Transfer Pricing Considerations for REITS Recovering From COVID-19

In response to the economic fallout from the COVID-19 pandemic, businesses quickly pivoted their focus to short-term strategies to generate immediate cash flow. For real estate investment trusts (REITs), there was an added layer of difficulty when attempting to set the arm’s length pricing with their taxable REIT subsidiaries (TRSs). As the world appears to be inching back toward some semblance of normalcy, REITs are focusing on long-term strategies, including renegotiating leases, leaning on recent technical and practical guidance on their path to recovery.

Background

The REIT Modernization Act (RMA) of 1999 gave REITs the right to own TRSs, which are subject to corporate tax but not to any of the REIT qualification tests. As a result, the RMA allowed REITs to be more competitive by offering a range of “non-permissible” services to their tenants without jeopardizing REIT status.[1] In order for the TRS to offer these non-permissible services, REITs must lease the rights to operate the properties to their TRSs in exchange for market rent. Such arrangements are common in the hospitality and healthcare industries due to the nature of the services performed and sources of income.

Internal Revenue Code (IRC) Section 856(d)(8)(A)(ii) states that the rent paid by a TRS to the REIT must be “substantially comparable to such rents paid by the other tenants of the trust’s property for comparable space.” To encourage compliance with this requirement, IRC Section 857 imposes a 100% excise tax on any amount of “redetermined rent” that was not set at arm’s length. Although the regulations do not specify acceptable methods to price intercompany leases, Section 857 does reference IRC Section 482 in defining redetermined rent.[2] As such, taxpayers have relied upon guidance for arm’s length pricing contained in the transfer pricing regulations under Section 482 in structuring their intercompany leases. Audits by the IRS and the resulting case law have provided further insights specific to these structures and allowed taxpayers to establish a fairly consistent approach to pricing these leases—typically setting rent such that the TRS and REIT are projected to earn a reasonable return in line with third-party comparables.

Impact of COVID-19 disruptions on intercompany leases

When the COVID-19 pandemic hit, many REITs, particularly in the hospitality sector, saw cash flows decrease or even go negative on the properties being leased to their TRSs, with notable exceptions such as REITS with marinas that could remain open during the lockdown. Impacted REITs imposed rent abatements or waivers to the intercompany leases, but longer-term solutions, such as renegotiating the leases, were not possible due to the high degree of economic uncertainty. Looking ahead, REITs are revisiting these contracts and considering how best to adjust transfer pricing under the current environment. Inaction may not be viable as pre-COVID rental terms may result in non-arm’s length outcomes going forward, creating potential tax audit risk. Although questions of when and how best to proceed are not straightforward, new guidance from the OECD has been released to help taxpayers navigate these challenges.

OECD transfer pricing guidance on COVID-19

While the IRS has not officially released guidance on how to adjust transfer pricing in response to COVID-19, the Organisation for Economic Co-operation and Development (OECD)—of which the U.S. is a member—has provided consensus guidance on this topic.[3] The OECD guidance endorses the use of a “transfer pricing adjustment” in response to COVID-19 provided the adjustment can be supported by reference to the behavior of comparable third parties and in consideration of the “options realistically available” to the parties. Although this guidance is not specific to REITs, the principles can be applied to intercompany leases impacted by COVID-19.

The path forward

Below are best practices that have emerged in evaluating how best to adjust intercompany leases between REITs and TRSs given the OECD guidance as well as third-party observations:

- Modeling: Due to the high degree of uncertainty still present in the market, REITs are advised to run multiple scenarios and pressure test new rental terms. Upside and downside scenarios will be important to consider before settling on the new rental terms.

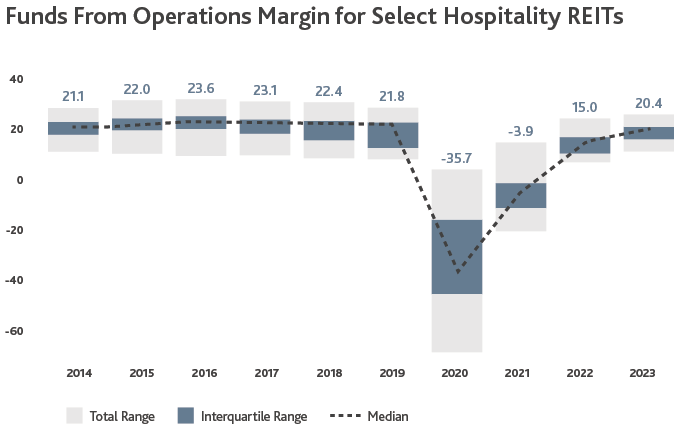

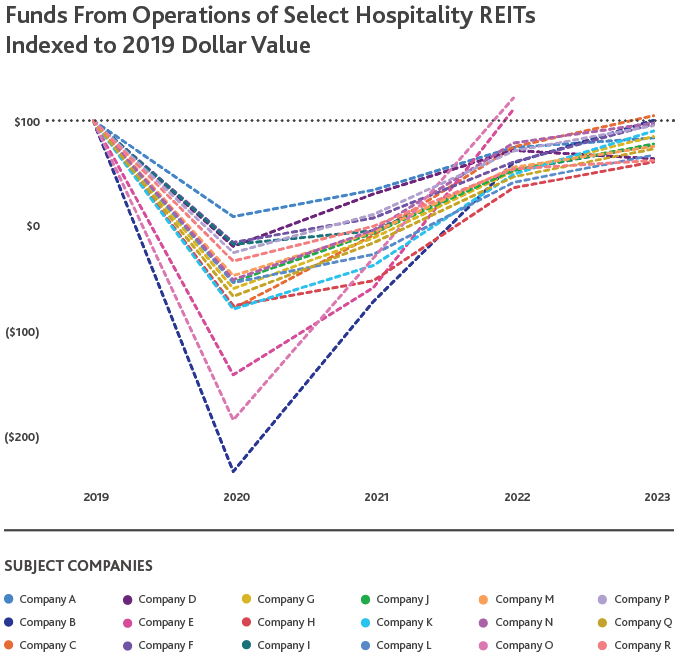

- Benchmarking: A standard approach has been to support the expected REIT and TRS returns post-lease by referencing third-party benchmarks. In today’s environment, it is recommended that taxpayers do not solely rely on historic financial data of these comparables. As such, BDO’s Transfer Pricing team utilizes the firm’s proprietary Forecast Engine tool (Forecasting: Key Driver for an Effective Transfer Pricing Strategy) to evaluate the projected returns of comparables based on consensus analyst forecasts. Such an approach allows REITs to factor in both the impact of COVID-19 as well as the expected recovery curve. This forecasting approach allows for consistency between the tested parties and the comparables. For examples of the tool’s capabilities, read BDO’s latest Forecast Engine Industry Impact Study.

Forecast Engine: Historic and projected funds from operations as a percent of revenue for a set of public hospitality REITs.

Forecast Engine: Historic and projected funds from operations indexed to the 2019 dollar value for each of the set of public hospitality REITs.

- Rent structure: In response to COVID-19, many lessors have provided less risky rental terms to their tenants (e.g., lower base rents in exchange for higher percent rents or layering in multiple break points). In line with the OECD guidance, such third-party evidence can be leveraged in designing new rental terms.

- Reset clauses: Considering the potential for future market volatility (e.g., driven by new COVID-19 strains), taxpayers may want to include terms in the agreement that allow for adjustments to the pricing in the event of certain trigger events. Such clauses should be aligned with commercial practice observed in the market (e.g., commercial adverse change provisions) structured such that they meet the “true lease” standards.

- Lease term: Another common theme is the emergence of shorter lease terms being offered which can reduce the risk of inaccuracies related to the forecast.

- Documentation: The OECD guidance states that any modifications to transfer pricing as a result of COVID-19 should be “well-supported by documentation outlining how the modification is in line with the arm’s length principle.” Thus, taxpayers are well advised to prepare robust documentation detailing their strategy and approach in light of the above considerations.

The global pandemic has created severe business disruptions for REITs. Although transfer pricing in this current environment may be difficult, technical and practical guidance can help pave a roadmap for REITs to successfully emerge more resilient than before. However, the path forward may not always be linear. Businesses should be prepared to experience different stages of recovery depending on their industry, region and segment.

[1] Matheson, Thornton, Taxable REIT Subsidiaries: Analysis of the First Year’s Returns, Tax Year 2001, www.irs.gov (accessed March 29, 2021).

[2] IRC Section 857(b)(7)(B)(i).

[3] Organisation of Economic Co-operation and Development: Guidance on the transfer pricing implications of the COVID-19 pandemic, December 18, 2020.

SHARE