Audit Quality Reminders Through the Lens of the Audit Committee

On March 24, 2022, the PCAOB released a new Spotlight publication, “2021 Conversations with Audit Committee Chairs.” The publication presents high-level observations and takeaways from the inspection staff’s interactions with audit committee chairs of U.S. public companies during the PCAOB’s 2021 inspections of audit firms. These observations represent important areas of consideration for audit committees, management, and auditors as well as other users of financial statements to consider with respect to the audit process and promotion of audit quality. To underscore the PCAOB’s observations, BDO has provided practical examples and resources for further consideration.

Required Communications with Auditors and Other Discussions

Where Audit Committees Indicate Perform Weel and Where They Have Room to Improve

How are PCAOB Inspection Reports Being Utilized?

What are Strengths of the Firm's Audit Quality Control Systems?

How are Annual Assessments of the External Auditor Performed?

How is the Use of Technology Being Considered?

How is Information Outside the Audited Statements Being Considered?

PCAOB Observations

In 2021, more than 240 audit committee chairs (AC chairs) provided their insights on a wide range of topics related to the oversight of external auditors and the audit process. The questions asked by PCAOB staff in these conversations were largely open-ended and the responses from audit committee chairs were captured by the staff and analyzed to identify recurring themes and patterns in the conversations. The PCAOB’s observations are intended to serve as a reference point for audit committee members, management, auditors, investors and others and do not represent formal PCAOB guidance.

These insights shared by audit committee chairs inform the PCAOB’s understanding of the financial reporting and auditing environment and enhance their activities to further promote audit quality and confidence in capital markets.

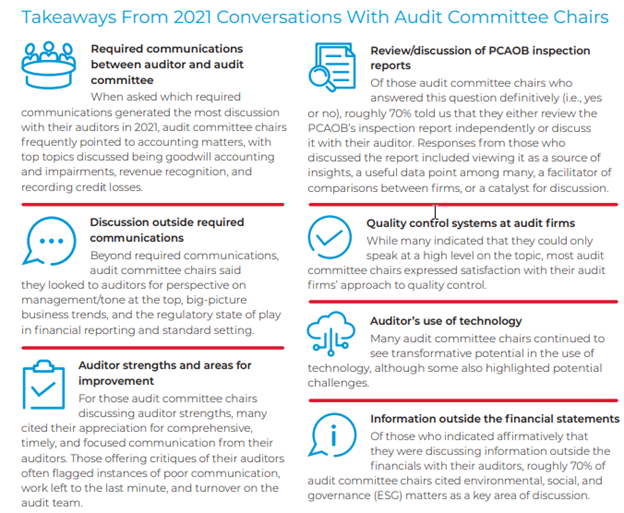

The following areas were identified as key takeaways based on conversations with audit committee chairs:

Refer to the PCAOB’s 2021 Conversations with Audit Committee Chairs for the complete report. Below represent BDO’s insights to expand on several of the observations shared by the PCAOB and may be further used by audit committees and management teams to help set expectations and enhance the audit process.

BDO’s Insights: Actions for Enhancing Audit Quality

Required Communications with Auditors and Other Discussions

The PCAOB indicated that required communications that garnered the most time during audit committee meetings with auditors included: accounting matters, policies and practices along with specific topics on accounting matters, CAMs, conduct of the audit process, internal controls which included cybersecurity concerns and systems implementation and impacts of spinoffs and capital structure transactions. COVID-19 concerns, particularly going concern and liquidity assessments, auditing remotely and audit risk assessments were further significant topics of discussion. Auditor independence and overall audit strategy to address high risk areas including those related to fraud, changes in accounting practices and management override of controls rounded out the topical discussions.

Best communication practices cited by audit committees included:

- Thorough anductive d well-prepped meetings: Audit committees should expect their auditors to prepare a thorough meeting agenda and provide meeting materials in advance. Advance preparation and review of such meeting materials provides for more constrialogue between the auditor and the audit committee and supports the audit committee in meeting its oversight responsibilities.

- Both formal and informal dialogue: It is important that interactions between the auditor and the audit committee be two-way interactions, and not simply a presentation from the auditor. Additionally, audit committee chairs find value in the ability to pick up the phone and discuss an issue directly with the engagement partner outside of regularly planned meetings. This should be a two-way street with clear understanding at the outset of the audit. Outreach by both parties should be expected as situations during the audit arise that need to be addressed or as industry, regulatory or other relevant matters develop impacting the business and/or the audit.

- Focus on topics that matter - Practices that our client audit committees find beneficial include:

- The provision by our engagement teams of the summary of significant audit risks up front in both the audit meeting materials as well as in discussion agendas, with more detailed information included as pre-reading. This allows the engagement partner to focus discussion time spent with the committee on the areas of the audit that often require the most time, effort, skill and judgment.

- Educational sessions offered by auditors on noteworthy or emerging topics. BDO engagement teams leverage the firm’s professional practice and subject matter experts to develop and deliver such educational sessions to our client board members and management teams to ensure that they are “in the know” about topics that directly impact the audit and their business operations. Such presentations may comprise a wide range of topics relating to significant and emerging accounting and financial reporting matters, various risks (e.g., regulatory, industry, etc.) and corporate governance.

- Access to robust centers of excellence to fulfill additional educational needs in the form of publications, alerts, practice aids, webinars, self-paced learnings, podcasts and the like. Refer to BDO’s Resource Centers for more information.

Where Audit Committees Indicate Auditors Perform Well and Where They Have Room to Improve

Audit committees appreciate open and timely communications - where issues are surfaced proactively in time for appropriate actions to be taken and objective insights are provided about capabilities of management and the tone they set for the organization. They further appreciate the industry knowledge evidenced by their engagement teams and incorporation of technology in driving audit effectiveness.

Challenges that impact the ability of audit committees to oversee the audit process include:

- Poorly planned engagements that allow for “pileups” or “surprises.” Workflow management should be a topic of conversation between the auditors and the audit committee and understanding how project and workload management as well as resourcing is an integral part of the audit process

- Greater use of technology. Audit committees should inquire about how the engagement teams leverage technology – automation, analytics, AI, etc. – within their audit, and how such has or will impact the effectiveness and/or efficiency of the audit process and engagement economics. Similarly, audit committees should understand the benefits or challenges faced by engagement teams in leveraging certain technology based on the company’s current information technology environment. Technology should be a tool for enhancing knowledge and expediting decision-making and not a replacement for skepticism and objective reasoning by the audit engagement team. Refer here for BDO’s innovative audit developments.

- Cost and fee overruns. In assessing the value of the audit, audit committees are often encouraged to ask the question of their auditors, “If you were given a X% increase in fees, what specific additional audit work would you contemplate performing?” This can be a very telling exercise to recognize additional areas of potential risk that are not necessarily getting the coverage they need if there is a narrow focus on fees over audit quality.

- Communication between internal and external audit functions. Audit committees have the responsibility to ensure that the external and internal audit activities are complimentary and supportive of the full risk exposure of the entity. This includes communicating activities that are planned and performed by the company’s internal audit function that may be relevant to the external audit. Regularly scheduled interactions with both internal and external auditors can provide higher visibility to the audit committee into the quality of audit work being performed and the results of such work being elevated to the audit committee’s purview.

- Engagement turnover. Talent management is a significant challenge both from a company perspective and from a vendor efficiency/effectiveness perspective.

- Audit committees are encouraged to understand explicitly how the engagement team may be dealing with staffing turnover and/or shortages. For example, many firms are employing more focused use of technology to allow for higher and best use of engagement team personnel in focusing on risk. How that technology is being used and the ability for the teams to place appropriate reliance upon it while still being able to demonstrate appropriate skepticism and objectivity are fair questions for engagement teams to be expected to address.

- Additionally, many firms are becoming more reliant on off-shore labor sourcing of qualified audit technicians who operate remotely but are an integral part of the engagement team. What audit committees need to be mindful of in these scenarios is the project management and supervision and review protocols in place to ensure that such work is being closely monitored and adheres to the same high standards in place for members of engagement teams operating in close proximity. For example, ask questions as to:

- How are the qualifications of such engagement resources being assessed?

- How is knowledge of appropriate and applicable auditing, accounting and reporting standards ensured by the audit firm?

- Are there supervisions/review protocols and how is the engagement team ensuring these are being followed?

How are PCAOB Inspection Reports Being Utilized?

PCAOB inspection reports have evolved over the last couple of years to provide information reflecting past trends in areas of sufficiency as well as deficiency in the conduct of audits and represents a data point for audit committees in understanding areas of focus for their auditors and delivery of audit quality.

- BDO highly respects the inspection process. Our annual voluntary Audit Quality Report outlines how we continue to evolve and invest in our approach to audit quality as a firm. As part of this discussion is how we specifically incorporate both the external inspections we are subject to as a firm, inclusive of the PCAOB annual inspection cycles, along with the internal inspection processes we have designed to strengthen our overall audit quality control environment. We anticipate the release of our 2022 Audit Quality Report in April 2022.

- We encourage our audit partners to hold candid discussions with the audit committee and management teams regarding our approach to audit quality, particularly as we continue to make significant changes in resources, technology and approaches in response to a rapidly evolving technology and regulatory landscape.

- These types of conversation should be expected as a normal part of engagement among audit committees and auditors over the audit and not simply as a point in time, perfunctory discussion.

What Are Strengths of the Firm’s Audit Quality Control Systems?

When asked about the audit firm’s audit quality control systems, audit firms appear to be doing a satisfactory job in the eyes of the audit committee, but this is based primarily on “high-level” impressions.

- Standardized processes and consistent firm processes across U.S. firms and within global networks are viewed as enhancing confidence in quality control. For example, BDO uses a single global audit methodology that is supported by a comprehensive set of content and technology that enables BDO engagement teams, across jurisdictions, to apply our audit approach in a consistent manner. Similarly, global independence policies and practices are established to drive compliance with independence standards among all our professionals. Use of global portal and related technologies and applications further ensure consistency in technology experience and data security for our clients across our networks.

- Continuous education of audit staff is a cornerstone of audit quality, given the evolving changes in standard-setting and emerging industry risks and opportunities facing clients. BDO provides our professionals a variety of firm-developed mandatory and encouraged learning opportunities across multiple fields of study that are both CPE and non-CPE worthy that take place in-person, hybrid and remotely. Further, we provide application hours to complement just-in-time coursework where engagement teams are assigned activities to timely apply auditing methodology and/or identify procedures relative to specific sequencing of audit execution work. We additionally support and encourage attendance via other in-person or online courses, technical conferences, time spent in review of trade journals, publications and other researching of information that our professionals normally engage in to remain current and enhance their skills. As important is the practical on-the-job-training that is part of our audit execution. As we continue to transition between in-person, hybrid and remote work, our engagement teams remain highly sensitive to the need for continued learning, interaction and oversight among the engagement teams.

- Review, supervision and consultation practices along with the use of specialists are viewed positively by audit committees. BDO’s audit approach necessitates the need for collaboration and the nature of our clients’ businesses often require specified skillsets and experience in the conduct of the audit. Including these resources as early as possible in the audit allows for more thoughtful consideration and may timely surface issues of importance to share with the client. Similarly, ensuring timely supervision and scheduled engagement quality reviews throughout the audit process enhance ability to properly sequence the audit, achieve milestones and address any issues in a timely manner.

- Tone at the top and sound governance are viewed as strong drivers of audit quality. Leadership structure, proper messaging and transparency to professionals and fundamental adherence to core purpose and values are significant areas of emphasis for BDO’s assurance practice. To learn more, visit our most recent BDO Audit Quality Report.

How Are Annual Assessments of the External Auditor Performed?

About three quarters of respondents indicate that they annually assess their external auditors. Some of the manners in which these are performed include:

- Surveys and checklists completed by the audit committee

- Surveys of management – inclusive of those in non-U.S. offices

- Meetings as part of the formal assessment process to separately get perspectives from the auditors, management and the audit committee

- A mix of the above

We recommend considering the Center for Audit Quality’s External Auditor Assessment Tool as a comprehensive tool for audit committees to use in these endeavors.

How Is the Use of Technology Being Considered?

The PCAOB remains interested in how to anticipate and respond to the changing IT environment. Audit committees were asked about their views on the public company’s own use as well as that of the auditors.

Positives - Transformative potential was noted in the use of:

- Data analytics used to spot anomalies, detect fraud and identify and assess risks.

- Automation in enhancing the efficiency of the audit, reduce costs and allow more engagement team focus on risks.

- Testing of entire data sets to reduce the need for sample testing.

Challenges – Variety of expected concerns were noted:

- Cybersecurity vulnerabilities to hackers and ransomware events.

- Quality control over low grade information as being predictive

- Emerging nature of technology that for many remain in preliminary stages of adoption and usefulness.

- Not a “silver bullet” in that technology should not be an excuse to allow “laziness” or “dullness” to creep in and prevent objectivity and skepticism in applying business insight.

How is information outside the audited financial statements being considered?

Investors and other stakeholders are interested in information that exists outside of the audited financial statements, such as ESG or non-GAAP measures. AC chairs were asked whether they were having any discussions with their auditor about this information. Of those who answered this question definitively, roughly 75% answered affirmatively.

- Interest in ESG - Roughly 70% of audit committee chairs cited ESG as an increasingly key area of discussion. We note that we are experiencing a significant increase in client ESG inquiries - this includes DEI, climate impact, shareholder engagement and much more. In terms of the role of the auditor, while responses varied, many AC chairs indicated that auditor involvement remained largely at a preliminary or high level. BDO is investing heavily in our internal ESG resources including BDO’s ESG Center of Excellence (CoE) and are engaging with clients on where they are on their ESG journey – e.g., identification and prioritization of ESG risks and opportunities, data collection, accuracy and related systems, processes and controls, integrating reporting, etc. The BDO ESG CoE contains numerous links to rapidly emerging thought leadership, webinars and podcasts to keep our clients knowledgeable on this rapidly developing landscape.

- Use of non-GAAP information - Several AC chairs referenced earnings before interest, taxes, depreciation and amortization (EBITDA) as a key measure, along with measures used by the company that might exclude stock compensation or other items. This remains an area of interest to both the PCAOB as part of the auditor’s responsibility for “other information” as well as by the SEC in terms of the appropriateness of the issuer’s presentation, consistency and relevance of related disclosures. The CAQ’s publication Non-GAAP Measures – A Roadmap for Audit Committees is a useful resource on how companies may better communicate their financial story while adhering to regulatory expectations of transparency regarding presentation, consistency and relevance.

SHARE