The Resilience Playbook for Manufacturers: Persevering Through a Pandemic

Well before the coronavirus was on most Americans’ radars, it was already on the minds of American manufacturers. For an industry so dependent on foreign-made parts and materials, the rapid spread of the virus on Chinese soil—and subsequent containment measures taken by Chinese authorities—had near-immediate domestic repercussions. When government authorities closed off the city of Wuhan in late January, with several major industrial hub cities following suit, many Chinese factories were forced to temporarily shut down or curb production. Hours, even days, were added to transportation routes due to blocked roads or health inspections. Manufacturers with in-region production facilities struggled with labor shortages and insufficient personal protective equipment. In the U.S., supply shocks were felt almost instantaneously—a preview of the business nightmare that would soon take hold stateside.

What has changed in the weeks and months since the first confirmed case in the U.S. is that the virus now feels deeply personal. At stake are both lives and livelihoods. Protecting frontline workers from infection has become the priority for manufacturers, regardless of their current financial condition. But for manufacturers of essential goods, closing factories and allowing employees to work from home isn’t necessarily an option.

Not every manufacturer has been able to avoid mandated shutdowns of “nonessential businesses,” and they face a different set of quandaries. They are at the mercy of individual states’ reopening plans. In states that have already lifted bans on nonessential manufacturing, manufacturers must weigh how quickly they can bring back furloughed employees safely. Meanwhile, the economic fallout is severe: Sales are down, and inventory either isn’t moving or is depleted.

The coronavirus crisis is really a tale of two manufacturers, with “essential” manufacturers in one camp and “nonessential” manufacturers in the other. Manufacturers of consumer nondiscretionary items like toilet paper or cleaning supplies may have actually experienced a spike in sales due to panic buying and stockpiling. Sales have also surged for manufacturers of medical equipment and supplies. On the other side are manufacturers of consumer discretionary goods and industrial suppliers to nonessential business sectors, who likely would have taken a financial hit even without forced factory closures.

That isn’t to say essential manufacturers have it easy, or that nonessential manufacturers are doomed. Supply chain disruptions and worker safety concerns will continue to plague manufacturers in all sectors. Profit margins will be squeezed. The manufacturers that benefitted from panic buying and critical shortages will likely see demand normalize. Nonessential manufacturers may be able to secure an exemption, repurpose production lines, or when factories finally reopen, tap into a niche customer interest that results in products flying off the shelves. Examples of innovating under crisis conditions are cropping up in every sector.

There will be winners and losers, however. The coronavirus crisis is not just a crisis of health, but a crisis of the economy—and it is in times of economic crisis that companies pull away from the pack or begin a decline that may be slow or rapid. Actions matter: It’s what you decide to do now that determines whether you sink or swim.

Bracing for Recession

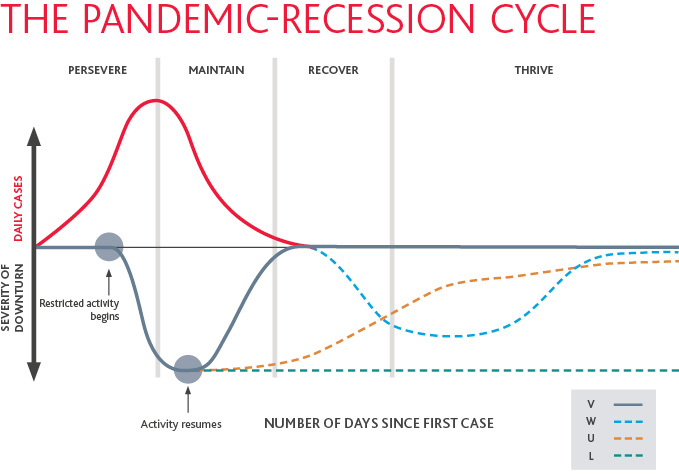

After 10-plus years of sustained economic growth, the U.S. economy officially fell into recession in February 2020, according to the National Bureau of Economic Research. Now the question is just how long the downturn will last and what recovery will look like. Predictions vary widely, but generally speaking, economists anticipate the recession will follow one of four shapes:

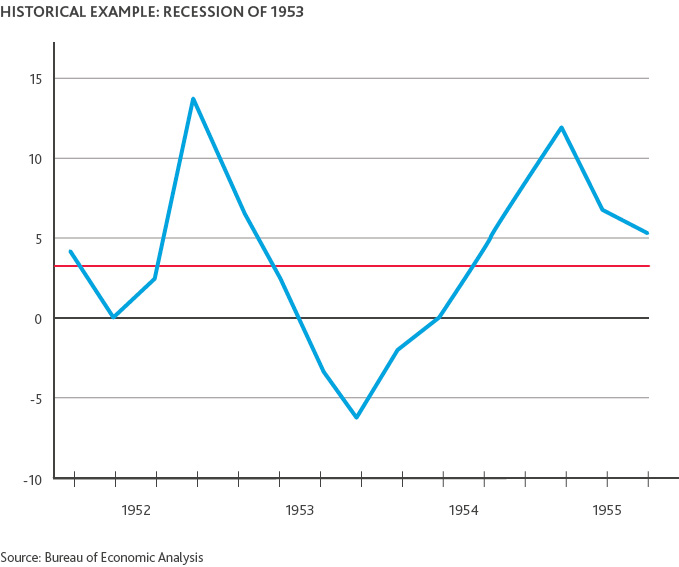

V-shaped: Considered a best-case scenario, in a V-shaped recession, the economy experiences a rapid, steep decline and then rebounds just as quickly. The U.S. would be in for only a few quarters of pain before business returns to pre-pandemic levels. A V-shaped recession is contingent on quickly containing the spread of COVID-19 and the ability of workers who lost their jobs during the lockdown to quickly regain employment.

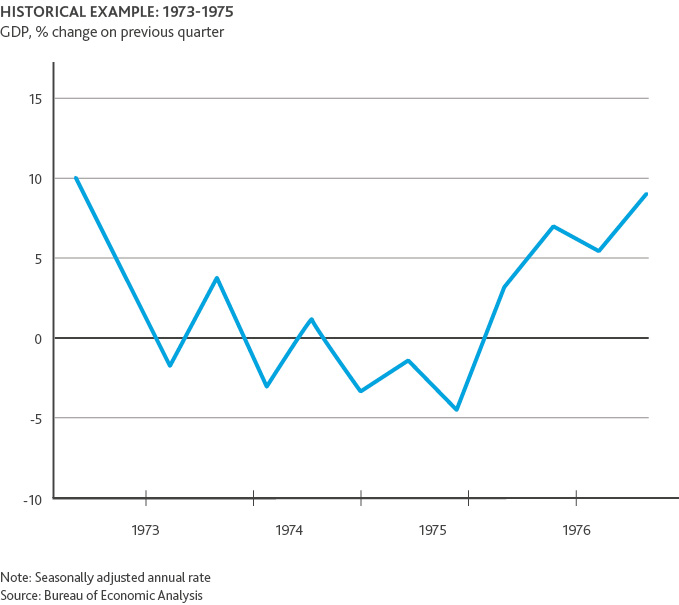

U-shaped: In a U-shaped recession, the economy experiences a steep decline, then stagnates for a longer period of time (several months to a couple years) before gradually recovering. In practice, the trough of the recession usually has a few false starts and stops before a slow recovery takes hold.

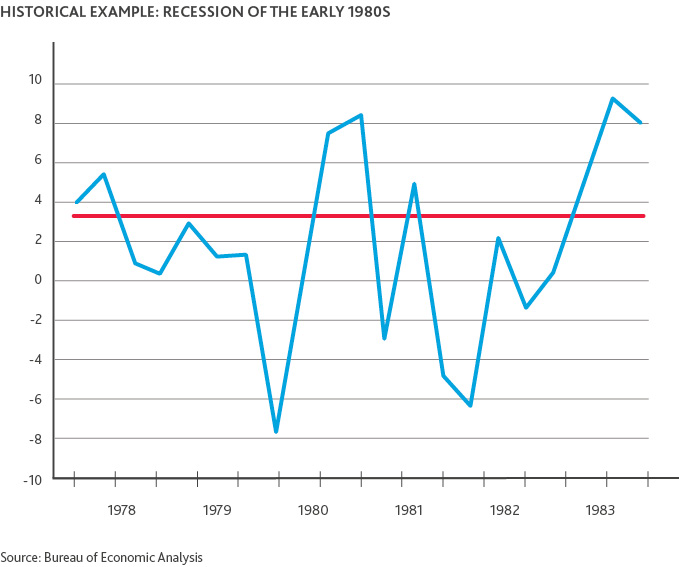

W-shaped: Also known as a double-dip recession, in a W-shaped recession, the economy temporarily rebounds after a short contraction, but then dips into a second downturn before fully recovering. Many economists fear that a second pandemic wave in the fall could cause a second steep decline midway through recovery from the economic impacts of the first.

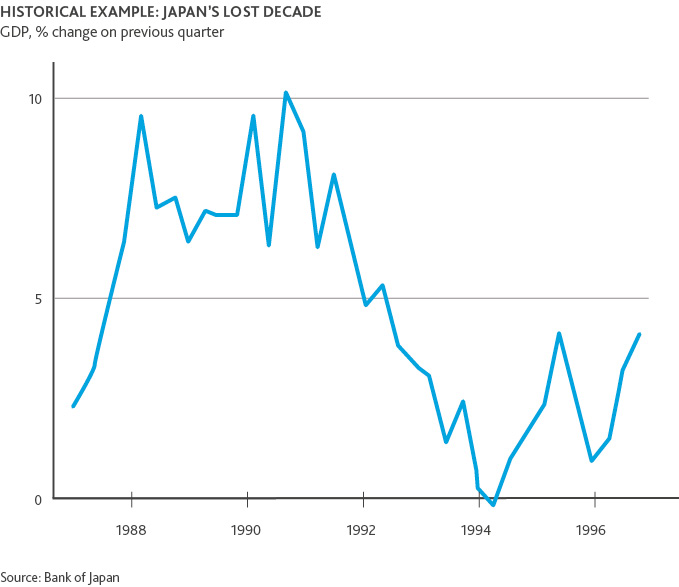

L-shaped: In the worst-case scenario, an L-shaped recession—also known as a depression—returning to the pre-recession rate of growth takes several years or more. The National Bureau of Economic Research recently published research arguing that an L-shaped recession is the most likely scenario based on their expectations of unemployment levels remaining high well after lockdown restrictions are lifted.

The R word is a scary one, regardless of what shape it takes. But economic turbulence doesn’t automatically mean disaster, even against the backdrop of a pandemic. It is, however, the great divider between those manufacturers that rise to the occasion and those that don’t. Manufacturers that can shift quickly from a defensive to an offensive posture will outperform their peers. The deeper the recession, the greater the gap grows.

Weathering an Economic Crisis, in Four Stages

From 1969 onwards, the average recession length has been just under 12 months. The duration of the Great Recession in 2008, however, was 18 months. But the current economic downturn is unlike any that has come before it because the genesis is a newly discovered infectious disease, not a failing of the financial system or monetary policy. Because the cause of the downturn is abnormal, there is hope that the recovery will be abnormally quick. But with so many variables at play—not only the efficacy of containment policies, but also society’s adherence to them; the possibility of a second pandemic wave and the extent to which we have built up herd immunity; the timely development of a vaccine and sufficient production capacity—the road to recovery remains uncertain.

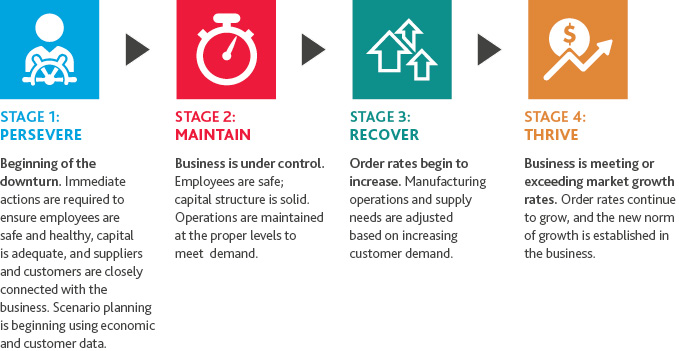

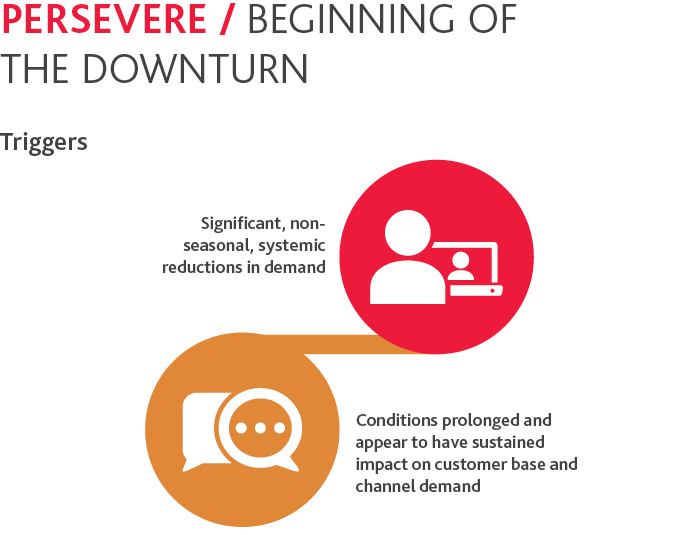

Though we don’t know what precise shape it will take, based on the behavior of past recessions and past pandemics, we can break down the current recession into four general stages. The duration of each stage will vary based on the course of the virus, the trajectory of the economy, and the severity of the financial impact on the individual manufacturer. Some manufacturers may already be at the point where they can transition from triage mode (the “persevere” stage) to performance optimization (the “maintain” stage). Others—especially those who have temporarily ceased production—may have to stay in triage mode a little longer.

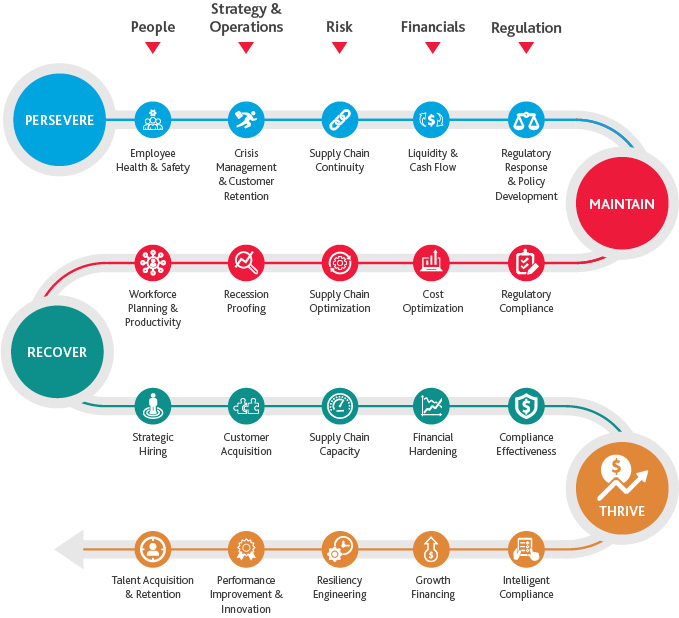

In the figure below, we outline the practical levers manufacturers should consider to expedite recovery and gain a competitive advantage at each stage of the pandemic-recession cycle.

In this first of a four-part series, we will focus on the moves manufacturers should make during the “persevere” stage to get from remediation to maintenance mode.

Employee Health & Safety

Good manufacturers prioritize the health and safety of their frontline workers above everything else. That means confronting the very real possibility that even after lockdown restrictions are lifted, social distancing protocols will likely need to remain in place. The downside of “flattening the curve” is that, barring the mass roll-out of a vaccine, the pandemic may last for as long as 18 months until we’ve achieved a baseline level of “herd immunity.”

While prevention is the goal, manufacturers should be prepared for the worst. Manufacturing plants have proven fertile ground for the virus to spread; several large outbreaks in the U.S. have been linked back to food processing plants. Even with the most comprehensive approach, there is simply too much room for human error.

Mental well-being is another critical component of workforce health and safety that is often overlooked. For onsite workers, going into work can feel like going to war. The anxiety of potential exposure to COVID-19, along with the stress of job insecurity at a time of record unemployment, can be debilitating, resulting in absenteeism or drop-offs in productivity. For employees who can work remotely, social isolation and loneliness can cause depression and cognitive decline. Employers have a responsibility to their people to do everything they can to alleviate fears and show empathy.

Here are the key actions manufacturers should take to protect their workforce:

| Conduct a workplace risk assessment across all facilities to ensure at-risk employees are adequately protected. | ||

| Readjust non-essential hours and evaluate work-from-home options for employees who can perform their jobs remotely. | ||

| Introduce staggered shifts and confirm tiered workforce plans to ensure essential workers are protected. | ||

| Provide essential workers with personal protective equipment along with training on how to properly use it. | ||

| Encourage sick employees to stay at home and consider instituting temperature checks throughout the day. | ||

| Ensure employees’ workspaces are at least six feet apart and minimize crossing of paths. | ||

| Put cleaning and disinfection protocols in place, following Environmental Protection Agency (EPA) and Centers for Disease Control and Prevention (CDC) guidance. | ||

| Where social distancing is not feasible, consider installing protective barriers and limit activity duration. | ||

| Develop an infectious disease response plan for mitigating potential exposure or a confirmed case. | ||

| Foster a positive workplace culture by communicating frequently and transparently and keeping employees connected to the company and to each other from a physical distance. |

The Offensive Play

Look for long-term solutions for social distancing rather than short-term fixes. How can you redesign workspaces on the shop floor to maximize productivity while ensuring appropriate physical distancing? Can you facilitate remote oversight so line managers don’t have to supervise employees in person? Is there manual labor that can be automated? Making these moves now will ultimately be less expensive than the added safety costs of keeping humans on the frontlines under current working conditions.

Liquidity & Cash Flow

This crisis requires manufacturers to act quickly. While your immediate focus needs to be on keeping your employees safe and healthy, you also need to keep your business financially stable. Expect cash flow to slow from reduced billings. If your business is facing a sales slump, you need to act now to protect your cash balance and offset declining revenues. If your business is seeing a surge in sales, don’t overlook increased operating expenses and the impact on profit margins. Regardless of your current sales levels, conserving cash will be key as we head deeper into the recession. A revised cashflow projection is essential for liquidity and business planning and allowing difficult decisions to be made as early as possible. You’ll also need to evaluate the potential impacts to your financial statements to assess your ongoing capacity to fund your minimum debt service obligations, as well as understand whether borrowing more capital would conflict with any existing debt terms and your ability to meet any financial covenants within your debt agreements.

Most manufacturers operate lean in the best of times, so there may not be much extra fat to trim. Everything in the budget is subject to review. More effective working capital management can also help better align the revenue and payment cycle, reduce overhead costs and free up much-needed cash to cover expenses. In addition, manufacturers should consider leveraging any tax strategies that can help lower their total tax liability and increase cash flow.

Short-term measures to improve liquidity and cash flow include:

- Conduct a cost reduction analysis, looking at cost structure and drivers. Distinguish the critical “good” costs from the non-essential “bad” costs.

- Identify quick-win savings opportunities.

- Involve tax expertise proactively to generate immediate cash flow.

- Take advantage of tax relief provisions included in the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

- Control variable costs and revenue/receivable risk.

- Liquidate obsolete or discontinued inventory.

- Negotiate discounts and longer payment terms with suppliers.

- Consider drawing down on your revolving credit facilities as a precautionary move.

- Negotiate a debt service holiday or covenant relief.

- Review your business interruption insurance coverage and establish claims milestones.

The Offensive Play

Deploy war-room analytics to get a 360-degree view of your financial health. Real-time visibility into your liquidity position and net working capital can help you ensure the accuracy of your cash flow forecast and identify potential cash crunches before they become an issue. Monitor procurement costs and track delivery performance overall to identify cost savings and uncover anomalies. See how you’re tracking against individual project budgets as well as budget roll-ups to prevent overspending and make sure resources are appropriately allocated.

Revenue & Customer Retention

COVID-19 has triggered radical shifts in demand. Consumer spending is down on the backs of widescale unemployment and reduced salaries, and corporate budgets have been slashed. Masks, cleaning supplies, packaged foods and—oddly enough—bread machines are flying off the shelves. Toilet paper is the new Tesla. On the other side of the coin are commercial products, luggage and most categories of apparel, for which there is little use in a shut-in economy. Manufacturers should take a hard look at their customer base and identify at-risk customers along with their level of exposure to them. If your ability to safely drive revenue in the next two to four months is in question, you should take preemptive measures to mitigate potential losses.

COVID-19 has also compromised manufacturers’ ability to maintain pre-pandemic levels of customer service. Customers once accustomed to same-day delivery options are now contending with two-week-plus wait times, fulfillment delays and product stockouts. Frustration is mounting. Even manufacturers of high-demand products like medical supplies and household staples, which have been largely insulated from a decline in new orders, need to worry about customer dissatisfaction. Raising prices and charging additional fees might provide a short-term revenue boost but won’t win you any lifelong supporters. To retain customers through a recession, customer loyalty is key.

Consider the following strategic actions to improve customer retention and mitigate revenue losses:

- Evaluate customer risk profiles and accounts receivables exposure.

- Expect some degree of loss; don’t waste resources fighting for every dollar.

- Grade customers on a letter scale of A to D using the 80/20 principle, and focus on improving relationships with your A’s and B’s.

- Reach out to priority customers to understand their situation, and adjust demand and collection plans accordingly.

- Revisit your pricing model to provide more flexible and affordable options (more aggressive pricing discounts may backfire in the long run, so tread carefully).

- Streamline operations to focus on products and distribution channels in highest demand.

The Offensive Play

If you’re experiencing an unsustainable decline in demand across the board, consider pivoting to a new product better suited to the current economic landscape. Pivoting production is challenging under the best of circumstances, and even more difficult amid a pandemic. To be economically feasible, focus on repurposing existing infrastructure and capabilities rather than rebuilding. Look at products with similar production processes and raw materials. Keep in mind that the more complex the production process, the harder it is to make the switch, and the longer it will take to become revenue‑generating.

Supply Chain Continuity Planning

From movement restrictions and shuttered production sites to demand surges to slumps, the coronavirus has wrought havoc on global supply chains. American manufacturers are still reeling from supply bottlenecks stemming from China’s COVID-19 response in January and February, which have since been compounded by restricted production activity in other global manufacturing hotspots, including here in the U.S. Unfinished goods sit idle on factory floors, awaiting the arrival of critical components stuck in transit or out-of-stock. Freight and transportation costs have skyrocketed. Panic buying and stockpiling has resulted in unexpected inventory shortages and capacity issues.

These supply chain disruptions can make it difficult or impossible for manufacturers to fulfill obligations to their customers, at least at the speed they’re used to. The way manufacturers navigate these challenges and manage product shortages or delays will be an important dimension of longer-term brand preservation.

To mitigate supply chain disruptions and minimize future supply chain risk, manufacturers should:

- Assess supply chain resilience. Introduce a supply network resiliency scorecard to evaluate current risk mitigation processes against associated goals and determine what corrective actions need to be taken. Your scorecard should include critical path analyses, interdependencies, product and service priority levels, value-at-risk and recovery time objectives.

- Mitigate supplier risk. Screen suppliers for interruption risk and categorize them based on importance and level of vulnerability. Create a list of critical suppliers “to watch” and shore up any single points of failure by identifying alternate suppliers and transportation modes and exploring strategies such as flexible contracting and multi-sourcing.

- Monitor demand signals. Maintain a daily pulse of customer demand shifts to obtain a real-time view of finished goods and inventory needs. Consider risk pooling strategies across parts or products to reduce demand variability and uncertainty. Determine the right cadence to update demand forecasts—likely at a higher frequency than you have previously.

- Communicate with key suppliers. Communicate frequently with suppliers to ensure their ability to serve your business. If you need to delay, increase or cancel inbound supply orders, understand there may be contractual implications for changes to orders.

- Review your insurance coverage. Make sure you understand the extent of your contingent business interruption insurance coverage. Pay close attention to whether your policy contains a communicable disease exclusion.

The Offensive Play

If there is one thing the coronavirus has taught us about managing a global supply chain, it’s that overreliance on a single geography is a massive liability. Get ahead of the game and look for ways to geographically diversify your supply chain, including, where it makes sense, opportunities for repatriation back to the U.S. Regional supply chains give you more flexibility when it comes to procurement and manufacturing—and there may be tax benefits to boot.

Regulatory Response

Essential vs. Non-Essential

The primary regulatory concern for manufacturers at this stage is whether they qualify as an “essential” business. Over 45 states have issued orders closing all “non-essential” businesses within their borders to flatten the COVID-19 infection curve. Manufacturers deemed nonessential by their state’s closure order can appeal the decision through the state-run appeal process. Manufacturers may also be able to pivot their production so that they fall within the essential category and avoid mandatory shutdowns. For instance, some large manufacturers of apparel and footwear that wouldn’t normally be considered essential have pivoted to produce face masks and scrubs.

The good news for those who have not been able to secure exemptions is that many states in the manufacturing heartland are loosening these restrictions. Michigan, for example, has permitted nonessential manufacturing to resume starting on May 18. Reopening, however, is contingent on following a multitude of state requirements to protect workers from the spread of COVID-19. Manufacturers should closely monitor states’ timelines for reopening and put a plan in place to ensure compliance with state-specific business requirements for resuming operations.

The Offensive Play

For manufacturers with production facilities in states with longer timelines, look into temporary options to redistribute production to another state where you already operate. If you have Tier 1 or Tier 2 suppliers in states with more stringent restrictions, you may need to identify second sources.

Economic Relief Programs

Another regulatory priority for manufacturers is navigating government stimulus packages to understand eligibility as well as terms and conditions and ongoing responsibilities. Manufacturers of all types and sizes are likely able to leverage some aspect of the economic stimulus packages passed by the federal government. Multinational manufacturers should also look at what additional opportunities may be available in the countries in which they operate.

Under the CARES Act, two disaster loan programs—the PPP and the Economic Injury Disaster Loans (EIDL) program—are available to smaller manufacturers via the Small Business Administration (SBA). For smaller manufacturers facing financial strain as a result of COVID-19, these forgivable loans can help offset a variety of costs. The PPP provides funds to pay up to eight weeks of payroll costs, including benefits. To qualify, your company must employ 500 workers or fewer (both full-time and part-time), or you must meet the industry size standard set forth by the SBA.

EIDL loans can be used to cover any necessary financial obligations. Initially made available to any small business with 500 workers or fewer for up to $2 million in loans, the program has since been significantly curtailed due to limitations in funding. As of May 4, EIDL applications are limited to agricultural and “agriculture-related” businesses only—which may include equipment suppliers to agricultural businesses and food production. Applications from other businesses submitted before the legislative change will be processed on a first come, first serve basis. The maximum borrowable amount has also been reduced from $2 million to $150,000.

Small to large manufacturers may also be eligible for low-interest loans under the $500 billion economic stabilization plan included in Title IV of the CARES Act. This includes $46 billion specifically allocated for air carriers and businesses deemed critical to national security—which are likely to include “critical manufacturers” as defined by the Department of Homeland Security—and $454 billion for the rest of the marketplace. Unlike the SBA programs, these loans must be paid back and come with public disclosure requirements.

Most recently, the Federal Reserve unveiled a new $600 billion Main Street Lending Program available to small and midsized businesses with up to 15,000 employees or up to $5.0 billion in 2019 annual revenues. Principal and interest payments on these four-year loans can be deferred for the first year.

Keep in mind that these government loans and incentives come with compliance obligations and significant government oversight and will require ongoing program management to avoid financial penalties as well as legal and reputational repercussions.

The Offensive Play

Eligible manufacturers can apply for loans under both SBA programs as long as they aren’t used to cover the same expenses. Participation in the SBA programs also doesn’t preclude you from taking out a loan under the Main Street Business Lending Program.

Accounting & Reporting

The accounting and financial reporting implications of these government loans, emergency grants and other interventions is an area of interpretation challenge. With so much uncertainty, ongoing assessment of the effects on financial reporting and disclosure requirements is key.

Where there is the most divergence in approach is in the accounting treatment of forgivable loans under the PPP. Participants in the PPP face challenges around eligibility and meeting forgiveness criteria that result in continual reconsideration of accounting and reporting decisions. Similarly, manufacturers seeking funds under the Main Street Lending Program must provide certifications to the lender and may be held accountable for material misrepresentations. Manufacturers will need to institute a formal loan compliance program that is continuously monitored for the life of the loan to ensure that none of the loan covenants are breached.

Looking beyond the audit and accounting implications of these new economic stimulus programs, manufacturers should be aware that the operational and financial impacts of COVID-19 may rise to the level of additional required disclosures in company financial statements. Under Generally Accepted Accounting Principles (GAAP), COVID-19 may constitute a “triggering event” for impairment testing of goodwill and long-lived assets. For example, manufacturers that now have excess inventory due to slower turnover may have impairments—especially if any materials come with expiration dates or may no longer be sellable (e.g., seasonal product). When recording revenue, manufacturers may also need to revise variable consideration estimates if promised goods can’t be delivered due to inventory shortages, shipping delays or temporary production halts. If customer collectability risks significantly change due to COVID-19-related financial distress, manufacturers may not be able to recognize that revenue.

In addition, for some manufacturers, there could be going concern considerations that require additional evaluation and discussions with your auditor.

Red flags include:

- Operating losses

- Working capital deficiencies

- Negative cash flows from operating activities

- A need to restructure debt to avoid default

- A need to seek new sources or methods of financing

- A need to dispose of substantial assets

- Work stoppages or other labor difficulties

- Loss of a principal customer or supplier

If your company meets conditions that raise doubt about your business’s ability to continue to meet its financial obligations, you may need make a going concern disclosure in your financial statements—even if you have a solid plan in place to alleviate the issue.

The Offensive Play

Automation can help lighten the load for the finance and accounting department. By automating manual audit and accounting tasks and streamlining processes, finance professionals can redirect their focus to more strategic work without compromising quality.

In professional sports, it’s often said that defense wins championships. But unlike the world of sports, where year after year, the rules of the game remain largely unchanged, the rules of business are in a constant state of flux. The only way to come out on top in an environment of uncertainty is to take offensive measures. With the right combination of foresight and strategic action, manufacturers can come out of the downturn stronger, more agile, and more innovative than before.

Manufacturing MVPs: Persevere Stage

A snapshot of the best offensice plays to combat the negative effects of the pandemic.| The Player: Milliken & Company The Play: The global textile manufacturer is increasing domestic production of personal protective equipment, including scrubs, lab coats and privacy curtains. |

||

| The Player: Copper Bottom Distillery The Play: The distillery shifted from spirits to producing hand sanitizer and is donating it to organizations in its community. |

||

| The Player: Long Island Racing The Play: The machine and engine shop has pivoted from producing motorcycles and racing machines to 3D-printing reusable face masks and shields. |

||

| The Player: Ohio’s COVID-19 Manufacturing Alliance The Play: The coalition of Ohio-based manufacturing companies has retooled its operations to produce between 750,000 and 1 million face shields and upwards of 1 million test swabs per week. |

||

| The Player: Rolls-Royce The Play: The luxury carmaker launched Emer2gent, a new alliance that brings together major global brands and tech companies to accelerate economic recovery through information sharing and data analytics. |

||

| The Player: Delkor Systems The Play: The advanced robotics packaging equipment manufacturer, which is seeing a surge in demand, is paying double time for hours worked over 40 to thank employees and keep morale up. |

SHARE