BDO Retail CFO Outlook Survey

This survey was conducted in Fall 2019, prior to the global COVID-19 pandemic. We know that every organization—including BDO—is focused on the well-being of families, colleagues, and our communities. The middle market has proven its resilience in times of turbulence, and we believe, with a conscientious business mindset, organizations will manage the situation effectively. For information on how to secure your business in the wake of COVID-19, please visit www.bdo.com/COVID-19.

Retail Rationalized

Table of Contents

- Against All Odds, Retailers are Upbeat for Growth

- New Offerings Reflect Millennial & Gen Z Purchasing Power

- Survey Demographics

Against All Odds, Retailers are Upbeat for Growth

Retailers are starting to get their bearings in a new economy.

Savvy consumers, market volatility surrounding trade negotiations, ongoing digital disruption…none of it appears to be stifling them.

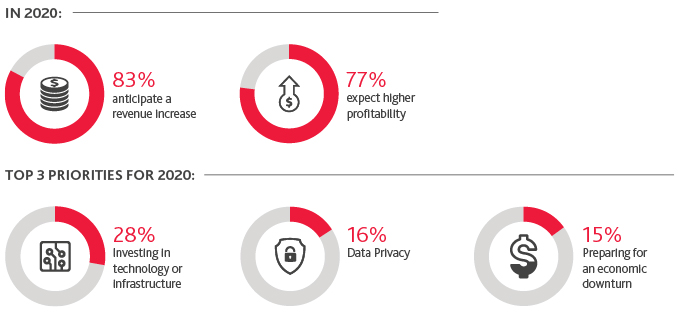

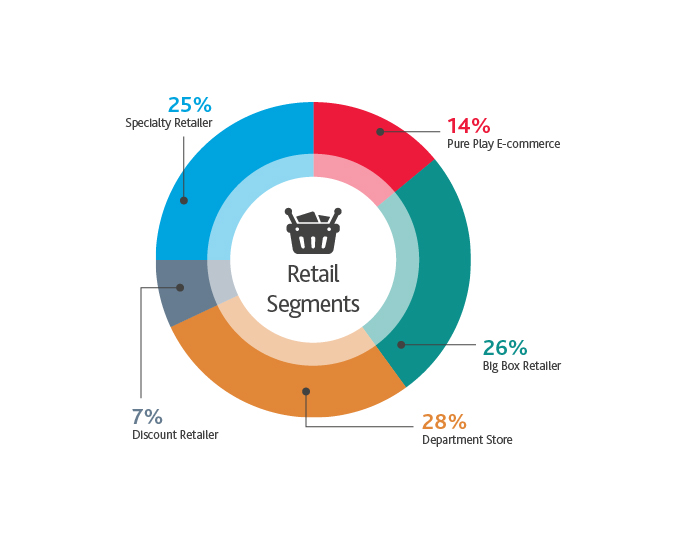

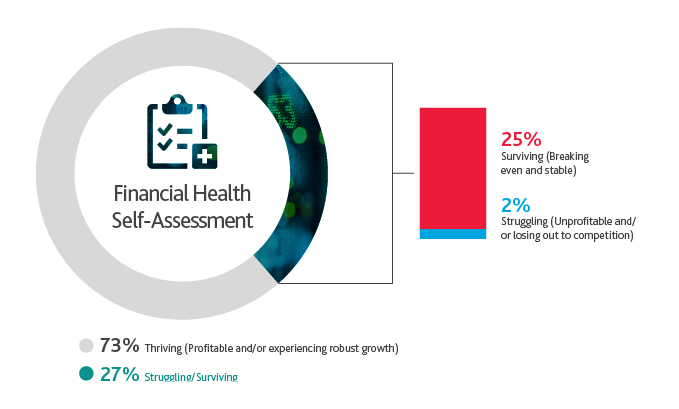

In fact, 73% of retail CFOs consider their companies to be thriving—profitable and experiencing robust growth—and expect continued momentum in 2020.

Across retail sectors, CFOs at big box retailers are the most confident, with 92% saying their companies are thriving, followed by specialty retailers (76%), pure play e-tailers (64%) and department stores (61%).

To adapt to their volatile reality, retailers are focused on investing in technology and infrastructure to offer digitally-native consumers the shopping experiences they desire. With smart investments that preserve relevance, retailers will be better equipped to stave off the impacts of tariffs and hedge against the potential threats of a recession. However, lack of preparation for a downturn or underestimating how attuned consumers are to market threats could be costly.

“Retail bankruptcies are accelerating, trade tensions are hindering sales, and a recession could be looming. And yet, many retailers are thriving in uncertainty, refuting the rumors of an industry-wide apocalypse. But even today’s retail winners may stumble if the economy takes a turn for the worse and consumer spending drops off. Choppy waters lie ahead. To stay afloat, retailers must balance smart, customer-centric investment with financial discipline.”

|

|

|

TARIFFS RAISE RETAIL PRICES & CURB CONSUMER SPEND

Retailers are wary of trade tensions heading into 2020. When considering their greatest geopolitical risks, most important policy priorities for the U.S. presidential election and their total tax liabilities, trade and tariffs top the list.

Although at the start of the U.S.-China trade war, the impact of tariffs was largely relegated to manufacturers, retailers and consumers have since learned they are not immune. In August 2019, President Trump imposed a new round of Section 301 tariffs of 15% on “List 4” items, which comprised everything from cotton to electronics.

Trade tensions and their uncertainties are likely to continue in the run-up to the 2020 election. Regardless of whether or not tariffs are lifted, retailers will be fighting an uphill battle. Even if a trade deal with China is inked and all tariffs are lifted, retailers will still be tasked with shedding the excess inventory that many stockpiled before tariffs set in. If more tariffs are implemented, inventory orders for the first half of 2020 will see substantial cost increases, especially for small and mid-sized retailers that have less leverage with suppliers.

Larger players can flat out refuse to accept tariff increases. Bed, Bath and Beyond and Target for example, have given their brand suppliers a tough choice: absorb the tariff costs or get a new buyer, according to Axios.

.jpg)

In response to escalating trade tensions, 40% of retail CFOs said they have raised prices on goods—a move that could heavily impact early 2020 sales and margins. Unfortunately for retailers, consumers of all generations are aware of today’s geopolitical issues and many are concerned about what it means for their wallets. Ahead of the crucial year-end stretch, 25% of consumers said they would decrease their holiday spend this year due to trade tensions, according to BDO’s 2019 Consumer Beat Survey.

Forty percent of retail CFOs also said they have considered other domestic alternatives for supply sourcing, and nearly the same proportion (39%) have considered sourcing from other countries outside of China.

The trade war with China has been an impetus for executives to rethink their global supply chains. However, rising costs of labor in China and other trends mean supply chains will be under review regardless of the outcome of this round of trade negotiations.

“Moving operations to more attractive locations like Vietnam and Malaysia are complex, and passing down tariff costs to today’s consumers is not a sustainable option. There are steps retailers can take to reduce their liabilities, but absolutely nothing should be done without first understanding your exposure to tariffs throughout the entire supply chain.”

|

|

DAMON V. PIKE |

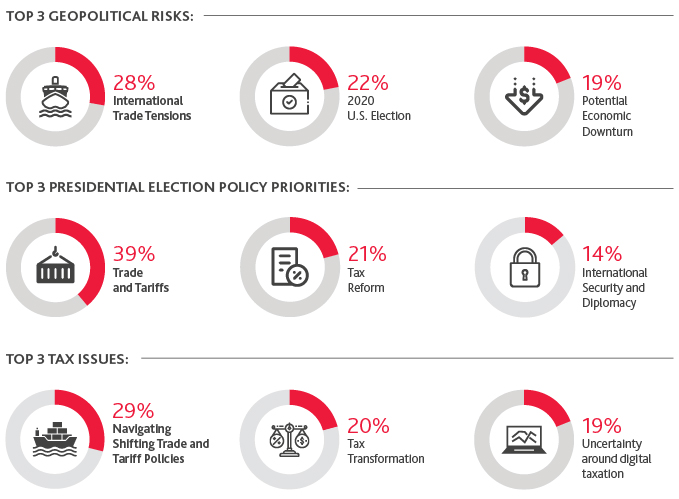

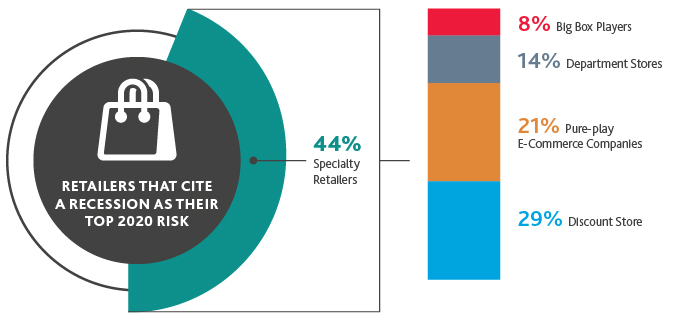

RETAILERS PURSUE GROWTH DESPITE POTENTIAL DOWNTURN

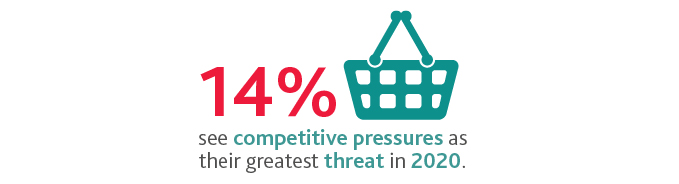

More than half of retailers (57%) anticipate a recession in the next 1-2 years, while 22% say a potential economic downturn is their business’ greatest threat in 2020. With limited offerings often seen as a luxury, specialty retailers, in particular, are more worried about the impact of a downturn compared to other sectors.

These concerns are well-founded, especially when considering that more than 1-in-3 consumers said they would decrease their Q4 2019 spending due to an economic downturn.

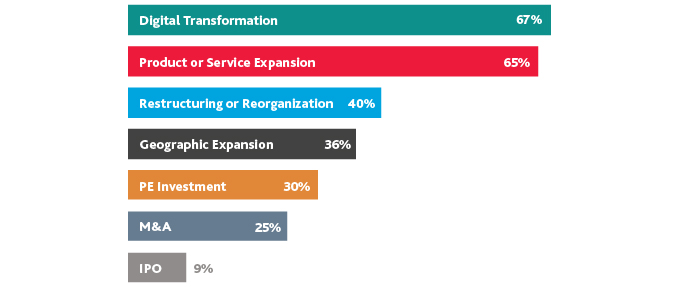

Still, retailers aren’t letting the anticipation of a downturn hinder their growth plans.

GROWTH STRATEGIES RETAILERS ARE PLANNING TO PURSUE IN 2020

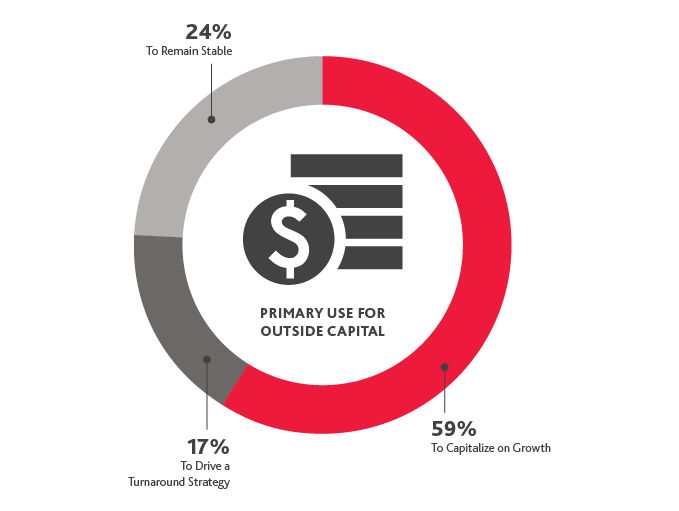

While restructurings and PE investment have historically been signals of distress for retailers, so-called Thrivers are proving they don’t need to be. A full 40% of Thrivers are restructuring or reorganizing in 2020, and 32% are seeking PE investment. Meanwhile, more than half of all retailers (53%) secured capital last year and among those who did, nearly all (89%) will look for more next year.

Retailers aren’t shying away from using outside funds to capitalize on growth, but without adequate reserves to withstand a recession, any growth could be usurped by significant debt.

New Offerings Reflect Millennial and Gen Z Purchasing Power

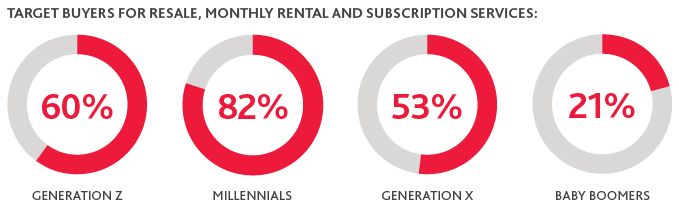

Millennials comprise 31.5% of the global population, while Gen Z accounts for 32%, according to a Bloomberg analysis. The majority of people in the world today have grown up in an era of global connectivity and limitless access—to endless options, experiences, opinions and education. If their needs aren’t met in one place, there is greener grass somewhere else, and they will find it. Retailers are all striving to be the greener grass for Millennials and Gen Z, but some may be underestimating what it takes.

Being responsive to shifts in customer demand extends not only to the customer experience, but to the products and services offered and the means of selling them. It’s for this reason 65% of retailers are expanding their products and services in 2020.

RETAILERS INTRODUCE NEW REVENUE STREAMS INSPIRED BY STARTUPS

“Recommerce” startups—or those offering resale, rental and other subscription services—have surged in popularity as consumers prioritize sustainability, unique merchandise and pure convenience. Now that these startups have effectively proven their concepts, established retailers are realizing the importance of suiting up for the recommerce show.

Retailers are wise to embrace new business models and diversify their revenue streams, but the costs and benefits of implementation need to be carefully analyzed before moving forward.

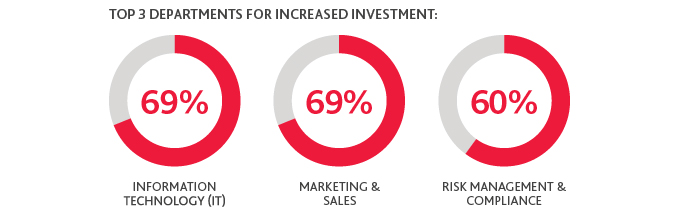

As retailers look to reimagine their businesses and transform, it takes a combination of front-end and back-end. Retailers are most focused on building out their IT infrastructure and marketing functions to draw customers. They are also investing in their risk management and compliance departments as they weigh innovation and growth with risk.

OMNICHANNEL IS OFFICIALLY OBSOLETE

The term “omnichannel” is now synonymous with “retail.” It no longer has a separate meaning. Consumers don’t consider whether they’re being serviced by a brick-and-mortar store or an e-commerce provider, they care that they are provided the optimal level of convenience or experience. Savvy brands are figuring out how to blur their channels, while developing strategies to seamlessly integrate new ones, including social and voice commerce, into their suites. It isn’t about being everywhere at all times, it’s about being available to the right customers in the right ways, as dictated by them.

Customers are warming up to the idea of using their smart speakers for purchases. In Q4 2019, more than 1-in-5 consumers (22%) said they planned to use a voice commerce tool like Amazon’s Alexa or Google Home for their holiday shopping. Looking forward, this is not a channel to be overlooked, as Juniper Research predicts the voice commerce market will reach $80 billion by 2023.

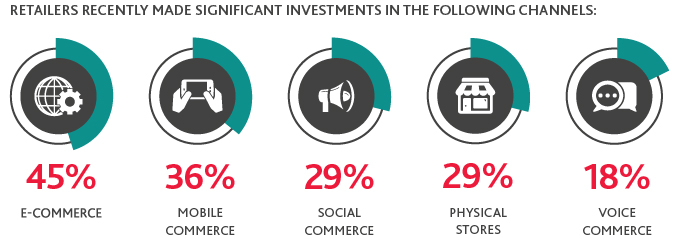

Across channels, retailers are prioritizing their e-commerce and mobile platforms. Reflecting the prevalence of shopping via social platforms like Instagram and Facebook, retailers are investing in their physical stores and social commerce platforms at the same levels.

RETAILERS BANK ON PAYMENT OPTIONS

Truly seamless shopping journeys mean eliminating friction from the browsing stage all the way through to purchase, regardless of channel. Customers demand efficiency in their transactions and value having options. A lack of payment options at checkout online can lead to cart abandonment. For retailers, this requires integrating digital payment processing systems in-store and adding plugins to checkout pages online and in apps. At the same time, cybersecurity considerations, processing fees and the costs of implementation should be weighed before rolling out new payment options.

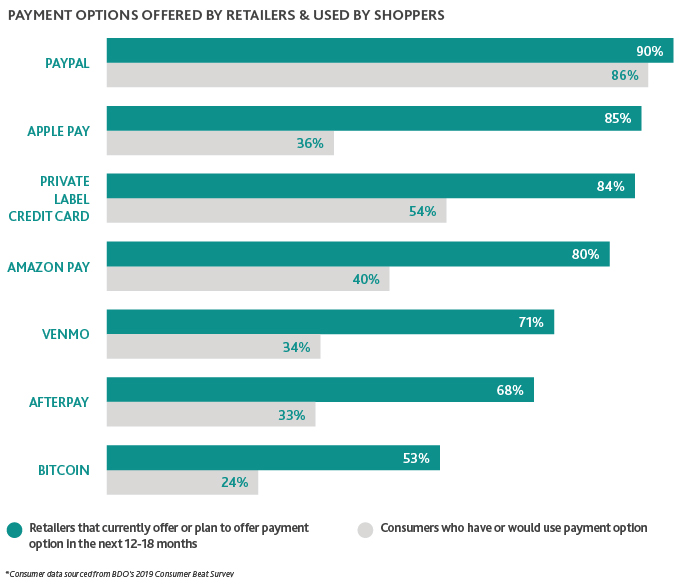

Among all digital payments asked about, PayPal is the most widely offered by retailers and used by consumers, likely since it was one of the first to market. PayPal-owned Venmo has a lower adoption rate by consumers, but is becoming increasingly popular.

Amazon Pay, while newer to the market than competitor Apple Pay, has greater usage among customers for shopping, as it’s available on any device, whereas Apple Pay can only be used on Apple-owned products. However, according to Statista, there are an estimated 700 million iPhone users worldwide, and on later editions, Apple Pay comes pre-downloaded.

In addition to a personalized checkout experience and payment flexibility, today’s shoppers also wish to have control over their financing. When it comes to financing options, more than 1-in-3 consumers (35%) said they would prefer to pay for a big ticket item in a series of installments rather than in full. To accommodate this growing consumer market, a majority of retailers offer AfterPay, an interest-free buy now, pay later payment service.

Consumers overall are comfortable using digital payments, but some are slower to adopt certain services due to security concerns. Retailers, too, are worried about the impact of a data privacy breach. In fact, 23% of retail CFOs surveyed say a data privacy breach is their top 2020 business threat, the most-cited across all risks. At the same time, 29% cite data privacy as their greatest regulatory concern.

Retailers reduce their liabilities with digital wallets, as the banks or processors do not pass payment details to the merchants for purchases made online or via mobile. For in-store purchases using a digital method, following Payment Card Industry standards—including EMV compliance—for payment terminals can add a layer of security when implemented, according to the standards.

“Put simply, more convenient checkout equals higher conversion rates, but retailers must balance payment innovation with security risks. By taking a threat-based approach to cybersecurity, one that’s tailored to a retailers’ unique threat profile, retailers can shield themselves from steep fines and reputational blemishes.”

|

|

GREG SCHU |

TRENDS IN IN-STORE CHECKOUT INNOVATION

Retailers are also investing in in-store checkout innovations, which roughly fit into three main categories: adding self-checkout kiosks or aisles, deploying scan-as-you-go technology through mobile devices, or enabling tracked shopping through sensors and cameras.

Each option has pros and cons and requires a level of technology and capital investment that should be factored into potential ROI.

Once retailers understand their options, they must determine which path, if any, is right for their company and customer.

REIMAGINED RETAIL REQUIRES NEW METRICS

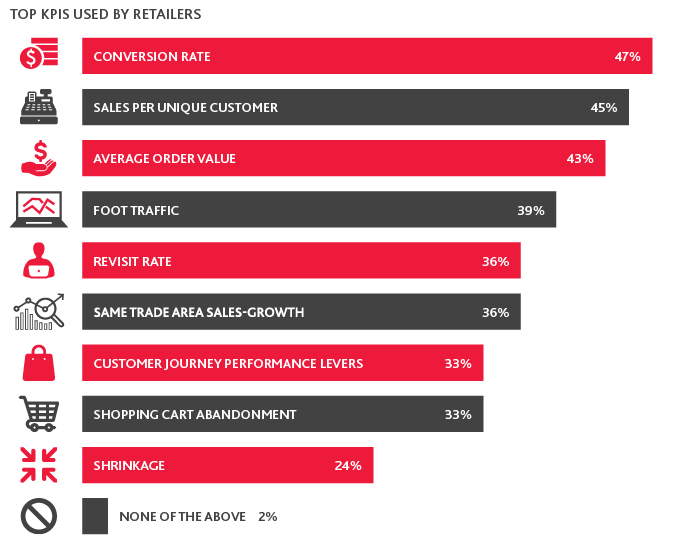

Quantifying success in modern retail requires new metrics, but many are still relying on traditional performance metrics for an outdated retail world, including same-store sales. Having effective KPIs is critical not only for reporting purposes, but also to understand what is and is not working in your business to drive strategic decisions. Identifying the right performance metrics should be a priority for retail CFOs who are charged with quantifying and communicating their business value, and making investment decisions, but just 1-in-10 say it is their greatest personal challenge.

Conversion rate, sales-per-unique-customer and average order are the most-cited modern metrics, but still, less than half of retail CFOs say their business tracks them. Across the board, more Thrivers than those who say they are just surviving track nearly every new KPI. These businesses realize that in-depth insights into metrics like friction across the customer journey and the lifetime value of a customer can make or break the overall health of a brand.

Rational retailers have a strong sense of their strengths and weaknesses, and the ability to benchmark

against peers.

Survey Demographics

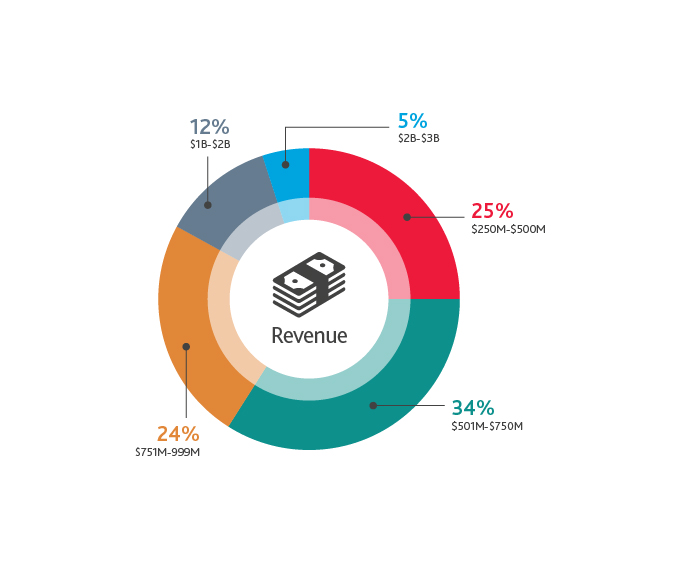

The 2020 BDO Retail Rationalized Survey polled 100 CFOs at U.S. retail organizations with revenues ranging from $250 million to $3 billion in October and November 2019. The survey was conducted by Rabin Research Company, an independent marketing research firm, using Op4G’s panel of executives.

Retail Rationalized is the idea that middle market and emerging commerce businesses—with fewer resources and heightened pressure from investors—are focused on business strategy and scaling up, but they need to give equal weight to financial management. Rational retailers have a strong sense of purpose and understand that innovation will only generate ROI if it’s based on a solid financial foundation and strategic choices. It’s no longer about who can check every box for a product or service. It’s about who has the clearest focus, the most thorough transformation strategy and the most financial flexibility.

.jpg)

SHARE