COVID-19 Impact on Critical Accounting Operations Part 2: Positioning Towards the Future

In the first piece in this series, we touched on COVID-19’s impact on finance and accounting operations, including a few immediate actions to take in order to set yourself, your team and your organization up to endure and bridge this crisis.

In this edition, we will address how CFOs, VPs of Finance and Controllers are able to pivot staffing and operations, as well as maintain the organization’s financial wellbeing, in an increasingly remote business environment.

As cities and states begin to re-open, and businesses start to transition into a post- lockdown economy, there will be short- and medium-term challenges that will need to be addressed. If you were able to weather the early storm and ensure that the necessary accounting processes were operational in a virtual environment, you are already off to a strong start.

Taking Stock of the New Normal

By now, you and your teams have likely had several weeks of remote working experience under your belts. As you begin to plan a return to work, the first exercise to go through is to debrief on the past several weeks of remote working, with a goal of identifying three primary categories:

|

|

1. What Worked Well |

|

|

2. What Could be Improved |

||

|

|

3. What Should be Scrapped |

If appropriate, consider debriefing with your team to better understand the challenges and successes associated with the remote working structure, in order to make better decisions around future work-from-home situations—which may come in waves through the fall and beyond as the virus ebbs and flows.

Once you have a sense of areas to sustain, enhance or to discard, the next step is to review your finance and accounting staff structure to determine if you have the correct capabilities to meet the demands of the new normal. For example, many CFOs are seeing an increased need for strategic financial planning and analysis skills in order to adequately budget, forecast and create financial models in an uncertain business environment.

Questions to ask yourself as you review your evolving staffing needs:

-

Does the finance and accounting function at my organization have the people, resources and capabilities needed to continue to operate efficiently and effectively in this new environment?

-

Do I have the right number of people on my team? Do I have the right combination of skills? Are new capabilities needed?

-

If a new hire is needed, whether on a contingent, part-time or full-time basis, how do I conduct the hiring process in an environment where face-to-face interaction is limited or not possible?

-

How will that new hire’s first week go? What does their onboarding process look like? How do I ensure cultural fit when the majority, if not all, of the team is still operating largely remotely?

-

As I identify what I need in order for my team to evolve, what is necessary for me to own in-house or what could I outsource? Outsourcing could mitigate day-to-day concerns about managing your headcount. Is there an opportunity to automate parts of the workflow to alleviate the burden on my existing workforce?

As you determine the right setup for your team, do not forget about equipping them with the tools they need in order to operate effectively from home. This includes establishing common collaboration, video and instant messaging tools, as well as cloud system application in order to gain secure access to your documents and data no matter where you are working. See our insight for more information on remote work tools you can use to stay productive.

This proactivity and flexibility will be increasingly important as future spikes in COVID-19 may force your organization to quickly shift back to remote working, even after lockdown orders are lifted and people make their way back into the office.

Maintaining Your Financial Health

As you plan the next few months, there are several important actions you can take to ensure your business is ready and equipped to ride the turbulence of the new business environment. Particularly in times like these, liquidity and cash flow management are the difference between enduring and going under.

While CFOs are typically front and center in strategic decision- making in the best of times, now is a time for finance and accounting teams to take a leadership role to steady and steer the ship. For most businesses, this is not a time for non- essential expenditures—now is a time for sustainability.

For the foreseeable future, cash (flow) is king.

At the base level, start by ensuring that your transactional capabilities are designed for this remote setting. One way to do that is by asking yourself how your order-to-cash process functioned over the past several weeks and isolating any challenges you faced in getting cash through the door in a timely fashion.

The same goes for vendor invoicing and cash disbursement processes as well as ledger maintenance and monthly financial reporting. These bookkeeping and core accounting functions should be streamlined, organized and running efficiently to make your operations as seamless as possible in the coming months. While drivers of revenue and expenses will vary depending on what industry you are in—particularly in this economic environment—having a good handle on what these are and how you can adjust these levers is important for any Controller or CFO.

On the revenue side, build different scenarios and models on what might happen to your revenue projections depending on the myriad of factors at play. What are the products and services that will be the biggest cash generators as you enter a period of preservation and maintenance? This can be done by reviewing and assessing drivers of sales through the first half of this calendar year.

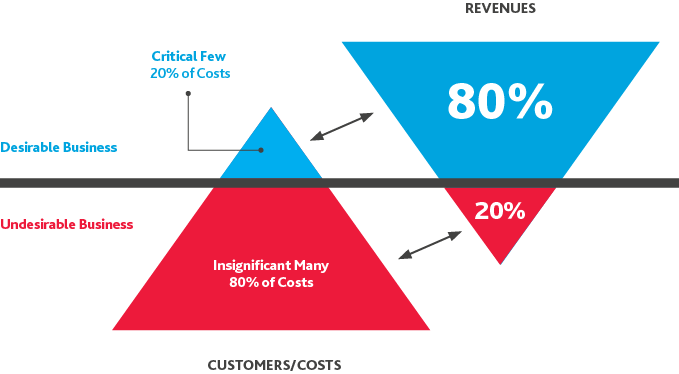

On the expense side, there are certain costs tied to revenue that will be necessary, but there are also costs that you should be reviewing for potential savings. With the 80/20 Rule in mind—the principle that that roughly 80% of the effects come from 20% of the cause—look at the largest expenses first, which are typically workforce, suppliers and facilities.

Spotlight: Cost Optimization with the 80/20 Rule

If everything is a priority, then nothing is a priority. The 80/20 rule—formally known as the Pareto Principle—is simple: 80% of outcomes result from 20% of efforts. For example:

-

80% of sales come from 20% of customers

-

80% of sales come from 20% of products/services/jobs

-

80% of customer complaints come from 20% of products/services

The principle illustrates that a “critical few” things generate most of the profit for an organization. Not all parts of a business are equally profitable.

Applying this methodology to your business in our current environment will prompt pivotal questions that impact all areas of the business:

-

Where do the pockets of high-profit business exist, and how do you maintain those pockets during the pandemic and/or recession?

-

How are key customers’ needs changing given the pandemic? How can you partner with your top customers to address them?

-

If you need to cut costs, how can you do so without impacting your best customers?

-

Can you retool the commercial organization to be better aligned with the key customers and markets?

-

How can you create a level of service that caters to those top 20% of customers to increase their satisfaction and accelerate growth during the recovery?

-

How can you set the right expectations for customers to avoid devoting too much time to those outside the top 20%?

We have already addressed staffing structure and what you can be looking for in terms of skillsets and expertise. In general, think about what your finance and accounting team will need to position itself in the future, and find that talent— whether you hire contingent labor, part-time, full-time or use an outsourced partner. From a cost perspective, there are additional approaches to reduce staffing expenses, such as offering sabbaticals, implementing pay reductions, offering flexible or part-time schedules, reducing certain benefits or 401(k) matching, reducing or cancelling bonuses, and others.

For your suppliers and vendors, work with them to negotiate a longer payment plan that works for all parties involved. If they are willing and able to do so, many vendors understand that providing a few weeks or months of flexibility can make a lot of difference.

Regarding facilities, the idea of office space itself and what the future of work looks like is being discussed widely, as businesses start to think about what a post-COVID office layout looks like. A reduction in office space as remote working is increasingly viable can create a meaningful cost reduction on rent, parking, or other fixed costs. In the meantime, if you are in long-term rental agreements for office space, remaining in a full-time remote mode for your team can save on specialty cleaning vendor costs, for example.

In addition to these primary cost centers, there are several other short-term measures CFOs and Controllers can take to improve liquidity:

|

Halting nonessential purchases |

||

|

Negotiating a debt service holiday or covenant relief |

||

|

Applying for a low-interest government loan |

||

|

Taking advantage of tax relief provisions |

Managing cash flow and strengthening your balance sheet is especially important in times like these. Do everything you can to build up a cash buffer that takes into account uncertainties in the economy, and that positions you to be able to go back into perseverance mode if needed in the months that come. Build and formalize your contingency plans so that you are ready to execute on them in short order.

For a full view of how to manage your business through crisis, consider reading the Resilience Playbook: From Recession to Recovery & Beyond.

The Return to Work

We are now officially operating in a new world. The next 18 months will look very different from the previous 18. As the environment remains uncertain around social distancing and lockdown measures, business leaders should be prepared to deploy and pull back resources as needed. CFOs and other leaders should have plans in place to be prepared for multiple scenarios—whether a full office return, partial office return, or remaining fully remote—and need to be agile in case plans need to switch on short notice.

The immediate term calls for a look at the resources that you have—both human as well as technological—in order to be as flexible and agile as possible to respond to whatever the national, state and municipal guidelines arise as businesses

transition from virtual office to physical locations and possibly back again.

At an initial tactical level, the first task is to ensure the health and safety of the team during any transition. While you may decide to make that transition back to the office a slow and gradual one, there will likely be certain employees who want to venture back into the office as soon as possible.

While an ill employee affects every part of the C-suite and broader company, there are several appropriate steps—with associated costs that the CFO must keep in mind—in case of employee illness and/or contamination of the office. Examine different scenarios, from best-case to worst-case, and develop contingencies for handling the crisis from a workforce cost perspective.

Finding the right return to work strategy will not be easy. It will likely be complicated, messy and without clear boundaries. However, tap your available resources for advice and to brainstorm on strategy—look to your legal partners, your HR team, and your external tax, accounting and advisory partners.

There is no doubt that the various transitions between physical and remote working occurring over the next several months will continue to be disruptive. A CFO, Controller or VP of Finance who has put plans in place and is able to stay flexible, nimble and make smart decisions in a swiftly changing environment will come out of this crisis in the best shape possible given the circumstances.

Pivoting to the Future

Businesses in every region, industry, and stage are experiencing this crisis in different ways. The rate of recovery will differ depending on a multitude of factors, including the decisions that CFOs and other members of the C-Suite make during this time of turbulence.

How management teams are able to react and evolve over the next several months will determine how they are set up to succeed as the economy recovers—whenever that may be.

As we settle into the next few months and think more about what the future holds, the next and final piece of this series will dig into what that “new normal” looks like, and how CFOs and finance and accounting professionals can best position themselves and their organizations moving forward.

SHARE