Top Tax Considerations for Boards in 2021

Tax strategy and planning remain crucial components of a successful, forward-thinking business plan. As the board’s role in overseeing and guiding overall strategy for an organization expands, an understanding of the need for emerging tax technology given changing regulations and the shifting tax landscape is more necessary than ever to keep up with evolving complexities. This year, on top of regularly occurring tax activity, boards and tax executives are faced with continuing COVID-19 complications, anticipated tax changes from a new presidential administration and the global discussion of taxation of the digital economy.

The 2021 BDO Tax Outlook Survey, which polled 150 senior tax executives at companies with revenues ranging from $100 million to $3 billion, reveals areas of risk that boards and management teams should have on their radar. Among the many considerations for directors, the importance of understanding total tax liability has become abundantly clear.

1. Capturing the complexities of total tax liability

Total tax liability is a calculation and a concept. It is an overarching understanding of the sum of all tax exposure by a business at any given time. This amount can continually shift based on deductions, various international, federal, state and local regulations, credits and more. Due to the complex nature of these calculations, a high-level working knowledge is key to assessing management’s design and execution of a successful tax strategy.

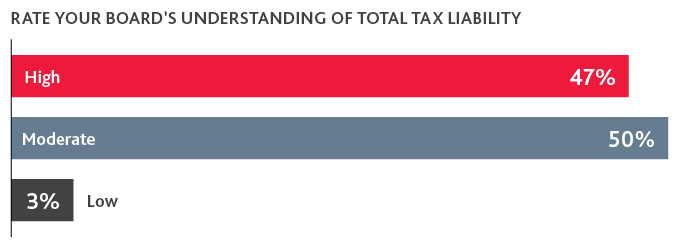

Although nearly half of senior tax executives rate their boards as having a high understanding of the matter, this still signals that those tasked with tax management feel more than 50% of boards require more education on what total tax liability is and how it impacts overall business strategy. Given the upward trend in the amount and complexity of tax liability noted by executives, this gap sparks some concern —73% of respondents said their total liability increased in the past 12 months, and 70% expect the same to occur in the next year.

It’s not just tax executives who are keeping total tax liability top of mind—CFOs also selected it as their top tax challenge in the 2021 BDO CFO Outlook Survey, certifying the need for more focus on the topic across leadership teams. Boards should be dialoguing with management and tax advisors on significant tax matters related to operations and transactions. These conversations allow parties to better understand the impacts of various scenarios, keeping in mind that every business decision has a tax implication. Investing in continuing education in this area is an opportunity for the board to identify risks in a timely manner and assess strategic tax planning when making business decisions.

For more on understanding total tax liability and what it means for business and corporate governance, visit BDO’s Tax Resource Center.

2. Tracking tax regulations and compliance needs

Keeping up with shifting tax regulations is an ongoing responsibility but will likely require an even greater focus following the 2020 election results and an economy that is still seeking to regain strength. State and local governments are likely looking to recoup lost tax revenues, which may lead to stricter regulation around sales that cross state lines and ultimately influence total tax liability.

As the landscape continues to change and potential tax reform remains on the horizon, management and the board’s ability to keep up with fluctuating guidance will be crucial to avoid reporting disputes. These are on the rise—55% of respondents said they had been involved in a tax dispute in the last 12 months, up from 40% last year. Boards are tasked with ensuring management teams are remaining abreast of evolving tax guidance and incorporating it into business planning to reduce both financial and reputational risk.

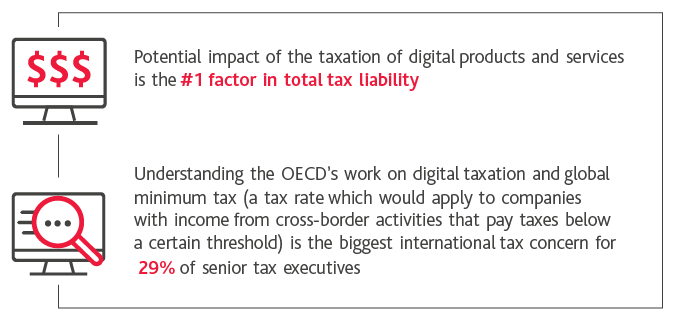

3. Eyeing the evolution of digital taxation worldwide

The idea of global digital taxation has long been discussed, even more so as commerce moves online and geographical boundaries are blurred. The Organisation for Economic Co-operation and Development (OECD) and the wider international business community recently made strides and are moving toward a global taxation agreement, something 79% of respondents believe will come to fruition within the next 12 months.

An agreement on this topic will have business implications beyond tax, especially for any organization that conducts online operations in multiple countries. Boards should take an active role in this conversation alongside management and tax teams, ensuring the organization is properly preparing for the ramifications such an agreement may have on their operations and bottom lines. By proactively evaluating digital activities, budgets and different tax scenarios, boards can avoid sticker shock when an eventual framework kicks in or avoid potential penalties down the line. The way U.S. businesses pivoted after the domestic cross-state South Dakota vs. Wayfair taxation case may serve as a helpful guide on how to plan for an eventual cross-border tax standard.

4. Bringing boardrooms up to speed with tax tech

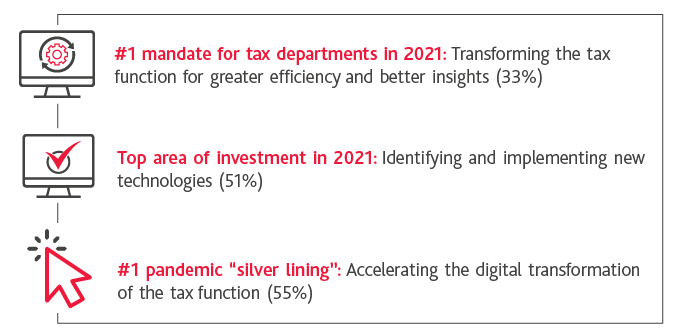

Technology is integral to every aspect of business, and the tax department is no exception. Failing to keep pace with technology advancements can have detrimental effects. This became especially clear in 2020 when the pandemic necessitated a rapid shift to remote operations. Organizations felt the impact, as more than half (56%) of respondents report that technology and process limitations had a major impact on their ability to keep pace with tax changes this year.

To bypass these limitations in the future, tax departments are increasing their focus on technology in 2021:

Boards must ensure they thoroughly understand the organization’s need for technology-based tools and capabilities used in the process for management of the tax function—increasingly complex compliance needs make investing in technology a necessity rather than an option. Organizations are rolling out digital transformation plans on an accelerated timeline, and technology increasingly guides overall tax strategies, compliance tracking, liability minimization and more. The ability to properly interact with tech used in the tax process and analyze results will set successful businesses apart from laggards.

5. Combatting lingering COVID-19 impacts

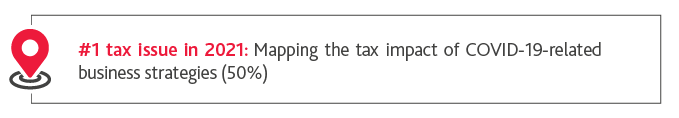

More than a year after COVID-19 first impacted U.S. businesses, its effects linger on, and the post-pandemic environment remains uncertain. Programs like the Coronavirus Aid, Relief and Economic Security (CARES) Act provided opportunities for relief, and it was up to organizations’ tax departments to identify ways to use tax as a tool for resilience. However, a short-term shift in strategy is often not without longer-term consequences.

Executed tax and liquidity strategies and 2021 planned strategies—from restructuring the supply chain to Social Security tax payment deferrals—will have tax implications down the line. Having a direct line to top tax executives and advisors will be essential for boards as they continue overseeing COVID-19-related consequences and changes to the business. Investors and other stakeholders are keeping a close eye on how leadership teams changed course due to the pandemic and expect a high level of insight into any decisions that are of material importance to operations. Boards must ensure necessary and transparent disclosures are made around COVID-19-related effects, tax implications included.

Conclusion

From a corporate governance perspective, boards have a responsibility to oversee an organization while ensuring the needs of all stakeholders are addressed. As tax planning becomes more complex, both a broad and a deeper understanding of the topic is necessary for boards to successfully provide the necessary level of oversight. Keen awareness of how management choices reflect total tax liability reverberate across an organization will help boards better mitigate risk and prepare for the future.

SHARE