BDO 2019 Shareholder Meeting Agenda

Market corrections and corporate culture. Trade wars and tax reform. Digital transformation and diversity. Acquisitions, sustainability, and executive compensation.

As shareholders gather for annual meetings, the list of issues in the spotlight are defined by the forces driving business growth … and business risk in equal measure.

Innovation may be currency, but the wrong tone at the top and lacking safeguards can take even the most innovative businesses down. Meanwhile, growing concerns over a potential market downturn and uncertainty around trade policy and regulatory change have shareholders eager to hear about stability, sustainability, and long-term strategy.

BDO’s 2019 Shareholder Meeting Agenda covers four key areas of shareholder concern and how boards should address them:

Digital Transformation & Data Protection

Digital Transformation is a Priority

Digital transformation is innovation’s Holy Grail. It is nearly impossible to walk into a boardroom without hearing the phrase bandied about. And for good reason. Having a digital transformation strategy is no longer optional; it is necessary for survival in today’s digital economy. Shareholders may question how much is being spent on digital transformation, who is leading the strategy, what the return on investment is, and how the organization compares to its peers. Communicating digital strategy to stakeholders and linking it to clear KPIs and business objectives are paramount.

BDO View

In our 2019 Middle Market Digital Transformation Survey of 300 C-suite executives, 48 percent said developing a digital transformation strategy is their number one digital priority. In our 2018 BDO Cyber Governance Survey, just over half of public company directors surveyed indicated that their organization had a digital transformation strategy, and 13 percent indicated they planned on having one in the future. Yet, an alarming 34 percent of public company board members indicated they do not currently have a plan nor are they planning for one in the near future.

Informed boards appear to be taking proactive steps to address technology disruption, including increasing capital allocation for digital initiatives, augmenting the board with directors who possess relevant skillsets, establishing digital innovation committees, overseeing development of a digital transformation roadmap, and introducing new metrics for business insights, among other things. We strongly recommend boards develop a formal mechanism for monitoring and reporting external signals of digital disruption and ensure management is thinking ahead. Responding to change is not enough; organizations need to anticipate it and act to stay ahead of the curve.

For more on how middle market organizations are reinventing business and operations for the future digital economy, read our insights: The Digital Transformation Playbook for the Middle Market and Digital Transformation: The Middle Market Goes “Back to the Future”.

Additionally, a new resource from the Center for Audit Quality, Emerging Technologies: An Oversight Tool for Audit Committees, provides a framework and potential questions that audit committees and other members of the board may ask to help inform their oversight and enable them to answer queries from shareholders regarding the impact of emerging technologies.

Data Protection and Cybersecurity Puts Reputations at Stake

Cyberattacks, increasing in frequency and in sophistication, continue to undermine public trust in business. The SEC reports that the average cost of a cyber data breach is $7.5 million and rising each year. In February 2018, the SEC issued interpretative guidance regarding public companies’ disclosure obligations for cyber risks and incidents, including disclosure about the company’s cyber risk management program and the board’s oversight role. Furthermore, the SEC continues to actively investigate cyber-crimes. In 2018, it reached a $35 million settlement with Yahoo for failure to disclose its December 2014 breach and released a Report of Investigation indicating future enforcement actions will focus on internal accounting control failures related to business email compromises. In addition to SEC activities, shareholders have brought cybersecurity class actions alleging violations of the federal securities laws, along with derivative suits alleging companies' boards of directors failed to take adequate steps to prevent cyber incidents.

As emphasis on cybersecurity concerns escalates, so does the interest in protecting large amounts of data being generated and maintained in the digital economy. Increasing data privacy and data protection regulation internationally (e.g., General Data Protection Regulation (GDPR)) and domestically, at the state-level, (e.g., California Consumer Privacy Act) is redefining protocols and protections for handling and protecting sensitive consumer information.

BDO View

Cybersecurity has remained at the forefront of risk management for those charged with governance. According to data from BDO's 2018 Cyber Governance Survey, public company boards are becoming more involved in cyber oversight, with 72 percent of board members saying the board is more involved with cybersecurity now than 12 months ago.

Board directors and corporate management should continue to critically assess cybersecurity threats, as well as related risks including the potential for violations of data privacy rules, insider trading on the heels of a cyber breach, and further exposure to evolving digital fraud. We encourage companies to have sound governance policies and controls in place, frequently reassess the internal and external threat landscape, and stress-test policies, procedures, and protocols to ensure effective design and operation.

Proactive risk mitigation strategies and the ability to communicate to stakeholders — including shareholders, regulators, customers, and others — how a company is preparing itself in the face of such risk may go a long way to build market confidence and help offset damage when a breach does occur. BDO continues to put forth a steady cadence of resources and learning opportunities to help companies navigate the changing landscape, including Top Ten Cybersecurity Trends and Key Recommendations for 2019 (insight); Cybersecurity and Resources Boards Need (archived webinar); Cybersecurity in the Digital Age (book); and De-Mystifying Cyber Threat Intelligence (insight).

People & Culture

Leadership Diversity Dominates the Agenda

Gender diversity in senior management positions has a notably positive effect on company performance. According to McKinsey & Company, companies in the top 25th percentile for gender diversity in management positions were 21 percent more likely to experience above-average profits.

At the board level, U.S. companies have long sought to increase representation of women corporate directors in an organic way. The results, while positive, have been slow-moving. According to BDO’s 2018 Board Survey, nearly one-fifth (19 percent) of directors believe their board has room to grow on this measure, and only one-third said their board uses formal diversity reviews to address the topic. Watchdogs, investors, and regulators are forcing their hands.

The world’s largest proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, have both recently updated policies to prioritize increasing diversity within the board, particularly with respect to gender, which will influence their corporate governance disclosure reviews and subsequent shareholder voting recommendations.

On the investor side, the largest institutional investors, including Vanguard and BlackRock, continue to publicly advocate for the long-term value proposition of companies with diverse board composition. Larry Fink’s 2019 letter to CEOs indicated that a company’s approach to board diversity would continue to be an engagement priority for BlackRock. Similarly, Vanguard’s Glenn Booraem has indicated that “gender diversity has emerged as one dimension on which there is compelling support for its positive effects on shareholder value.” Indeed, gender diversity on boards might soon move from best practice to requirement, with states like California already making it law.

It is worth noting, however, that boardroom diversity efforts have not necessarily translated to the C-suite. As of 2018, women comprise just 4.8 percent of Fortune 500 CEOs, while the overall percentage of Fortune 500 female board members is 22.2 percent, according to Pew Research.

BDO View

Although U.S. companies are facing heightened consequences for not diversifying their boards and executive management teams, this initiative should not be embraced simply to avoid such consequences. Companies should be focused on the opportunities that diversity provides in positively impacting the bottom line. Given the prominence of this topic, shareholders may want to know where companies stand in relation to the highly publicized California Senate Bill 826 and proxy advisory policy updates, as well as whether the board and management conducts formal diversity reviews.

Companies and their boards are further encouraged to consider the robustness of their current board refreshment/recruitment policies and related proxy disclosures. While strides made towards gender parity amongst board directors are notable, board diversity must extend beyond consideration of gender. Ensuring an array of diverse viewpoints enables board directors to solve problems more efficiently and encourages both creativity and innovation. To read more about BDO’s views on diversity, refer to a recent article published by Corporate Board Member.

Preparing for the Future of Talent

Business performance is inextricably linked to employee engagement and retaining high performers. But creating and achieving human capital strategies has become significantly more complex due to a variety of shifting societal-, economic- and technology-driven factors. Shareholders are keenly aware of today’s talent-related risks and expect the board to have strong oversight in change management.

According to a Pew Research Center study of U.S. Census Bureau data, millennials ages 21 to 36 (as of 2017, the most recent year of available Census data) comprise 35 percent of the American workforce. At the same time, the aging baby-boomer generation is remaining in the workforce longer. The percentage of workers aged 65 and over has risen from approximately 12 percent in the mid-1990s to more than 18 percent as of 2016, and is projected to increase to 20 percent by 2030. Managing the widening generational gap presents an ongoing challenge for employers.

In addition to demographic labor pool challenges, in-demand STEM skills — including data analytics and data science — are in short supply. While automation of manual, repetitive work is generally viewed favorably by shareholders, it hastens the need for more advanced technological and analytical employee skillsets. Preparing today’s workforce for tomorrow includes a combination of reskilling current employees and recruiting for new and evolving skills.

And with more tech-savvy workers comes demand for more sophisticated workplace technologies and greater flexibility. To attract and retain those with skills aligned with digital advancements, companies must woo their employees not only with competitive salaries but with evolving benefits and perks, from remote working and flexible scheduling to health and wellness programs, to extended maternity and paternity leave, plus out-of-the-box offerings.

BDO View

Boards and management should be attentive to both the organization’s needs as well as shareholders’ concerns regarding whether corporate talent strategies are evolving at a timely pace.

The importance of cultivating a mobile and agile workforce that is armed with continuous learning opportunities and adaptive workflows is key. BDO’s recent Digital Transformation Survey indicates that 54 percent of companies implementing digital strategies say lack of skills or insufficient training is their biggest challenge.

Sourcing new talent externally while elevating needed skillsets of existing talent sources is increasing in organizational risk prioritization. Further, aligning massive business-driven data with analysis needs and technological advances is a daunting but necessary means to an end for most businesses. Identifying and retaining talent to master this will be a multidisciplinary task that can be led by a strong and evolutionary Human Resources team. Refer to BDO’s “Aligning Your People Strategy with Your Business Strategy” insight.

Executive Compensation Still in Sharp Focus

Executive compensation has become far more than just a means for retaining essential talent. It has become a symbol of company values. Executive pay remains a target for many activist shareholders, and scrutiny is unlikely to relent. Public sentiment has shifted from skepticism to outright hostility for those organizations that are deemed to offer excessive pay that does not appear to align with the organization’s performance. ISS has issued new FAQs addressing U.S. Executive Compensation Policies and U.S Equity Compensation Plans for the 2019 proxy season beginning with annual meetings held on or after February 1, 2019.

The Tax Cuts and Jobs Act (TCJA) will add still more attention and critical commentary from outside stakeholders on not only how much but how executives are paid. There are a number of areas that are bound to attract attention:

-

What changes are being made to executive pay plans in response to TCJA and why? At whose expense?

-

Is a lower (or higher) CEO pay ratio this year versus last indicative of a policy change?

-

Is compensation for outside board members properly structured? Can boards govern their own pay fairly?

BDO View

The right approach for managing executive and board pay is based not only on competitive pay data, but a thorough understanding of all the issues impacting your company and designing your pay practices to address them.

Annually, BDO compiles two reports examining the executive and board compensation practices and trends of 600 mid-market public companies: The BDO 600 - 2018 Study of Board Compensation Practices and the BDO 600 – 2018 Study of CEO and CFO Compensation Practices. Pay practice trends are further explored in a recent archived webinar.

Corporate Culture Drives Company Values

Examples of executive misconduct abound. The #MeToo activist movement continues to make an impact in the boardroom against the backdrop of high-profile firings such as CBS’ Les Moonves. Meanwhile, an Alphabet shareholder recently sued the company's leadership over its approval of multi-million dollar exit packages for executives who had been accused of sexual misconduct.

Rigorous board oversight, zero tolerance for misconduct, and transparency are the best ways to assuage investor concerns. That tone should start from the top of the organization and extend throughout the company with clear consequences for bad behavior. An emphasis on voluntary disclosure by boards is intrinsic to a healthy corporate culture and will go a long way toward mitigating fraud and misconduct and building investor confidence. Proxy advisory firms also play a role in driving corporate accountability for these issues by continuing to focus on executive compensation policies (e.g., executive pay raises, claw backs, and other provisions) that do not align with good governance and corporate performance.

BDO View

Corporate culture — good or bad — is a significant differentiator for shareholders. Corporate boards and management teams who can demonstrate and lead a culture built on integrity, ethics, and values that is aligned with a clear corporate strategy help ensure smooth sailing. When this is made clear to investors through disclosures about expected behaviors, through demonstrable actions by those that support such behavior, and ultimately through the financial performance of the company, everyone wins. When leaders shirk such responsibility, the damage can be catastrophic for the company, both reputationally and financially. For more on this topic, refer to BDO’s archived webinar, “From Scandals to Serious Setbacks: How a Poor Company Culture Can Impact the Bottom Line.”

Market Movement

Geopolitical & Market Climate Rife with Uncertainty

Amid one of the longest bull markets in history, many analysts are quite certain a downturn is on the horizon, and it is just a matter of how soon it will occur. The World Bank forecasts a slowdown of growth in the U.S. as the impact of tax cuts wanes and the national debt weighs on expenditures. According to BDO’s Tenth Annual Private Equity PErspective Survey, 89 percent of private equity fund managers expect a market downturn to occur within the next two years. Shareholders will undoubtedly have questions about how companies are planning for a slowdown in economic growth and the strategy for recession-proofing the business.

Contributing to market turbulence are geopolitical concerns, such as trade tensions and uncertainty over pending Brexit. Meanwhile, change in control of the U.S. House of Representatives and battles over Federal Reserve policy have ramped up political and economic uncertainty. Tariff and trade embattlement is further disrupting supply chains. For example, ambiguity around the U.S.–China negotiations relative to substantial tariffs on Chinese imports and China’s retaliatory duties on U.S. imports are starting to impact companies’ revenue figures — as are the “national security” tariffs on imported steel and aluminum raw materials (with autos and auto parts rumored to be next). According to the National Association of Corporate Directors’ annual public company governance survey, geopolitical volatility is one of the top five trends expected to have the greatest effect on companies over the next 12 months.

BDO View

Companies and their boards are advised to stress-test regularly their current business strategies. By optimizing lean operations today, companies will have more time and resources to manage additional broader economic challenges in the months and years to come. By way of example, PE firms, as part of preparing portfolios for potential economic headwinds, are being more selective when evaluating highly valued deals (70 percent) and considering holding current investments for longer periods (14 percent). Reviewing debt practices is also trending, outside of choosing to continue to fund acquisitions through debt (23 percent), as many firms are applying debt proceeds to dividend recaps (30 percent), refinancing debt (14 percent) or investing in operational improvements (17 percent).

For global businesses, shareholders want to understand the exposure companies may be facing with respect to tariff and trade agreements and how management is poised to take advantage of opportunities or combat disadvantages as negotiations in these areas play out. For more information on how tariffs are impacting business, see BDO’s insight Much Ado About Tariffs: Preparing for March 1 and Beyond.

Heated M&A Environment

Despite concerns around an impending dip in the economy, reductions to the corporate tax rate and tax on repatriation of foreign earnings are providing businesses with motivation to pursue mergers and acquisitions (M&A) in 2019. 2018 saw deal volume decline slightly, but deal value grew due to mega-deals across numerous industries. Shareholders will want to know if M&A is a potential avenue for growth and how market volatility and a company’s ability to perform adequate due diligence and integration may impact plans.

BDO View

Whether an organization sees ample M&A opportunities ahead, or risk in the face of regulatory and policy changes, we encourage companies to develop a thorough corporate strategy to also think about how they are or will be communicating any potential move to shareholders. Companies pursuing a deal will need a sound, long-term strategy that factors in industry changes and external forces like geopolitical risks, tax ramifications, tech disruption, and potential market change. In an era of sky-high valuations and changing operational risks, seek advisors who can help develop the right growth or exit plan and conduct thorough, data-driven due diligence during the planning and valuation phases to allow for success during the integration phase of the transaction.

For more, see BDO's Q4 2018 Deal Advisor Digest and BDO’s Horizons 2019 – Issue 1 which provide strategic insights on M&A trends, economic indicators, and market predictions — both domestically and internationally.

Regulation and Reporting

Tackling Tax Reform & Tracking Total Tax Liability

Tax reform was the springboard for organizations to take a hard look at their tax exposures and opportunities. For board members, making sure their organization understands the company’s total tax liability — the sum amount of all taxes owed at the international, federal, state and local levels — is critical to effective financial oversight and strategic decision-making. Given the significant U.S. tax law changes and the growing complexity of global tax regimes, seemingly small changes in corporate strategy can have meaningful consequences on a company’s total tax liabilities across jurisdictions. Organizations must also keep a close eye on the evolution of digital taxation in the wake of the monumental Wayfair v. South Dakota Supreme Court decision and similar tax proposals overseas.

BDO View

Shareholders are immediately focused on what companies are doing with any savings from the reduced corporate tax rate, whether it be shoring up efficiency through digital transformation, streamlining processes, or other investments. Shareholders also want to understand how companies are adapting overall business strategy in response to federal and state reform and the impact of any changes.

Strategic tax planning today will help companies and their shareholders understand their total tax liability ahead of any market changes, putting them in a better position to respond. Establishing open conversations around tax strategy and liabilities will enhance transparency and trust.

Refer to BDO’s 2019 Tax Outlook Survey and Tax Transformation Guide, among other resources, for the latest on tax reform and tracking total tax liability.

Making Sense of New Reporting Standards

Boards and corporate management must be well acquainted with new regulations and accounting standards in order to anticipate their impact on their companies' policies, reporting requirements, and the organizational systems and controls. Shareholders may still be looking to understand the changes in reporting that new standards require and how this is reflected within the overall financial picture that companies are sharing publicly. The SEC has indicated it is closely following not only the propriety in which the standards are being accounted for but also how companies are choosing to disclose implementation of these standards in a manner which both investors and analysts can understand to make informed investment decisions.

Priority new standards and their effective dates include:

-

Revenue Recognition — The FASB’s landmark standard that converged with equivalent new International Financial Reporting Standards (IFRS) guidance and set out a single and comprehensive framework for revenue recognition took effect in 2018 for public companies and in 2019 for all other companies. This new standard has set the bar high. It has also provided management teams with a roadmap to establish the scope and timelines to implement and comply with other significant accounting standards that are on the horizon.

-

Lease Accounting — The highly-anticipated FASB leasing standard under ASC 842 for both lessees and lessors is taking effect. Most notably, companies will now report lease obligations on the balance sheet. Its requirements apply to public business entities and certain other entities for fiscal years beginning after December 15, 2018, and for interim periods within those fiscal years. These changes will be evident in quarterly reports released this April and May. For all other entities, the new standard is effective for fiscal years beginning after December 15, 2019, and interim periods beginning the following year.

- Current Expected Credit Loss (CECL) — The FASB issued a new accounting standard to replace the “incurred loss” impairment methodology with the CECL model, significantly accelerating the way credit losses on many financial assets — especially loans — are recorded. It will be effective beginning after December 15, 2019, for public business entities required to file with the SEC and after December 15, 2020, for all other public and nonpublic business organizations.

BDO View

The SEC continues to indicate it is “open for business” and encourages public companies to consult with the SEC staff on implementation of the new standards. Shareholders may have their own questions as to the comparability of financial reporting disclosures, the potential tax implications, and what the impact is on their investments. Companies should be thinking about how to share such information clearly and concisely to aid investment decision making and investor confidence.

BDO has compiled its annual Audit Committee Round-Up, a resource primarily designed for audit committees and management teams. It may also interest shareholders who want to better understand the underlying corporate considerations with respect to financial reporting, along with other governance issues.

Sustainability Reporting Shaping Decision-Making

In addition to traditional financial reporting and disclosures, more and more companies are turning to non-financial “sustainability” reporting out of the perceived need to provide additional information about how companies are managing environmental, social, and human capitals, as well as corporate governance, to enhance a decision maker’s understanding of the company’s material risks and opportunities. Significant international sustainability disclosure regulations and evolving sustainability reporting frameworks are garnering attention along with activities domestically by the U.S. Sustainability Accounting Standards Board (SASB) to encourage voluntary corporate sustainability disclosures that are material, comparable, and useful for investors. Companies may feel the external competitive pressures to report more about their business, but some may also see the opportunity to cultivate an expanding generation of potential capital sourcing in millennials, who characteristically are more focused on such non-financial metrics in making both investment and employment decisions.

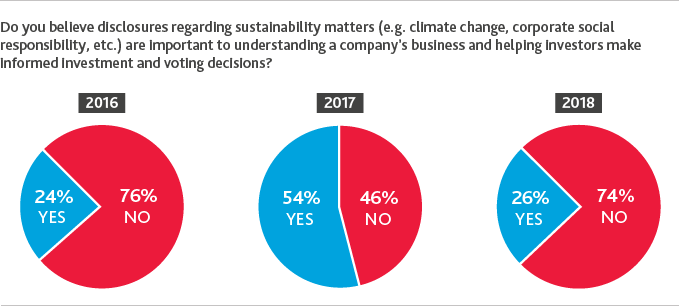

According to Gibson Dunn’s analysis of shareholder proposals, social and environmental proposals were the most frequent proposals submitted in the 2018 proxy cycle. BDO’s 2018 Board Survey results reflected a contrary position held by public company board directors influenced, perhaps in part, by a belief that sustainability reporting has been traditionally in the purview of the largest, multinational corporations:

Source: BDO 2018 Board Survey

BDO View

While still an evolving area in the U.S., we encourage boards and management teams to consider how voluntary sustainability disclosures may provide investors and key stakeholders with a more complete view of the company’s ability to manage risk and sustain longer-term value creation. We suggest boards take necessary steps to truly understand the interests of their current and potential investor pools, particularly in light of a millennial population, who both broadly support sustainability measures and have increasing access to investment capital.

Additionally, through providing this added layer of disclosure, investors and key stakeholders may be better able to discern and distinguish between companies based on their strategies and operational alignment. In essence, companies can use sustainability reporting as a differentiator in the marketplace to more effectively tell their story to shareholders and would-be investors. To learn more about sustainability reporting and why boards should take notice, refer to BDO’s recent U.S. publication and our global reporting journey guide.

Conclusion

The issues confronting corporate management and board directors at publicly traded companies are more complex than ever. It is critical that boards and executive leaders are ready to address the concerns that will likely arise in upcoming shareholder meetings. To hear more about the topics within this publication, please join us for our April webinars: 2019 Shareholder Meetings: What’s Next? Part 1 and Part 2.

Through our Center for Corporate Governance and Financial Reporting, BDO commits significant resources to keep our clients and contacts up to date on current and evolving technical, governance, industry, and reporting developments. Our thought leadership consists of timely alerts, publications, surveys, practice aids, and tools that span a broad spectrum of topics that impact financial reporting, as well as corporate governance. Our focus is not simply to announce changes in technical guidance, regulations, or emerging business trends, but rather to expound on how such changes may impact our clients’ businesses. Through our various webinar offerings, we reach a broad audience and provide brief, engaging, just-in-time training that we make available in a variety of ways to meet the needs of your busy schedule.

SHARE