BDO Healthcare CFO Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Treating Healthcare Distress

Table of Contents

- Introduction

- Reimagining the Hospital

- Innovating to Pay for Transformation

- Leveraging Data to Reposition for Growth

- Talent-Tech Conundrum

- Investing for a Value-Based Future

Introduction

Facing Recession, Healthcare Turns to Specialty Financing & Primary Care to Secure Value-Based Future

When it comes to healthcare—at the center of the 2020 presidential election—patients aren’t the only ones in distress over how to pay for it. Their providers are too.

Providers have high fears of a near-term recession amid increased concerns about reimbursement uncertainty and liquidity challenges, according to BDO’s Treating Healthcare Distress, a survey of 100 CFOs at provider organizations.

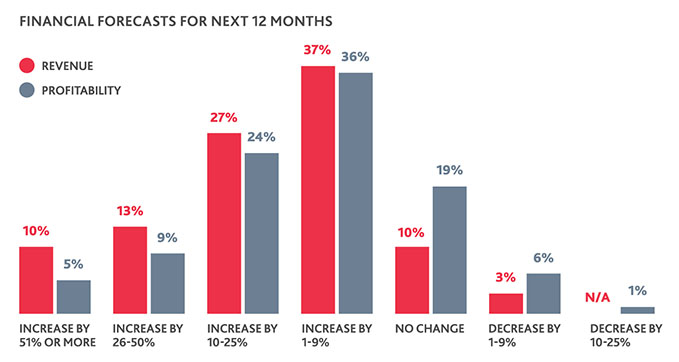

Though overall healthcare CFOs’ financial projections for 2020 are positive, most forecast just moderate increases in the 1-9% range in both revenue and profitability categories. In a tight liquidity environment, such ranges are easy to knock off course in an industry as uncertain as healthcare.

Market triggers like a potential recession and ongoing changes to reimbursement models are likely to put increased strains on providers—fears that show in healthcare’s overall outlook.

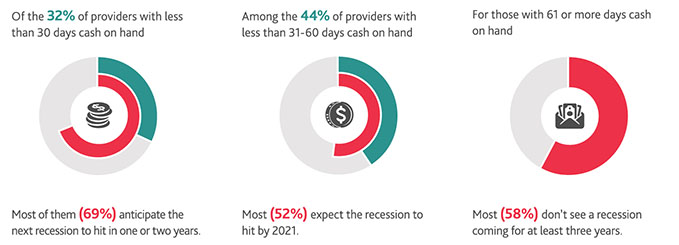

More than half (55%) of healthcare organizations anticipate a recession in the next year or two, and risks related to government reimbursement is the top concern for more than one in five (23%). More than three fourths (76%), meanwhile, have 60 days or less cash on hand.

Variables like instability around the Affordable Care Act (ACA), increased technology expenditures required to successfully adopt electronic health records (EHRs), and uncertainty around incoming payments because of fluctuating deductibles and patient copays have made having greater levels of cash a business imperative for healthcare.

They’ve also made it more difficult for providers to reach those levels.

To mitigate concerns around liquidity and gain access to capital needed to make investments in infrastructure, talent, and research & development (R&D), providers are tasked with reimagining themselves.

For many of them, they’re turning to transformative capital to do it.

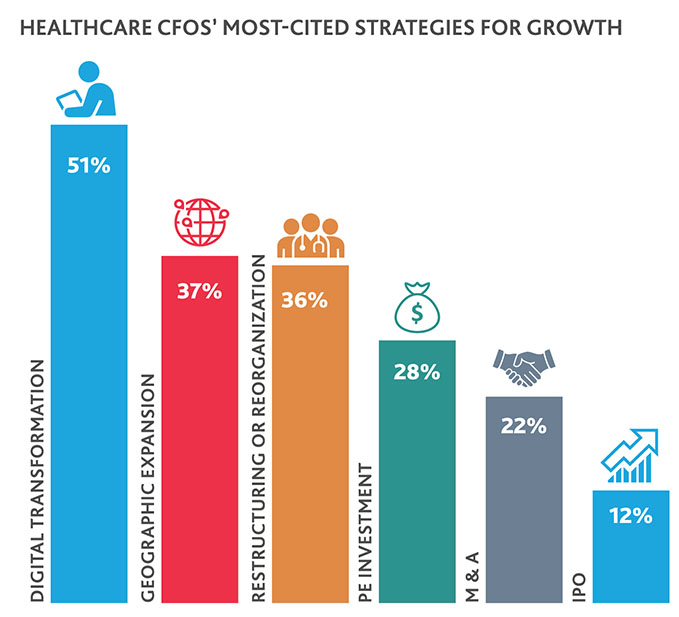

Bank loans or lines of credit are organizations’ largest financial obligation, cited by a plurality (42%) of healthcare CFOs. At the same time, 36% plan to undergo restructuring or reorganization in 2020, and more than a fifth (22%) anticipate pursuing M&A.

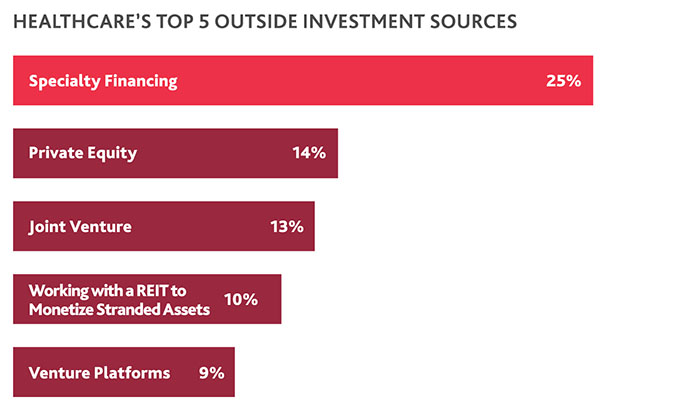

That may explain why the industry, unable to depend on once-stable-and-now-uncertain revenue sources but still in need of new capital for the top transactions they’re planning to pursue, is turning largely to specialty financing.

Specialty financing is the top outside source of investment healthcare is considering, with a quarter (25%) of CFOs citing it. Private equity (14%) and joint ventures (13%) round out the top three sources of external investment healthcare organizations are considering.

“When healthcare organizations pursue specialty financing, it can mean that they’ve reached their traditional credit limit and are in a distressed situation, and/or they’re considering a different type of transaction or investment structure with needed industry expertise from their lenders. Healthcare CFOs’ focus here demonstrates the increasing complexity of the environment under which healthcare organizations operate, and how the appropriate capital infusion is needed, aligned with shifting operating models.”

|

PATRICK PILCH, CPA, MBA Senior Managing Director and National Leader of The BDO Center for Healthcare Excellence & Innovation |

Challenges around liquidity may also be fueling greater fears of a recession.

Reimagining the Hospital

No matter which group of providers has the crystal ball, when the recession does hit, hospitals—at least in their traditional form—will feel its pinch more than other providers.

Even absent a recession, traditional hospitals face downward pressure on their revenues, as evidenced by the 30-a-year pace at which they’re shuttering. A troika of external pressures is quickening this trend and flipping healthcare from the hospital-centric model that rose out of the Progressive Era back to the prior outpatient- and home-centric system.

The Bundled Payments for Care Improvement Advanced Model, Hospital Value-Based Purchasing Program and Hospital Readmission Reduction Program are examples of how CMS is moving care from fee-for-service models to value-based ones. In the process, hospitals are being stripped of once-lucrative inpatient revenue streams like hip-and-knee replacements, which can now safely be done at outpatient and ambulatory care facilities.

Such programs are large reasons why hospital CFOs make up 73% of the healthcare CFOs who say government reimbursement risk, including from changes to Medicare or Medicaid rates, is their chief concern.

Un- and- Under-Insured Patient Populations Increase Uncompensated Care Risk

Because of the repeal of the individual mandate, hospitals also face increased financial risk around changes to the reimbursement for uncompensated care.

In 2014, under the ACA’s assumed Medicaid expansion, CMS began calculating disproportionate-share hospital (DSH) payments based on charity care and bad debt—together known as uncompensated care. DSH payments were previously calculated based on the number of Medicaid, dual-eligible and disabled patients treated.

Today’s DSH payments, however, are based on uncompensated care data from 2015-2017, which was before the rollback of the individual mandate took effect. Twenty-five percent of large businesses expect this will lead to some of their workers to stop coverage enrollment.

As the uninsured population grows, hospitals, especially those with a greater proportion of Medicaid patients and in states where coverage never expanded or was rolled back, are likely to see greater rates of uncompensated care.

“Uncompensated care isn’t just about the growth of the uninsured populations contributing to increased rates of charity care. It’s also about those who, even though they have insurance, are still unable to cover the costs of their care because of a deductible. We believe that as the number of consumers facing deductibles—and the price of such deductibles—increase, so will hospitals’ uncompensated care risk.”

|

STEVEN SHILL Assurance Partner, National Leader of The BDO Center for Healthcare Excellence & Innovation; BDO Board of Directors Member |

To survive in an environment that’s flipping their traditional business model on its head, hospitals need to flip—or disrupt—themselves from the inside.

More than a third (33%) of healthcare organizations overall are considering transforming their entire operating model in the next year—with hospitals making up 66% of them.

Technology-backed resource optimization is key.

This could mean removing certain physical assets that take up unnecessary space and require unnecessary spend, redesigning or repurposing other physical assets to improve patient experience and flow, or refocusing services offered at certain locations. It also might mean shedding certain physical assets to instead pay for added social and community-building activities, which improve care outcomes—especially among the senior population.

For example, more payers are reimbursing consumers for ride-sharing services to get to appointments, which eliminates the need for as much parking space. Hospitals may consider forgoing costly parking structures and instead offering ride-sharing arrangements or valet services.

“Successful operational transformations must align human experience, operations, technology and space as patients become consumers, and they have more choice and control over where they go for care. For hospitals, this means shifting away from a ‘more is better’ mindset to a ‘refined is better’ approach.”

|

CHRIS COOPER, RN, MHA, MIM Managing Director in The BDO Center for Healthcare Excellence & Innovation |

Innovating to Pay for Transformation

To afford such resource optimization projects amid tight liquidity, many hospitals are pursuing innovative sources of capital.

Civica Rx, a nonprofit collaboration between three philanthropies and 40 health systems representing more than 1,000 hospitals around the country, is one example of how hospitals can generate new sources of capital by creating services or products of their own.

The company, which according to its website is working with the American Hospital Association (AHA)’s Center for Health Innovation, has identified 14 hospital-administered generics as its initial focus and will either directly manufacture them or sub-contract to contract manufacturing organizations.

Leveraging Data to Reposition for Growth

When more reimbursement is tied to the quality of outcomes, healthcare organizations must be able to accurately record the quality—and value of—their care. That makes data the lifeblood of today’s healthcare.

Healthcare CFOs also see the risk they face in not pursuing digital transformation strategies the right way: According to at least one in five (22%), a data privacy breach is the biggest threat their organization faces, followed closely by falling behind on technology innovation (20%). Investing in technology or infrastructure is their biggest 2020 business priority, cited by nearly a third (29%).

Talent-Tech Conundrum

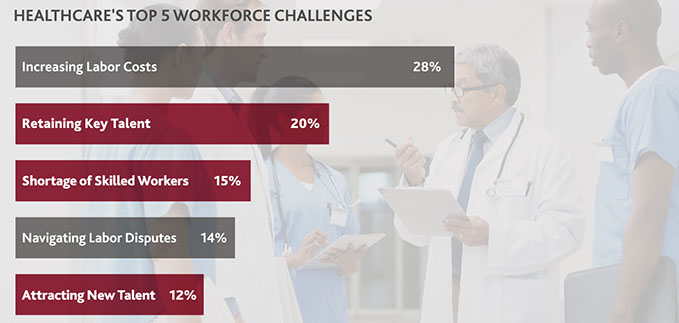

The increased investment in digital transformation, and the routine changes required by clinicians for such initiatives to succeed, is butting heads with another industry priority: workforce recruiting and retention. Cited by 16%, it’s the second-highest cited 2020 business priority for CFOs—and for good reason.

The necessary ramp ups of investment in digital transformation and tools that support it come when the industry faces what Harvard School of Public Health has deemed a “public health crisis.” Today’s physician shortage is expected to reach almost 122,000 by 2032, and burnout among physicians has reached an alarming 78%, according to Fortune.

The physicians that are still practicing, then, are being asked to do more with less: See more patients in less time and with less support, learn new skills and processes to support EHR adoption, and coordinate across various partners on the care continuum to ensure better outcomes and lower costs. They’re also under increased pressure to ensure positive patient satisfaction scores and consumer ratings on sites like ZocDoc, LocalMed and Opencare.

Such challenges are top-of-mind for healthcare CFOs: Retaining key talent, managing a shortage of skilled workers and attracting new talent are among the top five workforce-specific challenges they cite.

Neither area of investment—tech or talent—can survive without the other in today’s healthcare landscape.

To successfully integrate new technologies into the workforce—without further alienating physicians or other clinicians—healthcare organizations must find ways to promote workforce buy-in throughout all levels of their business. Organizational leaders should focus on addressing three issues:

Generational gaps: Millennials, Gen Xers and Boomers are all active in today’s healthcare workforce, with clinicians belonging to Gen Z joining the mix soon. Healthcare leaders must know how to communicate with and understand the learning styles of each generation. Strategies and tactics that may secure buy-in from the Boomer generation of clinicians may not work as well with the Millennial generation and vice versa.

Education and tools: As organizations begin to introduce new digital systems and processes into the workforce, they must provide clinicians with the proper education and tools to understand how to use them with ease. They can also use digital transformation to counteract physician burnout if used to energize the workforce and update facilities lacking modern equipment and technology. For example, though more than half (59%) of healthcare CFOs say they’ve invested in plant property and equipment in the last three years, that still leaves more than a third (41%) who have not. Digital transformation can help fill that gap and manage risks associated with outdated equipment and infrastructure.

Correcting misconceptions: Instead of feeling like new technologies are taking away from their time and creating more administrative work, leaders should frame—and set up for success—digital transformation initiatives as opportunities to improve efficiency, spend more time with patients and innovate to create new products.

“For digital transformation initiatives to have a truly positive effect on physician burnout rates, they should work to simplify process for clinicians, not complicate them further. Generating employee buy-in, ensuring that workforces are receiving the proper training and resources needed to adopt new technologies, and providing regular points of communication between clinicians and organizational leadership are key.”

|

HERMAN WILLIAMS, MD, MBA, MPH Managing Director in The BDO Center for Healthcare Excellence & Innovation |

Investing for a Value-Based Future

Given advances in modern medicine and increasing lifespans, it was only a matter of time before the industry reached the inflection point of demand outpacing capacity.

But now, other pressure points have arisen that are also contributing to healthcare distress: a potential recession, tightened liquidity, declining reimbursement levels, and the need to treat longer-living, faster-growing patient populations with less of a workforce.

Together, they necessitate one clear path forward: a value-based health system centered on preventative versus reactive care.

A key piece of that will be primary care.

The U.S. has historically underinvested in primary care, largely because much of the healthcare payment system still operates on a fee-for-service track. According to the Patient-Centered Primary Care Collaborative, the U.S. has spent 5-7% on primary care as a percentage of total care spending, compared to 14% amongst Organization for Economic Co-operation and Development countries overall.

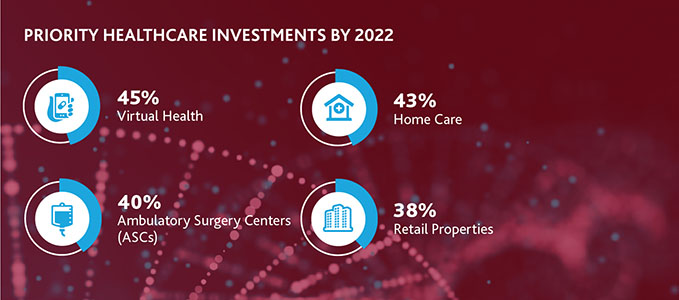

But U.S. healthcare CFOs have plans to change that, according to their investment priorities. More than half (51%) say they plan to invest more in primary care services in the next three years—a step that has been shown to improve patient outcomes and provider burnout, lead to fewer care inequities and lower costs.

Virtual health, home care and community-based health centers, other priority investment areas for healthcare, will also be key to supporting a value-based system—as they improve consumer access to care in less expensive settings.

Telemedicine and remote patient monitoring tools allow hospitals and other providers to offer follow-up care to patients in their homes at more regular intervals without them having to worry about getting to or scheduling an appointment.

“Tools like wearables and sensors, mobile health monitoring applications and virtual reality can help consumers improve overall health, manage chronic conditions and improve feelings of social isolation by serving as connection points to family and friends. Urgent care centers and retail locations—like those now offered by CVS Health, Walgreens and others delving into the healthcare industry—provide consumers less costly, more convenient locations to receive regular, preventative services.”

|

DEB SHEEHAN Managing Director |

Increasing reimbursement for such care will only quicken this trend from facility to home and community.

For example, in its 2020 Medicare payment rule, CMS finalized several orthopedic-related changes, including adding knee replacement and repair procedures as approved services at ASCs, and adding hip replacements and numerous spinal surgical procedures as approved services at hospital outpatient facilities.

“Changes like these will only quicken, as CMS looks to solidify the value-based system. But such changes could have adverse impacts on hospitals, as they open new doors to competitors including ASC management companies and larger orthopedic practices. At the same time, they could also present new opportunities, should hospitals choose to expand their ASC services through M&A or a joint venture with a physician practice.”

|

CHAD BESTE Partner in The BDO Center for Healthcare Excellence & Innovation |

Looking to 2020, consumers and providers have something in common: The system isn’t working for them, and it’s causing them distress.

Both have a shared interest in bringing down costs of (receiving or providing) care.

Providers who follow that shared interest by investing more in areas that promote preventative, more affordable models of care will be the ones who thrive in today’s consumer-driven model—regardless of what 2020 may bring.

Learn how you can realize Shared Care, Shared Value to secure your future.

SHARE