Achieving Operational Efficiency Through Digital Transformation

To Thrive During Volatility, Oil & Gas Companies Need to Think Digitally

As downward pricing pressures rage and with much of the world’s easy-to-reach oil already consumed, oil and gas companies are tasked with producing more with less—or risk shutting their doors. To accomplish this, energy companies are investing in new technologies to drive operational excellence while boosting profit margins, improving safety and reducing speculative risk. As a result, digital transformation—the adaptation to and adoption of new technologies changing the way industries create value—is reinventing the rules of business in the natural resources industry.

Digital transformation in natural resources has made headlines beyond the sector as oil and gas majors link up with their Big Tech counterparts. The success of recent partnerships between Google and Total for artificial intelligence and Microsoft and Equinor for cloud computing are tangible proof points that these emerging technologies are not just a fad—they are increasingly viewed as a necessity to compete in the tightening markets of today and tomorrow.

Exploration and production have always been high-risk and complex business propositions. Now, with a greater degree of real-time data to drive trends, patterns and insights, companies can make more informed decisions earlier in the process, thus greatly reducing the cost of exploration investments while increasing the probability of extraction success. Digital transformation is driving new levels of operational excellence and productivity, product insights and discovery and optimizing the supply chain up and downstream.

What does this mean for middle market natural resources companies? According to new research, those who would ignore these forces of disruption do so at their own peril. Thankfully, there is still time to enact change without being left behind—but that time is running out. According to BDO’s inaugural Middle Market Digital Transformation Survey, which polled C-level executives at companies with annual revenues between $250 million and $3 billion, 68 percent of natural resources executives have either developed a digital transformation strategy (36 percent) or are in the midst of developing one (32 percent)—and an additional 28 percent are already executing against one.

The population of those still on the fence about digital transformation is dwindling, as mid-market natural resources executives are set to increase spending in the coming year near universally: a whopping 96 percent plan to increase their digital budgets over the next year—most (88 percent) between 1-9 percent. This measured but undeniable push towards digitization highlights both the unique challenges facing middle market energy companies, who must stay lean and efficient to operate in an increasingly resource-constrained world, and the unique opportunities provided by these new technologies to help increase said efficiency.

This dual imperative for innovation and efficiency is reflected in the most popular funding strategies for digital investments by mid-market natural resources organizations: working capital is the most popular financing source, cited by nearly 60 percent of respondents. Further highlighting the priority these organizations are putting on digital transformation, 52 percent are planning the use of a sale or divestment to fund their investments, while 28 percent plan to use R&D credits to finance their digital innovation. The latter is an increasingly enticing opportunity for companies thanks to the Tax Cuts and Jobs Act of 2017, which repealed corporate alternative minimum tax (AMT) and limits generating net operating losses (NOL). As a result of these changes, some businesses now have the opportunity to use the R&D credit to recoup a portion of the cash invested in developing or improving new technologies.

If claimed appropriately, R&D credits can provide meaningful cash savings for companies of all sizes, from entities with one employee to one with thousands. R&D credits can enable companies to offset their federal and state tax liabilities by up to 20 percent of their qualified spending on innovative activities. Even if companies are not paying taxes, they can still benefit from R&D credits. For example, many states will pay the value of the credit. Additionally, the federal and state credits can be carried back or carried forward to earlier or later tax years, when they could be used to offset past or future tax liability.

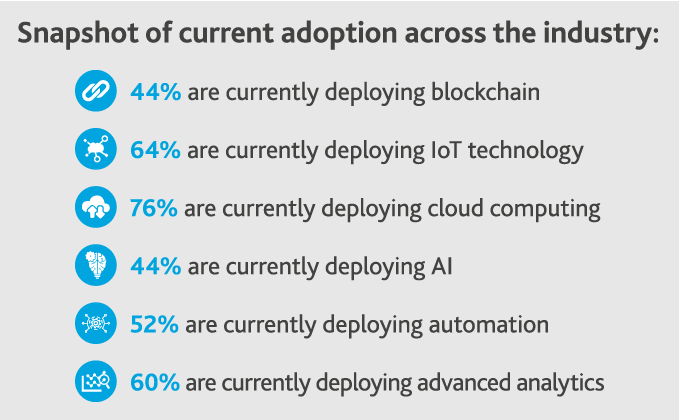

These new emerging technologies that are disrupting industries across all sectors—blockchain, artificial intelligence and machine learning, cloud computing and internet of things (IoT)—have increased potential within natural resources to boost efficiency and operations, in many cases within existing systems. Eightyfour percent said their capabilities to integrate advanced technologies (automation, sensors, data analytics) into their existing operations and infrastructure were excellent or very good—which is likely an overly optimistic view, but points to the immediate benefits that can be achieved by implementing out-of-the-box technology. But, what does adoption of these technologies look like on the ground?

“No business or industry is immune to disruption. Disruption can be turned from threat to opportunity, but only with a combination of foresight and focus. Organizations that don’t take proactive steps to adapt their business to meet tomorrow’s needs will soon be relegated to the archives of history.”

MALCOLM COHRON

National Managing Director and National Digital Transformation Services Leader

Across the Supply Chain

Maintenance and Safety

Boasting a true eagle-eye view, drones are eclipsing traditional inspection methods and facilitating early detection of oil and gas leaks in difficult-to-access locations, like offshore drilling sites. Augmented reality tools are improving safety by enhancing remote service capabilities, allowing experienced specialists to immediately assist underskilled technicians in these isolated locations, instead of needing to travel on-site to inspect the issue. In the midstream sector, drones equipped with thermal imaging systems can help identify points of vulnerability across the nation’s 2.4 million miles of pipelines. By combining this drone imagery with augmented reality to connect specialists to the potential issues—wherever they may be located—companies are better able to identify and prevent worker safety and maintenance issues before they escalate.

At the same time, augmented reality can serve as a proactive tool to improve the training and upskilling process for new and existing employees alike, effectively acting as an upgraded version of the traditional handbooks and field manuals. Instead of looking at static diagrams, inputs and charts, trainees and experienced engineers can learn while applying their new skills in a guided, simulated environment—updated with real-time data—for improved safety outcomes.

Increased Connectivity

Increased data integration and information sharing up and downstream could allow companies to adjust production levels in real time, based on inventory data from storage facilities, rate of distribution and forecasted demand.

Upstream

A core part of exploration, seismic imaging is a process already rooted in data analytics and 3D visualization models. Exploration and production (E&P) companies moving into the next generation of seismic imaging are experimenting with 4D models that integrate production data to map changes in reserves’ oil and gas levels. These advances aim to more precisely pinpoint the quantity of resources and the lifespan of each well.

The digitization of drilling processes is a potential gold mine for oilfield services (OFS) firms. Adoption of these technologies is growing among E&P companies due to their numerous benefits and applications, including:

-

Software sensors to determine which drilling method combine the right mixture of sand, water and chemicals to maximize a well’s output.

-

Automated drillers to increase production and reduce costs.

-

Drilling equipment embedded with smart sensors to collect data.

The X-Factor

Integrating data collected from disparate drilling tools, often housed by different OFS vendors, allows for the analysis of the full picture of a company’s production.

Midstream

Key areas of transformation include data integration and automated flows to track inventory levels and real-time monitoring systems and process controls across the supply chain.

Equipping railcars and tracks with smart sensors and thermal detectors can provide real-time geolocation data and monitor crucial safety features to minimize the risk of derailments, and preemptively identify areas of repair for near to real-time maintenance.

Pipelines with smart sensors can detect leaks early and monitor variables such as pressure, temperature and any deformations in the pipeline’s infrastructure.

Downstream

Smart sensors and cognitive solutions enhance measurement, monitoring and management of the refinement process from raw to finished goods for increased safety and functionality.

Predictive analytics equip companies to forecast demand with greater accuracy, seamlessly communicate data throughout the supply chain and automate production levels.

For the early adopters that have already begun investing in digital transformation and technological advances, the investment is already impacting their bottom lines. The ROI of digitization and digitalization for natural resources companies was supported by the survey findings. The industry is seeing higher than average returns on their digital investments compared to companies their size in different industries—and significant returns in their own right: 84 percent saw an increase in profitability in the last 12 months due to their digital investments. Nearly 1 in 3 executives reported an increase of 10 percent or more.

While the opportunities from—and need for—digital transformation in natural resources are clear, the process of adopting and maintaining these technologies is not without challenges.

In order to successfully make the jump, organizations must keep these two key factors in mind:

A skilled workforce is vital to both develop and maintain a company’s digital transformation, yet only 44 percent of organizations are implementing training to upskill employees as a component of their plans to enable and ensure employee adoption—compared to 62 percent of their peers across the middle market. While 36 percent plan to hire new talent to help drive digital transformation, training existing employees is key to success as well.

Natural resources companies face a tough balancing act: pursing digital transformation and minimizing expenditures, all the while ensuring the resources to mitigate the risk of current and future cyberattacks. On top of this challenge, the industry (particularly oil and gas companies) is already a prominent target for such attacks—spurred by geopolitics, ideology, as well as simple opportunism. While the international oil sector is expected to increase investment in cyber defenses by $1.9 billion this year, many energy players are underfunding cyber. And mid-market companies are often behind the power curve in implementing and maintaining cybersecurity controls. Middle market natural resources companies cited cybersecurity as their top challenge to move forward with new digital initiatives. Similarly, cyberattacks or privacy breaches took the top spot on the list of ongoing digital threats to their organizations.

Conclusion

Digital transformation may be a long and winding road, but it’s a journey that middle market natural resources organizations can’t afford to delay. While most have already begun, for those that have yet to start, or are just beginning, the window of opportunity to catch up to the rest of the market is quickly closing.

If not available internally, digital transformation leaders should seek the counsel of outside experts—preferably those with deep industry expertise—who can assess their actions with an objective eye and counsel them through all the changes. Ideally, their journey is one of incremental improvements to advance digital capabilities and maturity, with every increment along the way framed against a clear business case and immediate ROI.

It won’t be an easy process, but in an uncertain future, digital is a definite. Those that infuse digital transformation into their cultural DNA will reap the rewards, while those who don’t risk being left in the dust for good.

SHARE