Deferred Revenue Haircuts are Going Away

FASB simplifies purchase accounting for deferred revenue, enhancing comparability in the pre-acquisition and post-acquisition periods

Many acquisitive technology companies and private equity funds have historically faced operational challenges when valuing deferred revenue. This issue arises in purchase accounting and explaining the lack of comparability between pre-acquisition and post- acquisition GAAP revenues. With the Financial Accounting Standards Board’s (FASB) release of Accounting Standards Update (ASU) 2021-08, relief from these challenges is available for all public and private entities. Prior to an entity adopting this ASU, it is required to account for the deferred revenue acquired by recording deferred revenue at fair value.

Fair value of deferred revenue is generally determined by computing an amount equal to the cost of providing the service in the post- acquisition period plus a reasonable profit margin, which typically results in a significant downward adjustment (commonly referred to as a ‘haircut’) for technology companies — and particularly those in the software/software-as-a-service (SaaS) sector. After adoption of this ASU, an entity will generally account for deferred revenue as if it had originated the contract, resulting in no deferred revenue ‘haircuts’ at the date of acquisition.

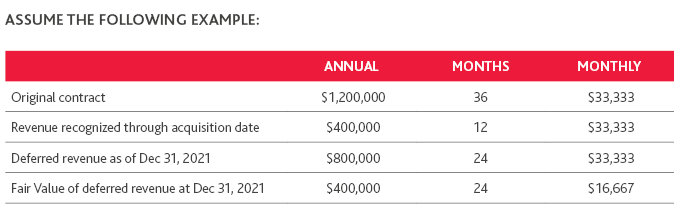

EXAMPLE PRIOR TO ADOPTION OF THE ASU:

On January 1, 2021, Company X enters into a $1.2 million customer contract for a SaaS solution, including maintenance, support and unspecified upgrades commencing on January 1, 2021, and ending on December 31, 2023. Company X invoices and receives $1.2 million in January 2021.

On December 31, 2021, Company X is acquired by another entity resulting in a business combination. Company X’s pre- acquisition deferred revenue balance pertaining to this transaction would be approximately $800,000 on December 31, 2021, based on ratable revenue recognition. After a careful analysis of the cost to provide the SaaS in the post-acquisition period, Company X determines the fair value of the deferred revenue to be $400,000, which will be recognized over the remaining contract term of 24 months.

EXAMPLE AFTER THE ADOPTION OF THIS ASU:

Assuming the same example above, Company X would record deferred revenue as if it had originated the contract. As a result, it would generally carry over the deferred revenue balance of $800,000 as of the acquisition date, which would be recognized over the remaining contract term of 24 months.

ADOPTING ASU 2021-08 WOULD PROVIDE THE FOLLOWING BENEFITS:

Increased comparability of revenues between the pre-acquisition and post-acquisition period.

-

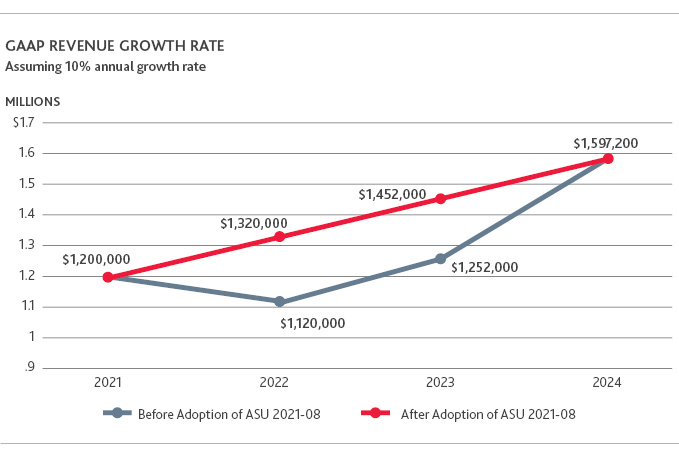

Before the ASU adoption, revenue comparability would be distorted: a) between the pre-acquisition and immediate post- acquisition period, showing an immediate post-acquisition revenue decline, and b) between the immediate post-acquisition period and succeeding years, showing a later revenue increase, which would not correlate to underlying bookings trends.

-

These distortions will no longer occur after adoption of ASU 2021-08 as demonstrated in the table above.

-

With the increasing private equity (PE) acquisition activity in the software sector, these comparability issues are more pronounced, given that the portfolio company is the acquiree and 100% of its deferred revenues are subject to being haircut.

Reduction in non-GAAP pro forma adjustments to GAAP financial statements.

Users of the financial statements often have a hard time grasping the conceptual basis for the deferred revenue haircuts, and they want comparability to prior periods. Prior to the adoption of this ASU, the deferred revenue and related revenue fair value adjustments, have often been reversed in providing non-GAAP measurements to investors and creditors and for management incentive plans.

Reduction in certain other challenges and costs.

The fair value adjustments of deferred revenue were often complex and required significant judgment. As a result, entities spent additional effort and incurred additional costs in preparing complex valuation models. Furthermore, entities often incur additional cost and complexity to maintain the appropriate records and to respond to inquiries regarding the fair value adjustments. After the adoption of this ASU, such additional costs and complexities should be limited. However, an entity will need to continue to ensure that an entity acquired in a business combination was appropriately applying the correct revenue recognition accounting in the pre- acquisition period before recognizing the acquired deferred revenue at the acquiree’s historical balances.

Public business entities will be required to adopt the standard in fiscal years beginning after December 15, 2022. All other entities will be required to adopt the standard in fiscal years beginning after December 15, 2023. However, early adoption is permitted, including adoption in an interim period. An entity that early adopts in an interim period should apply the amendment retrospectively to the beginning of the fiscal year of adoption and prospectively to all business combinations that occur on or after the date of adoption.

For clarity, if a calendar fiscal year entity entered into business combinations in February 2021 and November 2021 and elects to apply the amendment to the November acquisition, then the entity will need to also apply the amendment retroactively to the February 2021 acquisition for its 2021 annual 2021 GAAP financial statements.

As a whole, this updated guidance will allow organizations to better communicate their value and understand the value of acquisition targets. Organizations should evaluate their unique circumstances and consult with accounting professionals to determine the appropriate date to adopt the standard.

Leaders should continue to stay up to date with the FASB’s guidance as ASUs are released. If you have questions about how ASU 2021-08 affects your company, contact us to learn more.

SHARE