BDO Retail Rationalized Survey

Table of Contents

“The majority of retailers are stuck in survival mode. Playing catch-up in perpetuity is preventing retailers from seizing new opportunities and leapfrogging the competition. It’s time for retailers to get rational: Scale with stability. Focus with foresight. Invest with intention.”

Natalie Kotlyar

Partner and Retail & Consumer Products practice leader

Introduction

2018 kicked off with tax cuts and closed with record holiday season results for the industry overall.

A healthy economy helped quiet the rumblings of a retail apocalypse. It wasn’t all rosy, though, as the industry contended with a steady drumbeat of bankruptcies, burdensome levels of debt, new entrants, and shifts in buying power across generations—all of which pressure retailers to innovate.

Combating these dynamics for any retailer is a challenge—but even more so for middle market and emerging businesses that have greater resource constraints. Too often, these organizations are focused on business strategy transformation without giving equal weight to financial and operational management. And too often, retailers make large scale investments without an honest understanding of their value to consumers.

Retailers who will thrive under these market dynamics are realistic about their true strengths, choices and their opportunities. They will have a strong sense of purpose and understand that innovation will only generate ROI if it’s based on a solid financial foundation and strategic choices.

It’s no longer about who can check every box for a product or service, it’s about who has the clearest focus, the most thorough transformation strategy, the most financial flexibility. This is Retail Rationalized.

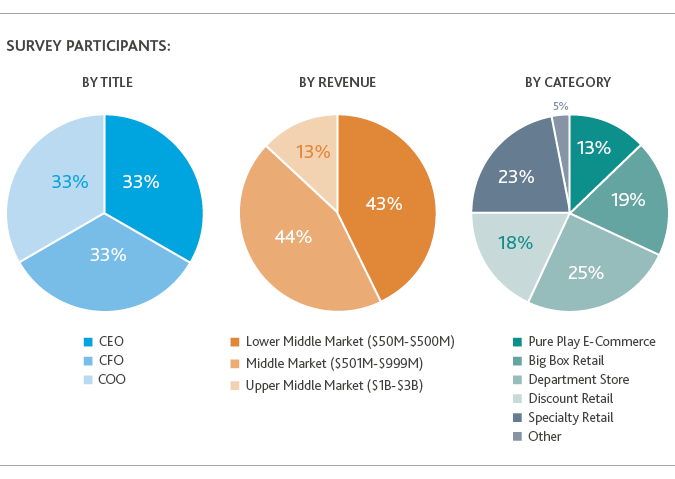

We surveyed 300 retail C-suite executives on overall health and strategic planning because it’s critical that retailers take a hard look at their businesses now: On the heels of the longest bull market on record, many predict we are at the precipice of the next market downturn.

Regardless of when the next market correction occurs, industry dynamics will inevitably favor those who are thinking long-term. What worked to keep businesses afloat in 2018 may not be enough once that correction hits, and retailers that are just surviving today could find themselves in trouble.

Against the mixed backdrop of today’s landscape, we set out to find what distinguishes Thrivers from Survivors.

44% of retailers are actively planning for a market correction.

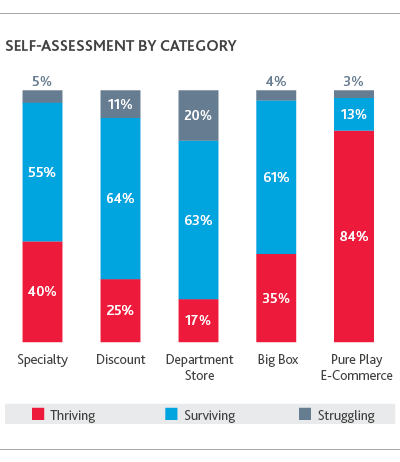

For the purposes of this survey, organizations are categorized in three groups, according to their self-assessment:

-

Thrivers: Profitable and experiencing robust growth

-

Survivors: Stable and breaking even

-

Strugglers: Unprofitable and/or losing out to competition

.png)

With less overhead and no dead store weight, an overwhelming majority of pure play e-commerce businesses (84 percent) are thriving. At the same time, one in five department stores are struggling as they seek to optimize their physical assets and compete with online offerings and attractive prices. More than half of traditional retailers—including big box, department store, discount and specialty retailers—are just surviving.

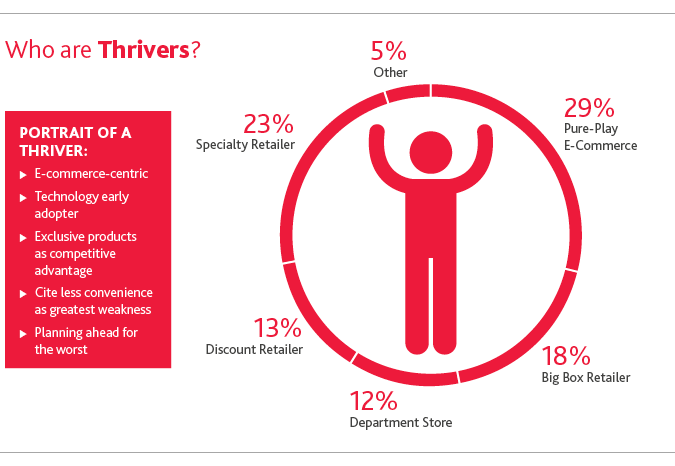

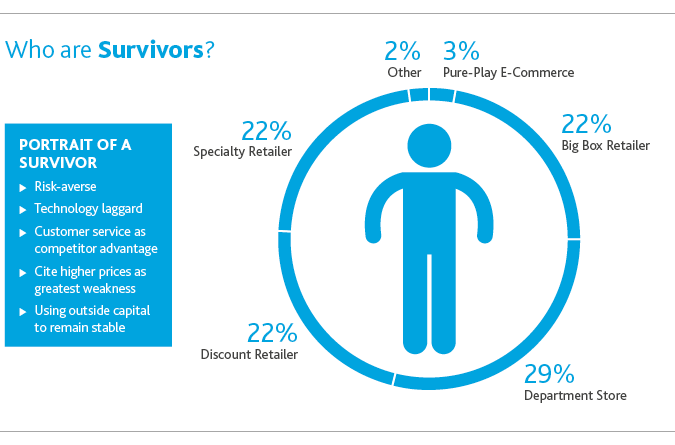

We learned that there are key differences between how retail Survivors and Thrivers are operating and making decisions. Survivors tend to avoid risk and are focused on keeping pace with traditional competitors, while Thrivers are making smart bets and focused on standing out from competition with exclusive offerings. Most importantly, Thrivers are planning ahead.

It’s the Thrivers who are actively planning for an economic downturn and anticipating increased levels of retail bankruptcy in 2019. Meanwhile, the majority of Survivors are taking a wait-and-see approach to what could potentially be a legitimate retail apocalypse.

Retailers will stay stuck in survival mode until they leapfrog the competition, or invest in future needs. This means knowing where to focus and anticipating consumer demands before they are realized. It also requires a solid financial foundation to make the leap effective long-term.

|

|

|

|

|

|

|

|

|

|

|

|

Capital Moves and Investments

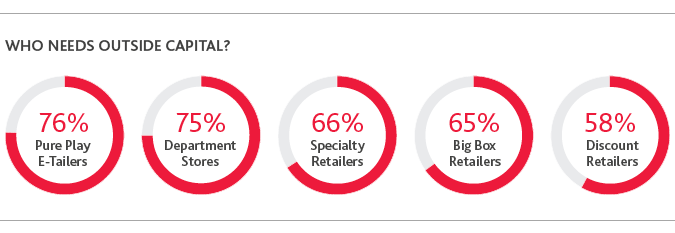

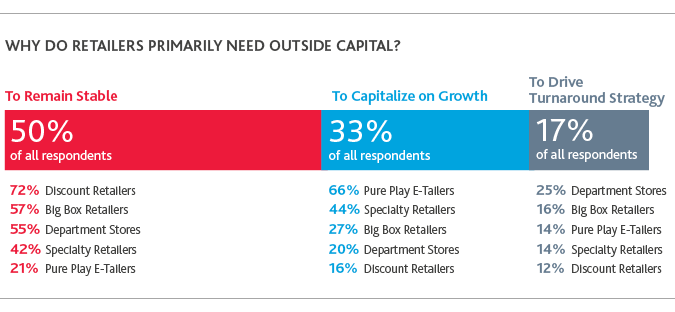

Sometimes it takes money to make money. Two in three C-suite executives surveyed say they have recently secured—or will soon secure—outside capital, but their needs for capital infusion vary by type of retailer.

Traditional retailers that need capital are largely using it to remain stable, while the majority of pure play e-tailers are looking to capitalize on growth. A sign of industry health overall, fewer than one in five retailers need a capital infusion to drive a turnaround strategy.

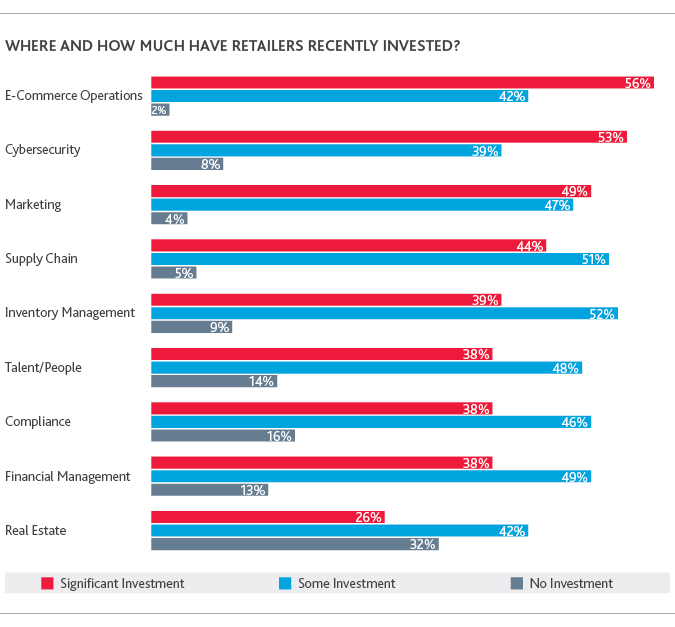

Across the board, retailers are making significant investments in their e-commerce operations, with traditional retailers facing an uphill battle against pure play e-tailers who exclusively operate digital channels. As a result, retailers’ real estate assets are the lowest priority for investments, and among those who have changes planned for their store footprints, most are remodeling or downsizing. Still, over one in three Thrivers are planning to grow their store count, with some e-tailers making their foray into the physical space.

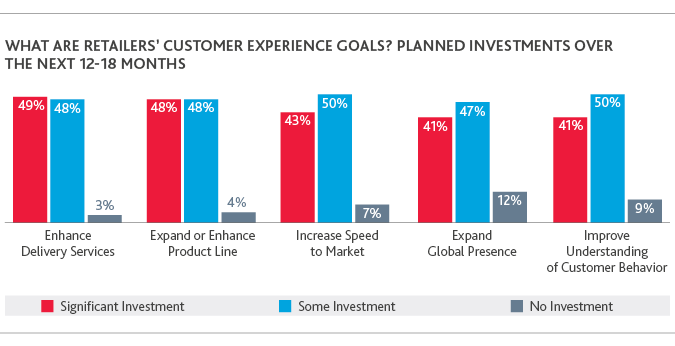

Retailers are also planning to invest in improving their customer experiences over the next 12-18 months. As younger generations are increasingly spending on experiences over material goods, it’s critical that retailers make a compelling case for dollars to be spent on their brand. Facing heightened demand for convenience, exclusivity, novelty and authenticity, nearly all retailers are dedicating resources to enhance delivery services and product lines, as well as boost speed to market for new products.

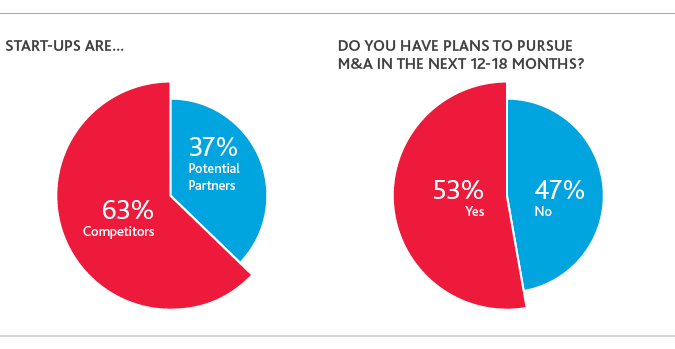

Retailers are also deploying capital into M&A—and increasingly, with nontraditional partners. In fact, the value of U.S. deals in the retail trade sector reached approximately $8.85 billion as of Q3 2018, according to Statista. Deal activity throughout 2018 illustrates the growing trend of traditional retailers partnering with start-ups and pure-play e-tailers—some of which may have once been competitive threats. These partnerships help traditional retailers stay relevant as they build out their technology and reach, while putting customers at the forefront.

Spotlight On: Start-Ups Rise Up

| Q1 | Q2 | Q3 | Q4 |

Nordstrom acquired two retail technology start-ups: MessageYes, a conversational commerce platform, and BevyUp, a back‑end digital sales communication platform |

Amazon bought online pharmacy start‑up PillPack |

Legacy mattress company Serta merged with fast-growing, direct-to-consumer online mattress brand Tuft & Needle |

Walmart acquired Bare Necessities, an e-commerce intimates and sleepwear retailer |

Yet the majority of retail executives still see start-ups as competitors.

Bottom line: For Survivors to become Thrivers, they must make the hard choices before the hard choices are made for them. This starts with focusing and optimizing investments: exit unprofitable stores or transform them into distribution centers; devote resources to upskill employees; and replace legacy systems with next-generation technology throughout the supply chain. In some cases, the hard choice may mean partnering with a competitor.

Competition & Differentiators

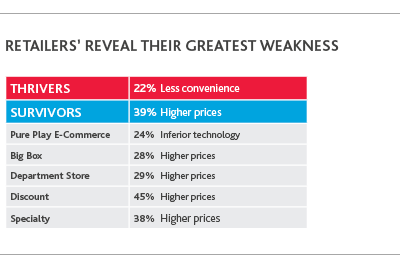

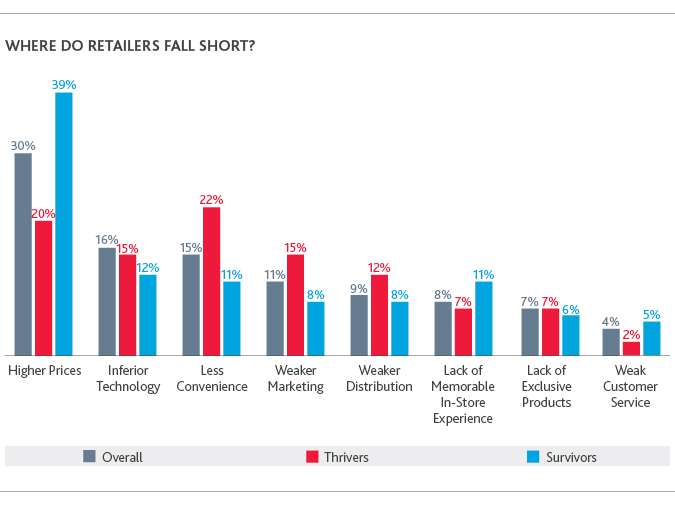

To have foresight, retailers must first have a firm understanding of their status quo, including their strengths, weaknesses and true competitive differentiators.

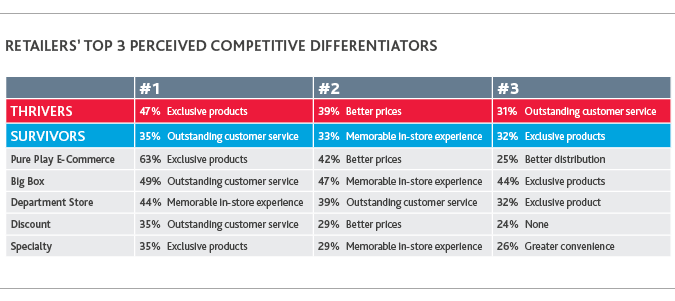

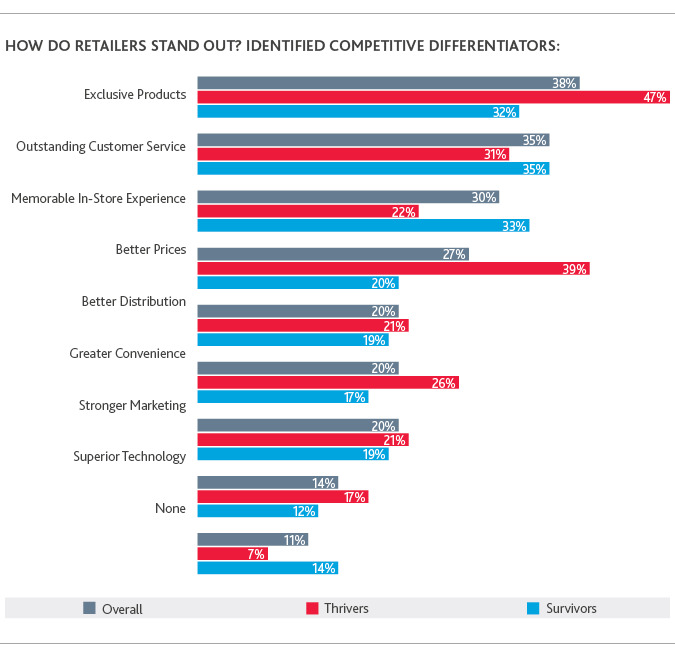

The highest percentage of retailers believe that their exclusive products, customer service and in-store experiences set them apart from their greatest competitor—with the top differentiators varying by category. In particular, most pure play e-commerce and specialty retailers tout their exclusive products, while big box and discount retailers rely on their customer service to capture business from competitors. Department stores see their physical space as their strongest assets and hope their in-store experiences are more memorable than competitors.

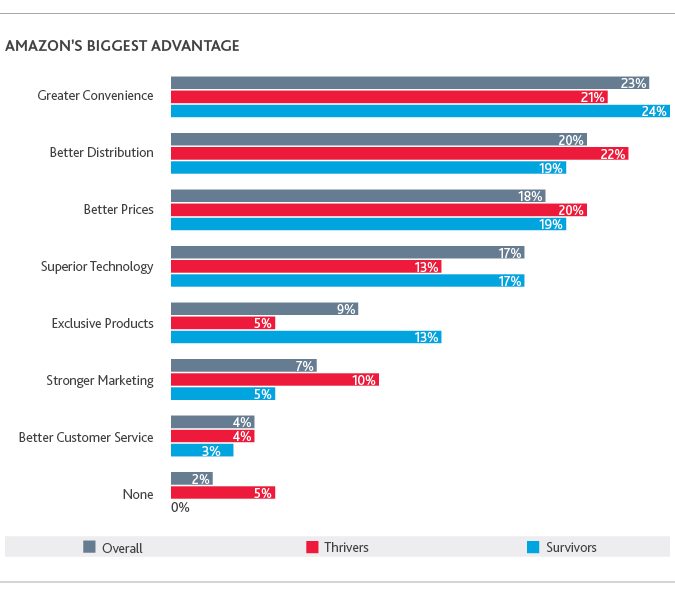

Although some retailers may not consider Amazon their greatest direct competitor today, 70 percent of those surveyed believe the cons of partnering with Amazon outweigh the pros. With most retailers disinterested in leveraging the behemoth’s reach and reputation, they are wise to Amazon-proof their business as the giant continues to extend its roots.

Only 9 percent of retailers see exclusive products as Amazon’s biggest advantage over their business. While this may change as Amazon continues to roll out its private label brands, Thrivers are wise to be capitalizing on this perceived gap today.

Similarly, just 4 percent of retailers see customer service as Amazon’s biggest advantage over their business. Despite the convenience that Amazon offers, they are perceived to lack strong customer service when it comes to experience and human interaction—areas where Survivors are doubling down.

70% say the cons of partnering with Amazon outweigh the pros.

To Amazon or Not to Amazon?

Retailers Weigh Partnerships

In Q3 2018, apparel retailer J. Crew announced that it would begin offering its budget-friendly line, J. Crew Mercantile, through Amazon Fashion. News of the partnership raised eyebrows, as the retailer had previously rejected the idea with concerns that the brand’s bestsellers would be cannibalized by Amazon’s own private label collection.

J. Crew isn’t the first to change its tune, though. The brand will join the likes of Nike, Chico’s and The Children’s Place, all of which have recently and gradually begun to offer their products on Amazon. Nike began testing its direct partnership last summer by offering a limited assortment of footwear and apparel for sale on Amazon, hoping to box out third-party sellers conducting business through the website. So far, though, they’ve had some tough lessons learned: Shortly after becoming a first-party seller, Nike found that the third parties they aimed to take the place of were able to continue conducting business through Amazon by listing identical products under a new product identification code.

If becoming a first-party seller on Amazon isn’t enough to eliminate third-party sellers, why are more brands moving toward direct partnerships?

PROS:

-

Customer retention

-

Potential to quickly liquidate excess inventory

-

Soaring Amazon Prime subscriptions and top-notch shipping and return policies

-

Wider distribution channels and more advanced shipping networks

-

Access to customer data

Though there are clear incentives for joining forces with Amazon, there are a number of caveats that deter retailers from taking the leap:

CONS:

-

Potential cannibalization of established niche customer base

-

Loss of control over product messaging, pricing, display and placement

-

Concerns of diminishing brand equity for those who have fostered an aura of exclusivity

-

Misalignment of goals and values

Bottom line: Many retailers claim to have the same differentiators, and they can’t all be right. In particular, Survivors—the majority of which are traditional retailers—say their customer service and in-store experiences are stronger than competitors. This may be the case for some, but given the competition with one another, it’s clear their perceived strengths may not be differentiators in reality.

Nearly one in four (22 percent) consumers say bad customer service is a deterrent, according to our 2018 Consumer Beat Survey, but in order for strong customer service to be a competitive differentiator, retailers need to turn the advantages of human interaction and physical space into growth. For example, well-trained and tech-enabled store associates that effectively assist shoppers on the floor are more likely to drive loyalty. While middle market retailers are pressured to minimize labor costs, adequate staffing levels and investing in training are critical to converting the necessity of good customer service into a unique selling point.

Technology & Transformation

Only 14 percent of retailers see superior technology as a top advantage over competitors. As technology continues to disrupt all business functions, from finance to supply chain and marketing, it’s likely that future Thrivers will be the ones in that 14 percent.

According to our 2019 Middle Market Digital Transformation Survey, 38 percent of retailers plan to increase their spending on digital investments by between 1 percent and 9 percent over the next 12 months, while 27 percent plan to increase their spending by 10 percent or more.

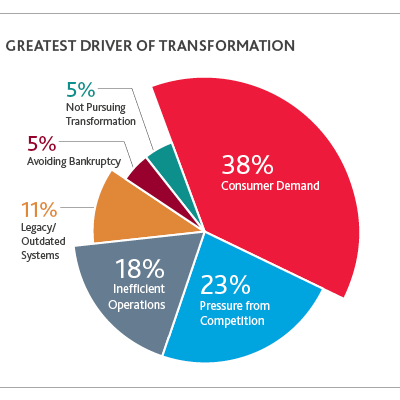

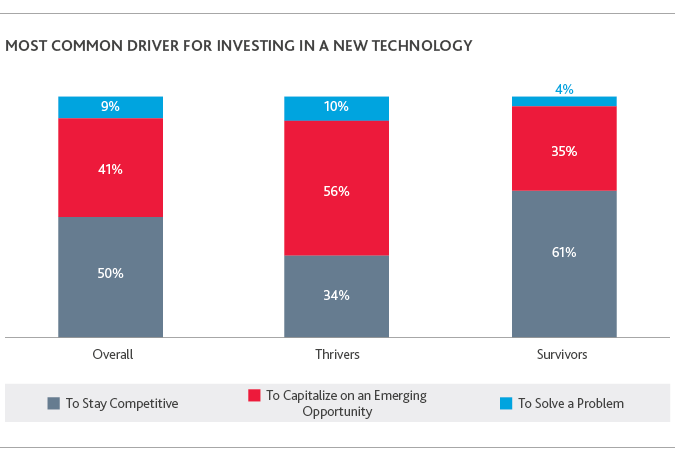

Deciding where to implement new technology is a challenge, and often comes with a trade-off. Retailers across the board cite competition as a top factor driving business transformation and investments in new technology. To leapfrog competitors, however, retailers should prioritize revenue-generating digital initiatives that address consumer pain points unmet by competitors or automate routine processes that detract from that focus.

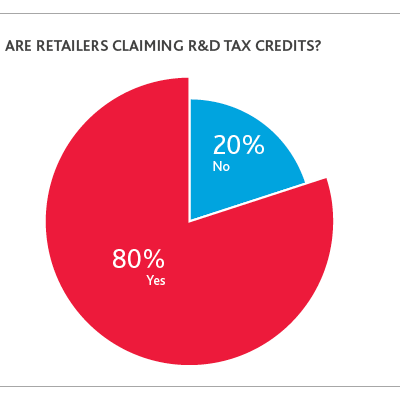

Capturing R&D credits can help offset some of those hard investment choices, as they are designed to encourage innovation and reward retailers for investing in related personnel, research and equipment. However, one in five retailers surveyed are not taking advantage of R&D tax credits.

But before identifying a solution, retailers must accurately define their problem. Design-thinking principles can help with this process, according to our Digital Transformation Playbook for the Middle Market. This entails accurately reflecting customers’ points of view based on real-world observations—a process that requires research and data.

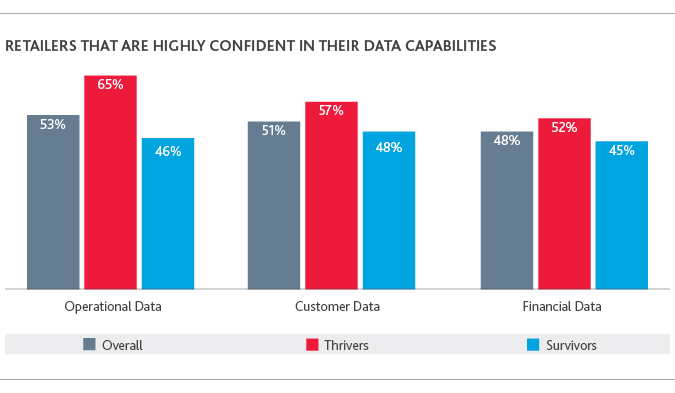

However, less than half of Survivors are highly confident in their organization’s ability to gather, analyze and act upon financial, operational and customer data, compared to the majority of Thrivers. So while the highest percentage of retailers overall claim consumer demand is their biggest driver of transformation, they can’t effectively respond to consumer demand without having the data analytics capabilities to identify behaviors and needs.

Only 41% of retailers are planning to significantly invest in improving their understanding of customer behavior over the next 12‑18 months.

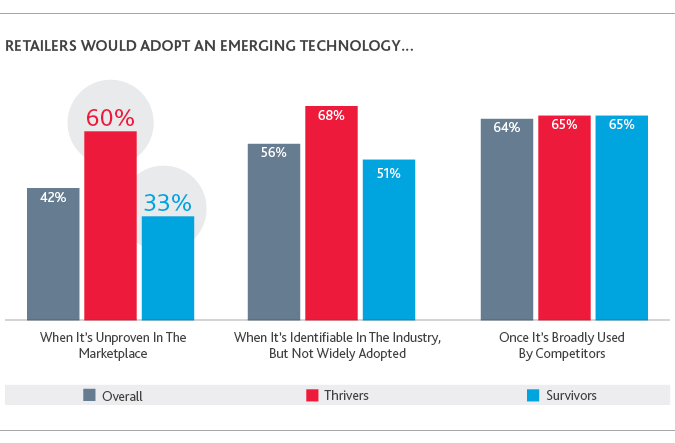

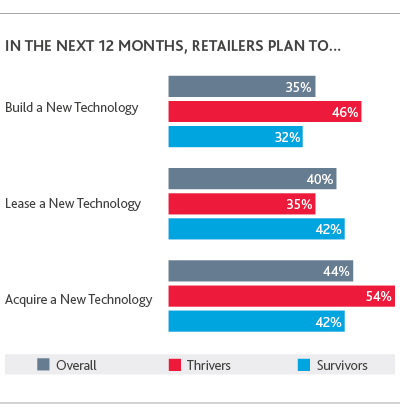

Across the board, Thrivers are far more likely to take risks when it comes to technology. Half as many Survivors said they would be an early adopter of a new technology, and more Thrivers are acquiring or building new technologies this year rather than leasing.

42% of retailers would consider being an early adopter of an emerging technology.

“Considering the consequences of non-compliance with the GDPR—potential fines up to £20 million or 4 percent of global turnover, whichever is greater—unprepared retailers could be rocked when a GDPR-equivalent arises, like the California Consumer Privacy Act. Having the right information governance policies in place will not only help minimize exposure to fines, but also reassure customers that their privacy is a priority, which in turn earns their trust and loyalty.”

Mark Antalik

Managing director in BDO USA’s Technology and Business Transformation Services practice

Customer data-driven strategies are key to survival, but they also bring risk—including uncertain ROI and data privacy. Smart retailers are preparing now for an inevitable GDPR-equivalent in the U.S., but too many are standing still.

|

|

|

|

Bottom line: Technology disruption can be turned from threat to opportunity, but only with a combination of foresight and focus. For the middle market, this means establishing a digital strategy that balances the long-term vision with realistic short-term goals and committing to continuous progress.

Becoming a Thriver

Moving from Survivor to Thriver requires a rational approach: ensuring a durable financial foundation and planning with a strong sense of purpose. To break the cycle of survival mode, retailers are forced to shed old habits and adjust their way of thinking; they cannot thrive if they are solely focused on keeping pace with competition.

What can today’s Survivors learn from Thrivers?

-

Cover the basics: Be rational about strengths and weaknesses and plan ahead. You still need to ensure compliance and a strong balance sheet. You can’t grow without a solid foundation.

-

Make the hard choices before they’re made for you: Middle market retailers are challenged to combat disruptive industry dynamics with fewer resources than larger peers and often, with more pressure from investors. Ask yourself the difficult questions and cut the nonessentials.

-

Place smart bets: Develop a strong sense of purpose and invest to fill gaps desired by customers and left open by competitors. Don’t wait until peers have moved the goal post to adapt.

Methodology

About the 2019 BDO Retail Rationalized Survey

The 2019 BDO Retail Rationalized Survey was conducted by Rabin Research Company, an independent marketing research firm, in November 2018. The survey included a mix of 300 CEOs, CFOs and COOs from Retail & Consumer Products companies with revenues ranging from $50M-$3B.

SHARE