Deploying Capital

Deploying Capital is Tough, But It Must Be Done

Fifty-eight percent of private equity fund managers are more interested in making acquisitions rather than selling, while 42 percent noted they would rather focus on exiting investments.

Moreover, 64 percent of respondents indicated they intend to increase the amount of capital they deploy, while 31 percent plan to invest the same as usual, with only five percent expecting to decrease the amount of capital they will invest.

That capital will likely go to finance between one and four platform deals, with the plurality—33 percent— of respondents specifically expecting to make two platform deals over the next 12 months.

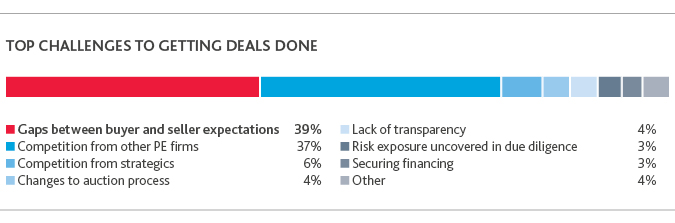

While private equity firms may express an interest in making more acquisitions, they will have to overcome a few roadblocks to bring those deals to fruition. When asked about the top challenges to making investments, 39 percent of survey respondents point to the gap between buyer and seller price expectations.

To wit, during the third quarter of 2017, median enterprise valueto-EBITDA multiples reached 10 times, well above the five-year median multiple of 7.6 times, according to PitchBook. This is certainly bringing pause to potential buyers.

The gap in price expectations may widen even more over the next year in some industries. For instance, when asked which three industries could see valuations increase over the next 12 months, 67 percent of respondents point to technology, 59 percent mention healthcare & biotech, and 37 percent choose financial services.

Additionally, private equity firms seek to embrace disruptive technologies that will transform the way different industries operate. About one quarter of fund managers (26 percent) see retail and distribution as the sector that is bound to undergo the most transformation, closely followed by technology (25 percent), and healthcare & biotech (12 percent).

Intense competition is another challenge to getting deals done. While 71 percent of fund managers say other private equity firms are their main competition, strategic acquirers are also getting in their way. Because strategics can extract synergies by acquiring companies and merging them into their operations, they are able to pay higher multiples in an already frothy environment.

Despite reports of institutional investors such as family offices and pension funds increasingly looking to make direct investments, thus bypassing the private equity middleman, only about seven percent of respondents see these investors as competitors.

Then of course, there are only so many potential acquisition targets for private equity buyers to pursue. And out of the finite amount of companies that do exist, not all of them are necessarily worthy targets. Given that valuations are so high, and are expected to remain high over the near future, private equity firms are being very careful and trying not to overpay.

That explains why private equity firms have focused mostly on acquiring high-growth companies. According to PitchBook survey data from the third quarter of 2017, 61 percent of deals executed by survey respondents involved target companies with over 10 percent revenue growth in the trailing 12 months.

That said, more than eight in 10 fund managers (85 percent) expect the value of their portfolio to increase in the next year, with just three percent forecasting a decrease. Of respondents that are banking on an increase, 50 percent believe the value of their portfolios will increase between 11 and 25 percent over the next 12 months, while 25 percent expect the increase to be between zero and 10 percent. An additional 16 percent expect to see gains of more than 25 percent.

SHARE