Selecting a Contracting Solutions Partner

We all like to have choices, but having too many can lead to choice paralysis—especially if your options look similar. Often, the decision to buy software is based simply on a presentation that looks great, but once deployed, the product does little to move the organization forward.

The result is a system supported by disparate manual processes that lacks overall adoption and becomes stagnant or misused—ultimately, a wasted investment. With so many packages in the market, how can purchasers make informed decisions that check all the right boxes? Take away the ambiguity by following a selection strategy rooted in fact.

First, the software selection process should balance measurable criteria and qualified insights. Developing and leveraging a fact-based model defined well before any diligence is performed will highlight the solution with the best fit to the enterprise. Establishing measurable criteria is key to assessing the best and most viable choices while singling out those that don’t align with your vision. Having a clear expectation and understanding of what you need makes it easier to weed out what you don’t. Determining a software package that fits with your company’s vision should follow a project format, with a plan and deliverables, and yield a business case that supports a decision for a software partner. In addition, selecting software should not be based on technology alone. A software partner should not only provide the application, but also support and align with your long-term goals as an organization.

Management of the selection process is best accomplished with the same planning and execution vigor as an implementation project. Using a methodology-governed approach allows decision-makers to focus more on tangible elements and less on showmanship.

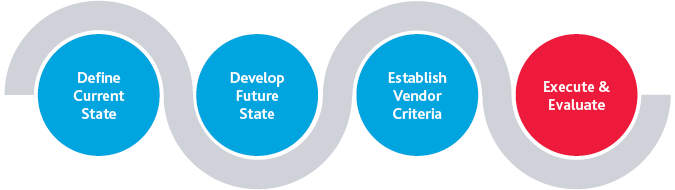

A well-executed selection project contains the following four components developed with the unique requirements of the enterprise at the forefront:

Most software solutions can meet a high percentage of business and technical requirements related to mature contract administration processes. Thus, the primary focus of the evaluation is the vendor’s fit with key business and technical differentiators, and critical and high-priority requirements unique to your organization. A software solution can’t fix broken and inefficient processes on its own. To get the most from a solution, you must first seek to define and understand the current state of your business. To know what to fix, spend time documenting current processes, identifying best practices, uncovering gaps, and reviewing policies that need to be managed with a software solution. Without a map of what you currently do, you’re more likely to mismatch what a software solution should do. Operating procedures morph over time, and the actual execution may no longer follow the original standards developed. This doesn’t mean the processes are incorrect; however, if a new standard has been established, the intended software needs to support it. This type of mapping also gives the personnel directly involved in the process an opportunity to pinpoint current bottlenecks or areas for improvement, both in processes and tools, and to identify work performed outside of a system. Updating this documentation prior to implementation will not only save time, but also ground expectations and possibly highlight important key performance indicators used in the evaluation model.

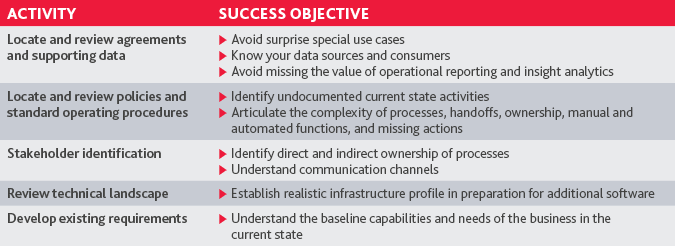

Some key activities and success objectives of the current state definition include the following:

With the current baseline defined and understood, it’s easy to identify where an organization is on the maturity curve and where the growth opportunity lies. Greater business value is achieved as a company matures its processes and toolsets. Use the maturity curve components to determine where your organization lands—this will enable the future state to come into focus. Improved efficiencies and effectiveness transform operational activities into business value through monitoring, compliance and analytics.

Understanding the current state also provides insight to missing factors, processes that should remain intact, and actions that need to be optimized. To develop the future state, determine the baseline by taking the best practices utilized and add desired enhancements to create a set of requirements that drive and support functional use cases. At times, articulating what you think you need can be a challenge, but think big. What would you want to do if you had no limits? What would you automate? What information are you looking to unlock, predict, or manage? The optimized processes should drive the system to support the business operations. First, focus on the gaps identified in the current state. Then, determine the areas of the process requirements that have top priority and the measure of that success. Filling existing gaps can boost a process maturity level rather quickly. Think big, start small, and prepare to scale quickly. With this approach, it may be necessary to establish interim processes and tasks to bridge the current activity to the intended end state.

When defining the future state, it’s imperative that all key stakeholders are involved in the vision. With stakeholder involvement and representation of all constituents, requirements and expectations can be proactively managed during the selection process. Garnering support and sponsorship as part of the future state development activities links the corporate vision to the business implementation.

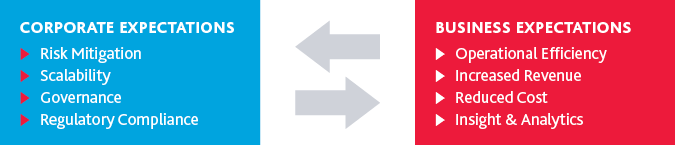

Knowing these expectations can have a significant impact on the direction of the future state definition. This symbiotic set of expectations ultimately drive process change, solution requirements and key performance indicators.

In parallel with the activities above, stakeholders and sponsors should establish the criteria desired in a partner. The creation of a measurement scorecard allows the community to focus on the categories and questions that offer insight into vendors’ capabilities and fit. The evaluation scorecard should align with your unique criteria and be used to review and measure ratings of a vendor’s fit. Selecting a vendor should not be based on functional fit alone. A complete scorecard provides the additional measures by which a vendor should be evaluated to fully meet the needs long-term. The main categories contained within the scorecard cover product function, budget and a detailed vendor profile—including capability, viability, and commitment. Aside from the obvious functional fit to the requirements, the vendor profile should evaluate research & development spend and investment, commitment to the industry or service roadmap, implementation track record, growth potential and more. Determine the components to be measured and the priorities or values that are desired in a partner prior to any product presentations. This ensures a non-biased, balanced approach to reviewing and comparing vendors.

Assigning a weighted priority within each measured area provides a way to emphasize the importance of one set of measures over the other. This allows organizations to make decisions based on the elements that align more closely to the long-term vision established early on.

The final series of tasks are the culmination of the preparation and planning effort completed thus far. Development and execution of the vendor evaluation activities includes the creation of the request for proposal, which contains the list of prioritized requirements with a fit rating and a live demonstration of the software in action, stepping through the functional use cases unique to your business. Gathering a team of subject matter experts to participate in the live demos will provide a pressure test of the vendor’s fit performance. Demonstration feedback should be married with the requirement fit analysis to determine if the solution proposed truly meets the expectations, what it can do to enhance your current state, and what—if any—modifications to the product need to be made. The combination of the traditional requirement list and a user-driven functional use case provides the prospective vendors with a view into the organization and its operating footprint. Developing your requirements and use cases are paramount in matching your needs to the optimal solution. The best use cases include a narration of process and requirements to be implemented within the application. During the demonstrations, vendors walk through the use case verifying the functionality used to execute the process in its entirety. Users should have a guideline of expected results to score the relevance of the demonstration against the required success metrics. Demonstrations are a way for a vendor to prove their application in the use case business setting, and also allow them to showcase their unique value and additional capabilities that can be applied to the organization.

Building a vendor profile based on the scorecard elements, demonstration of use cases and references, feeds the compilation of all results and should highlight the following:

- Unique processes/data/business insight drivers;

- Vendor scores (high and low areas);

- Common areas of strengths and weaknesses;

- Implementation plan approach options;

- Opportunity for process automation;

- Resource advantages, disadvantages, and savings;

- Vendor’s estimated total cost of ownership;

- Vendor’s estimated cost for gap closures;

- Estimated implementation costs

Applying the pre-established evaluation criteria to the profiles and scorecards yields the vendor best suited to support the enterprise. Ultimately, the solution recommendation can be made and would enable the organization to develop the following:

- Justification for the recommendation;

- Tangible metrics to support a business case and develop a detailed budget;

- Implementation/migration timeline for transition to the new application;

- Identification of which data and information needs to be migrated, cleansed and/or archived;

- Estimated timeline for the implementation;

- Estimated resource plan required for implementation;

- Estimated high level costs for the implementation;

- Estimated scope/activity list;

- Gap catalog;

- Key considerations and potential risks;

- System implementation sequencing;

- Organization adoption and/or transition plan

With a thoughtful and well-executed plan, evaluating the choices and deciding on a software partner can certainly be easier. A calculated approach leverages a fact-based model to evaluate each vendor across your key categories to determine the best overall fit and viability of the long-term solution. Establishing the measurement criteria prior to any assessment ensures your non-biased evaluation. Using business insights, use case demonstration feedback, requirement fit results, and references to qualify the analysis within the scorecard yields a result that is a fair and balanced view of the software providers’ landscape.

SHARE