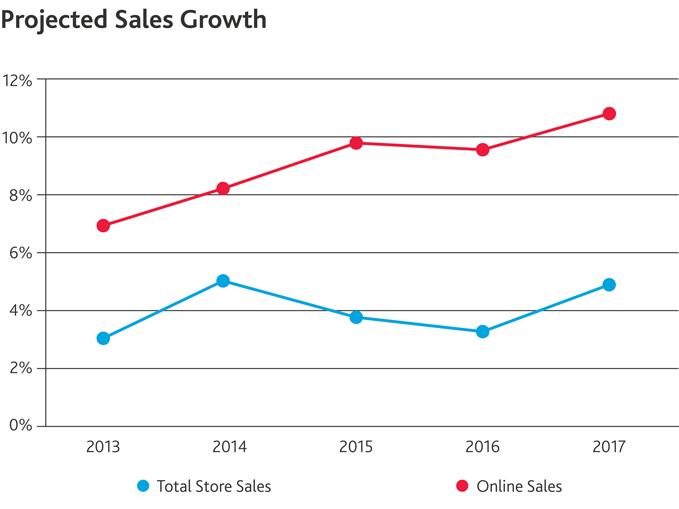

Following two consecutive years of softening projections, retail CFOs forecast 4.9 percent sales growth for 2017, according to our 11th annual Retail Compass Survey of CFOs. Last year, retailers in our survey projected a 3.4 percent overall sales increase—in line with the actual 3.3 percent rise in 2016 retail sales reported by the U.S. Census Bureau. With their sights set high on growth, retailers are betting on online sales, which they expect to comprise 15 percent of the overall pie. In fact, retail CFOs project a 10.7 percent boost in online sales in 2017, the highest level in our survey’s history.

Fueling this optimism is amplified consumer confidence, which reached a 15-year high in December, according to The Conference Board. Sixty‑seven percent of retail CFOs believe consumer confidence will increase in 2017, up significantly from 28 percent who felt similarly at the beginning of 2016.

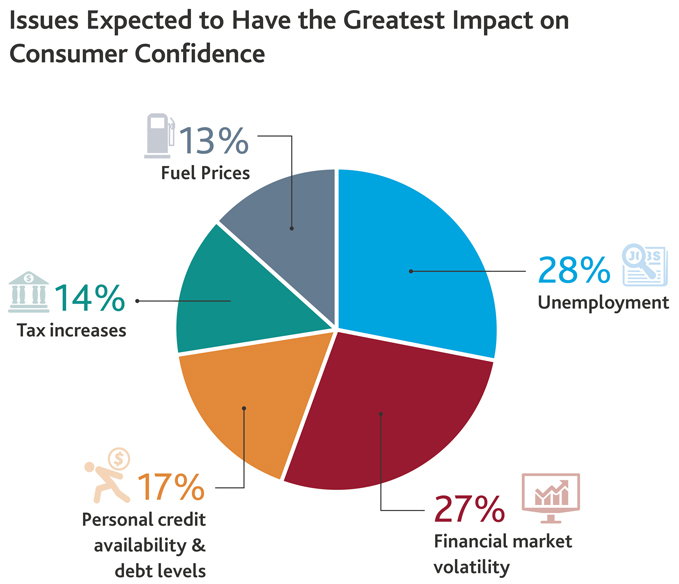

When considering the factors that are most likely to impact consumer confidence in the year ahead, 27 percent point to financial market volatility, a steep decline from 46 percent last year. With fuel prices low and less concern about personal income tax rates, 28 percent of retail CFOs cite unemployment as the factor with the greatest influence on consumer confidence this year.

Tax and Regulatory Matters Pose a Backdrop of Uncertainty

Beyond an anticipated uptick in consumer spending, retail CFOs are watching to see if President Trump’s campaign promise of comprehensive tax reform will come to fruition this year. When considering tax developments that may be on the horizon, a majority (61 percent) say a reduction in the U.S. corporate tax rate would have the greatest impact on their business, followed by state income and franchise tax audits (19 percent), expanding sales and use tax laws (10 percent) and reform of international taxation including repatriation (9 percent).

In BDO’s 2016 Tax Outlook Survey, 77 percent of tax directors believed that tax reform would pass if a Republican won the presidency. In the 2017 survey, all 100 tax directors surveyed think tax reform is at least slightly likely.

But comprehensive tax reform may be a double-edged sword for some industry players. In addition to a proposed corporate rate reduction, one tax reform plan, contained in the House Republicans’ policy agenda A Better Way: Our Vision for a Confident America, also suggests transforming the current tax regime from a worldwide approach to a destination-basis tax system with border adjustments. Early indicators show that retailers—perhaps above any other industry—see the destination-basis tax system as having a potentially detrimental effect. A broad coalition, including the Retail Industry Leaders Association and more than 120 other trade groups, recently launched a campaign against a border-adjusted tax. While a majority of retail CFOs were not familiar with the specific proposal on import tax at the time our survey was conducted in January, of those who were familiar, more than half said it will have a negative impact.

Overall, 22 percent of retailers cite federal, state and local regulations as the top risk keeping them up at night.

Download the full report to learn more about the GOP's border adjustment tax proposal.

“Although reduced corporate tax rates are at the top of retailers’ wish lists when it comes to reform, sweeping reforms with border adjustments could dictate whether they end up in the black or the red. For an industry that relies heavily on global products, an import tax could be a game-changer, and retailers need to be prepared to evaluate and potentially reorient the business model as this evolves.”

- Mike Metz, tax partner in BDO’s Consumer Business practice

Retailers Grapple with Potential Labor Cost Increases

In the midst of the president’s promise for “America First” policies, the U.S. retail industry added 39,400 jobs in January over December, making up nearly a fifth of the 227,000 jobs added to the nation’s economy, according to the National Retail Federation (NRF). With labor a significant—and growing—line item on retailers’ income statements, labor regulations, including the Department of Labor’s proposed overtime rule and federal minimum wage hikes, are top of mind for retail CFOs.

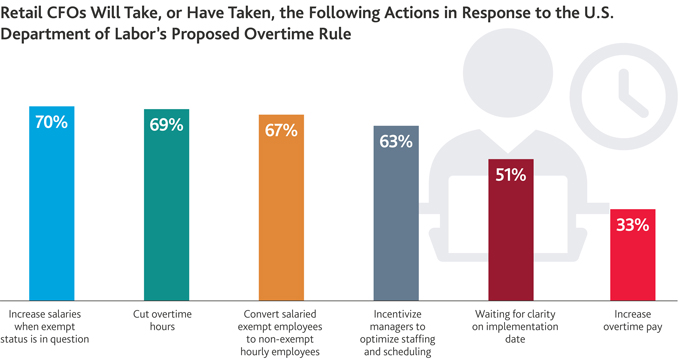

Nearly half (45 percent) of retail CFOs surveyed are taking action in response to the proposed overtime rule, which remains frozen after a federal judge halted it ahead of the planned implementation date of Dec. 1, 2016. Among those, 70 percent say they will increase salaries when exempt status is in question, 69 percent will cut overtime hours and 67 percent will convert salaried exempt employees to non-exempt hourly employees.

At the same time, efforts to raise the minimum wage have gained momentum in recent years, with states including Washington, California, New York, Connecticut and Massachusetts raising their wage floors to $10-$15 per hour. When asked how retailers will respond to a potential federal minimum wage hike from the current $7.25 per hour, a large majority (70 percent) say they plan to automate or simplify processes to boost efficiency. Fewer retail CFOs say they will accelerate the closure of underperforming stores (39 percent), reduce headcount (34 percent), outsource non-core functions (30 percent) or cut employee hours (27 percent).

Download the full report to see how retailers have taken action in response to the FASB's new revenue recognition standards.

Competition and Consolidation is Top Concern

In the first month of the New Year alone, Wal-Mart purchased online footwear retailer ShoeBuy, and ThreeSixty Group bought The Sharper Image brand. Meanwhile, The Wall Street Journal reported that Hudson’s Bay has approached Macy’s about a potential takeover, Kate Spade is rumored to be exploring a sale and e-tailer Nasty Gal was acquired by British retailer Boohoo. These deals and talks illustrate a trend: The retail M&A market is active.

As retailers come to grips with the reality of today’s cutthroat environment, 38 percent cite competition and consolidation as their top concern in the next year. They are gearing up for another year of ongoing consolidation across the industry as players vie for market share. In fact, 11 percent of retail CFOs say they plan to invest more capital in M&A activity this year.

Overall, nearly half (46 percent) of those surveyed forecast an uptick in retail M&A activity in 2017, and only 1 percent think it will decrease. Retailers’ bullish outlooks for the industry are also reflected in their valuation expectations. This year, retail CFOs expect buyers will pay an average EBITDA multiple of 7.0, the highest in our survey’s history.

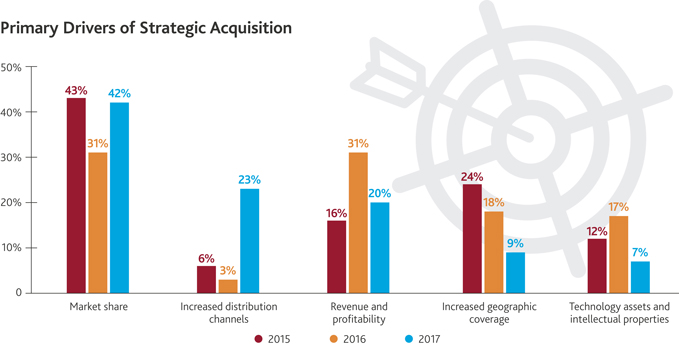

Evidenced by Wal-Mart’s recent acquisition of Jet.com, as well as the Hudson’s Bay-Gilt Groupe and Bed Bath & Beyond-One Kings Lane deals in 2016, retailers are realizing that to level the playing field with new age players, they need to invest in bolstering omnichannel offerings—and one way to do so is through a strategic acquisition. More than half of retail CFOs (56 percent) anticipate M&A activity will be largely driven by strategic buyers this year. Among those, CFOs say strategic buyers will be primarily targeting market share (cited by 42 percent). However, nearly one-quarter (23 percent) expect increased distribution channels to be the key driver of strategic acquisitions, up significantly from 3 percent in 2016. According to BDO’s 2017 PErspective Private Equity Study, 69 percent of fund managers rank sale to a strategic buyer as the exit option they expect to generate the greatest return this year.

Promising market conditions may also lead retailers to refinance debt in order to improve cash flow for strategic growth investments. In line with last year’s findings, only 8 percent of retail CFOs expect it to be “very difficult” for retail and consumer products companies to refinance debt in 2017.

“Private equity is facing stiff competition for deals in the retail space. Strong e-commerce capabilities have become the price of entry to the industry. Strategic buyers are willing to pay a premium for robust online platforms to help them expand their reach, putting a squeeze on PE buyers who may not have the same incentive. But there is a silver lining: PE firms looking to exit their investments in e-commerce companies are facing a seller’s market tipping in their favor.”

- Kevin Kaden, partner in BDO’s Transaction Advisory Services practice

Building Up Supply Chain to Break Down Channel Silos

Consumers have grown accustomed to blurred lines between shopping platforms. The pressure is on for retailers to meet demands by offering a seamless shopping experience across physical and digital channels—which means bridging any disconnects between brick-and-mortar and e-commerce operations. To do so, more than one-third (39 percent) of retail CFOs will invest more capital in their supply chain during the next year.

Retailers are also wary of potential impediments to supply chain efficiencies, whether caused by potential taxes on imports, labor issues, global political instability or natural disaster. Fourteen percent of survey respondents cite U.S. and foreign supplier risks as their greatest concern this year, up from 8 percent in 2016. Since supply chain disruptions can wreak havoc on retailers’ operations, supplier and vendor risks, including shipping and regulatory compliance, were also cited as a top risk by 93 percent of retailers in our 2016 Retail RiskFactor Report.

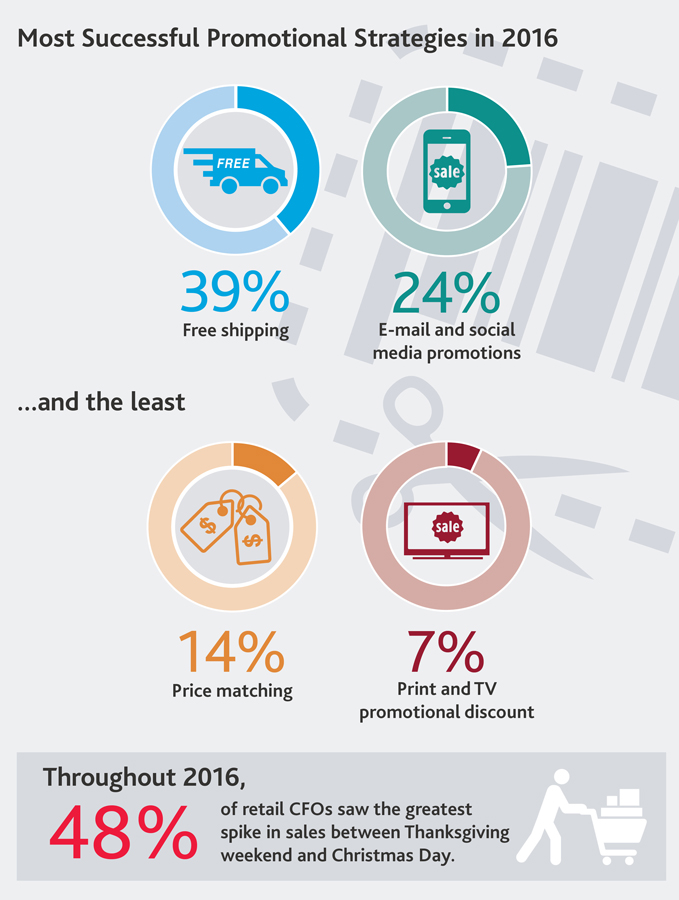

Not only is a well-organized supply chain necessary for smooth operations and healthy margins, but also to meet the basic expectations for consumers in today’s convenience economy. Customers are increasingly sensitive to the perception that they’re absorbing shipping and packing costs. Unsurprisingly, free shipping was the most successful holiday promotional strategy last year for 39 percent of retailers, up from 20 percent in 2015.

When thinking about the right mix of promotional strategies to draw customer dollars across channels, 62 percent of retail CFOs are planning to devote more resources toward their marketing and advertising. After free shipping, email and social media campaigns were cited as the top promotional strategy for nearly one-quarter of retailers (24 percent).

Stores are in the Midst of Evolution, Not Extinction

Macy’s, Sears, J.C. Penney, The Limited and American Apparel are just a few among the wave of traditional retailers that announced plans to close stores in 2017. Others are transforming storefronts into distribution and fulfillment centers. At the same time, historically pure-play e-tailers, including Amazon and Warby Parker, are venturing into brick-and‑mortar.

Amid this maelstrom, retailers are rethinking their approach to physical space. In fact, more than half (52 percent) of retail CFOs said they plan to invest more in redesigning and remodeling stores in the year ahead, while 31 percent are allocating capital to expand U.S. store locations.

“The spate of store closures does not portend the end of brick-and-mortar retail as we know it. What it does indicate is that the evolving shopping landscape, from the de-malling of retail to the emphasis on experiential shopping and technology, is forcing retailers to revisit their real estate portfolios and eliminate wasted space. The mentality is shifting from ‘location, location, location’ to optimization, digitization, personalization.”

- Ross Forman, managing director in BDO’s Corporate Real Estate Advisory Services and leader of Real Estate Strategy and Portfolio Optimization

Retailers Talk Tech

Overall, nearly three-quarters (74 percent) of retail CFOs will invest more capital in IT systems and technology in the next 12 months. Retailers will harness technology to expedite checkout times, improve customer service and appeal to consumers’ appetite for unique, engaging and interconnected shopping experiences. But keeping customers engaged through their screens is an uphill battle.

In an effort to capture this elusive audience, 68 percent of CFOs say they’re planning to dedicate more resources to bolster e-commerce and mobile channels this year. Thirty-eight percent intend to up their spend on mobile specifically—and for good reason. According to the NRF, smartphone traffic is expected to rise tenfold from 2014 to 2019, and users already look at their devices 150-200 times daily on average.

Digital Growth and Security: A Balancing Act

With robust digital channels a prerequisite, retailers are focused on strengthening and securing their platforms. More than half (57 percent) of CFOs surveyed said they increased their cybersecurity spending in the past 12 months. Among these retailers, almost all (94 percent) are employing new software security tools—up from 85 percent in the prior year—and 74 percent have created a response plan for security breaches. Just 29 percent have hired an external consultant and 9 percent onboarded a chief security officer in the past year—both declines from prior years, as many retailers likely prioritized key cyber personnel as an early response to cyber threats in the industry.

Retailers are not the only ones committed to securing sensitive customer and company data. Federal and state governments are also pushing to minimize organizations’ and public exposures. With that in mind, 70 percent of retail CFOs anticipate cybersecurity regulation will increase in the year ahead.

Retailers also face pressure from the payment card industry to bolster their cybersecurity controls. A large majority (82 percent) of retailers are currently EMV compliant, up from 76 percent last year. But a common challenge lies in retailers conflating EMV compliance with cyber risk management. In reality, EMV compliance is only one piece of the puzzle, albeit an important one.

Retail IPO Market’s Steady Pattern Persists

Just three retailers went public in 2016, raising a total of $314 million, according to data compiled by Bloomberg. In 2017 thus far, TheStreet reported that Claire’s stores and Neiman Marcus Group terminated IPO plans.

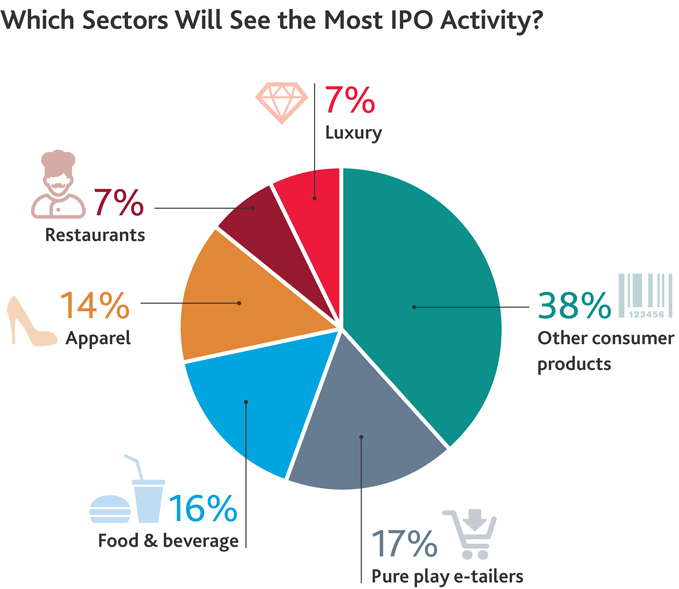

Looking ahead, the majority (57 percent) of retail CFOs think retail IPO activity will remain flat in 2017, while 28 percent predict an increase. Capital markets executives, however, were slightly less optimistic, with 16 percent of those surveyed in BDO’s 2017 IPO Outlook survey predicting retail IPO activity will rise this year. When asked which sectors are most likely to see the most IPOs in the year ahead, 38 percent of retail CFOs point to other consumer products and nearly one-in-five (17 percent) say pure play e-tailers.

A slew of positive economic conditions is fueling a promising 2017 outlook for retailers, but it’s important to carefully assess both sides of the coin. A saturated market is driving intense competition while proposed tax and regulatory policies add a layer of uncertainty to industry forecasts. Retailers will be best suited to close out 2017 with results to match their current optimism if they are methodical about adapting strategies and spend to reflect changes in market conditions and consumer behaviors.

The BDO Retail Compass Survey of CFOs is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with chief financial officers. The survey was conducted within a scientifically developed, pure random sample of the nation’s leading retailers. The retailers in the study were among the largest in the country. The 11th annual survey was conducted in January 2017.

SHARE