CAQ Issues “Critical Audit Matters: Key Concepts and FAQs for Audit Committees, Investors, and Stakeholders”

A new publication issued by the Center for Audit Quality aims to assist users of financial statements in better understanding the identification and communication of critical audit matters (CAMs) within the new auditor’s report. Changes to the auditor’s report required by PCAOB AS 3101 were divided into two phases and CAMs are the second and more significant phase of implementation effective between June 30, 2019 and December 17, 2020. The inclusion of CAMs in the auditor’s report is intended to make the report more informative and relevant to its users by identifying and describing CAMs, while also detailing how the risk was addressed in the audit and direct financial statement users to relevant financial statement accounts or disclosures.

Overview

This summer, the Center for Audit Quality (CAQ) released a new publication,

Critical Audit Matters: Key Concepts and FAQs for Audit Committees, Investors, and Other Users of Financial Statements, as a resource for financial statement users to better understand the second phase of implementing PCAOB AS 3101, The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses and Unqualified Opinion. The CAQ publication includes the definition of a Critical Audit Matter (CAM) and provides an overview of how auditors will identify and determine whether a matter is a CAM. The CAQ further explains the required CAM communication. The U.S. is adopting the concept of including matters within the auditor’s report with the benefit of the experience of expanded auditor reporting in other jurisdictions. The CAQ summarizes these past experiences from various international jurisdictions and compares their regulations to the PCAOB standard. Finally, the CAQ answers some frequently asked questions regarding the implementation.

Implementation

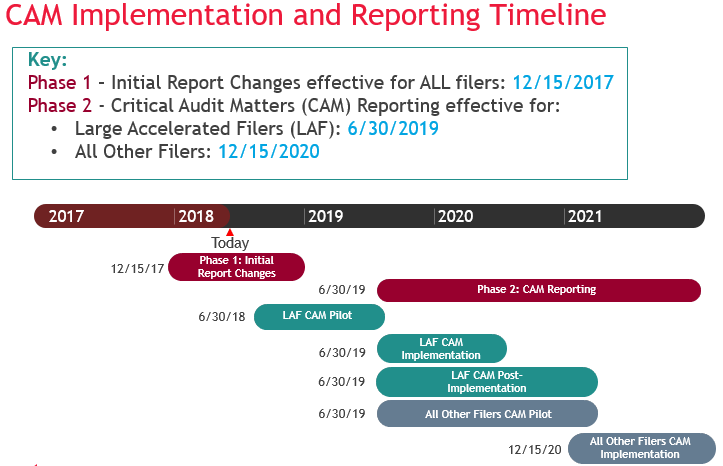

The effective dates for CAMs to be included in the auditor’s report are as follows:

-

For audits of large accelerated filers: fiscal years ending on or after June 30, 2019

-

For audits of all other companies to which the requirements apply:[1] fiscal years ending on or after December 15, 2020

Click the image to view larger version.

During this time, BDO is performing pilots to test our methodology for determining and reporting CAMs and will use such information to inform good practices in reporting for all public filers.

Critical Audit Matters

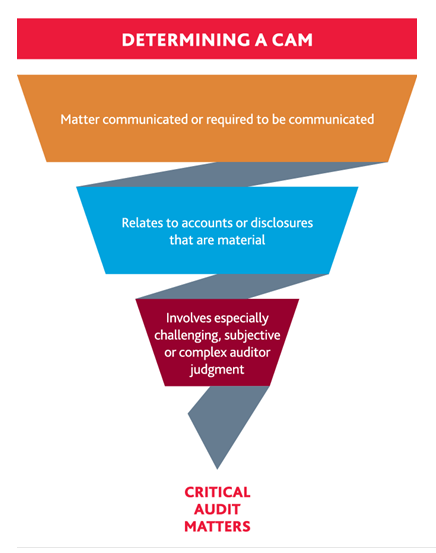

A CAM has a three part definition as follows:

-

Arises from the audit of the financial statements that was communicated or required to be communicated to the audit committee. This language aligns with communication requirements stating the auditor is to provide the audit committee timely observations arising from the audit that are significant to the financial reporting process. Simply stated, this is already being done in conversations between auditors and the audit committee.

-

Relates to accounts or disclosures that are material to the financial statements. This allows for the matter to be a component of an account, not necessary the entire account.

-

Involves especially challenging, subjective, or complex auditor judgment. The auditor may give consideration to materiality, assessment of risk, degree of auditor judgement, significant unusual transactions, degree of auditor subjectivity in applying transactions, degree of auditor subjectivity in applying procedures, nature and extent of audit effort including extent of specialized skill or knowledge, including consultations, and nature of audit evidence, among other considerations.

CAM Reporting

CAM reporting is intended to make the auditor’s report more informative and relevant to its users, but explicitly does not alter the opinion of the financial statements taken as a whole. The CAQ provides sample language to this effect to introduce the CAMs, and there is further PCAOB guidance on language if there are no CAMs to be reported.

There are four primary CAM reporting requirements:

-

Identify the CAM;

-

Describe the principal considerations that led the auditor to determine that the matter is a CAM;

-

Describe how the CAM was addressed in the audit; and

-

Refer to the relevant financial statement accounts or disclosures that relate to the CAM.

While the specifications to be communicated are precise, SEC Chairman Jay Clayton noted that CAM reporting should not result in boilerplate language that lacks meaningful information specific to the audit.

Consideration of Previous Reporting Standards in Other Jurisdictions

The International Auditing and Assurance Standards Board (IAASB), the European Union (EU), and the Financial Reporting Council (FRC) have all adopted requirements in their respective standards that expanded the auditor’s reports in their jurisdictions. Of particular interest is the IAASB’s 2016 year end implementation as the first year of implementation was analyzed by the Association of Chartered Certified Accountants who reported that the new standards did help provide better information to investors. The report further noted three additional benefits: better governance, better audit quality, and better corporate reporting.

The PCAOB standard is not identical, as each jurisdiction needs to consider the evolution of the disclosure, the jurisdiction’s capital markets and disclosure regimes, and each jurisdiction’s legal environment which creates differences in risk. The CAQ publication further compares the standards within its publication.

Next Steps

Critical Audit Matters: Key Concepts and FAQs for Audit Committees, Investors, and Other Users of Financial Statements serves as a valuable resource to board members in raising awareness of the changes to the auditor’s report brought about by PCAOB AS 3101. These enhanced communications should assist board members in the execution of their oversight duties, together with users of financial statements with respect to increasing transparency, consistency and reliability within the financial reporting chain.

As noted above, BDO is performing pilots to test our methodology for determining and reporting CAMs. Additionally, the PCAOB and SEC have committed to performing post-implementation reviews of the new standard. These results will be compiled and analyzed and these activities are expected to result in further guidance and thought leadership throughout the implementation phases.

Following includes recently issued tools and resources audit committees and board members may find helpful:

| Recommended Resources | Date |

|---|---|

| The Future of Auditor Reporting is Here | December 2017 |

| CAQ Publication: Critical Audit Matters: Key Concepts and FAQ | July 2018 |

| CAQ Publication: The Auditor’s Report: Considerations for Audit Committees | December 2017 |

| SEC Approves the New PCAOB Auditor Reporting Model | November 2017 |

| PCAOB Staff Guidance | Updated December 2017 |

| PCAOB Illustrative Examples | August 2013 |

We commend the CAQ for producing valuable tools and resources on this topic and others relevant to boards of directors. We will continue to highlight these and other activities, trends, and relevant discussions points to our client audit committees and management teams through our Center for Corporate Governance and Financial Reporting.

SHARE