2017 BDO Retail CxO Holiday Survey

Stores and Shoppers Sing Different Carols This Holiday Season

Today’s retailers claim to know their customers better than ever before. They have the ability to analyze customer data, use algorithms to target individuals and personalize shoppers’ experiences in a multitude of ways. Still, retailers’ extensive planning and hard work can be easily undermined by consumers’ ever-changing behaviors and budgets. Just how well do retail executives’ holiday season expectations align with consumers’ holiday shopping plans?

BDO’s inaugural 2017 Retail CxO Holiday Survey report explores the divide between retailers’ and consumers’ plans for how and where they’ll invest this holiday season. For this report, a mix of 100 retail CEOs, CFOs and CIOs were surveyed on their 2017 holiday season forecasts. At the same time, 1,000 consumers throughout the U.S. were surveyed on their holiday shopping plans. This panoramic vantage point illuminates some surprising differences between how executives in the C-suite and consumers on Main Street imagine this holiday season will play out.

“This year’s holiday sales may reveal a hard truth. The disconnect between retailers’ expectations and consumers’ actual preferences around online shopping, shipping and disposable income suggests that consumers are evolving faster than the C-suite can adapt. Retailers can bridge this gap by improving their data analytics, customer service and offerings tailored to their core demographics.”

Natalie Kotlyar

National leader of BDO’s Retail & Consumer Products practice

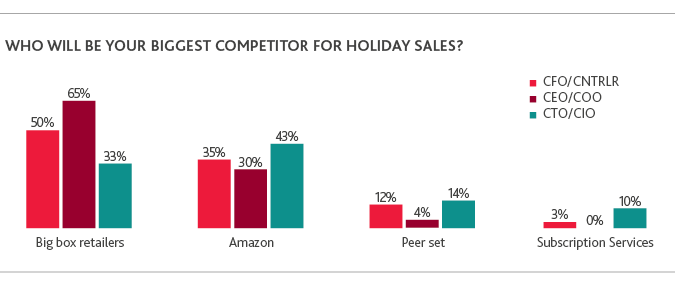

Amazon Dominates Headlines, but Competitors Still Not Convinced

Retailers and consumers’ opinions starkly differ when it comes to the most buzzed about name in retail today: Amazon. Somehow, retail executives might still be underestimating the e-commerce giant. Most retailers surveyed are more worried about competition with big box retailers, but less than onefourth of consumers say they will buy most of their holiday presents at stores like Walmart and Target.

Looking closely at Amazon’s customer base, 37 percent of high-income consumers (those with annual household incomes exceeding $100,000) intend to make the majority of their holiday purchases on Amazon this year—42 percent above the average for all respondents. When it comes to age cohorts, 32 percent of Millennials (ages 18-36) plan to spend most of their holiday budget on Amazon, compared to 22 percent of Baby Boomers (ages 53-71). Overall, Amazon’s customers span all age groups and income levels, with only more room to grow.

As traditional retailers vie against Amazon for market share, they juggle the difficult balancing act of managing improvements to their customers’ in-store and online shopping experiences. Retailers still manage to make money in their brick-and-mortar shops, contrary to many headlines, but their future success is up for grabs. According to the 2017 BDO Retail RiskFactor Report, 44 percent of retailers cited risks associated with mall traffic and competition for prime commercial real estate. Retailers’ risk analysis was spot on: Only 14 percent of consumers plan to buy most of their gifts at department stores this year, as some players in this category fail to obtain private funding or lose financial stability under mounting pressure from investors and competitors.

In the C-suite, more CIOs see Amazon as their main competitor for the holidays than any other type of executive. At the same time, the majority of CEOs think that big box retailers will be their chief competitor. Executives might still be wary of fully acknowledging Amazon’s incredible grip on the e-commerce market, but this holiday season’s sales will better solidify just how much they should pay attention to online shopping’s seemingly unstoppable growth.

Shaking the Sales Snow Globe

Consumer confidence and spending was cited as a business risk by 90 percent of retailers in their latest 10-Ks, according to the 2017 BDO Retail RiskFactor Report. Their concerns over Americans’ leaner budgets are confirmed by this year’s consumer and executive survey data. Despite the recent hurricanes and tax reform’s slow progression, retailers predict holiday sales will increase by an average of 2.2 percent this season, a more muted outlook compared to the National Retail Federation’s projection of a 3.6 percent to 4 percent sales boost. But, retail executives surveyed might still be overly optimistic this year. A majority of consumers plan to spend the same amount of money as they did last year on holiday presents, although this varies slightly between demographics. Nearly half of Millennials are planning to spend more money on holiday gifts this year, perhaps a result of their growing disposable incomes. Meanwhile, parents are more likely to strive to uphold the magic of the holidays, as 33 percent of respondents with children at home plan to spend more money on holiday gifts this year, compared to 18 percent of those without.

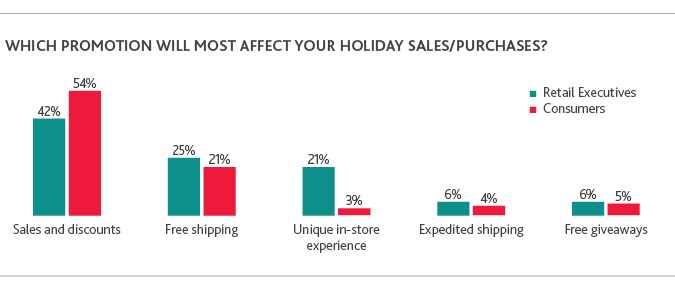

Sales Top Shoppers’ Holiday Wish Lists

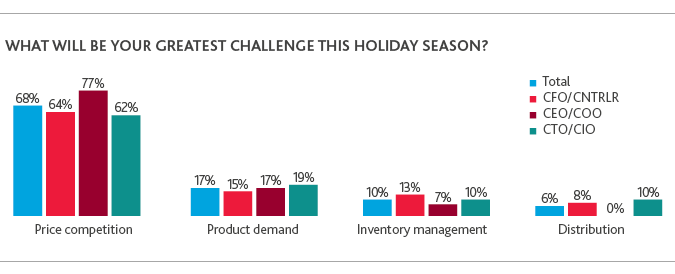

Retailers and consumers do see eye to eye on one issue: price. According to both executives and consumers, retailers with competitive prices will capture the majority of holiday sales. Fifty-four percent of consumer respondents will choose stores with the most budget-friendly prices, while 68 percent of retailers say that price competition will be their greatest challenge this year.

Even though many retailers acknowledge the importance of maintaining affordable prices, 36 percent do not plan to offer any special holiday promotions whatsoever, and 80 percent of retailers plan to offer the same number of discounts and promotions this holiday season as in years past. Many retailers are finding it harder to keep their prices low, as 99 percent of those surveyed cite industry competition and consolidation as a concern in the 2017 BDO Retail RiskFactor Report.

In fact, the obstacle of price competition is reaffirmed by the 68 percent of retailers reporting that their greatest challenge this holiday season will be cutting costs. While retail giants like Amazon and Walmart have the resources to swiftly innovate and cut costs, the majority of retailers hustle to offer competitive prices and products. Midmarket retailers might consider focusing on their customer service, subscription services, loyalty programs or exclusive products to offset the effects of a hyper-competitive market.

Cyber Monday Set to Capture Thanksgiving Weekend Sales

As consumers increasingly search online for the best holiday deals, retail executives anticipate higher Cyber Monday sales this year. Executives surveyed project Cyber Monday sales to increase 2.6 percent this year, compared to an expected 1.8 percent bump for Black Friday. This year, more retailers plan to close their doors on Thanksgiving to improve employee satisfaction and draw more feet in-stores on Black Friday.

These projections underline the growth of e-commerce and the importance of consistently offering discounts throughout the entire holiday season, as 35 percent of retail executives plan to do. With more consumers planning to flood e-commerce sites this season, retailers would be wise to make sure their logistics and delivery services are ready to accommodate a massive influx of orders.

Spruce Up the Shopping Experience or the Shipping Experience?

Added restaurants, spas and gyms make for luxurious in-store features, but today’s shoppers might be too busy to enjoy these amenities. Generational differences emerge when it comes to delivery versus in-store options. Seventy-three percent of Millennials say they would pay extra for shipping for a $40 gift to ensure on-time delivery, compared to 58 percent of Baby Boomers. Meanwhile, 28 percent of respondents aged 18-34 would pay an extra $10 to have a $75 gift shipped in time for a holiday party instead of traveling 15 minutes to retrieve it from the store. Just 8 percent of 55-64-year-olds would make the same choice. For better or for worse, the holidays might make shoppers more eager than usual to have their gifts delivered on the dot.

“Consumers access to endless information and shopping options has reshaped their purchasing behavior. But having more options also means making more decisions. Retailers who simplify the decision-making process will win the most loyal customers, and a solid shipping offer is one of the easiest decisions for today’s consumer to choose. Although many consumers still prioritize saving money over time, the most successful retailers meet them in the middle by offering a smooth delivery process at competitive rates.”

Jennifer Valdivia

Partner in BDO’s Retail & Consumer Products practice

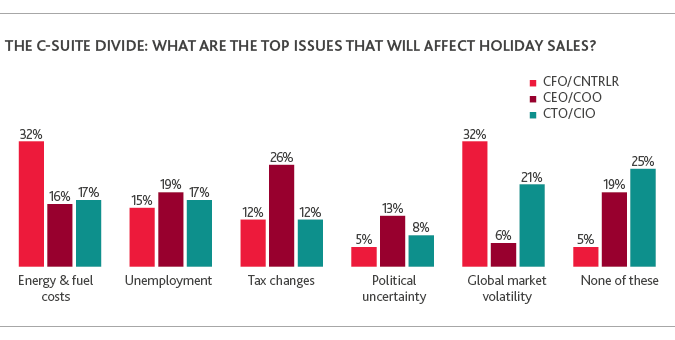

The C-Suite Divide

Apart from some noteworthy gaps between executives and consumers’ holiday plans, BDO’s data reveals another significant divide between respondents: CEOs, CFOs and CIOs’ unique holiday season outlooks. Most CFOs believe that energy and fuel costs as well as global market volatility will be the economic issues with the most impact on their holiday sales. The top boss, however, takes a different stance: A plurality of CEOs see tax changes as the economic issue most likely to impact holiday sales this year. These differences highlight how executives’ unique positions within their companies can shape their opinions on financial and operational challenges and opportunities. Ensuring consistent communication and transparency throughout the C-suite could be key to moving a company’s management forward in unison.

Understanding consumers is both an art and a science. Personalized experiences based on data can only work for so long before shoppers’ human quirks are revealed; quantitative analysis needs to be balanced with a qualitative understanding of who the core customer is and what they most desire. At the top of retailers’ wish list this year should be an emphasis on comprehensively interpreting what works and what doesn’t in terms of holiday strategies. With this new knowledge, companies can continue their hard work of adapting to the swift, challenging, yet exciting new retail ecosystem.

The 2017 BDO Retail CxO Survey is a national telephone survey conducted by Market Measurement, Inc., an independent market research consulting firm, whose executive interviewers spoke directly with 100 chief executive officers, chief information officers and chief operating officers in September and October 2017. The survey was conducted within a scientifically developed, pure random sample of the nation’s leading retailers.

BDO’s Consumer Beat Survey was conducted in October 2017 using ORC International’s CARAVAN® omnibus among a nationally representative sample of 1,020 U.S. adults age 18 and older.

SHARE