2016 BDO Manufacturing RiskFactor Report

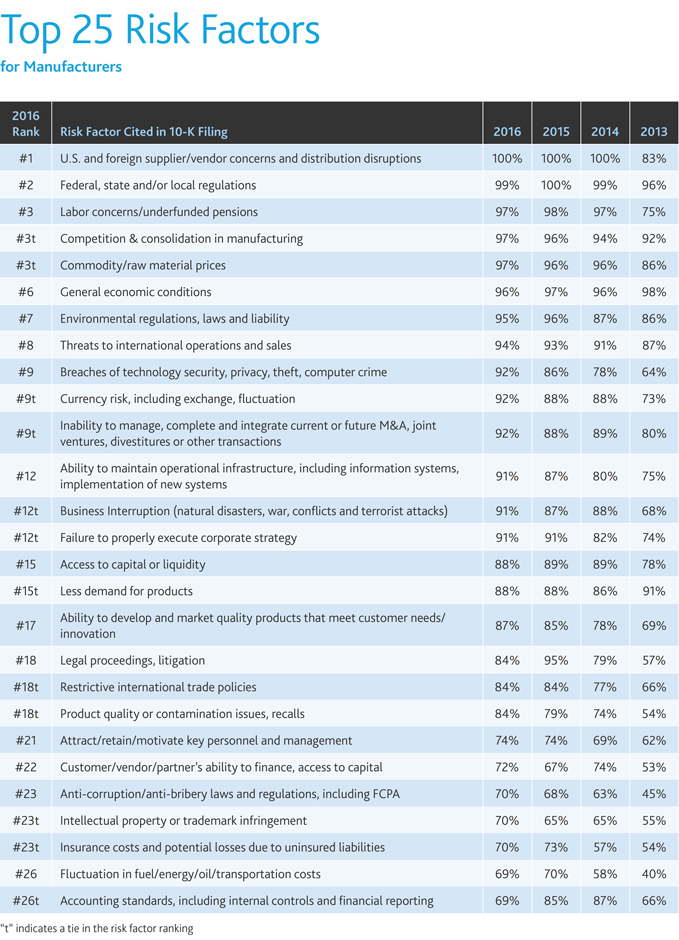

The 2016 BDO Manufacturing Risk Factor Report examines the risk factors in the most recent 10-K filings of the largest 100 publicly traded U.S. manufacturers across five sectors including fabricated metal, food processing, machinery, plastics and rubber, and transportation equipment. The factors were analyzed and ranked by order of frequency cited.

Manufacturing Industry Serves Up New Risks

The manufacturing industry is getting mixed reviews.

The Institute for Supply Management (ISM) Index reported that activity was up in April after five straight months of declines. Then, in late May, the Purchasing Manager’s Index reported the first reduction in output since September 2009. In the trenches, manufacturers say domestic demand has been solid, while global business has been more challenging. And the end customer matters: in a recent earnings call, Caterpillar’s CEO noted, “Just about any market that’s away from oil is doing pretty good.”

“Pretty good” is a modest but realistic goal for manufacturers this year, and their top concerns echo this cautious optimism. Our annual analysis of the most frequently cited risk factors found the supply chain remains at the top of the list—cited by 100 percent of manufacturers we analyzed—while emerging and growing risks in cybersecurity, competition, labor, pricing, regulations and international operations are also keeping manufacturers up at night.

“All it takes is one weak link in the security chain for hackers to access and corrupt a product feature, an entire supply chain or a critical piece of infrastructure. The stakes are too high in the manufacturing industry for complacency or inattention. Security can no longer be considered an add-on to products and processes. It must be built in from design to distribution, and monitored with a high level of priority.”

- Shahryar Shaghaghi, National Leader, Technology Advisory Services and Head of International BDO Cybersecurity

Manufacturers Scamper to Shore Up Security

Manufacturing was the second-most targeted industry for cyber attacks in 2015, according to IBM. While the industry may have flown under the radar as high-profile attacks against the retail, financial services and healthcare industries made headlines, manufacturers’ information, intellectual property and products have become prime targets for cyber criminals.

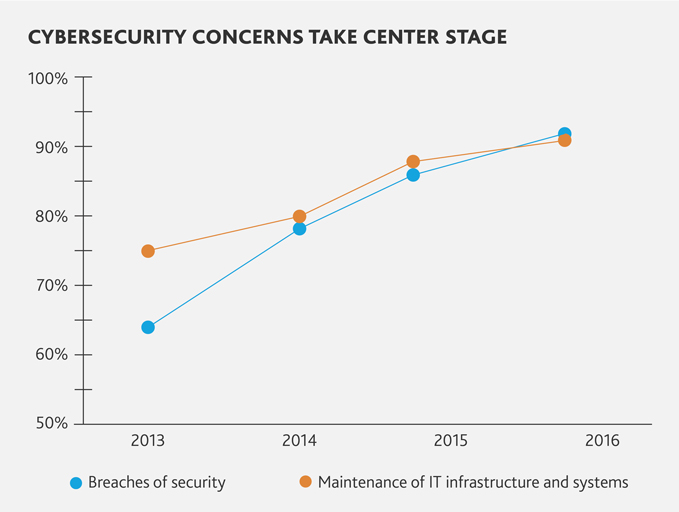

As a result, cyber risk is moving up on manufacturers’ list of priorities, ranking in the top 10 risk factors for the first time in our analysis. More than nine in ten manufacturers (92 percent) cite cybersecurity concerns this year, up 44 percent from 2013. Nearly all (91 percent) also cite operational infrastructure risk, including information systems and implementation of new systems and maintenance.

While manufacturers recognize the cyber issue, only eight percent in the MPI Internet of Things Study, sponsored by BDO, said they are very confident in their ability to prevent an IT breach. As manufacturers develop smart products and processes, more data and network entry points are created every day. To maintain a competitive advantage, manufacturers must contend with both information technology risks and operating technology risks. Companies are increasingly wary of product performance problems and liability that can result from system breaches, in addition to vendor issues and equipment failures. Eighty-four percent of manufacturers report product quality, contamination and recalls this year, up from 79 percent in 2015.

Competition and Consolidation Spur Innovation Risks

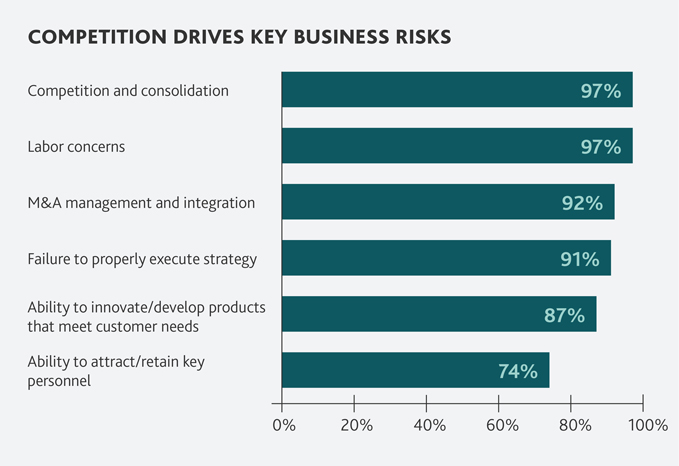

Nearly all manufacturers (97 percent) cite competitive pressure this year, and those concerns may also be contributing to a number of related business challenges.

Our Q1 2016 Manufacturing & Distribution M&A Review and Outlook found industry M&A activity last year surpassed 2014 levels, but slowed sharply in December 2015 and January 2016. Strategic and financial buyers alike are exhibiting a continued interest in deals, but lower valuations and still-challenging economic fundamentals are tempering optimism. Ninety-two percent of manufacturers cite the inability to manage, complete and integrate current or future M&A or joint ventures this year, up from 88 percent in 2015.

Facing heightened competition, manufacturers are clamoring to be leaner and meaner. More than nine in ten manufacturers (91 percent) note inability to properly execute corporate strategy—including cost reduction, capacity expansion or improving efficiencies—as a concern this year. Furthermore, 87 percent report risks around their ability to develop and market quality products that meet customer needs, up from 85 percent in 2015 and 69 percent in 2013. Keeping up with emerging technologies like the Internet of Things (IoT), machine learning and virtual reality is likely fueling this uptick.

Manufacturers also continue to face challenges bridging the talent gap. Today’s factory jobs require greater technical competencies, and companies are competing for a new generation of workers in a shallower talent pool. Labor concerns are cited by nearly all (97 percent) manufacturers this year, and risks related to labor strikes are cited by 66 percent, up from 62 percent in 2015. Moreover, with major strategic and technological changes impacting the industry, the right leadership team is more important than ever. For the second year running, nearly three quarters (74 percent) of manufacturers note concerns attracting and retaining key personnel.

“The skills gap is impacting manufacturers of all sizes, in all sectors. Despite boasting higher wages and greater benefits than average, the manufacturing industry is on track for two million unfilled jobs in the next decade. Manufacturers are fighting to win over the same pool of applicants as Silicon Valley and other tech-enabled industries. It’s critical to educate the next generation about the opportunities manufacturing jobs offer.”

- Larry Barger, Senior Director in BDO’s Manufacturing & Distribution practice

Market Fundamentals Cause Uncertainty at Home

Slow economic growth has led to cautious manufacturers and consumers. GDP growth for Q1 2016 was just 0.5 percent, as opposed to 1.4 percent during the same period last year, and consumer spending has also been soft. Amid this uncertainty, 96 percent of manufacturers cite general economic conditions as a risk, and 88 percent cite concerns over less demand for their products or services.

Manufacturers also worry about the fiscal health and diversity of their customer base. Just under two-thirds (64 percent) cite the loss or slowing rate of purchases from a major customer in their filings, and 72 percent disclose concerns about the financial stability of their customers and partners, including their access to capital and financing. According to the Federal Reserve Bank of New York’s latest Survey of Consumer Expectations on credit demand and access, the rejection rate per applicant increased by one percentage point from October 2015 to March 2016. Meanwhile, businesses are increasingly skittish about taking on debt, with demand for commercial and industrial loans plunging in the first few months of the year.

Turbulent International Winds Blow Manufacturers Back Ashore

While the U.S. market is still contending with some economic weakness, the global picture is grimmer. The Wall Street Journal recently reported that manufacturing activity in China, France and Brazil is declining and global industry leaders like Honeywell and Cummins are citing difficulties abroad. The strength of the dollar, which reached 12-year highs in November, also contributed to lower-than-expected profits and greater challenges for manufacturers looking to increase their global business. Demand from international customers for U.S. goods and services has historically increased when America is “on sale.”

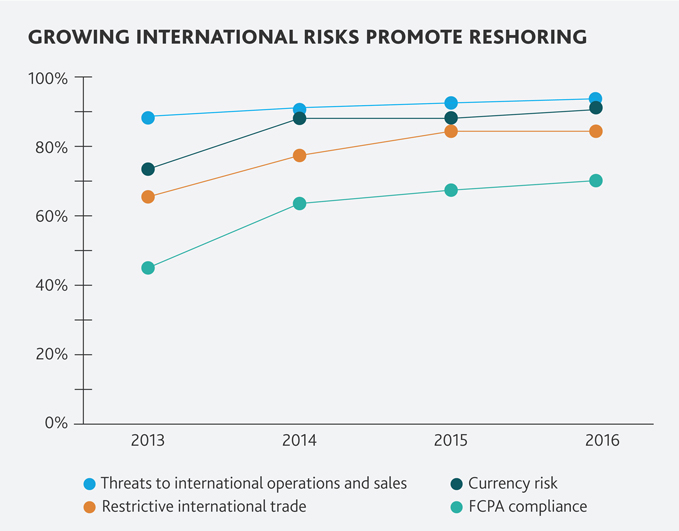

Amid these concerns, 94 percent of manufacturers note threats to international operations and sales, up from 93 percent last year and 87 percent in 2013. Ninety-two percent cite currency risk, including exchange rates and fluctuation, up from 88 percent last year.

Manufacturers with global operations also cite growing concerns over the international regulatory environment. Seventy percent of manufacturers worry about their ability to comply with the Foreign Corrupt Practices Act (FCPA) and other anti-corruption and bribery laws. Following heightened enforcement, FCPA risks have escalated since 2013, when just 45 percent of manufacturers noted it as a concern. A 2014 FCPA enforcement action against a mid-sized firearms manufacturer illustrated that global giants aren’t the only industry players subject to scrutiny.

National and international debates around trade are also top of mind for manufacturers. This year, 84 percent cite restrictive international trade policies as a risk. The National Association of Manufacturers (NAM) applauded the Trans‑Pacific Partnership, which was signed in February after seven years of negotiation, and its efforts to promote open markets. Still, the Office of Foreign Assets Control’s economic sanctions settlements have totaled $3.5 million year to date.

Challenging global markets, trade issues and the strong dollar are encouraging reshoring initiatives. According to the NAM, unit labor costs in the U.S. manufacturing sector have declined by 12.3 percent since the end of the recession, which further encourages companies to hire and expand in the United States. A March 2016 study from the International Economic Development Council also found that “the cost savings that American firms had enjoyed [from outsourcing] began to erode around the year 2010.”

“U.S. manufacturers appear just one cup short of a complete recipe for significant success in the coming years. A comparatively attractive market, technological advancement and presidential platforms focused on manufacturing growth all bode well. Unfortunately, the critical ingredient of skilled talent isn’t readily available on the shelf, and manufacturers and the country must invest in education to change the conversation.”

- Rick Schreiber, Partner and National Leader of BDO’s Manufacturing & Distribution practice and NAM Board Member

Regulatory and Tax Landscape Complexity Escalates

In addition to managing regulatory risk at the international level, manufacturers cite the U.S. regulatory landscape as a significant challenge this year. NAM reports that manufacturers pay an average of $19,564 per employee, per year to comply with federal regulations—nearly double the average across industries. Not surprisingly, federal, state and local regulations are highlighted by 99 percent of manufacturers, making it among the top two risks for the fourth year running.

The election cycle has brought regulations impacting the manufacturing sector into further focus as both sides of the aisle discuss plans to invest in or spur manufacturing job and business growth. While just 28 percent of manufacturers note concerns over changes in government banking, monetary and fiscal policies this year, mentions of such risks are up five percentage points over 2015.

Environmental regulatory risks, cited by 95 percent of manufacturers, are also top of mind this year. Forty-two percent mention regulations around emissions standards specifically. In April, the United States signed the Paris Agreement with 175 countries, which included a pledge to reduce 2005-level greenhouse gas emissions by 26 to 28 percent by 2025. Manufacturers will be charged with joining other industries and consumers to focus on clean power and energy efficiency to meet these goals. With major automakers recently reporting emissions testing fraud, compliance and controls are in the crosshairs.

This year, 69 percent of manufacturers are concerned about accounting risks, including their internal controls function and accuracy of financial reporting. Over the next year, manufacturers will need to work toward adopting the new accounting rules from the Financial Accounting Standards Board. In particular, manufacturers will need to pay close attention to the new lease accounting standard.

“Manufacturers are subject to various aspects of the regulatory landscape, but compliance and competitive advantage are not mutually exclusive. When done right, risk management can be more of a boon than a burden to manufacturers by reducing costly errors and enhancing the operational foundations of the business.”

- Dawn Williford, South Region Leader of BDO’s Risk Advisory Services

“Now that manufacturers know the R&D tax credit will remain available for years to come, they can get better at long-term planning for innovation and making things better, faster, cheaper or greener. For manufacturers that have already been claiming the R&D credit—and for those that haven’t—now is a great time to make sure you’re not leaving money on the table.”

- Chris Bard, Partner and National Leader of BDO’s R&D Tax Credit Services Practice

While emerging technology, competitive and regulatory risks are impacting every sector, gauging the mood of the manufacturing industry might depend on who you ask. Economic uncertainty may have executives planning cautiously for growth, but in the context of the global economy, U.S. end customers have more money to spend than their international counterparts. At the same time, many manufacturers are incentivized to move jobs back home-—only to compete for skilled labor in short supply. In 2016, we expect manufacturers to continue to adapt to new technology opportunities like IoT and automation. By aligning with innovation, they will be better positioned to attract new engineers and skilled workers.

Fabricated Metal

In a sector driven by demand across the industries they serve -—including auto, construction and machinery, which have benefitted from ongoing low oil prices—fabricated metals manufacturers are facing fierce competition for new orders. A notable 14 risks are cited unanimously among fabricated metal companies in our analysis, including industry competition and consolidation, business strategy, and the ability to develop products that meet evolving consumer needs.

Competition and the ongoing strength of the dollar could be hampering demand abroad and threatening the industry’s exports pipeline. Threats to international operations and sales, international trade concerns and currency risks are cited by all fabricated metal manufacturers. Each category is between 6 to 16 percentage points higher than the industry average.

Still, domestic demand is trending positive. The chair of the ISM highlighted fabricated metals as a strong performer behind new orders this spring.

Food Processing

Consumers are growing more conscious of ingredients and sourcing practices, seeking out good nutrition and fresh foods. Challenged by the inextricable link between health and diet, all food manufacturers in our analysis cite concerns around brand reputation and image compared to just 57 percent across sectors. Product recalls are also matters of public health and safety, so the reputational repercussions are often severe.

Supply chain risks and federal, state and local regulations are also cited by all food manufacturers analyzed. Increased regulatory pressures, including the new FDA labeling requirements, are bringing more scrutiny to food processing methods and marketing.

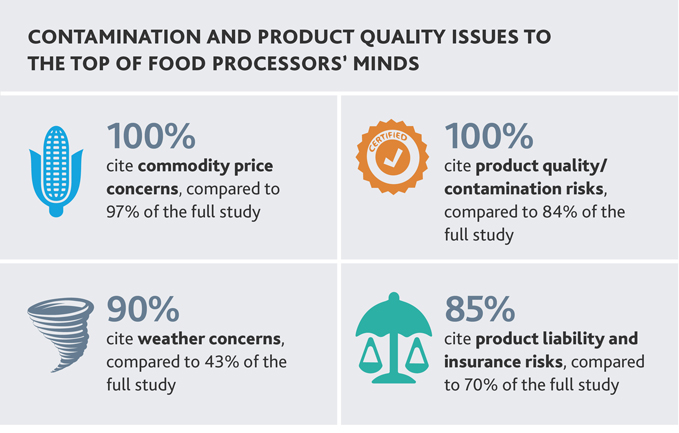

In addition, greater incidences of extreme weather damaging crops and reducing harvests could be contributing to concerns around commodity and raw material prices. Egg prices skyrocketed in late 2015 after an outbreak of avian flu, and high-profile foodborne illness outbreaks among major food industry players have brought contamination and product quality issues to the top of food processors’ minds. Food processors appear more mindful of these risks than their peers.

Machinery

Facing a wide array of business challenges, six risks sit atop machinery manufacturers’ lists, including supply chain concerns; federal, state and local regulations; threats to international operations and sales; environmental liability; data security breaches; and access to capital.

Sixty-five percent of machinery manufacturers cite low oil prices, as many who have relied on producing equipment for oil rigs and pipelines continue to face hurdles. Eighty percent highlight copyright infringement and intellectual property risks, compared to 70 percent in the full study. The increasing complexity of factory equipment produced as a result of the rise in additive manufacturing and robotics could be a contributing factor.

As factory floors across industries house more sophisticated machinery and fewer laborers, companies might be borrowing to finance the purchase of new technologies that competitors are embracing. Risks related to indebtedness and restrictive debt covenants are cited by 80 percent of machinery manufacturers—a figure significantly higher than in other subsegments we analyzed. Despite these unique challenges, according to IBISWorld, the sector is poised to grow by 2.2 percent to reach $59 billion in the next five years, spurred in part by demand in the construction and auto manufacturing industries.

Plastic and Rubber

Three risks are mentioned by 100 percent of plastic and rubber manufacturers: supply chain concerns; federal, state and local regulations; and commodity and raw material costs.

The sector also has the highest percentage of companies citing fluctuations in oil prices. Lower oil prices are freeing up capital for more investment in expansion and the future. However, recycled plastics—which are made from oil—are taking a price hit as well. The fluctuation and dependency on oil prices, however, could be contributing to higher concerns around component and commodity costs.

On the contrary, plastic and rubber manufacturers appear less exposed to international risks. Fewer cite global operations and international trade risks, and just 40 percent mention FCPA concerns—the lowest rate of any sector studied. Still, rubber manufacturers in particular are continuing to contend with fierce competition overseas, particularly from China, according to IBISWorld. This has led the United States to impose high tariffs on Chinese tires to protect the industry.

Looking ahead, the industry is likely to benefit from positive signals in the building products industry like construction and housing starts as well as modest but encouraging trends in the auto industry.

Transportation Equipment

Nine risks top the list of concerns among the transportation equipment companies analyzed: supplier chain concerns; federal, state and local regulations; general economic conditions; labor concerns; industry competition; breaches of security; inadequate access to capital or liquidity; environmental liability; and business interruption.

As the auto industry innovates autonomous vehicles, companies are becoming more fearful of security and data breaches that could not only put consumers’ personally identifiable information at risk, but also their physical safety. In addition, 70 percent cite seasonality or cyclicality of business results as a risk, which is notably greater than the industry average (45 percent). The increasing frequency of extreme weather events and business interruption due to natural disaster could be contributing to this uptick.

Transportation equipment manufacturers are also frequent clients of government agencies, and as a result, 60 percent mention restrictions on government spending and contracts in their annual filings. According to IBISWorld, growth in this sector has been offset by declines in military spending. While ongoing budget sequestration and pressure on the government to trim its spending could be contributing to these challenges across the industry, the outlook for commercial airlines and automobiles looks brighter.

What do manufacturers need to know about the new FCPA pilot program?

Regulators around the world have increased their focus on individual accountability, holding not just companies and corporate officers liable for corporate wrongdoing.

Due to the Yates Memo and the recently announced FCPA pilot program, the Department of Justice (DOJ) is encouraging broader civil enforcement, raising the threshold on what constitutes cooperation credit, and strengthening coordination with foreign counterparts. In the DOJ’s own words, “This should send a powerful message that FCPA violations that might have gone uncovered in the past are now more likely to come to light.”

The one-year FCPA pilot program is intended to better incentivize companies and individuals to cooperate in investigations and enforcement actions. Cooperation credit is factored into the DOJ’s decision to move forward with (or defer) prosecution and may ultimately reduce any resulting sanctions. While the program offers more clarity, the requirements for companies to earn cooperation credit in FCPA violations are still somewhat vague. The Justice Department has stated that to earn the maximum credit under the pilot, companies need to voluntarily self-disclose an FCPA violation before a threat of government investigation arises, show full cooperation in the investigation and complete timely remediation. A company can receive a lesser credit if it demonstrates full cooperation and remediates but does not voluntarily disclose.

Setting up a FCPA compliance program begins with a comprehensive and tailored risk assessment to identify the aspects of the company’s operations (including its supply chain) and business relationships that are susceptible to corruption/bribery risk. It should also evaluate the existing compliance functions and internal controls in place to address these vulnerabilities. The areas of the business with the highest risk of noncompliance should be prioritized and closely monitored. For high-risk business functions or third-party relationships, due diligence every 18 months no longer makes the cut.

In a recent interview with Law360, Nina Gross, Managing Director in BDO’s Global Forensics practice, said about the new pilot program, “The devil is in the details. It remains to be seen how this is going to work.”

The pilot reinforces what we’ve known for a while: The DOJ is ramping up its investigative and prosecutorial efforts. With that in mind, manufacturers doing business overseas need to take a fresh look at their FCPA compliance programs, address any gaps in oversight and due diligence, and have a plan of action should a violation occur.

Newly Permanent R&D Tax Credit Offers Savings for Manufacturers

In December 2015, Congress passed the Protecting Americans from Tax Hikes Act of 2015 (PATH Act), which extended and made permanent a number of important tax credits—including the federal research and development (R&D) credit.

The permanent extension is a welcome change for manufacturers who, according to IRS statistics, accounted for more than $6.5 billion of the total $10.8 billion in federal credits claimed by corporations in 2012. Before the PATH Act, the credit would be passed for a year or two and then expire, leaving taxpayers to wonder, often until their tax year was over, whether they’d be allowed to report a credit for the year. Now, they can consider it a permanent component of their tax planning strategies.

The R&D tax credit can sometimes be overlooked by manufacturers who think “R&D” is a bar too high to meet and that their activities don’t qualify. The truth is manufacturers engage in a myriad of activities that can qualify regardless of what’s being manufactured: paper, food, apparel, chemicals, furniture, plastics—it doesn’t matter. All of these industry subsectors have reported millions of dollars of R&D credits, and they’ve enjoyed the tax savings, reduction in effective tax rates and increase in earnings and cash flows that R&D credits can bring. Increasing technological innovation in the industry, including IoT and robotics, should only serve to amplify opportunity.

Along with two other changes to the credit, smaller manufacturers have greater opportunity to take advantage of research credits.

-

“Eligible small businesses,” generally defined as privately held companies with less than $50 million in average gross receipts for the preceding three tax years, can use research credits to offset their Alternative Minimum Tax.

-

Startup manufacturers, defined as having gross receipts of less than $5 million and no gross receipts for any taxable year before the five-year period ending with the current taxable year, can use R&D credits to offset the employers’ portion of their payroll taxes with a potential for up to $250,000 for each eligible year for up to five years.

SHARE