Technology Mid-Market M&A Update

From 2008 to 2018, global GDP grew at an average annual rate of 3.4%, despite sustained geopolitical, regulatory and economic uncertainty around the world. At the end of that period, however, there were signs that the chaotic environment was finally taking a toll on the global economy. In the second half of 2018, volatility in financial markets, combined with trade tensions and other factors, destabilized the U.S. stock market and led the IMF to downgrade its estimate of global economic growth for 2019.

Worldwide M&A activity caught the cold, dropping by 25% from Q4 2018 to Q1 2019, according to Mergermarket. While global stocks recovered quickly from the December downturn, mid-market M&A remains in a slump, with volumes dropping 2% from the first quarter to the second. All told, H1 2019 volume was down 23% from the same period last year.

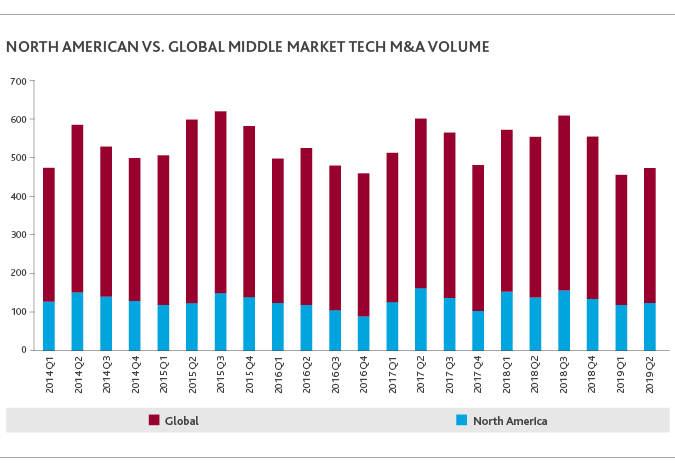

Tech M&A fared slightly better, with volume falling only 20% from Q4 2018 to Q1 2019 and actually increasing by 3.6% from Q1 to Q2. Tech M&A volume dropped by 18% in H1 2019 versus H1 2018. This resilience, combined with continued interest in the tech sector from strategic and financial buyers alike and the proven value of M&A as a vehicle for growth, could bode well for a rally in the second half of this year.

In this inaugural BDO Technology Mid-Market M&A Update, we look at the key factors that led to the H1 2019 drop in tech mid-market M&A activity and new threats and opportunities that technology leaders should consider as we approach Q4 2019 in this period of sustained uncertainty.

Review of Technology Mid-Market M&A Activity

Deal Volume Quarter-over-Quarter

After plunging by 20% from Q4 2018 to Q1 2019 (from 420 to 336 deals), global tech mid-market M&A activity started to stabilize in Q2, with volumes increasing by 3.6%, according to Mergermarket. North American mid-market tech M&A volumes mirrored those results, dropping by 11% from Q4 to Q1 before posting a modest recovery of 4.2% in Q2. Deals can take months to close, so substantial movements up or down in financial markets aren’t immediately evident in M&A figures. The first half of the year is a case in point. While the global economy has rebounded after an unsteady H2 2018, according to Pitchbook, global M&A volume hit a nine-year low in Q1 2019 thanks to the downturn’s impact on the cost of financing deals.

Deal Volume by Sector

In North America, overall deal volume fell by almost 29% between H2 2018 and H1 2019. However, technology deals represented the largest segment of M&A volume, as was the case throughout 2018.

Notable Deals

The largest North American mid-market technology deals in H1 2019 include:

-

JPMorgan’s acquisition of healthcare payment solutions provider, InstaMed

-

Envestnet, Inc’s acquisition of PIEtech, Inc., and

-

Kohlberg Kravis Roberts & Co. L.P. taking over OneStream Software LLC.

All four deals were valued at $500 million each. The largest technology deals worldwide—the acquisition of Switzerland’s Veeam Software AG by Canada Pension Plan Investment Board and Insight Venture Partners LLC; Gems Education’s purchase of Ma’arif for

Education & Training; and TPG Capital / Insight Venture Partners’ takeover of Kaseya Limited—shared that same valuation.

Deal Activity: Strategic Buyers vs. Financial Buyers

Strategic and financial buyers combined to print a record number of billion-dollar deals—108—in 2018, according to 451 Research. Private equity (PE) buyers and tech giants like Microsoft and IBM harmonized their shopping, but the former’s impact on tech accelerated, declaring that “tech has become a private equity-backed industry.”

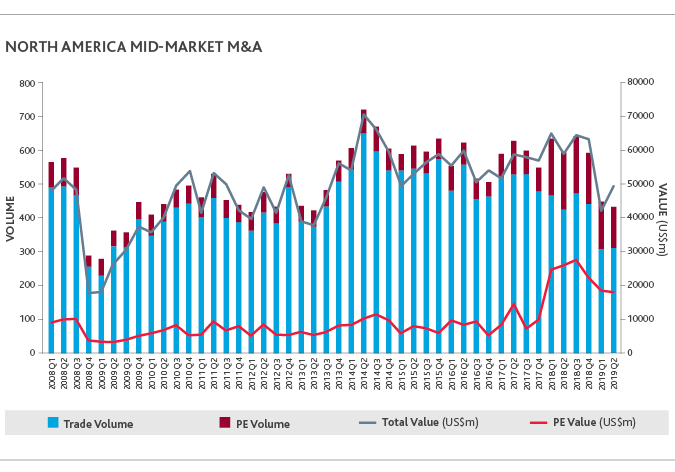

North America: Mid-Market M&A Activity by PE Volume/Value Overall

Though analysts expected 2018’s record pace to continue into 2019, North American PE deal volume in mid-market M&A fell in H1 2019 by 18% versus the previous half year. Interestingly, while trade volume remained steady in Q2, the decrease in PE volume accelerated, sliding from 151 deals in Q4 2018 to 140 in Q1 2019 and 121 in Q2.

While strategic M&A volume across all industries fell by 29% from H2 2018 to H1 2019 in North America, PE volume dipped by only 18%. As a result, PE deals as a percentage of total deal volume increased to 33%.

In the North American tech sector, software continued to be a focus for PE deal-making. Low overhead, high organic growth and customer retention (“stickiness”) make these companies attractive, especially those based on the Software as a Service (SaaS) model. During Q1 2019, 15.2% of deals involved software, with 20.6% involving other technology, according to Mergermarket data. One example is the $11 billion leveraged buyout of Ultimate Software Group by a consortium including Hellman & Friedman, Blackstone and CPP Investment Board. Vista Equity Partners closed on two $1.9 billion deals, one for Apptio and the other for the gym scheduling app, Mindbody.

Globally, mid-market tech M&A PE deal volume fell in H1 2019 by 23% versus the previous half year. Trade volume decreased by 26% over the same period. Trade volume increased in Q2, while PE volume continued to slide, from 450 deals in Q4 2018 to 396 in Q1 2019 and 341 in Q2. Total PE deal value fell by 23% from the second half of 2018 to the first half of 2019.

Macroeconomic Factors Impacting Technology M&A Activity

Tax and Trade Environment

Our quarterly BDO Deal Advisor Digest for Q4 2018 cited tax and trade as the chief factors in the 2018 seesaw ride.

Tax: On the tax front, the report suggested that the Tax Cuts and Jobs Act of 2017 both helped and hurt M&A activity. It removed uncertainty around the future of tax reform, gave companies an infusion of after-tax cash for growth and investment, and included provisions that made asset acquisition more attractive. All of this prompted some companies to proceed with plans that had been on hold.

At the same time, since a rising tide lifts all ships, those infusions of cash increased competition for deals and buoyed valuations. The new law also limited the deductibility of interest expense to 30% of EBITDA, potentially increasing the income tax liability of a post-transaction entity in highly leveraged deals. The result was that, while 61% of board members told us his or her organization benefited from the tax reform, only 11% said it directly resulted in pulling the trigger on a merger or acquisition.

Trade: Trade wars hit goods-producing companies harder than services-oriented ones. For that reason, the tech sector in general is not as vulnerable as the retail, automobile and chemical industries. However, within the tech space, semiconductor suppliers and companies like Apple that rely on China to assemble their hardware will feel the biggest impact from prolonged uncertainty around trade. According to recent news reports, 60% of Qualcomm’s revenue comes from China.

The first round of tariffs excluded many tech components, and the H2 2019 stock market rally was driven in large part by optimism that a deal would be reached. Apple in particular felt the positive effects of progress in talks between the world’s two largest economies. On the company’s Q1 earnings call, Apple CEO Tim Cook said the company’s outlook in China was significantly rosier than at the end of 2018. Fast forward a few months to August, however, and the U.S. has announced a 10% tariff on, among other things, smartphones.

For tech companies, the real benefit of a U.S.-China trade deal may be in the text rather than the numbers as many operate at double-digit profit margins, making a 10% tariff relatively easy to absorb. For example, the collapse of negotiations back in May was due in part to China reneging on promises to open up the Chinese market to U.S. companies and take steps to end intellectual property theft. According to the 2019 China Business Climate Survey of companies doing business in China, 46% said lackluster protection of intellectual property rights was a significant concern. Any trade deal that includes meaningful concessions by China on those points will be a boon to U.S. tech companies.

Despite the latest round of new tariffs announced in August, President Trump has said that trade talks will continue between Washington and Beijing.

Economy

Uncertainty is supposed to be bad for business, but the 10-year bull market in the U.S. has coincided with a sustained period of unpredictability in global economic policy.

By the end of 2018, though, there were signs that the global economy had reached the limits of its resilience. The Global Uncertainty Index, which measures unpredictability in 20 countries, reached a record level in December, which also happened to be the worst December for U.S. stocks since 1931. Thanks in large part to the U.S. government shutdown, the U.S. component of the index set its own record the following month.

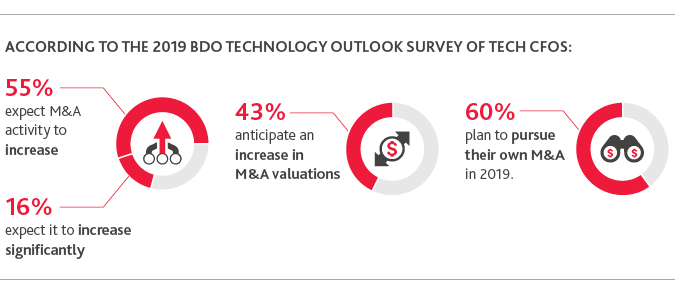

BDO’s 2019 Technology Outlook Survey, released in February, showed that 84% of U.S. tech CFOs surveyed expected higher total revenues in 2019. That rosy outlook has proven to be prescient: According to CSIMarket.com, quarterly revenue growth in the tech sector was 29% year-over-year. Tech stocks have soared in kind, with the S&P 500 technology sector up more than 30% through the end of July. This is despite developments that should drag on tech companies, like the ongoing trade war between the U.S. and China, and the Department of Justice launching antitrust investigations targeting search, social media and digital companies.

The tech sector appears unshakable, but there is no escaping its inextricable link to the broader economy. In July, the IMF revised its global growth forecast for 2019 down to 3.2%, off 0.1% from the April projection. That would mark the slowest growth rate since the trough in 2009. The IMF still predicts an uptick in 2020, but that projection was also lowered by 0.1% from the April forecast, to 3.5%.

With the U.S.-China trade war, Brexit still unresolved, new issues emerging in the form of the crippling protests in Hong Kong, tanker turmoil in the Strait of Hormuz and trade tensions between Japan and South Korea, the world finds itself dealing with more uncertainty, not less.

Regulation

In the technology sector, intellectual property increasingly drives M&A activity, and therefore, countries have taken steps to prevent geopolitical rivals from acquiring new or disruptive technology. This has complicated and delayed cross-border M&A, while increasing regulatory scrutiny has delayed closings and could impact future deals.

Technology M&A deals targeting U.S. firms are receiving more scrutiny from the Committee on Foreign Investment in the U.S. (CFIUS). That body is responsible for quantifying the potential impacts to national security of foreign investments in U.S. companies. CFIUS has been especially wary of deals being pursued by Chinese acquirers in the tech sector. That extra attention has had a chilling effect on inbound activity, with deal value dropping 68.5% from H2 2017 to H1 2018, according to Mergermarket. Over that period, only five transactions originated from Chinese investors.

The U.S. may be right to be protective. China’s “Made in China 2025” program aims to shift the country from making things invented in other countries to becoming a hotbed of innovation in its own right. To achieve that goal, China has encouraged the acquisition of U.S. and European tech companies and absorbing their intellectual property and tech expertise. The U.S. government is trying to derail this strategy, expanding the scope and authority of CFIUS. Germany and the UK are following suit. In response, China is turning its focus to Asian countries more receptive to its overtures, like South Korea and Japan.

Antitrust

China is also making changes in its handling of antitrust issues in cross-border transactions. The country consolidated its three antitrust bodies into the State Administration for Market Regulation (SAMR) and in 2018 rejected or delayed several transactions, including Qualcomm’s bid for NXP.

In the U.S., the FTC and Antitrust Division of the Department of Justice (DOJ) have, to date, kept enforcement actions consistent with pre-Trump administration levels. The high technology and internet sectors remain a top focus for the agency.

Data Privacy

The introduction of GDPR in May 2018 has added a new layer of complexity and risk to cross-border mergers and acquisitions. The U.S. currently lacks a unified data protection law, instead following a “sectoral” approach, with legislation being introduced on an ad hoc basis. The push for a GDPR-style law to be implemented in the U.S. is gaining momentum, and California’s Consumer Privacy Act, or CCPA, paints a picture of what that might look like. The law, which goes into effect in January 2020, gives residents of California the right to see the personal data that businesses have collected on them, demand that the data be deleted and opt out of having their data sold to third parties. The legislation applies not only to businesses based in California, but to any entity that operates in or handles the personal data of California residents.

These statutes increase the level of sophistication and due diligence required when analyzing cybersecurity infrastructure and privacy protocols of a target company, and the risks can be substantial. A huge data breach within Yahoo that came to light in the midst of Verizon’s 2017 acquisition of the web services provider shaved $350 million off Yahoo’s price.

Importantly, a target company that is compliant with GDPR is a good start. Many of CCPA’s provisions are similar to those of its continental counterpart, but there are numerous and substantial differences that entail a CCPA-specific compliance strategy for companies subject to both laws.

Political

Ahead of the 2020 presidential election, the tech sector has found itself the target of campaign rhetoric. Presidential candidate Elizabeth Warren’s March 8th blog post called for the reversal of “illegal and anti-competitive tech mergers,” including Facebook’s acquisition of WhatsApp and Instagram and the purchase of Waze by Google.

“The technology industry [companies] have to take into account that there is a spotlight on them, and that the transactions are likely to get a lot of scrutiny,” said Mark Ostrau, a partner and the chair of Fenwick & West‘s antitrust and trade regulation practice group. “They’ll need to factor that into their risk assessment.”

The next 18 months are likely to stoke the flames of discontent on both sides and could set the stage for action in 2021, especially if the election results in one party taking both the executive and legislative branches of power.

Q4 2019 Outlook

Like the U.S. stock markets, which rebounded quickly after a precipitous drop in December 2018, we expect North American tech mid-market M&A to recover, albeit more slowly. This is partly a result of the prolonged timelines, complexity and due diligence inherent in M&A transactions, but also because volatility and uncertainty continue to permeate the U.S. and global economies.

Specific areas of concern are the U.S. economic, political, regulatory and monetary arenas, uncertainty around Brexit, the erratic nature of trade and tariff discussions involving the U.S., and slowing growth in China. While we expect tech mid-market M&A activity will increase in Q3, performance in Q4 and especially Q1 2020 will hinge on two variables: Trade talks between the U.S. and China and the U.S. and Europe, and monetary policy decisions among the top central banks. If those variables are resolved favorably, the IMF’s prediction of growth in H2 2019 and 2020 will play out and M&A activity should follow.

If antagonism grows between the U.S. and its major trading partners or a profits recession forces the Fed to maintain or even raise interest rates, we may see H1’s performance repeated in H2 and the first half of 2020. Some analysts anticipate that would be a major headwind to M&A activity. Thanks to ten years of economic expansion and the recent tax reform, however, many companies have cash reserves on hand to shield them from the effects of a downturn. Tech companies in particular benefitted from a provision in the tax law allowing them to repatriate foreign profits at a lower rate. Some of these companies may see a recession as an opportunity.

While there is cautious optimism of continued economic prosperity, it behooves technology leaders to plan M&A scenarios through this lens as well as from a more conservative point of view as we head into the last quarter of 2019 and beyond. Having a handle on current “dry powder” to invest in acquisitions will give tech firms an advantage no matter which scenario plays out.

SHARE